За более чем 30 лет независимости из Украины за границу вывели не менее $100 млрд, сообщила глава Национального агентства по розыску и управлению активами (АРМА) Елена Дума. По нынешнему курсу — это более 4 трлн грн, или же более двух госбюджетов Украины на 2024 год в доходной части.

Для возвращения таких активов АРМА еще в июле 2023-го разработало и утвердило порядок реализации арестованных активов за рубежом.

В ноябре прошлого года правительство внесло изменения в Порядок № 719, который определяет процедуру реализации арестованных активов на электронных торгах. Только тогда была предусмотрена возможность привлечения иностранных торговых площадок за пределами Украины, хотя АРМА работает с 2016 года.

В то же время агентство не может выбирать покупателя самостоятельно, а обязано создать конкурсную комиссию с участием представителей Минэкономики и Минюста. Те же должны выбрать организатора торгов по восьми критериям. Их можно найти в Порядке отбора на конкурсной основе юридических лиц, осуществляющих реализацию арестованных активов.

Если коротко, то они в основном о наличии у участника конкурса:

- надлежащей материально-технической базы для организации и проведения реализации актива на электронных торгах по принципу аукциона;

- практического опыта не менее трех лет по реализации таких активов;

- соответствующего персонала, например оценщиков, с по крайней мере трехлетним опытом работы в сфере аукционов;

- соответствующего ценового предложения и тому подобное.

То есть, по словам Елены Думы, продажа активов основывается на опыте: для яхт это может быть мировой аукционный дом, для недвижимого имущества — агентство недвижимости, для произведений искусства — специализированные площадки.

Кроме того, уже в январе 2025 года должен заработать обновленный Единый государственный реестр активов, на которые наложен арест в уголовном производстве (ЕГРАА).

Сейчас ЕГРАА насчитывает более 324 тыс. записей, из них 72 тыс. — активы в управлении АРМА.

«По состоянию на 2024 год общий портфель АРМА уже составляет 12 млрд грн, из них управление денежными средствами — это 10 млрд грн, 8 млрд грн из которых в военных облигациях, то есть они уже работают на Силы обороны», — говорит Елена Дума.

По ее словам, в январе-октябре 2024 года АРМА получило 2 млрд грн от управления арестованными активами и их реализации.

«Только доход от ОВГЗ составляет уже 700 млн грн в государственный бюджет. В августе мы закупили военные облигации на $31 млн, которые за один месяц принесли доход в $700 тыс. В сентябре приобрели военные облигации на 6,5 млн евро», — добавила глава агентства.

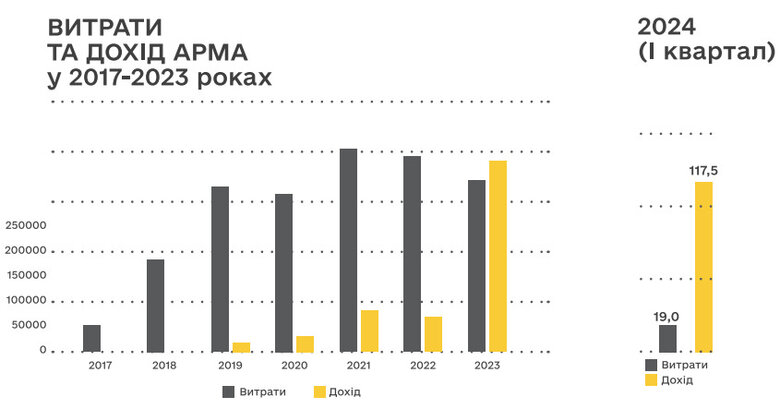

Кстати, такую эффективность АРМА начала показывать с 2023 года, когда Елена Дума стала во главе агентства. До того денег на содержание институции тратилось больше, чем она приносила бюджету.

Дело Лазаренко

Говоря о выводе денег из Украины, нельзя не вспомнить пятого премьер-министра — Павла Лазаренко.

