«Нагрели» государство более чем на треть миллиарда гривен и на присвоенные средства спонсировали русскую церковь в Украине. В Киевской области БЭБ разоблачило Инну Мельник – жену броварского бизнесмена, владельца ряда компаний Сергея Мельника.

Досудебное расследование уголовного дела продолжается – слово за судом, который состоится 3 октября. Удастся ли «налоговой уклонистке» избежать ответственности? Ведь ее муж, тоже причастный к финансовым схемам, известен в городе влиятельными связями и открыто кичится умением «решать» дела в свою пользу.

Супруги Мельники – достаточно известны в деловых и криминальных кругах Броваров. Сергей – совладелец ряда компаний, зарегистрированных в Киевской и Черниговской областях, а его жена Инна – частная предпринимательница. Оба, как рассказывают местные жители, – страстные поклонники и щедрые меценаты церкви русского патриархата.

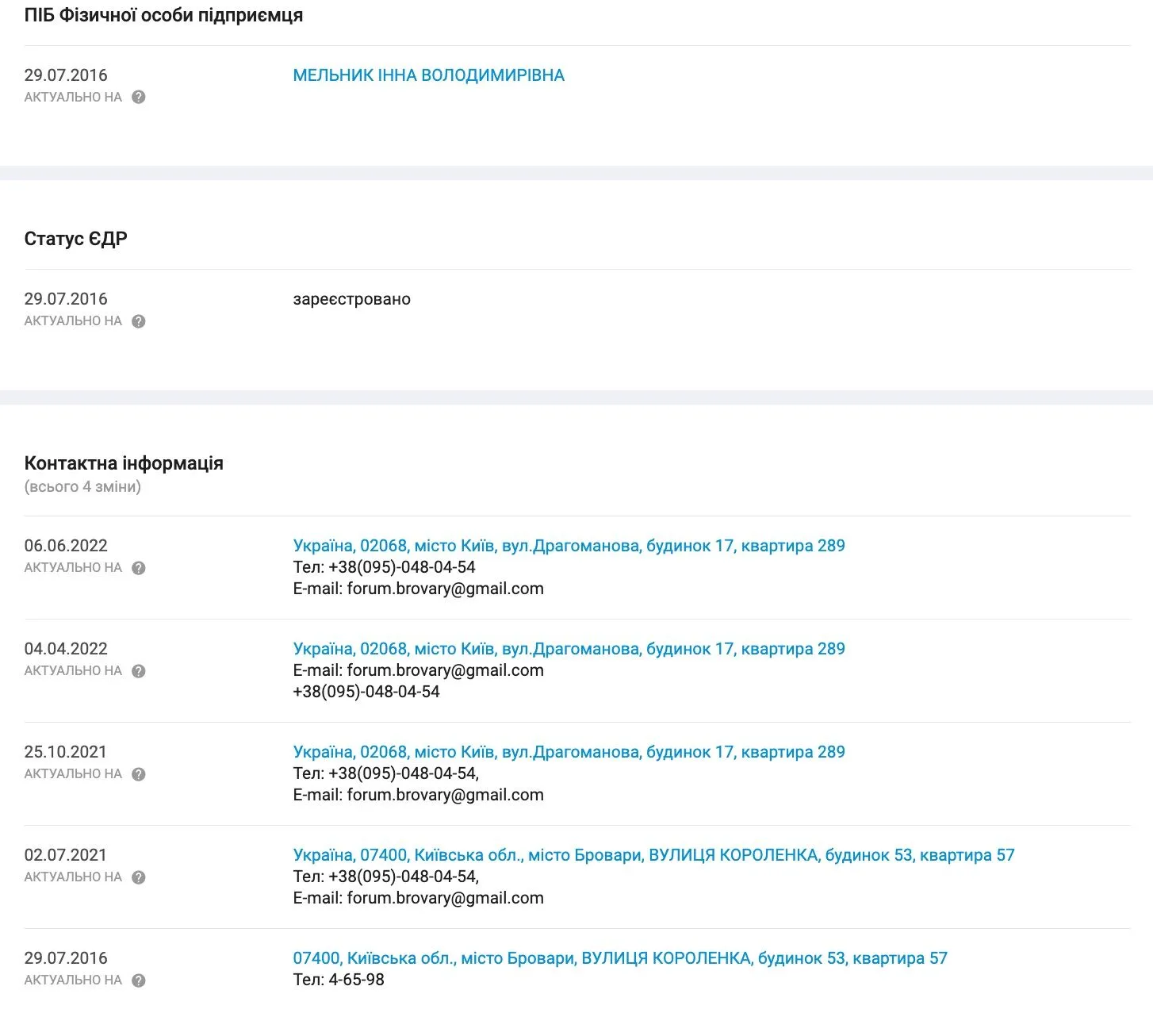

Примечательно, что ФЛП Мельник Инна Владимировна (ИНН 2632712503) с основным видом деятельности «Оптовая торговля текстильными товарами» исторически была зарегистрирована в Броварах, но впоследствии из-за конфликта мужа с горсоветом изменила место «прописки» на Киев, чтобы не платить налоги в Броварской территориальной громаде.

