Ольга Гутовськая, бизнес-леди, смогла приобрести активы 21 банка-банкрота и получить доступ к информации о тысячах украинцев.

В банковской сфере Украины скандалы случаются часто. Конечно же, самый громкий – это дело о хищении из «Приватбанка» бывшим менеджментом 8,4 млрд грн. Но и в его «тени» существуют истории. Одна из них — покупка за бесценок активов 21 банка-банкрота. Основным фигурантом этого скандала стала бизнес-вумен и юрист Ольга Гутовская. «Комментарии» разбирались в деталях скандала и того, как так получилось.

Кто такая Ольга Гутовская

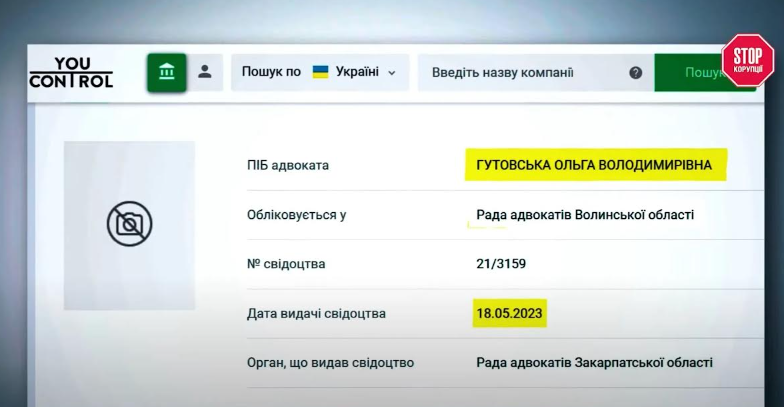

Впервые в украинском информационном пространстве Ольга Гутовская появилась в 2019-м году как юрист, комментируя одному из украинских изданий как раз дело «Приватбанка», который пытался вернуть через Лондонский суд почти 2 млрд долларов выведенных ранее из финучреждения. Любопытно, что в аналитическом сервисе YouControl, данные о юристе Ольге Гутовской датируются лишь маем 2023 года, когда она стала адвокатом во Львовской области.

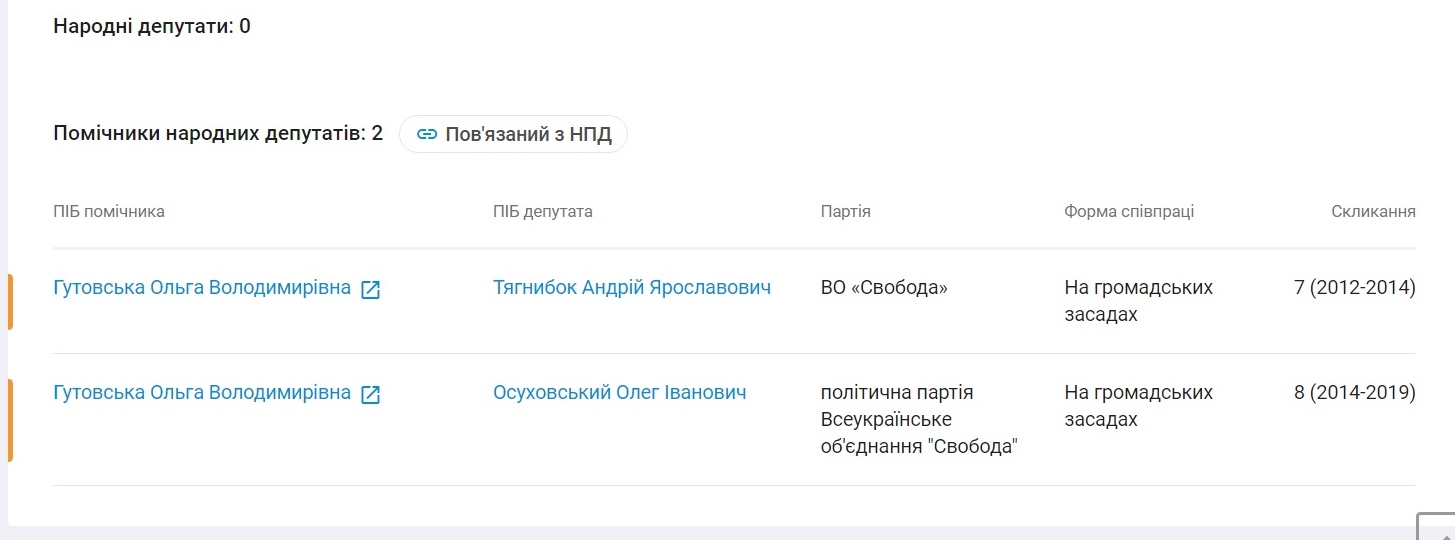

Ранее, с 2012 по 2019 годы, «госпожа юрист» была помощником народного депутата Украины, лидера ВО «Свобода» Олега Тягнибока. А также занималась бизнесом через компании «Энд пи Киев» и «Шандельер групп» и руководила двумя общественными организациями.

