Государственные финансы Украины находятся в экстремальном режиме. Реанимационная палата подключена к внешним источникам. Без ~$40 млрд. иностранных ресурсов в 2024г. справиться с фискальными вызовами будет весьма проблематично. Минфин, Нацбанк, Кабинет Министров по всему миру ищут кредиты, гранты, самые разные виды помощи

Ведутся переговоры с международными организациями, правительствами и клубами кредиторов. Украине остро нужны деньги на оружие, энергетику, логистику, снабжение ВСУ и производства базовых товаров/услуг для людей. Ключевое слово – «базовых», тех, которые необходимы для выживания с одной стороны и для победы над врагом с другой.

Украине помогают деньгами (львиная доля – дорогие кредиты), ожидая ответственного отношения к государственным расходам. Когда в семье случается форм-мажор (пожар, наводнение), она не может себе позволить сохранить структуру и объём расходов до несчастного случая. Источники доходов семьи сокращаются. Разумно, логично, ответственно сокращать расходы. Да, родственники, друзья, просто добрые, сердечные люди помогают семье в беде. Одни дают одежду и еду, другие мебель, третьи дали попользоваться автомобилем. Добрые люди вошли в положение, предоставили кредит в надежде, что семья восставит фискальное, бюджетное здоровье.

Представьте, если в такой ситуации семья, которой помогают чуть ли не всем добродетельным миром продолжает жить, как будто трагедия случилась не у них. Новые гаджеты, модная брендовая одежда последних коллекций, отдых два раза в год, итальянская мебель на дачу и непременно салоны красоты/фитнесс два раза в неделю – всё это в затратах семьи. Как вы думаете, насколько хватит душевной щедрости, сердечности соседей/друзей такой семьи помогать ей деньгами и ресурсами?

Власти Украины проводят бюджетную политику только с одним расчётом. Это расчёт на списание государственных долгов внешними кредиторами. Чем больше дадут, тем лучше. Всё равно мы отдавать не собираемся, потому что с такой экономикой отдавать такие долги невозможно. Для развивающей страны безболезненное обслуживание госдолга размером более 60% ВВП требует темпов роста более 7% ВВП.

В Украине даже теоретически обсуждать идею о том, что внутренним покупателям государственных ценных бумаг в текущем режиме и в будущем не будут платить или платить с дисконтом, Правительство опасается. Поэтому тема списания госдолга относится исключительно к внешним кредиторам. И вот мы имеем деморализующий кейс дискриминации экономически субъектов по стране происхождения.

