Несколько ончейн-индикаторов вошли в так называемую «зону риска», что может являться сигналом начальной стадии бычьего рынка. К такому выводу пришли в Glassnode.

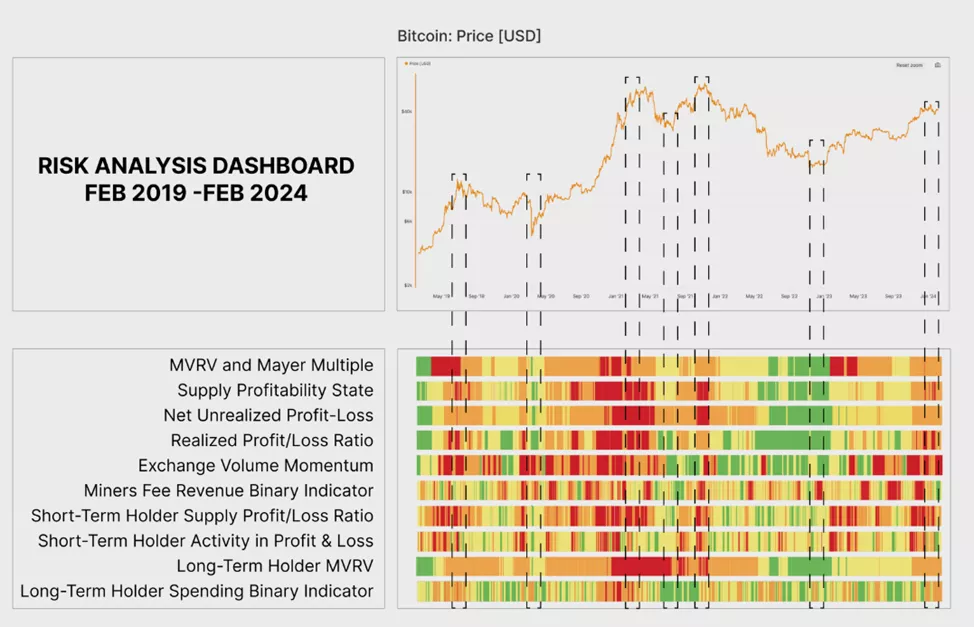

Анализ базируется на группе показателей, которые учитывают широкий набор данных и категорий поведения инвесторов. Их комбинация часто дает более полную картину состояния рынка. Она охватывает как краткосрочные, так и долгосрочные циклы.

На приведенной диаграмме они представлены в виде тепловой карты различных степеней риска за последние пять лет. Она демонстрирует существенное совпадение метрик и значимых ценовых экстремумов.

Согласно специалистам, высокий показатель риска обычно наблюдается на ранних стадиях бычьего рынка биткоина. Он означает возврат ходлерами к «значимому уровню» рентабельности, который может подтолкнуть их к началу фиксации прибыли.

Новости о ETF смягчили перегрев

В частности, к этой критической зоне подступил индикатор MVRV применительно к долгосрочным инвесторам. Столь высокое значение (2,06) не наблюдалось с момента коллапса FTX.

Схожий статус «высокого» и «очень высокого» риска в настоящий момент характерен еще для шести из оставшихся девяти метрик. Это означает относительно низкий уровень реализованной прибыли с учетом активного роста цены в последние недели, пояснили специалисты.

