Австрийские «Райффайзенбанк» и UNIQA Insurance Group AG договорились о продаже долей в своей российской дочерней страховой компании «Райффайзен Лайф». Она достанется «Ренессанс Жизнь» (входит в группу «Ренессанс Страхование»).

Ключевым бенефициаром «Ренессанс Страхования» является Борис Йордан. Еще часть долей у структур, связанных с олигархом Романом Абрамовичем и его партнеров.

Как удалось выяснить, еще одним бенефициаром «Ренессанс Жизнь» может стать хозяин «БКС Холдинга» Олег Михасенко. В таком случае, если состоится сделка с «Райффайзенбанком», он гипотетически может стать хозяином одного из крупнейших страховых бизнесов страны. И из трио Йордан-Абрамович-Михасенко именно Йордан может оказаться слабым звеном. Абрамович и Михасенко выдавят его из этого бизнеса?

Сделка по «Ренессанс Жизни» еще не завершена — для этого требуется разрешение регуляторов. Сумма предполагаемой сделки не называется.

«Ренессанс Страхование» — одна из крупнейших страховых компаний страны. 52,12% акций ООО «Холдинг Ренессанс Страхование» принадлежит «Группе Спутник» Бориса Йордана (состояние на 2022 год — $1 млрд).

Объединенная группа «Ренессанс Страхование» появилась в 2017 году в результате сделки группы «Ренессанс страхование» и НПФ «Благосостояние». Происходило это при участии печально известного фонда Baring Vostok. В 2021 году основатель фонда Майкл Калви был приговорен к условному сроку на пять лет и шесть месяцев по уголовному делу о растрате в банке «Восточный».

Изначально организационно-правовой формой «Ренессанс Страхование» было АО. В этот период Борис Йордан испытывал финансовые трудности. Помочь согласился Роман Авдеев. В 2018 году его «МКБ Банк» открыл структуре Йордана кредитную линию на 2,7 млрд рублей. Однако уже в 2019 году залог был снят, Йордан расплатился.

Произошло это благодаря размещению крупного облигационного займа на 3 млрд. рублей. Изначально целью выпуска объявили именно рефинансирование кредита, полученного в «МКБ Банке».

Однако расплата по долгам сама по себе не предполагает наличие серьезных средств на дальнейшее поддержание и развитие бизнеса. И в 2021 году господин Йордан нашел себе новых партнеров – структуры олигарха Романа Абрамовича. Он же мог и помочь Йордану расплатиться с Авдеевым при размещении облигаций, рассчитывая на долю в бизнесе.

В результате по решению участников АО было реорганизовано в ПАО. ООО «Грано» Абрамовича получило 9,99% долей структуры, а у ООО «Инвест АГ», которое представляет интересы партнеров олигарха, Александра Абрамова и Александра Фролова, оказалось 9,55%. Еще 4,33% получил другой член команды Абрамовича Андрей Городилов, а 4,77% оказалось у «Обь Капитал» президента «Инвест АГ» Сергея Братухина.

Сделка с «Райффайзенбанком» значительно усилит позиции «Ренессанса» на страховом рынке РФ. Однако, каким-то образом партнеры умудрились залезть в договорные отношения со структурами главы «БКС Холдинга» Олега Михасенко, и теперь и вовсе могут остаться без «Ренессанс Жизни».

Явление Михасенко в «Ренессанс Жизнь»

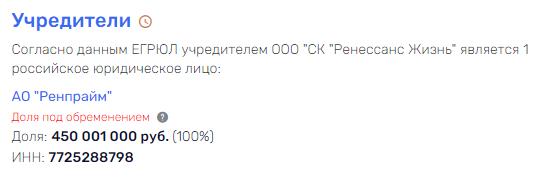

Все 100% долей «Ренессанс Жизни» записаны на АО «Ренпрайм», которое занимается консультированием по вопросам коммерческой деятельности и управления. Учредителями «Ренпрайм» выступают ООО «Группа Ренессанс Страхование» и АО «Ренконсалт».

Обе структуры испытывали серьезные финансовые трудности. Доли (52%) ООО «Холдинг Ренессанс Страхование» в ООО «Группа Ренессанс Страхование» были в залоге у «МКБ Банка» Романа Авдеева. Речь идет еще о том периоде, когда структура Йордана была АО, а не ПАО.

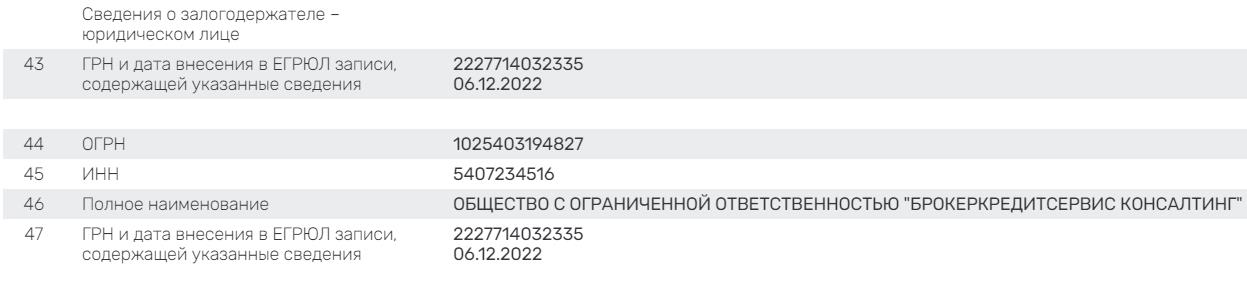

Уже после реорганизации и вхождения в состав акционеров Абрамовича и Ко там внезапно появился и Олег Михасенко. В 2022 году все 100% долей «Ренпрайма» были переданы в залог ООО «БКС Консалтинг», которое входит в ООО «БКС Холдинг» Олега Михасенко. При этом активы самого «Ренпрайм» превышают 15 млрд рублей.

