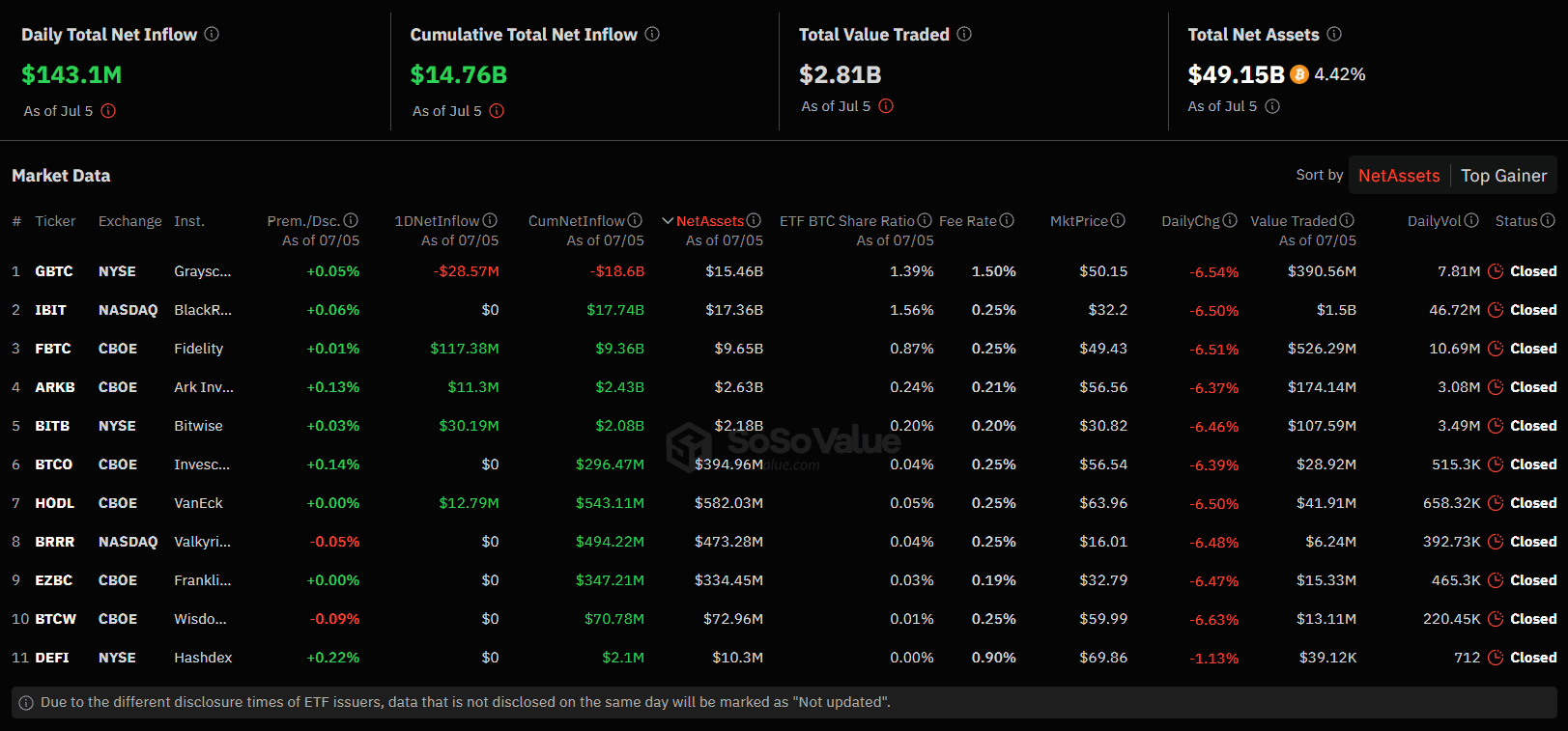

5 июля 2024 года спотовые биткоин-ETF зафиксировали чистый приток капитала в размере $143,1 млн, по данным SoSo Value. Основная часть финансовых вливаний поступила в криптофонд от компании Fidelity Investments.

На инвестиционный продукт Fidelity Wise Origin Bitcoin Fund (FBTC) пришлось 117,4 млн от общего притока. Суммарный объем активов под управлением (AUM) фонда составляет $9,65 млрд. FBTC занимает третью позицию по этому показателю среди всех спотовых биткоин-ETF в США.

На втором месте по притоку находится биржевой фонд от компании Bitwise Asset Managment под тикером BITB. За прошедшие сутки этот инвестпродукт получил финансовые вливания в размере $30,2 млн. AUM криптофонда держится на отметке в $2,08 млрд.

Третье место по объему полученного капитала занимает спотовый биткоин-ETF от фирмы VanEck — $12,8 млн. Размер активов под управлением биржевого фонда под тикером HODL составляет $582 млн.

