Российский олигарх и один из спонсоров путинского террористического режима Аркадий Ротенберг де-факто продолжает контролировать один из крупнейших торговых центров страны Ocean Plaza.

Если аукцион по приватизации Ocean Plaza объявят в ближайшие дни, то новый владелец торгового центра будет должен Ротенбергу 8 млрд грн, или $200 млн, и избежать этого долга у него вряд ли получится.

Ситуацию может исправить Фонд госимущества с Минюстом, но чиновники не спешат вмешиваться.

Откуда у Ocean Plaza взялся долг, если торговым центром все время владел Ротенберг?

В прошлом году Высший антикоррупционный суд принял без преувеличения историческое решение и сделал первый шаг к национализации одного из крупнейших и, наверное, самого дорогого торгового центра страны Ocean Plaza.

В процессе суд обнародовал ранее неизвестные детали, которые проливают свет на то, как российский олигарх Аркадий Ротенберг получил в собственность торговый центр и управлял им.

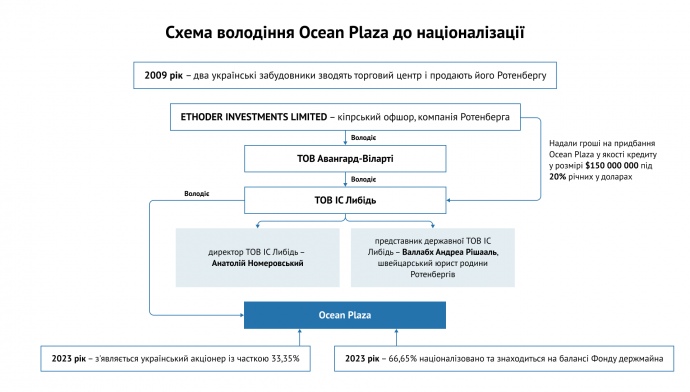

История Ocean Plaza начинается в 2009 году. Именно тогда два украинских застройщика возвели торговый центр, и его приобрел путинский олигарх Аркадий Ротенберг.

Формальным владельцем Ocean Plaza стало украинское ООО «ИС Лыбидь», которым на 100% владело ООО «Авангард-Виларти», а то в свою очередь на 100% принадлежало кипрскому оффшору Ethoder Investments Limited. И дальше по цепочке к Ротенбергу.

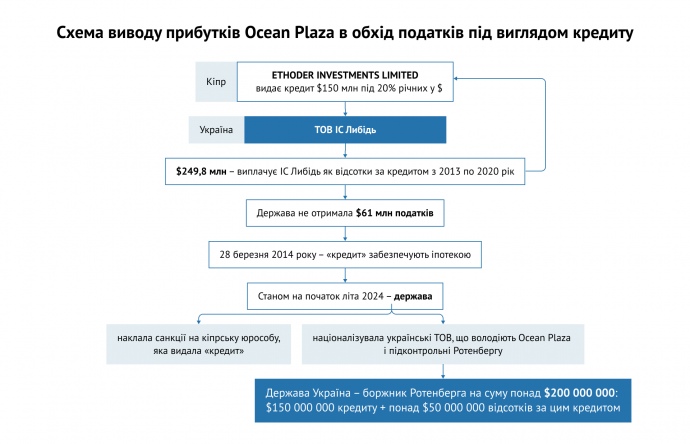

Деньги для приобретения Ocean Plaza ООО «ИС Лыбидь» получило от материнской Ethoder Investments Limited в качестве кредита. Сумма кредита — $150 млн, процентная ставка — абсолютно нерыночные грабительские 20% годовых в долларах. Ни один бизнесмен в здравом уме на такие условия не пойдет.

Ловушка Ротенберга. Вместе с Ocean Plaza государство «национализировало» семимиллиардный кредит

Только смысл кредита был не в кредитовании, а в уклонении от уплаты налогов. Под предлогом выплаты процентов по кредиту из Украины на Кипр выводилась прибыль Ocean Plaza.

