В период с 16 по 23 марта 2024 года 42 проекта привлекли инвестиции на общую сумму $262,8 млн.

В частности, за неделю финансирование получили:

- $60 млн — Figure Technologies. Компания закрыла раунд финансирования серии А, который совместно возглавили Jump Crypto, Pantera Capital и Lightspeed Faction при участии Distributed Global, Ribbit Capital и CMT Digital. Полученные средства используют для запуска платформы Figure Markets, которая будет функционировать на блокчейне Provenance. На площадке можно будет торговать криптовалютами, акциями и «альтернативными инвестициями».

- $55 млн — Succinct. Стартап, занимающийся разработкой решений с технологией zero-knowledge proofs, привлек инвестиции в рамках посевного раунда финансирования и раунда серии A, который возглавила компания Paradigm. Также инвесторами стали Robot Ventures, Bankless Ventures, Geometry, ZK Validator, сооснователи Polygon Сандип Наилвал и Дэниел Любаров, основатель EigenLayer Шрирам Каннан.

- $28 млн — Espresso. Компания привлекла инвестиции от Andreessen Horowitz и Polygon Labs. Известно, что раунд финансирования серии B завершился в феврале 2024 года. Капитал будет использован для продолжения разработки продуктов Espresso и расширения команды.

- $20 млн — Morph. Разработчики сети второго уровня сообщили о завершении посевного раунда инвестиций, который возглавил фонд Dragonfly Capital с участием Pantera Capital, Symbolic Capital, Spartan Group, MEXC Ventures, Public Works и других фондов. Команда планирует использовать капитал для расширения штата и маркетинга, а также совершенствования технической инфраструктуры.

- $18 млн — Mystiko Network. Команда Web3-протокола завершила посевной раунд финансирования, который возглавила венчурная фирма Peak XV Partners (ранее Sequoia Capital India/SEA). Также инвесторами стали Samsung Next, Hashkey, Mirana, Signum, Coinlist, Tribe Capital, Morningstar Ventures, Навал Равикант, Сандип Наилвал и Гокул Раджарам (Gokul Rajaram).

- $11,5 млн — Tokenize Xchange. Сингапурская криптовалютная биржа получила инвестиции от венчурной компании Trive и частных инвесторов. Новые средства используют для расширения команды. Фирма планирует увеличить численность персонала в Сингапуре в 5 раз в ближайшие 18 месяцев.

- $11 млн — MANTRA. Стартап, который стремится создать «адаптированную к токенизации реальных активов (RWA) сеть» на базе блокчейна Cosmos, привлек инвестиции. Раунд финансирования возглавил фонд Shorooq Partners с участием Three Point Capital, Forte Securities, Virtuzone, Hex Trust и GameFi Ventures.

- $9 млн — Ten. L2-сеть на базе Ethereum получила инвестиции от R3, Republic Crypto, KuCoin Labs, Big Brain Holdings, Magnus Capital и DWF Labs. Разработчики позиционируют TEN как универсальное, ориентированное на конфиденциальность решение второго уровня для Ethereum. Оно призвано обеспечить быстрые и недорогие транзакции при сохранении приватности и безопасности.

- $8,5 млн — Zone. Африканская платежная компания объявила о завершении посевного раунда финансирования, который возглавили венчурные фирмы Flourish Ventures и TLcom Capital. Стартап создает децентрализованную платежную инфраструктуру на основе блокчейна для поставщиков финансовых услуг на континенте и за его пределами. Новое финансирование используют для развития сети внутри страны и привлечения большего количества компаний. «Значительная часть» полученных средств будет направлена на проведение комплексной пилотной программы по тестированию трансграничных платежей, запланированной на 2025 год.

- $6,2 млн — Rails. Децентрализованная криптовалютная биржа привлекла инвестиции в рамках посевного раунда финансирования, который возглавил Slow Ventures при участии CMCC Global, Round13 Capital и Quantstamp. Капитал используют для увеличения инженерной команды и расширения ее стратегии лицензирования и регулирования.

- $6 млн — Keyring Network. Лондонская компания, которая призвана «помочь институциональным инвесторам взаимодействовать с DeFi-платформами», закрыла посевной раунд финансирования. Инвесторами стали: Gumi Cryptos Capital, Greenfield Capital, Motier Ventures, Kima Ventures и другие.

- $6 млн — Moondance Labs. Стартап закрыл стратегический раунд финансирования, который совместно возглавили KR1, SNZ Capital и Scytale Digital при участии Arrington Capital, Borderless Capital, Cross-Chain Fund Wormholecrypto, Hypersphere и Blockchain Founders Fund, а также инвесторов-ангелов. Собранные средства будут использованы для роста команды и развития протокола инфраструктуры Tanssi.

- $3 млн — CoinMart. Криптовалютная платформа привлекла финансирование от IDG Capital. Новый капитал компания стремится использовать для того, чтобы расширить свое присутствие, а также улучшить услуги по всей Европе.