Ранее, с 2012 по 2019 годы, «госпожа юрист» была помощником народного депутата Украины, лидера ВО «Свобода» Олега Тягнибока. А также занималась бизнесом через компании «Энд пи Киев» и «Шандельер групп» и руководила двумя общественными организациями.

Мужем Гутовской был сотрудник Государственной налоговой инспекции Ярослав Землянский, правда о доходах супруги последний в декларации в 2019-м году почему-то умолчал. Впрочем, если в тот момент она жила и работала в Лондоне, это было объяснимо.

Мужем Гутовской был сотрудник Государственной налоговой инспекции Ярослав Землянский, правда о доходах супруги последний в декларации в 2019-м году почему-то умолчал. Впрочем, если в тот момент она жила и работала в Лондоне, это было объяснимо.

По сведениям сайта СтопКор, в 2020-м году Гутовская стала совладелицей (75%) зарегистрированной в Лондоне компании WWRT Limited с уставным фондом всего в 5 фунтов стерлингов.

Последняя специализируется на поиске и возврате активов по всему миру, так гласит сайт компании в Интернете. Правда, ознакомиться с «портфолио» фирмы и ее успешными действиями невозможно, так как на сайте информация отсутствует.

Об успехах компании можно судить по выступлениям Ольги Гутовской в украинских СМИ. Так, в июне 2022 года она, якобы, добилась ареста экс-банкира Сергея Тищенко, владельца «Фортуна-банка» по делу о мошенничестве, причем сделала это в Лондоне. А уже спустя 3 недели бизнесмен был задержан в Лондоне, о чем сообщали «Комментарии».

Сам банк «Фортуна», испытывавший проблемы с 2014 года, официально был признан банкротом еще в феврале 2017 года. И хотя официально 99,5% банка принадлежали матери господина Тищенко Мотроне Тищенко, Сергей гарантировал часть кредитов финучреждения лично, так что позднее через суд добивался уже банкротства себя как физлица.

По фабуле дела Сергей Тищенко и его супруга Елена обвинялись в выводе из банка «Фортуна» 100 млн дол, а истцом по делу была как раз WWRT, вероятно, действовавшая в интересах некого заказчика. Во всяком случае так можно было бы подумать, если бы не один факт, о котором стало известно почти 1,5 года спустя.

Что вменяют Ольге Гутовской

В декабре 2023 года журналисты проекта СтопКор пообщались с бывшей женой Сергея Тищенко, Еленой, и провели расследование деятельности Ольги Гутовской.

По словам Елены Тищенко, деятельность Ольги Гутковской направлена на покупку за бесценок пакета долгов ряда украинских обанкротившихся банков. Собственно, именно WWRT Limited другая компания – «Стар Инвестмент Ван» переуступила пакет долгов ряда украинских обанкротившихся банков, которые в свое время сама приобрела всего за 0,03% от общей стоимости всех кредитов и залогов.

«И вот когда они уже оформляли переуступку, четко проявился этот умысел. Потому что они отступили права только по кредитам. А залог «Стар Инвестмент Ван» оставил себе. По законам как Украины, так и любой другой страны, такое невозможно. Потому что залог обеспечивает выполнение основного обязательства. Он идет исключительно в привязке к кредиту. И тем, что они себе оставили залог, а фирме WWRT сбросили кредиты, они уже показали, что это фактически одни и те же люди».