Еще в должности первого вице-премьера организовал поставки газа и нефтепродуктов в Днепропетровскую область, а с 1996-го — в Украину в целом через коммерческую компанию Единые энергетические системы Украины (ЕЭСУ) Юлии Тимошенко. Сверхприбыли формировались благодаря завышению цены на газ для украинских потребителей. Выводились деньги в частности через турецкую компанию United Energy International Limited — дочку ЕЭСУ.

В сентябре 1998-го Генеральная прокуратура Украины возбудила против Лазаренко уголовное дело. Его обвиняли в хищении государственного имущества в особо крупных размерах. Но в начале 1999 года Павел Лазаренко выехал из Украины. Задержали его в Нью-Йорке при попытке пересечь границу по поддельному паспорту.

В 2004 году украинский бизнесмен Петр Кириченко, один из партнеров Лазаренко, свидетельствовал, что перечислил чиновнику $30 млн и помогал отмывать деньги через Антигуа, Швейцарию и Польшу.

В августе 2006-го суд Калифорнии приговорил Павла Лазаренко к девяти годам заключения и штрафу в $10 млн. Вышел на свободу бывший премьер в ноябре 2012 года.

Всего Лазаренко удалось вывести из Украины около $200 млн. Вернуть эти деньги государство пытается до сих пор.

В августе 2024-го стало известно, что Министерство юстиции США через процедуру гражданской конфискации хочет изъять в пользу Украины более $200 млн. Эти средства арестованы в разных странах. Судебные процессы по ним продолжаются уже около 20 лет.

В апреле 2017-го тогдашний заместитель Генерального прокурора Украины Евгений Енин говорил, что правительство США планирует вернуть украденные Лазаренко деньги на определенных условиях, а не просто перечислить их в государственный бюджет.

По словам Енина, защита Петра Лазаренко предлагала американскому правительству заключить соглашение «50 на 50», но предложение отвергли.

Возможно дело сдвинется с мертвой точки после того, как лидеры стран «Большой семерки» согласовали предоставление Украине $50 млрд займов, которые будут погашаться за счет доходов от замороженных российских активов.

Россияне выводят деньги из Украины

С начала полномасштабного вторжения в Украину закон запрещает убирать российских владельцев или бенефициаров из компаний. Впрочем, несмотря на ограничения, 621 компания избавилась от российского следа и не только продолжает работать в нашей стране, а они еще и выигрывают миллионные государственные тендеры.

«Министерство юстиции в 8 из 10 проверок доказало, что регистрационные действия были незаконными. Однако изменения не были отменены, а компании с отбеленной репутацией продолжают работать на рынке Украины», — говорится в материале Опендатабот.

В Минюсте заявили, что регистрационные изменения могут быть отменены или по решению суда, или же в случае, если жалобу подаст лицо, права которого нарушены, в течение двух месяцев со дня, когда лицо узнало или могло узнать о нарушении своих прав, но не позднее одного года со дня принятия соответствующего решения, совершения действия или бездействия.

Но в подавляющем большинстве случаев уже прошло более одного года с момента перерегистрации, то есть сроки упущены. В то же время нет и конкретного пострадавшего лица от вывода российских капиталов и отбеливания бизнеса.

«Сейчас сложилась довольно странная ситуация: Украина требует от зарубежных партнеров блокировки российских активов и передачи нам этих денег, в то же время россияне спокойно и безнаказанно выводят свои капиталы из Украины. Этот вывод просто не контролируется госучреждениями, в обязанности которых входит мониторинг регистрационных действий.

Даже при условии, когда частная компания принесет готовый перечень потенциальных нарушителей, а государственные учреждения их подтверждают — ничего не происходит. Министерство юстиции не может эти нарушения устранить за давностью действий и отсутствием лица, которое пострадало.