Замыкает четверку криптовалютных ETF, пребывающих в «зеленой зоне», инвестиционный продукт от компаний Ark Invest и 21Shares. За прошедший торговый день он получил в общей сложности $11,3 млн.

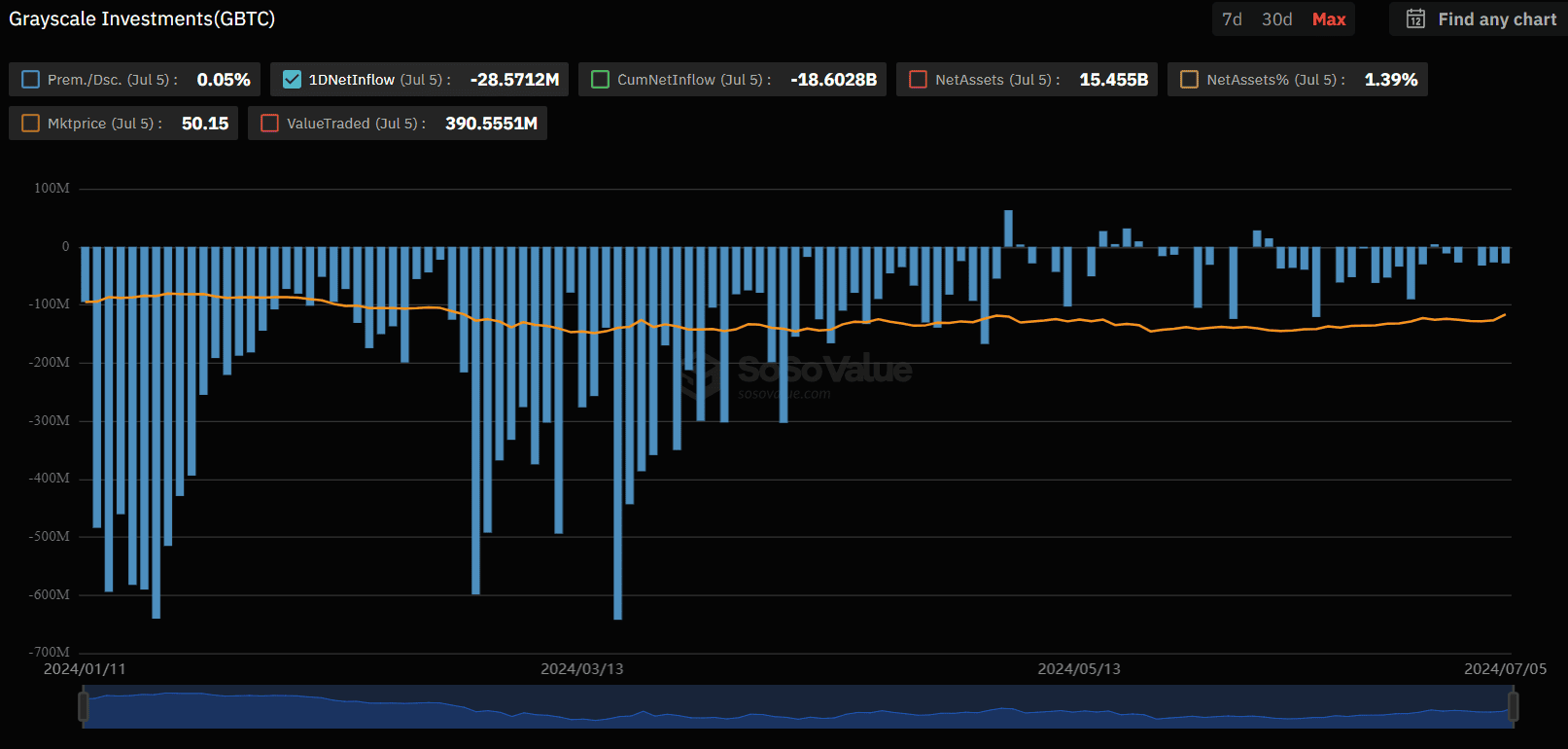

Тем временем конвертированный фонд от финансового гиганта Grayscale Investments продолжил терять средства. 5 июля 2024 года спотовый биткоин-ETF под тикером GBTC лишился $28,6 млн. С момента запуска этот криптофонд потерял суммарно $18,6 млрд. AUM инвестпродукта от Grayscale находится в районе $15,5 млрд.

Оставшиеся шесть биржевых фондов на базе биткоина завершили прошлый торговый день с нулевыми показателями притока/оттока. Среди них числятся криптовалютные ETF от таких компаний, как BlackRock, Franklin Templeton, Valkyrie Digital Assets и других игроков рынка.