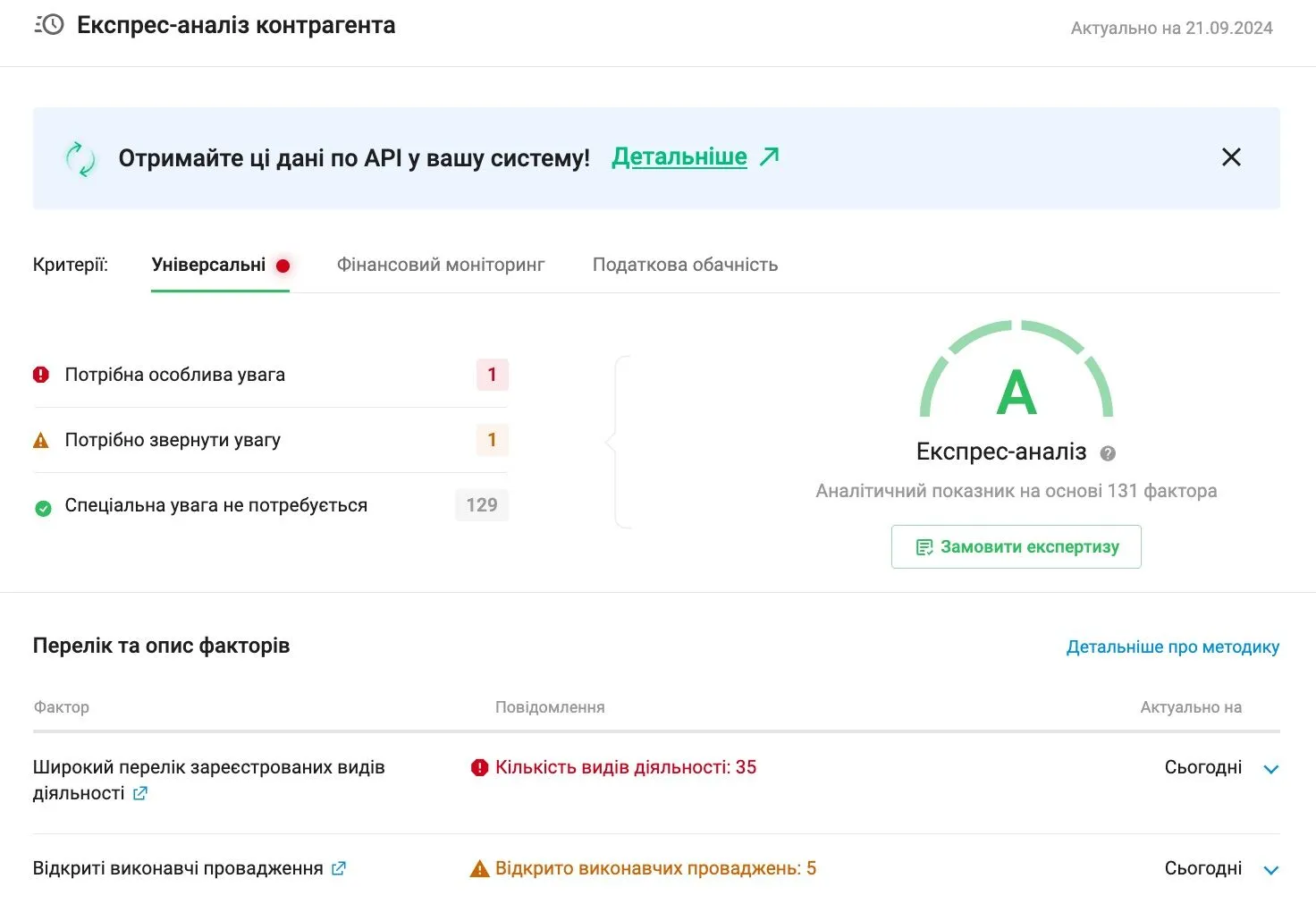

Как зафиксировала информационно-аналитическая платформа YouControl, по состоянию на сегодня в отношении ФЛП открыты пять исполнительных производств.