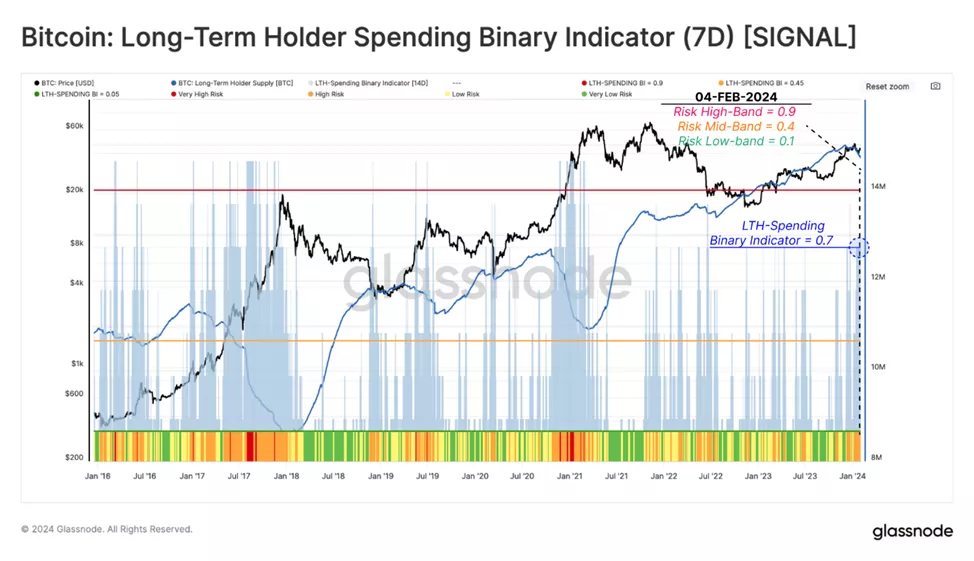

Умеренная «разгрузка» ходлерами монет после одобрения спотовых биткоин-ETF вывела показатель их трат от «зоны риска».

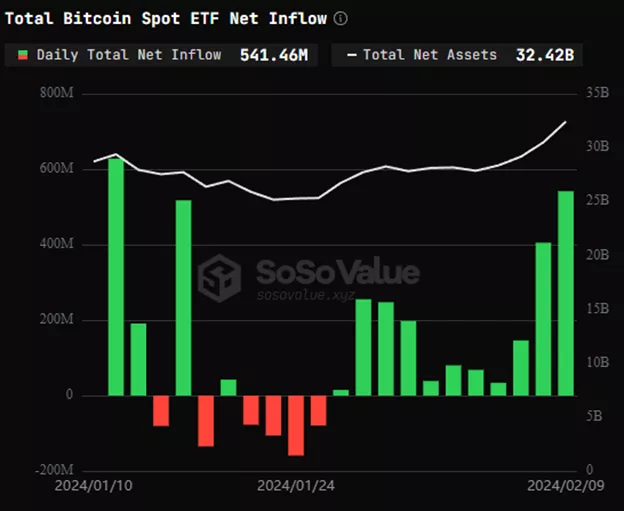

11 февраля цена первой криптовалюты закрепилась выше $48 000. Продолжение позитивной динамики совпало с увеличением чистого притока в биржевые фонды на базе цифрового золота до рекордных $541,46 млн (9 февраля). Объем активов под управлением продуктов достиг $32,4 млрд.

Улучшение динамики стало возможным в том числе благодаря уменьшению оттока из GBTC до минимальных с момента регистрации ETF значений — $51,81 млн.

Сопротивление на $50 000

В комментарии ForkLog трейдер Артем Звездин отметил завершение в начале февраля продаж по факту одобрения ETF. Эксперт видит в текущей динамике возвращение институциональных инвесторов, которые увеличивают долю риска в портфелях в ожидании снижения ФРС ключевой ставки.

«Если биткоин не закрепится выше психологической отметки $50 000 в ближайшую неделю, можно ожидать небольшой технической коррекции в диапазон $44 000-45 000 и последующий рост. Главными фактором станут ожидание [изменения] политики Федрезерва и халвинг. На мой взгляд, первая криптовалюта в этом году уже не упадет ниже $40 000. В ближайшие месяцы можно ожидать повышения котировок к $60 000», — написал Звездин.

На сопротивление вблизи $50 000 также указал соучредитель и CEO Material Indicators Кит Алан. Он сослался на объемы выставленных ордеров и указал на неблагоприятное соотношение «прибыль/риск» для краткосрочных покупателей на текущих уровнях. Специалист подчеркнул отсутствие изменений в позитивных ожиданиях для ходлеров.