В конце сентября ПАО «Софтлайн» должно была начать торговлю акциями на Московской бирже. Однако листинг может быть «лапшой», которую Игорь Боровиков вешает на уши инвесторам, чтобы выкачать из них деньги.

После начала СВО владелец компании «Софтлайн» Игорь Боровиков разделил бизнес на международный, который представляет компания Noventiq, и российский, представляемый «Софтлайн». После этого Боровиков получил ее за символический $1.

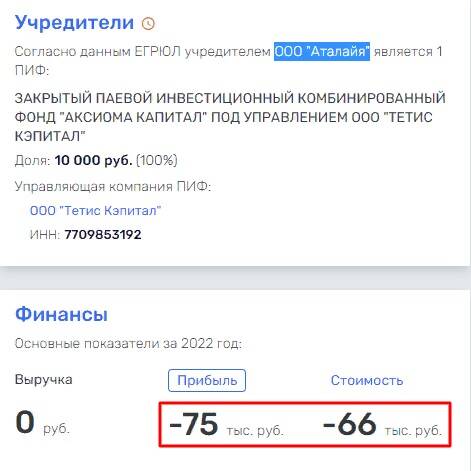

В мае Игорь Боровиков якобы продал компанию «Софтлайн» ЗПИФу «Тетис Кэпитал» под управлением ООО «Тетис Кэпитал» Олега Белая. На самом деле Боровиков продал ООО «Аталайя», «дочкой» которого было ПАО «Софтлайн». Сегодня стало известно, что ООО «Аталайя» вышло из капитала «Софтлайн», но официально об этом пока не сообщили, и это настораживает.

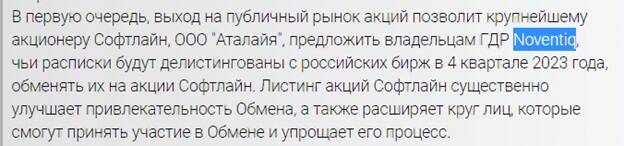

«Аталайя», которая напоминает обычную «пустышку», должна была предложить глобальные депозитарные расписки (ГДР) компании Noventiq владельцам акций «Софтлайн», после чего она планировала выйти на Московскую биржу.

Компания Noventiq в июне объявила о том, что уходит с Московской и Лондонской биржи ради слияния со SPAC-компанией Corner Growth Acquisition и получения листинга на американской бирже NASDAQ.

Фактически Игорь Боровиков пытается втюхать зарубежным держателям ГДР Noventiq акции российского подразделения ПАО «Софтлайн», чтобы повысить его инвестиционную привлекательность перед выходом на Московскую биржу. Каждый держатель одной ГДР Noventiq получит в течение двух лет три акции «Софтлайн». Просто какой-то аттракцион невиданной щедрости.

Теперь стало понятно, зачем Игорь Боровиков объявлял о продаже компании «Софтлайн». При таком раскладе речь шла об обмене между двумя компаниями, принадлежащими разным владельцам, а не о «мутняке» внутри одной компании, что и есть на самом деле, так как гендиректор у ПАО «Софтлайн» после ее «продажи» остался прежний. Обычно его меняют.

В последнее время в СМИ публиковались новости об обеих компаниях, которые должны были создать их привлекательный образ. В начале мая появилась информация, что оборот «Софтлайн» вырастет на 40%. В конце мая стало известно, что компания не выплатит дивиденды по итогам 2022 г. Это должно насторожить новых акционеров. Если у компании все хорошо, то почему она не выплачивает дивиденды и можно ли на них рассчитывать в будущем?

Привлекательный образ создавался и для компании Noventiq. В середине апреля стало известно, что она откроет офисы в Сингапуре и Индонезии. А вообще они уже имеются в 50 странах. На днях появилась информация, что компания расширяет свой бизнес в Индии.

