В 2024 году придется платить больше налогов. Всем без исключения. И хотя формально налоговые ставки останутся неизменными, пополнение госбюджета будет обеспечено за счет борьбы с уклонением и путем скрытого повышения фискальной нагрузки.

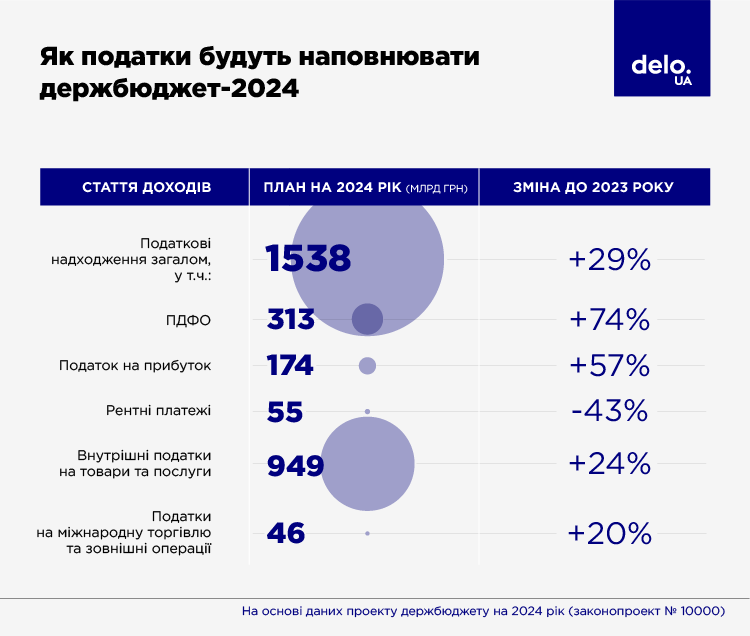

В проекте государственного бюджета на 2024 год, который размещен на официальном сайте парламента, указано, что налоговые поступления составят не менее 1,54 трлн грн. Рост доходной части, которая будет сформирована за счет налогов, по сравнению с 2023 годом составит почти 29%.

Тем не менее, денег от налогов все равно не хватит, чтобы перекрыть бюджетный дефицит. Несмотря на то, что дефицит в 2024 году сократится до 20,4% ВВП против ожидаемых 26% ВВП в 2023 году. Поэтому порядка 43 млрд долл. Украина намерена привлечь за рубежом, преимущественно в виде кредитов и грантов от партнеров. А в общей сложности внешние заимствования в 2024 году составят 100% общего объема поступлений.

Но усиление фискального давления неизбежно. Так что, налогоплательщикам следует держать карман шире.

Сколько принесут налоги госбюджету в 2024 году

Проект госбюджета-2024 рассчитан исходя из общей суммы доходов в размере 1,75 трлн грн. Традиционно большую часть этих доходов должны принести налоги. Их доля в доходах составит порядка 88%. В доходах госбюджета на 2023 год доля налоговых поступлений находится на уровне 86%. То есть, на 2 п.п. меньше.

Иными словами, в 2024 году при формировании доходов государственного бюджета упор на налоговые платежи станет еще сильнее. Доля неналоговых поступлений, среди которых основную сумму генерируют доходы от собственности и предпринимательской деятельности, административные сборы, наоборот сократится.

Больше всего принесут госказне внутренние налоги на товары и услуги – 949 млрд грн или 62%. К ним относятся прежде всего акцизы на произведенную в Украине продукцию и НДС.

Налог на доходы физлиц (НДФЛ или подоходный налог) вместе с налогом на прибыль предприятий должны обеспечить в 2024 году поступления в сумме 487 млрд грн или 32%.

Меньше всего поступит в бюджет налогов на международную торговлю – 46 млрд грн или 3%. В основном это платежи от ввозной пошлины.