Решением ВАКС установлено, что в период с 2013 по 2020 год ООО «ИС Лыбидь» выплатило процентов по этому кредиту на около $249,8 млн. По подсчетам финмониторинга, в результате этой схемы до государства не дошло более $61 млн налогов.

Все это время гасились только проценты по кредиту, основная часть задолженности не менялась. Это делалось для того, чтобы выводить на Кипр всю прибыль от деятельности Ocean Plaza.

В 2014 году началась война — начал пылать восток Украины, россия захватила Крым. Ротенберг, в отношении которого начали вводить санкции, решил подстраховаться. 28 марта 2014 года «кредит» обеспечили ипотекой, говоря по-простому, здание Ocean Plaza, оказалось в залоге под $150 млн.

Распространенная схема, которую часто используют для защиты от рейдерства: имущество закладывается через «фейковый» кредит, и таким образом рейдерам забрать его становится намного сложнее или вовсе невозможно. Только в нашем кейсе схему использовали для защиты от национализации.

Позже в качестве дополнительной меры предосторожности в Ocean Plaza появился украинский акционер с долей в 33,35%. По моему мнению, такой же фейковый, как и кредит, и сделано это было только для защиты Ротенберга от санкций, но эта тема тянет еще на одну колонку, так что не будем отвлекаться.

10 мая 2022 года постановлением следственного судьи Печерского районного суда города Киева по делу № 757/10779/22-к был наложен арест на 100% корпоративных прав ООО «ИС Лыбидь» и ООО «Авангард-Виларти».

А уже 13 сентября 2022 года тот же Печерский суд снял арест с 33,35% ООО «ИС Лыбидь» и 33,35% ООО «Авангард-Виларти». Из указанного постановления следует, что основанием для этого стало непредоставление прокурором доказательств, которые бы свидетельствовали о каких-либо логических и объективных основаниях для наложения ареста. По «странному стечению обстоятельств» прокурор на указанное судебное заседание не явился.

20 марта 2023 года решением ВАКС было национализировано 100% ООО «Авангард-Виларти» и 65,65% ООО «ИС „Лыбидь“», которое и является владельцем торгового центра Ocean Plaza.

Еще 33,35% из-за ряда махинаций с уменьшением уставных капиталов и благодаря снятию ареста Печерским судом на момент вынесения решения о национализации уже принадлежали украинскому акционеру, что спасло 33,35% ТЦ от национализации.

На начало лета 2024 года у нас сложилась такая картина. Государство национализировало подконтрольные Ротенбергу украинские ООО — владеющие торговым центром; наложило санкции на кипрское юрлицо, выдавшее «кредит», и готовит аукцион по приватизации 66,65% ООО «ИС „Лыбидь“», которому принадлежит 130 тыс. квадратных метров ТЦ Ocean Plaza.

Здесь стоит упомянуть важную деталь. В том самом решении суда, которое я упоминаю в начале статьи, речь идет о письме Службы внешней разведки Украины. В нем подчеркивается, что ТРЦ Ocean Plaza принадлежит украинскому ООО «ИС „Лыбидь“» лишь формально, а фактически его контролирует компания Ротенберга, предоставившая кредит.

Таким образом национализация корпоративных прав ООО «ИС „Лыбидь“» сделала государство Украину должником Ротенберга на сумму более $200 млн ($150 млн кредита и еще более $50 млн процентов по этому кредиту).

На Ocean Plaza все еще висит кредит российскому олигарху

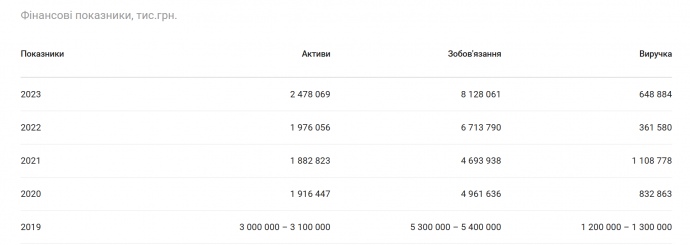

С набежавшими процентами долги ООО «ИС „Лыбидь“» на конец 2023 года составляют 8,1 млрд грн, или чуть больше $200 млн. Это больше, чем стоит весь торговый центр.