Какой орган власти в Украине возьмет на себя контроль за перерегистрацией российских активов и отменит сроки давности по таким операциям? Кто, в конце концов, должен инициировать дальнейшее рассмотрение дел, где фактически пострадавшим является государство Украина? Пока эти вопросы остаются открытыми, россияне продолжают выводить свои средства, а их бизнесы — зарабатывать на украинцах и государственных тендерах», — отмечает основатель Опендатабота Алексей Иванкин.

Выводят миллиарды зерном

Как ранее писал БизнесЦензор, от 20% до 50% экспорта украинского зерна может использоваться для вывода валюты за границу и отмывания денег.

Схема с «черным зерном» используется для уклонения от налогообложения и вывода валюты из страны. Неучтенное зерно покупают у фермеров за наличные и оформляют на фиктивные компании-однодневки, которые экспортируют его за границу.

По дороге груз может несколько раз менять владельца и в конце концов продается конечному покупателю. Но полученные средства остаются у одной из компаний-посредников и в Украину не возвращаются.

Экс-заместитель главы Офиса Президента Ростислав Шурма в одном из интервью Экономической правде в прошлом году утверждал, что экспортеры, которые вывозили зерно по теневым схемам, не вернули в Украину до $20 млрд выручки.

«Все думают, что это была какая-то большая централизованная схема. Нет. Как раз вопрос в том, что это была абсолютно децентрализованная история, в которую побежали сотни предпринимателей разного рода, если их так можно назвать. Это не крупные зернотрейдеры. Во-первых, это очень тяжело администрировать, во-вторых, есть риски, связанные с тем, что ты можешь потерять свою кредитную историю, можешь получить уголовные преследования. Преимущественно этим занимались несистемные средние компании», — заявил Шурма.

В целом экспорт «черного зерна» позволяет отмывать и выводить за границу доходы от других теневых схем, которые предусматривают продажу товаров или услуг за наличные. В частности, по данным СБУ, именно таким образом выводили средства из Украины организаторы нелегальных схем с азартными играми.

Опыт Коломойского

В 2021 году американское издание Pittsburgh Post-Gazette обнародовало масштабное расследование о том, как Игорь Коломойский отмывал через ПриватБанк и Deutsche Bank незаконно полученные доходы, покупая сталелитейные заводы и недвижимость в США.

Авторы расследования утверждают, что в период с 2008-го по 2015 год Игорь Коломойский и его партнеры вероятно похитили не менее $750 млн, а затем перевели деньги через многочисленные банковские счета компаний, открытых на Кипре и Виргинских островах. В конце концов средства оказались в Соединенных Штатах через Deutsche Bank USA — сотрудники учреждения выдавали фиктивные займы подконтрольным олигарху компаниям.

Около $526,6 млн перевели контролируемым Коломойским и его партнерами фирмам в штате Делавэр, где большую часть суммы использовали для покупки 18 объектов недвижимости, в том числе девяти металлургических заводов, пяти небоскребов, двух офисных парков и закрытого завода Motorola на северо-западе от Чикаго.

Минюст США неоднократно обращался в суд относительно возможного вывода Игорем Коломойским и его партнерами денег из ПриватБанка. Требования исков исчисляются миллионами долларов.

Сейчас же Игорь Коломойский уже более года находится в СИЗО в Украине. Его подозревают в мошенничестве и завладении средствами ПриватБанка, а также в организации заказного убийства в 2003 году. Ему объявили несколько подозрений по разным эпизодам.

По словам самого Коломойского, подозрение ему вручили после звонка из Америки.

Ранее сообщалось, что олигарха лишили украинского гражданства, чтобы упростить его экстрадицию в США. Впрочем, запроса со стороны американцев не было.

***

$100 млрд, выведенные из Украины за годы независимости, — солидная сумма, которая пригодилась бы Украине в условиях полномасштабной войны и острой потребности во внешнем финансировании государственного бюджета.

Однако пока они не более, чем легендарное золото гетмана Полуботка — о деньгах все знают, но не могут их получить. Возврат активов, как показывает история того же Лазаренко, — растянутый во времени трудный процесс без каких-либо гарантий. Поэтому рассчитывать на эти средства пока не приходится.