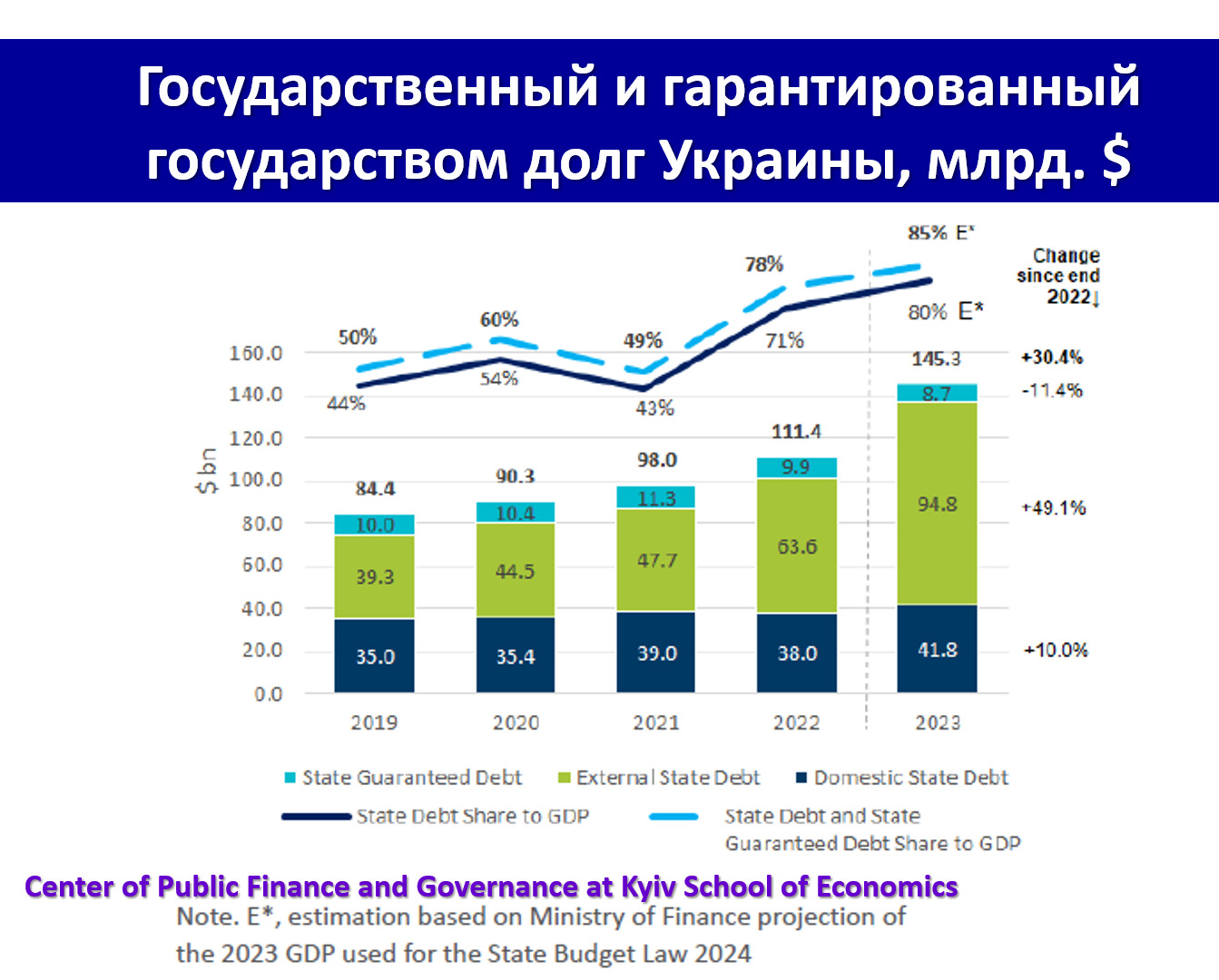

По итогам 2023г. госдолг Украины составил 84,4% ВВП. По состоянию на 01.04.2024г. он резко вырос на 434 млрд. гривен, пробив отметку 90% ВВП. Поскольку львиная доля внешних долгов страны (~75%) номинирована в долларах и евро, то для оценки объёма ресурсов на их финансирование нужна определённость в курсовой политике. Одно дело обслуживать госдолг при курсе ₴38 — 39 за $1, другое дело – ₴43 – 45 за $1. С гигантским дефицитом торгового баланса, инвестиционной засухой внутри страны, жёсткими ограничениями по платёжному балансу и сильнейшей зависимостью от внешнего финансирования административная консервация курса гривны в районе ₴40 за $1 долгое время невозможна, особенно при охлаждении отношения кредиторов к Украине и их разочаровании нашей экономической политикой. Правду говоря, источников для такого разочарования предостаточно, и они совсем не про ход военных действий.

В 2024г. Украина должна потратить $25,2 млрд. (~₴1,1 трлн.) для обслуживания государственного долга. ₴589,24 млрд. – на платежи по внутренним ценным бумагам государства. Почти 35% этой суммы – процентные платежи. Война озолотила покупателей ОВГЗ. Суммы выплат по внешним обязательствам Государства — ₴427,42 млрд. 58% этой суммы – проценты.

В 2023г. обслуживание государственного долга обошлось Украине в $18,7 млрд. или ~10,6% ВВП. Из этой суммы $15,6 млрд. (более 83%) было заплачено по внутренним кредитам, $3,2 млрд. – по внешним. Если оценить ВВП Украины в 2024г. на $185 млрд. государственный долг заберёт у нас 13,6% ВВП. Это примерно половина того, что мы тратим на оборону. Как вам такая долговая и фискальная политика Правительства?

Первые три года войны для участников долгового рынка Украины – настоящая золотая жила. Вот уж точно, кому война, а кому источник невероятного обогащения. Украинские банки, особенно пятёрка самых крупных в шоколаде. Прибыльность бьёт через край. Вот и в I квартале 2024г. украинские банки увеличили чистую прибыль на 18% по сравнению I кварталом 2023г. За первые три месяца 2024г. они заработали ₴40,5 млрд, ($1,05 млрд). Главный источник прибыли – государственные ценные бумаги (ОВГЗ и депозитные сертификаты НБУ). Они были и остаются активными участниками строительства долговой пирамиды. Её строительство никто не отменял. Так только 14 мая Минфин продал годовые гособлигаций на ₴11,5 млрд. под 15,25% годовых. При годовой инфляции в 4 – 5%, ручной фиксации курса гривны это финансовая операция даже похлеще, чем валютно-обменные операции второй половины 1990-ых.

Не удивительно, что Кабинет Министров, Министерство финансов, Нацбанк, а также их институциональные и коммерческие партнёры, включая банки и инвестиционные компании, спелись, слились в единый синдикат зарабатывания высокой прибыли за счёт Государства. Только подзабыли эти финансовые бароны, что Украина воюет, что такого рода финансовый, денежный, долговой шабаш резко снижает доверие к Украине, охлаждает сердечность и щедрость наших партнёров, снова поднимает на повестку дня вопрос: «Если они сами так к своей стране, своей экономике, своим людям относятся, то почему мы должны переживать? Почему мы должны платить за их схематоз, за обогащение 1% населения за счёт 99% остальных?»

Сколько бюджетной, долговой верёвочке не виться, конец всё равно наступит, и будет он очень болезненный, напряжённый и кризисный. Архитекторы украинской фискальной и долговой пирамиды рассчитывают на списание госдолга. А если нет? Выгодополучатели долговой государственной пирамиды уверены, что они вовремя успеют выйти в кэш и спрятать чистую прибыль в твёрдой валюте. О том, какой будет курс гривны после этого, ₴50 или ₴70, они точно не беспокоятся. Впрочем, практика «кидалова» в финансовом секторе Украины явно прижилась.

Если не получится уговорить внешних кредиторов на списание долга, если не выйдет уломать внутренних на такое же, тогда остаётся аргентинский (до Милея) вариант – дефолт. После него уже другие переговоры, но без долговой удавки на шее. Тоже очень неприятная процедуру. Тоже с высокими репутационными рисками. Те субъекты, которые толкают нас в неё, рассчитывают на то, что лично они от этого не пострадают. Да, они вынуждены будут уйти из власти, но сколько в новейшей истории Украины было фентифлюхтеров и швендипопперов, которые крали, кидали, пилили, разоряли «народное добро» — и ни тюрьмы, ни даже обнуления репутации.

Есть только один способ остановить долговую и бюджетную вакханалию – радикально пересмотреть параметры доходов и расходов бюджета. Полноценная налоговая реформа с глубокой ревизией расходов бюджета – это необходимая, но не достаточная часть программы мер по спасению украинской экономики, по спасению страны от двух самых больших врагов: нацистской России и доморощенной бюрократии, как фундамента коррупции и Олигархата.