Реальная цена торгового центра без долгов на сегодня не больше $150 млн. Предположим, что завтра у Ocean Plaza появляется новый собственник и он заплатит за 66,65% стартовые $40 млн на аукционе. В дополнение к стартовой цене он будет вынужден выплатить Ротенбергу еще $200 млн.

Таким образом, заплатив $240 млн, новый собственник получит 66,65% от $150 млн. «Абсурд», — скажете вы. Но представители Фонда госимущества так не считают и живут в параллельной реальности.

Информация легко проверяется в YouControl. То есть вместо реальной цены, торговый центр обойдется вдвое-втрое дороже. Раздел — обязательства ООО «Инвестиционный союз „Лыбидь“» на 2023 год.

Наверное, вам сейчас пришло в голову, что подсанкционному российскому олигарху можно не платить, пусть, мол, утрется. Тем более что юрлицо, на которое выводили деньги, под украинскими санкциями.

Только на той стороне тоже не дураки сидят. И кредит, по нашему мнению, может быть переоформлен на другое юрлицо, возможно, даже украинское с учредителем в лице какой-то семьи индусов из пригорода Лондона. Сразу же после приватизации те придут в украинский суд с иском о взыскании долга.

Украинский, британский да и какой угодно суд этот иск с большой вероятностью удовлетворит. Кредит и ипотека оформлены в соответствии со всеми нормами закона, и новому владельцу придется либо отдавать торговый центр, либо проспонсировать российский ВПК на $200 млн. Враг будет в восторге от такого поворота событий.

Что нужно сделать государству, чтобы Ротенберг действительно избавился от Ocean Plaza как актива и не смог через суд потребовать от государства Украина или нового собственника $200 млн? Идем читаем закон и действуем точно так, как там написано. А именно:

Долги государственных предприятий, учреждений и организаций Украины и/или хозяйственных обществ, в уставном капитале которых более 50 процентов акций (долей) принадлежат государству, права требования которых были принудительно изъяты в соответствии с настоящим Законом как объекты права собственности Российской Федерации и ее резидентов, считаются погашенными со дня вступления в силу закона Украины, которым утвержден указ Президента Украины о введении в действие решения Совета национальной безопасности и обороны Украины о принудительном изъятии соответствующих объектов права собственности Российской Федерации.

Для старта процесса Минюст и Фонд госимущества должны немедленно подать иск об изъятии в доход государства права требования по кредиту к компании, которая на 50% принадлежит государству (ООО «ИС „Лыбидь“»).

Переводя с юридического языка на человеческий, с помощью решения суда умножить на ноль долг госпредприятия враждебному олигарху.

Все! После этого долг будет списан, на торги выставляется чистое юрлицо без долгов, и после этого можно будет говорить о справедливых рыночных условиях аукциона по приватизации.

Почему Минюст и Фонд госимущества не совершают действия, предусмотренные законом, чтобы избавить государство Украина от долга в $200 млн? Это некомпетентность и медленные бюрократические процессы или игра на стороне враждебного олигарха? Думаю, мы получим ответ на этот вопрос в ближайшее время.

Ocean Plaza все еще управляет команда, нанятая Ротенбергом

Благодаря управленческой команде Ocean Plaza близкий друг Путина Ротенберг в обход налогов вывел сотни миллионов долларов из Украины. За деньги с этих счетов сын Аркадия Ротенберга Игорь в 2017 году приобрел 48% акций Тульского патронного завода, а в 2019 году — 50% Ульяновского патронного завода. Позже эти предприятия получали госконтракты на производство вооружения. Которым вражеская армия убивала украинцев.