По данным наших источников, с марта 2019 года на ФЛП Мельник И.В. были оформлены все супер- и мини-маркеты сети ФОРУМ, BONUS и RC, а также аптеки МЕДЕЯ. А с началом полномасштабной войны в Украине, воспользовавшись ситуацией и мораторием на проверки, предпринимательница перестала сдавать отчетность, платить НДФЛ с зарплат рабочих и другие налоги, кроме НДС. Кроме того, не оформляла работников официально, выведя таким образом значительную часть бизнеса «в тень».

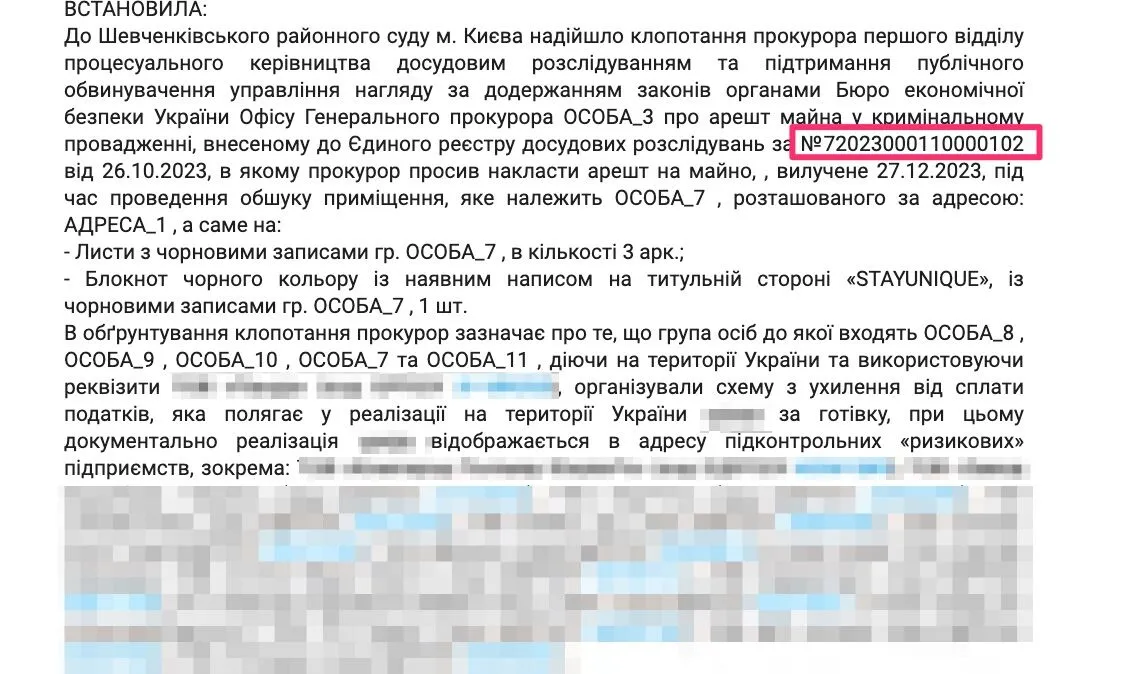

Год назад Инна попала в поле зрения правоохранителей в связи с масштабной схемой уклонения от налогов. Главное подразделение детективов Бюро экономической безопасности Украины при процессуальном руководстве прокуроров Офиса Генерального прокурора расследует уголовное производство №72023000110000102 от 26 октября 2023 года по признакам уголовного правонарушения, предусмотренного ч. 3 ст. 212 УКУ.

Фигурантом является вышеупомянутая ФЛП Мельник И.В., а заседание по делу должно состояться 3 октября 2024 года.

Речь идет о немалой сумме: 356 млн грн. Как возник этот долг перед государством?

Как следует из материалов дела, расследованного детективами БЭБ, группа лиц, используя реквизиты одного из предприятий, организовали схему по уклонению от уплаты налогов, которая заключается в реализации на территории Украины товара за наличные, при этом документально реализация отражалась в адрес целого ряда подконтрольных «рисковых» фирм.

Как это выглядело на практике?

Начиная с 2020 года, Инна Мельник при прямом руководстве своего мужа Сергея предположительно занималась уклонением от уплаты налогов, привлекая в схему самого Сергея Мельника, дочь, а также руководителей и сотрудников ООО, где они являются учредителями.

Так через ФЛП Мельник С.Б. и ФЛП Мельник А.С. (которые находятся на едином налоге и являются связанными лицами) проходили миллионы гривен за «липовые» маркетинговые, консультационные и другие услуги, которые фактически не предоставлялись. А в бюджет из этих средств платились фактически копейки.