Какими будут суммы поступлений по разным видам налогов

Практически по всем основным налогам будет рост, и довольно существенный. Если проанализировать план на 2024 год и сравнить его с теми цифрами, которые заложены в государственном бюджете на 2023 год (в редакции от 21 июля 2023 года), то наибольший прирост ожидается по следующим налогам:

- НДФЛ – на 74% до 313 млрд грн;

- налог на прибыль предприятий – на 57% до 174 млрд грн;

- акцизный налог на произведенные в Украине товары – на 54% до 99 млрд грн;

- НДС на произведенные в Украине товары/оказанные услуги (с учетом бюджетного возмещения) – на 31% до 298 млрд грн;

- ввозная пошлина – на 26% до 44 млрд грн;

- акцизный налог на ввезенную в Украину продукцию – на 21% до 97 млрд грн;

- НДС на импортные товары – на 15% до 456 млрд грн.

В то же время, по отдельным статьям будет падение. Например, поступления от рентной платы и платы за использование других природных ресурсов просядут более чем на 43% до 55 млрд грн.

Сумма акцизного налога на импортируемые в Украину автомобили сократится на 21% до 10 млрд грн.

А поступления от вывозной (экспортной пошлины) в 2024 году уменьшатся почти в полтора раза до 975 млн грн.

За счет чего будет обеспечен прирост налогов

Если исходить из приведенных выше цифр, картина вырисовывается следующая. Кабинет министров, и Министерство финансов в частности, вместе с депутатами явно возлагают большие надежды на детенизацию доходов населения и на борьбу с «зарплатами в конвертах». По крайней мере, увеличение сумм подоходного налога более чем в 1,7 раза говорит именно об этом.

Кроме того, власть, похоже, верит в восстановление украинского бизнеса. Ведь сумма налога на прибыль предприятий не только вернется на довоенный уровень, но и превысят на 19% цифру, которая фигурировала в госбюджете на 2021 год. Хотя, само собой, не последнюю роль в увеличении поступлений от компаний и предприятий будет играть усиление контроля со стороны Государственной налоговой службы (ГНС).

Рассчитывают депутаты и на эффект от повышения налогов на топливо, которое произошло 1 июля 2023 года. Например, поступления от акциза на импортное топливо в 2024 году вырастут на 41%, а поступления от акциза на топливо, которое производится в Украине увеличатся в 17 раз!

Рост уплаты НДС, который ожидается в 2024 году в общей сложности более чем на 20%, связан как с упомянутым уже повышением топливных налогов, так и с увеличением объемов импорта (по прогнозу МВФ, этот рост в 2024 году к 2023 году составит 17%), а также с восстановлением внутреннего потребления.

Что касается падения по рентным платежам, то это прямое следствие упадка добывающей промышленности. В 2022 году объем выпуска промышленной продукции в целом сократился на 37%. При этом, добыча металлических руд упала на 62%, добыча нефти и газа – на 8,4%, добыча угля – на 8%. Похоже, что ситуация явно не улучшится. Ни в 2023 году, ни в 2024-м.

К чему следует готовиться налогоплательщикам

Увеличение плана налоговых поступлений косвенно свидетельствует о том, что ГНС будет активнее бороться с уклонистами. Депутаты уверяют: повышение налоговых ставок пока не предвидится. Соответственно, резервы для пополнения бюджета нужно искать среди тех, кто избегает уплаты налогов и занимается оптимизацией.

В принципе, у налоговиков руки для этого развязаны. Мораторий на проверки с 1 августа де факто упразднен. А с 1 октября возвращаются штрафные санкции для бизнеса за нарушения, связанные с применением РРО.

Кроме того, в рамках договоренностей с МВФ Украина обязалась до конца 2023 года принять Национальную стратегию доходов. Одним из пунктов этой стратегии должен быть алгоритм, который позволит убрать злоупотребления при участии физлиц-предпринимателей.

По информации из налогового комитета Верховной Рады, которая есть в распоряжении Delo, пока что никакие изменения в упрощенную систему не предвидятся. Но никто не мешает налоговой уже в рамках действующего законодательства активизировать борьбу с «зарплатными ФЛП», которые позволяют компаниями-работодателям минимизировать налоговую нагрузку на фонд оплаты труда.

Впрочем, скрытое повышение налогов все-таки произойдет. Оно станет следствием роста минимальной зарплаты с 1 января 2024 года на 6% до 7,1 тыс грн в месяц. Запланировано также увеличение прожиточного минимума на 13% до 2920 грн. Это потянет за собой рост налоговой нагрузки для плательщиков единого налога 1 и 2 групп, и для всех предпринимателей и компаний, которые платят единый соцвзнос.