Институциональные инвесторы предпочитают вкладывать средства в Ethereum и стейблкоины, розничные — в биткоин. Это следует из нового отчета экспертов Bybit

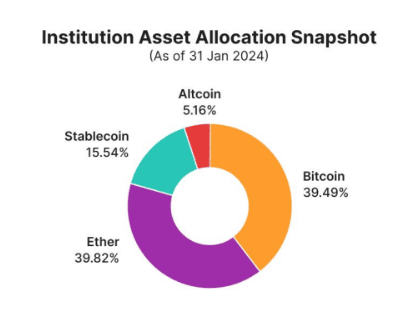

Согласно ему, доля Ethereum в портфелях институциональных инвесторов составляет 39,8%, биткоина — 39,4%. Еще 15,5% приходится на стейблкоины:

Эксперты полагают, что превалирование доли Ethereum связано в первую очередь с предстоящим обновлением Dencun, что, как ожидается, приведет к значительному сокращению издержек и упрочит позиции актива:

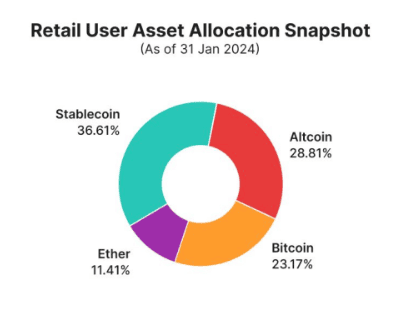

В портфелях розничных инвесторов, согласно отчету, превалирует доля стейблкоинов — 36,6%. На альткоины приходится 28,8%, на биткоин — 23,17%. Ethereum занимает последнее место:

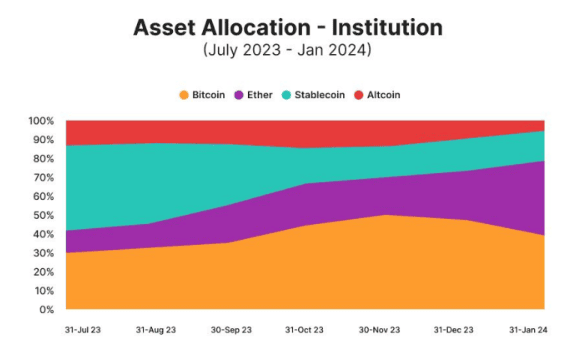

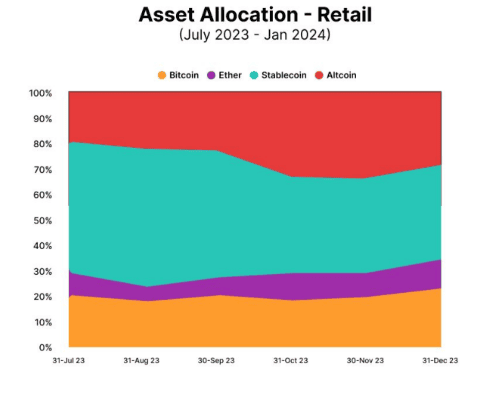

При этом, по словам экспертов, в январе 2024 года обе категории инвесторов снизили долю альткоинов в своих портфелях ввиду высокой волатильности таких токенов.

В особенности это хорошо видно на этой диаграмме. Розничные инвесторы активно покупали альткоины в начале осени 2023 года, однако позднее стали продавать их:

Примечательно, в преддверии одобрения спотовых биткоин-ETF в США институциональные инвесторы стали снижать долю криптоактивов в своих портфелях. Розничные, наоборот, повысили ее, отметили эксперты.