После конфликта со столичным ГУ ДПС для продолжения своих «схем» супруги Мельники основали несколько новых обществ: ООО «Хай Маркет», ООО «Импортфуд», ООО «Прод База». При этом в криминальную схему втянули пенсионерку Ольгу Суницу – мать Инны Мельник.

После чего большинство торговых точек под брендами ФОРУМ, BONUS и RC были переведены в управление ООО «Хай Маркет», а часть аптек МЕДЕЯ – на ФЛП Суница А.А.

Далее приведем лишь один наглядный пример, как дельцы обманывали государство и фискальную систему.

По данным финансовой отчетности за 2023 год, опубликованной в открытых источниках, ООО «Хай Маркет» (в активы которого входят, напомним, ТРЦ Форум, супермаркеты Bonus, локальная сеть маркетов RC и т.п.) задекларировало доход в 181 млн грн, чистая прибыль – меньше чем 2 млн грн и персонал из 45 сотрудников.

Исходя из этой информации, штат каждого магазина должен составлять всего 2-3 работника, а чистая прибыль одной торговой точки – около 10 тыс. грн в месяц. Что выглядит достаточно абсурдно. Отсюда можно предположить, что большинство сотрудников работают «в черную», а доходы – не учитываются должным образом. Добавим, что компания ООО «Хай Маркет», которая управляет целой сетью торговых точек, зарегистрирована в обычном жилом доме.

Таким образом, как следует из уголовного производства, вся так называемая хозяйственная деятельность ФЛП Мельник И.В., ООО «Хай Маркет», ФЛП Суница А.А. – это не прозрачное и открытое ведение бизнеса, а фактически теневые «схемы» во избежание уплаты налогов.

Примечательно, что согласно плану проверок налоговой на 2024 год, ФЛП Мельник И.В. было включено в план. Однако в феврале 2024 года по рекомендации бухгалтера, юриста и самого Сергея Мельника представителей ГУ ГНС в Киеве к проверке просто физически не допустили, о чем были составлены соответствующие акты.

Более того, для предотвращения фактической проверки супруги тайно вывезли всю документацию относительно финансовой деятельности ФЛП Мельник И.В. с территории предприятия. А представителям ГУ ГНС в Киеве сообщили, что очень ценные документы якобы «были украдены войсками рф во время оккупации с. Богдановка Киевской области».

Судебное заседание по делу Мельник назначено на 3 октября. Казалось бы, развязка – близко. Но возникает вопрос: не удастся ли дельцам «замять» дело?

Ведь муж главной фигурантки – Сергей Мельник – открыто кичится влиятельными связями в местных правоохранительных органах и умением кулуарно «решать» вопросы в свою пользу.

В этом контексте можно вспомнить другой судебный спор – хозяйственный, который Сергей Мельник ведет против собственного брата Константина, и странную благосклонность броварских полицейских во главе с главой РУП Дмитрием Шульгиным к скандальному бизнесмену.

Напомним, в Броварах сотрудники районного управления полиции, возглавляемого подполковником Шульгиным, вмешались в хозяйственный спор между совладельцами группы предприятий и, вероятно, подыгрывают Сергею Мельнику, инициировав незаконное уголовное преследование и настоящий «телефонный террор» другого участника. И все это – несмотря на существующее решение Минюста не в пользу Сергея.

В то же время на сомнительные силовые действия со стороны Сергея Мельника (такие, как несанкционированный снос забора на чужой территории) местные правоохранители почему-то не реагируют. Кроме того, Сергей открыто заявляет, что фактически «нанял сотрудников полиции и ТЦК» для давления на оппонента.

Заметим, что за более 2,5 года войны ни ФЛП Мельник Инна Владимировна, ни ее муж-бизнесмен Сергей Мельник ни разу не донатили на помощь ВСУ. Куда же на самом деле идут вероятно присвоенные ими многомиллионные доходы, учитывая приверженность семьи УПЦ МП? Вопрос риторический.

Не задействует ли Сергей Мельник неофициальные силовые рычаги влияния и на этот раз? Какое решение по делу его жены – налоговой «уклонистки» – примет суд? Заметим, следствие в лице Бюро экономической безопасности действовало профессионально и беспристрастно, собрав все необходимые доказательства по 356-миллионной схеме.

Надеемся на объективность и справедливость отечественного правосудия и на то, что дельцов, которые опустошают бюджет во время войны, все же привлекут к ответственности.