Две недели назад Noventiq Holdings plc сменила юрисдикцию с Кипра на Каймановые острова. Это было сделано перед слиянием с Corner Growth Acquisition и выходом на NASDAQ. После вступления в Евросоюз в 2004 г. привлекательность Кипра как офшорного рая снизилась по сравнению с Каймановыми островами. И это тоже звоночек для будущих инвесторов «Софтлайн», которые захотят совершить обмен. Не задумал ли чего худого Игорь Боровиков?

Сейчас вообще непонятно, что происходит и кому сейчас принадлежит ПАО «Софтлайн». Возможно, ее бывшему владельцу Игорю Боровикову, который хочет и на Западе работать, и в России бизнес не потерять, для чего и затеял канитель с обменом ГДР на акции. Вероятно, в этом может быть и еще какая-то выгода, когда выступаешь организатором обмена.

«Финты» Игоря Боровикова?

В России интересы Боровикова представляет член совета директоров ПАО «Софтлайн» и его гендиректор Владимир Разуваев. СМИ писали, что он – руководитель нескольких компаний, к которым еще до недавнего времени имел отношение Игорь Боровиков. Структуры, руководимые Разуваевым, получают господряды и имеют выручку на миллиарды рублей.

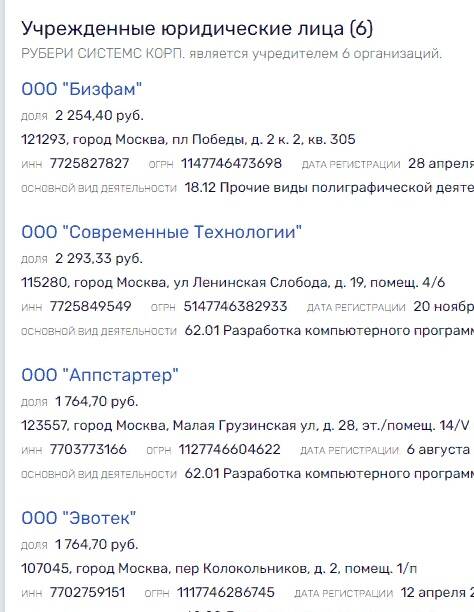

На сегодняшний день Игорь Боровиков является учредителем 2 действующих компаний – ООО «Современные технологии» и ООО «Бизнес решения». В первой работает всего 1 сотрудник, зато учредителей – 5 физических лиц и «РУБЕРИ СИСТЕМС КОРП» с Британских Виргинских островов, которые не раскрывают своих бенефициаров. Офшор выступает соучредителем в 4 действующих компаниях, через которые, судя по их финансовой деятельности и количеству сотрудников в штате, могут выводиться деньги.

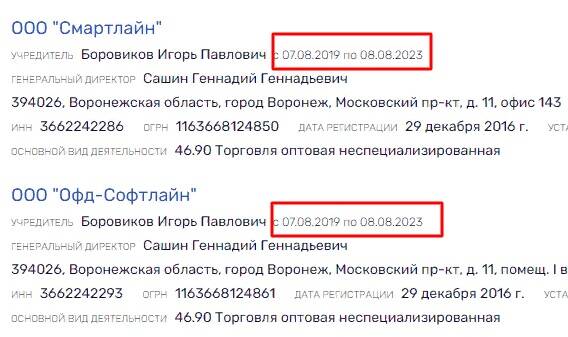

В июле-августе Игорь Боровиков вышел из капитала 9 компаний. Видимо, чтобы его не связывали с российским бизнесом, о выходе из которого бизнесмен объявил еще в апреле. Организация обмена с российским подразделением «Софтлайн» бизнесом не считается?

ООО «Смартайн» имеет господряды на 1.2 млрд руб., выручку 905 млн руб. и прибыль 27 млн руб. За год она выросла на 1406%. У ООО «Офд-Софтлайн» контракты с госструктурами на 2.2 млрд руб., выручка 880 млн руб., прибыль – 26 млн руб. Интересно не уйдут ли компании, из которых вышел Игорь Боровиков, в минус по итогам 2023 г.?

Что-то у Боровикова явно пошло не по плану. А на кону стоят листинги его компаний на Московской и американской биржах. Если Игорь Боровиков действительно преследует эти цели.