Ethereum (ETH) утратил дефляционный характер после развертывания обновления Dencun в сети, что может иметь серьезные долгосрочные последствия. Об этом сообщает The Block со ссылкой на отчет экспертов CryptoQuant.

Напомним, обновление Dencun состоялось в середине марта 2024 года.

В отчете подчеркивается, что после этого апгрейда существенно сократились сборы, как на втором, так и на первом уровнях.

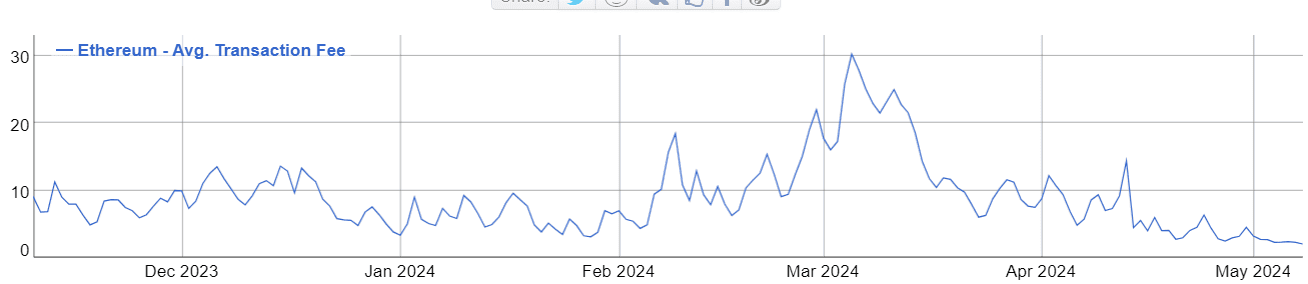

Если до Dencun, в начале марте 2024 года, средняя комиссия в сети Ethereum составляла от $16 до $30, то после него показатель снизился до уровня в $6-$11.

На момент написания значение сократилось до $2, согласно BitInfoCharts:

При этом в 2021 году в сети Ethereum прошел хардфорк London. В числе прочего, он заложил механизм сжигания части комиссий, чтобы сделать актив дефляционным.

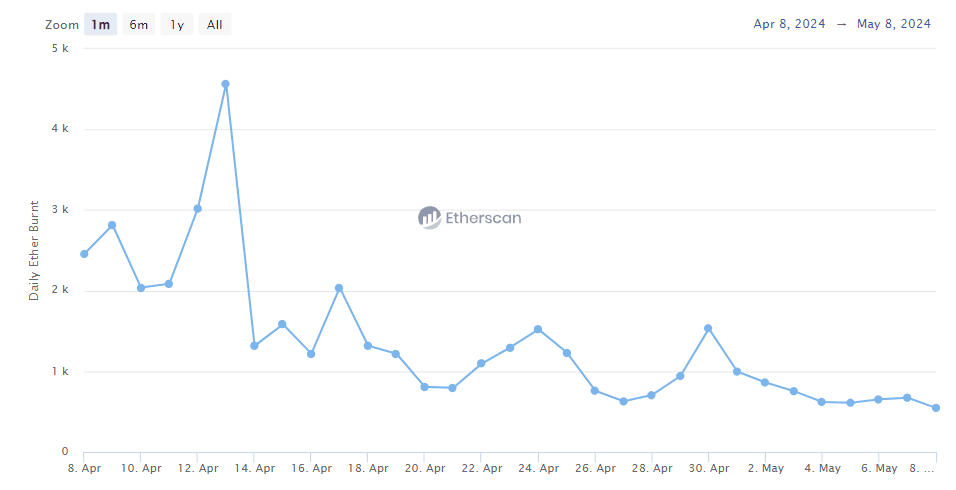

Снижение сборов привело к тому, что суточный объем ликвидируемого Ethereum сократился. Это сделало монету инфляционной, подчеркнули эксперты CryptoQuant.

Это подтверждают и данные Etherscan. Ранее мы писали о том, что суточный объем сожженного Ethereum установил новый минимум в 610,52 ETH. Но затем показатель обновил его.

На момент написания он сократился до 547 ETH:

«До обновления Dencun более высокая сетевая активность в сети Ethereum означала рост показателя сожженных комиссий. Это, в свою очередь, приводило к сокращению предложения. Однако после обновления Dencun общая сумма сожженных комиссий перестала быть связана с сетевой активностью», — подчеркивается в отчете.

Эксперты пришли к выводу, что для возврата к дефляционному характеру потребуется более высокая сетевая активность. В противном случае актив окончательно потеряет этот статус.