- $3 млн — Bi.social. Децентрализованный протокол социальной торговли объявил о завершении раунда финансирования, в котором приняли участие Web3Vision, WAGMi Ventures и QF Capital. Средства будут использованы для развития проекта.

- $3 млн — Tensorplex Labs. Web3-стартап с элементами искусственного интеллекта (ИИ) завершил посевной раунд финансирования, который совместно возглавили Canonical Crypto и Collab+Currency при участии еще 18 инвесторов. Компания будет использовать средства для разработки децентрализованной инфраструктуры искусственного интеллекта.

- $2,2 млн — GRVT. Гибридная криптовалютная биржа привлекла инвестиции в рамках стратегического раунда финансирования. Инвесторами стали: QCP Capital, Selini Capital и Pulsar Trading.

- $2 млн — GAM3S.GG. Игровая Web3-платформа привлекла инвестиции от Merit Circle, WWVentures, Cogitent Ventures, P2 Ventures, Cypher Capital, Acheron, Basics Capital, OIG Capital, BreederDAO, Hercules и инвесторов-ангелов. После получения финансирования компания начнет разработку собственного токена G3.

- $2 млн — Umoja. Децентрализованный протокол завершил начальный раунд финансирования. Проекту удалось привлечь средства от венчурных фондов Coinbase Ventures, Blockchain Founders Fund, 500 Global. Кроме того, протокол поддержали такие организации, как Quantstamp, Orange DAO, Hyperithm Psalion и Blizzard Fund от Avalanche. Привлеченный капитал будет направлен на расширение доступа к протоколу «умных денег», предлагающему автоматизированные инвестиционные стратегии.

- $1,5 млн — EarlyFans. SocialFi-приложение, созданное на базе экосистемы Blast, получило инвестиции в рамках посевного раунда финансирования. Инвесторами стали: GBV Capital, Alchemy, Alliance DAO и еще 9 контрагентов, включая частных.

- $1,5 млн — Savage. Web3-компания собрала средства в рамках посевного раунда финансирования. Инвесторами стали: Faculty Group, Polygon Ventures, Morningstar Ventures, Ash Crypto, Terranova Ventures, Banter Capital, Vendetta Capital, VBC Ventures, Top7ICO и другие.

- $1 млн — Juice Finance. DeFi-проект, созданный на базе экосистемы Blast, привлек финансирование от Артура Хейса, DWF Labs, Delphi Digital и других. Цель стартапа — предоставить инновационные решения в секторе DeFi, используя возможности экосистемы Blast.

- $1 млн — Ooga Booga. Агрегатор децентрализованных бирж на базе Berachain закрыл раунд финансирования при оценке в $10 млн. Инвестиции возглавил фонд Kenetic Capital с участием PANONY, CitizenX Crypto Ventures, Cypher Capital Group, Sneaky Ventures и еще 14 контрагентов.

- $1 млн — Castle Of Blackwater. Команда Web3-игры сообщила о завершении стратегического раунда финансирования. Инвестиции стартапу предоставили Metrics Ventures, 3Commas Capital и Faculty Group.

- $1 млн — Trex20. GameFi-платформа, построенная на базе биткоина, привлекла средства от Moonrock Capital, Marshland Capital, NxGen, x21 Digital, Oddiyana Ventures, Triple Gem Capital, Nabais Capital.

- $900 000 — Dolomite. Протокол на базе Arbitrum объявил о завершении стратегического раунда финансирования. Инвесторами стали: сооснователь Polygon Сандип Наилвал, DCF GO, Pentoshi, генеральный директор Polygon Labs Марк Буарон и DeFi Dad.

- $500 000 — Bitbrand. Блокчейн-платформа, на которой можно приобрести предметы роскоши в цифровом виде, привлекла финансирование от Hustle Fund, Side Door Ventures, GFR Fund и других.

Еще ряд проектов привлекли финансирование, однако не сообщили о сумме инвестиций.

Торговая платформа Rollie Finance, использующая искусственный интеллект, получила финансирование от Animoca Ventures, M77 Ventures и частных инвесторов.

Платформа OpenStamp, построенная на базе протокола STAMP, привлекла капитал по оценке в около $50 млн. Посевной раунд возглавил Animoca Ventures с участием KuCoin Ventures, MH Ventures, VitalTao Capital, Lotus Capital, Brotherhood Ventures, Blue Node Capital, D64 Ventures, Luminescent Capital, Spicy Capital, Halvings Capital, SPEC Capital и YM Capital. Компания будет использовать новый капитал для расширения и совершенствования своей платформы.

Протокол кредитования на базе Blast — Pac Finance — получил инвестиции от Manifold.

Компания Entangle объявила о получении инвестиций от Consensys.

Стартап ZKasino закрыл стратегический раунд финансирования, в котором приняли участие MEXC, Big Brain Holdings, Pentoshi, 0xSisyphus. Оценка компании составляет $350 млн.