Получается, что при негативном для Бориса Йордана и его ближайших партнеров сценарии «Ренпрайм», а значит и «Ренессанс Жизнь» могут оказаться в собственности у структур Михасенко. В таком случае, сделка с «Райффайзенбанком» превратит его в одного из крупнейших страховщиков жизни и здоровья в РФ.

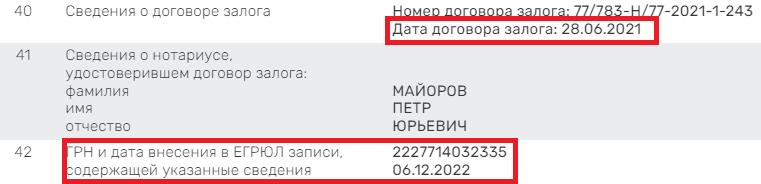

Внимание на себя обращает следующее: договор залога был составлен 28 июня 2021 года. А дата внесения информации о залоге в ЕГРЮЛ — 6 декабря 2022 года. Т.е. между этими событиями прошло около полутора лет, что может свидетельствовать о возможном конфликте. Никак не могли договориться?

Не исключен и вариант, при котором сами Йордан и партнеры могли решить раздробить свой бизнес. Другой возможный сценарий – контролирующий значительную часть «Ренессанс Страхования» Роман Абрамович и держащий в залоге «Ренессанс Жизнь» Олег Михасенко могут просто выдавить Йордана из страхового бизнеса.

С кем поведешься

Между тем, Олег Михасенко в прошлом уже имел дело с «Ренессансом». Только тогда речь шла о банке «Ренессанс Капитале» (основной бенефициар — «ОНЭКСИМ» Михаила Прохорова), часть топ-менеджеров которого перешла на работу к предпринимателю, который тогда планировал вывести своего брокера БКС на IPO.

Речь о экс-главе DMA в «Ренессанс Капитале» Станиславе Сурикове, директоре лондонского офиса Майке Смите, операционном директоре Ризване Кайяни и директоре по взаимоотношениям с клиентами Юлии Ярославцевой.

Новые сотрудники подчинялись главе инвестбанковского подразделения БКС, выходцу из Bank of America Кену Чаргеишвили. Однако впоследствии Михасенко решил заменить его на своего земляка, первого зампреда ФК «Открытие» Романа Лохова, который был конкурентом Сурикова на рынке.

В результате Лохов и Суриков не сработались, а Михасенко наверняка испортил отношения и с «Открытием», и с «Ренессанс Капиталом». При этом в какой-то период времени Сурикова вообще перестали пускать на работу, а затем ему же стали приходить запросы об отсутствии на рабочем месте. Кроме того, Суриков и Ярославцева не получили зарплату за несколько месяцев, а также премии.

Впоследствии их обоих уволили за прогулы, а Кайяни и Смит уволились сами. Суриков пытался добиться правды в суде, но проиграл. Об этом пишет Forbes (архивная ссылка) .

Т.е. Михасенко мог переманить топ-менеджеров у ключевых конкурентов, воспользоваться их компетенциями для укрепления на рынке, а затем банально обмануть, не выплатив якобы полагавшиеся им деньги.

И если у Михасенко есть какие-то договоренности с бенефициарами «Ренессанс Страхование», то не провернет ли он нечто подобное и с ними, заполучив «Ренессанс Жизнь»?

Кажется, действовать не по правилам, писаным или неписаным — вполне в стиле господина Михасенко. Удивительно то, что он создал одного из лидеров финансового рынка России, лишившись необходимого для такой работы аттестата.

В 2009 году Федеральная служба по финансовым рынкам (ФСФР) аннулировала квалификационные аттестаты Михасенко и его заместителя Антона Ветошкина. Было объявлено, что БКС нарушала предписание ФСФР о запрете «коротких продаж», а также не соблюдала правила внутреннего учета и контроля. Об этом пишет РБК.

Лишь в 2015 году он рассказал, что аттестат ему вернули. Но подчеркнул, что сейчас находится на такой должности, что никакие аттестаты ему уже не нужны.

Его БКС банк тоже окружают неприятные события. Он упоминался в контексте истории с предполагаемым выводом активов для владельцев «Пробизнесбанка». В 2021 году кредитор рухнувшего актива ООО «Вэй М» подал к банку три иска в Арбитражный суд Москвы.

Соответчиком по первому является брокер BrokerCreditService (Cyprus) Limited (BCS), по второму – Sova Capital Limited (SCL) (оба входят в группу БКС). В этих двух исках к BCS и SCL истец оспаривал сделки, проведенные в день отзыва у банка лицензии. Ценные бумаги на 25 млрд рублей были списаны со счетов «Пробизнесбанка» как обеспечение.

Для Бориса Йордана это серьезный повод задуматься – а не выкинет ли Михасенко какой-то «финт», если у Йордана не найдется средств, чтобы снять залог с «Ренессанс Жизнь»? В таком случае и Роман Абрамович наверняка будет рад подставить партнеру подножку.