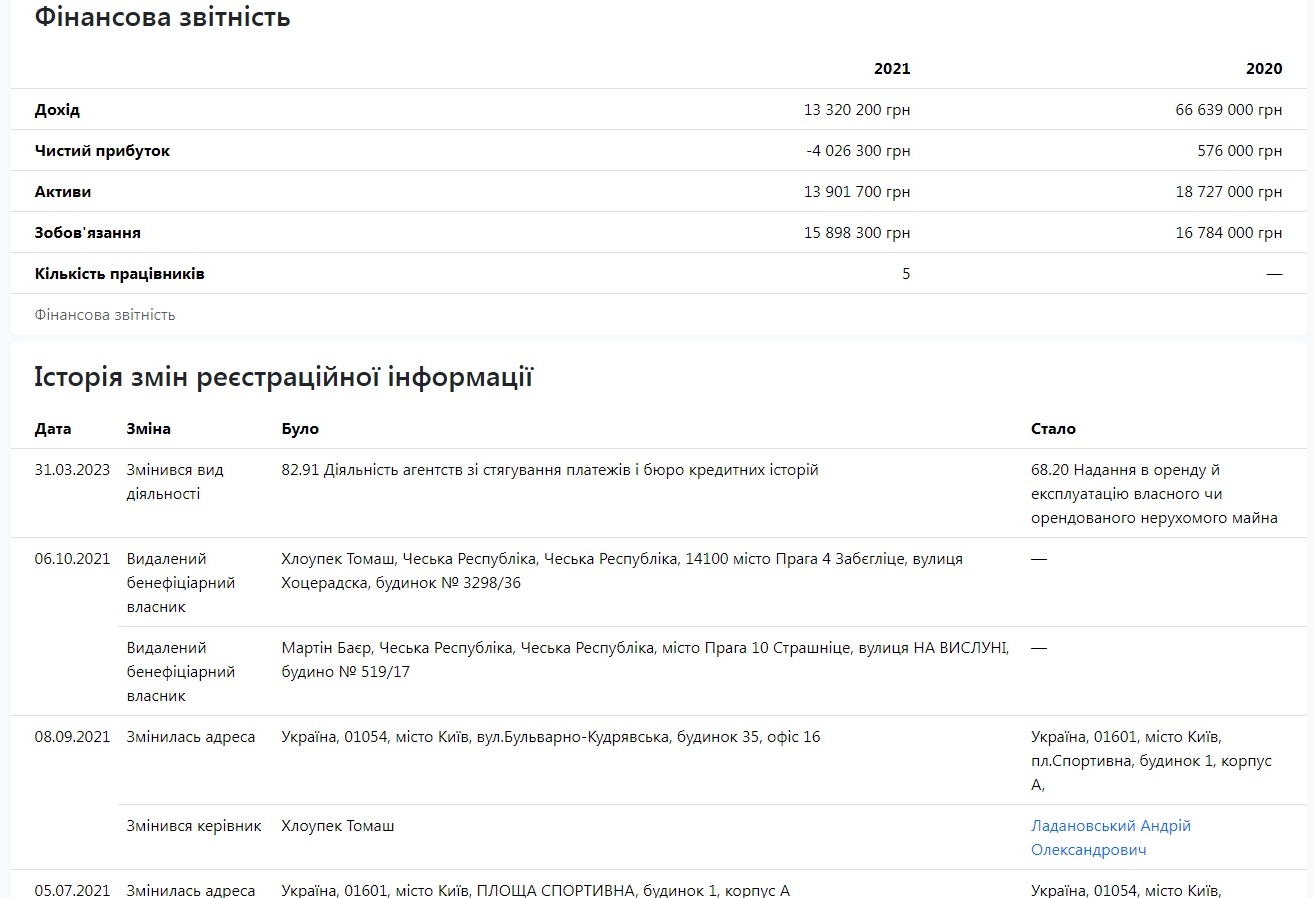

Действительно, по данным YouControl в Украине работает ООО «Стар инвестмент ван», которая официально занимается недвижимостью. В то же время, как следует из некоторых судебных решений, компания часто покупает имущество должников у различных банков. Собственно, до изменения с 31 марта 2023 года вида деятельности на «аренду жилья», компания имела основным кодом экономической деятельности 82.91 «Деятельность агентств по взысканию долгов и бюро кредитных историй».

Официально, сама ООО «Стар инвестмент ван» принадлежит чешской компании ООО «Стар инвестмент цезет ван», а владелец у нее — гражданин Люксембурга Эрикс Мартиновсксис.

Вместе с тем, существуют несколько уголовных дел, по которым, как утверждают СМИ, в качестве подозреваемой проходит Ольга Гутовская.

Следует обратить внимание, что деятельность «Стар инвестмент ван» и WWRT Limited может касаться каждого украинца, поскольку в приобретенных фактически по дешевке портфелях есть и множество обычных кредитов простых граждан. И тот, кто выкупил данный «лот», получил доступ к их личным данным.

Таким образом, компания «известного международного юриста», ставшей адвокатом всего полгода назад, и о фирме которой нет никакой внятной информации даже на сайте компании, может получить в свои руки данные о тысячах или даже десятках тысячах украинцев, задолжавших по кредитам 21 банку. Куда пойдут после этого персональные данные очень важный вопрос, особенно в условиях продолжающейся войны.