Команда L3-решения Gull Network, построенного на базе блокчейна Manta, объявила о закрытии стратегического раунда финансирования. Инвесторами стали GBV Capital, Magnus Capital, x21 Digital, Maven Capital, Basics Capital и другие. Средства используют для реализации миссии по внедрению инноваций и расширения бизнеса.

Платформа токенизации на Cardano — NMKR — цель которой сделать Web3 доступным, привлекла финансирование от EMURGO Ventures. Новый капитал используют для того, чтобы расширить охват NMKR на азиатском рынке токенизации NFT и RWA.

L1-блокчейн XPLA закрыл стратегический раунд финансирования, в котором принял участие венчурный фонд Builder Capital.

Платформа Eesee, которая предлагает «геймифицированную торговлю цифровыми активами» привлекла стратегические инвестиции от Animoca Brands.

Интернет-магазин криптоигр HyperPlay получил финансирование от Square Enix. Компания намерена использовать полученные средства для дальнейшего расширения своего игрового магазина.

Венчурная фирма Alpha Token Capital вложила средства в Web3-компанию Carrieverse, которая создает метавселенную.

Компания Asterix Labs закрыла стратегический раунд финансирования. Инвесторами стали: 20 Hashed Fund, Everest Ventures, Momentum 6, Arcane Group, DeFi Capital, LiquidX и еще три контрагента.

KiloEX — децентрализованная биржа построена на базе BNB Smart Chain, привлекла стратегические инвестиции от Foresight Ventures, Poolz Ventures, Manta Network, 7UpDAO и GTS Ventures.

Игровая Web3-компания Nebula Revelation, завершила новый раунд финансирования, в котором приняли участие DWF Labs, Waterdrip Capital, Central Research, Stratified Capital и CapsuleX Labs.

Команда L2-решения на базе биткоина — AIL2 — объявила о получении стратегических инвестиций от Waterdrip Capital, Satoshi Lab, Foundinals Lab, Monday Capital, AlNN Labs, Bitrise Capital, Genblock Capital и других.

Платформа Flash Protocol получила финансирование от DWF Labs, Signum Capital, Rarestone Capital, Cogitent Ventures, Portico Ventures и еще 4 контрагентов.

Топ-5 фондов по количеству инвестиций в период с 16 по 23 марта, согласно данным CryptoRank:

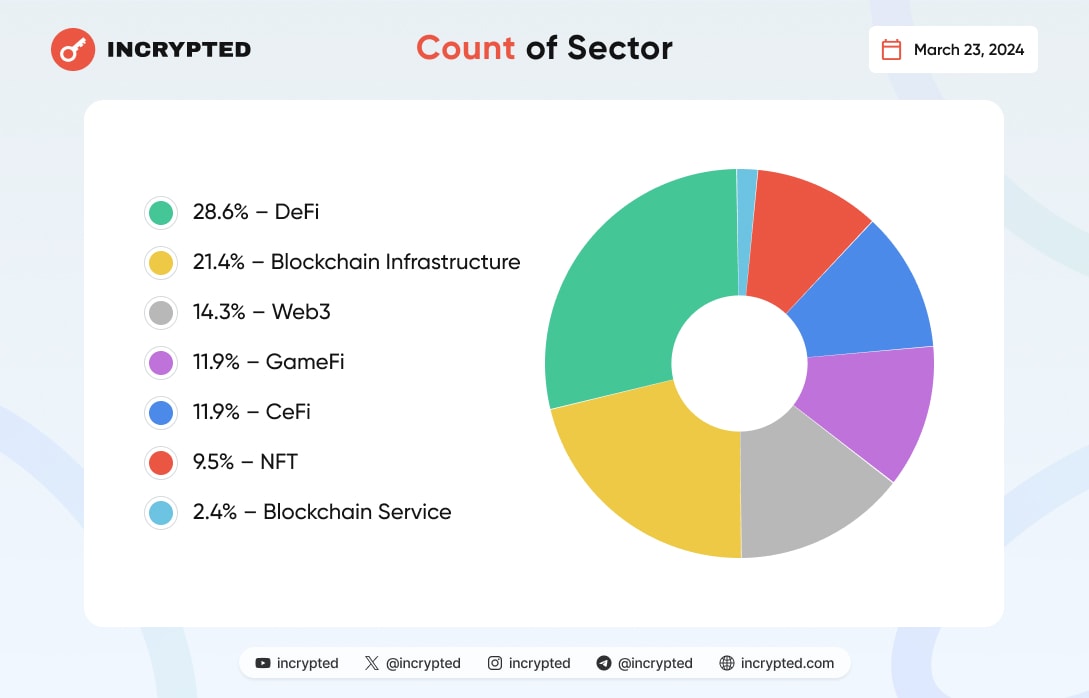

За неделю финансирование привлекли проекты таких сегментов: Web3, блокчейн-сервисы, блокчейн-инфраструктура, GameFi, DeFi, CeFi, NFT и другие.

Напомним, в период с 9 по 16 марта 38 проектов привлекли инвестиции на общую сумму $258,7 млн.