Только пособники врага вместо того, чтобы стать фигурантами уголовных дел, продолжают руководить самым известным ТЦ страны. Видимо, для того чтобы избежать ответственности, формальным директором ООО «ИС „Лыбидь“» перед национализацией назначили некоего Анатолия Сергеевича Номеровского.

Этот человек никому не известен, ничем не руководил. Подставное лицо, или «зиц-председатель Фунт», как писали классики. Но Фонд госимущества это устраивает. Говорят отчетность сдает вовремя.

Еще более странная реакция Фонда госимущества, владеющего мажоритарной долей в Ocean Plaza. Процитирую бывшего и.о. главы Фонда госимущества Александра Федоришина в интервью Forbes, где тот прямо говорит, что руководство никто менять не собирается: «Но я своих коллег спрашиваю, что для вас важнее: влезать в это длительное управление, из которого нам только будут „сыпаться камни“, или чтобы этот актив был показательно, успешно продан. Мы сделали акцент на приватизацию».

Недавно в еще одном интервью Forbes уже глава фонда Виталий Коваль так и не смог ответить на три (!!!) вопроса журналиста, как он собирается решать вопрос с многомиллионными обязательствами: «Я отвечу на ваш вопрос вопросом к вам. Вы как гражданин Украины считаете, что лучше сделать с Ocean Plaza: быстрее, но в этом году или дольше и, возможно, с большей суммой, но через долгий период?». У меня просто нет комментариев.

Еще одним из представителей уже государственной ООО «ИС „Лыбидь“» является Валлабх Андреа Ришааль, который, согласно решению ВАКС, является швейцарским юристом семьи Ротенбергов. Фонд госимущества, вы существуете вообще?

Все это позволяет констатировать, что на третьем году полномасштабной войны семья Ротенбергов сохраняет контроль над Ocean Plaza и его финансовыми потоками!

Фонд госимущества «нарисовал» цену Ocean Plaza с потолка

Согласно закону, принятому в начале 2022 года, стартовая стоимость активов для приватизации определяется как балансовая стоимость. И это теоретически может быть приемлемым для приватизации просто недвижимости. Только вот стартовую цену ООО «ИС „Лыбидь“» посчитали на уровне школьного урока математики. Активы компании умножили на 0,65 (долю государства) и получили стартовую цену в 1,6 млрд грн.

Но в нашем случае у компании есть еще пассив, а это тот самый долг в 8 млрд грн. Если учесть его, то стоимость получится со знаком минус. А если провести инвентаризацию, то сумма окажется третьей. Но инвентаризацию не проводит все тот же Фонд госимущества. И блокирует все тот же вышеупомянутый «эффективный менеджмент».

Все это можно назвать жонглированием цифрами, подменой понятий или как угодно, но стартовая цена Ocean Plaza совершенно точно не имеет отношения к реальной стоимости ООО «ИС „Лыбидь“».

Почему так происходит? Есть несколько идей. Пассивность чиновников? Возможно. Для Фонда госимущества это не первая подобная история. Ocean Plaza является одним из множества объектов, которые перешли в собственность государства, после чего государство даже не пытается разобраться, чем оно владеет, сколько это все стоит и как им эффективно управлять.

Сопротивление со стороны руководства торгового центра, которое действует в интересах Ротенберга? Тоже возможно. Неожиданная несговорчивость миноритарного собственника? И снова возможно. В ответах на эти вопросы попробую разобраться в следующих публикациях.

Три тезиса вместо итогов

Ротенберг сохраняет контроль над торговым центром и его денежными потоками через кредит и менеджмент ООО «ИС „Лыбидь“», который годами работал на семью Ротенбергов и вывел в офшоры сотни миллионов долларов.

- Минюст и Фонд госимущества не совершают действий, предусмотренных законом, и не взыскивают права требования по кредиту в пользу государства.

- При наличии долга в $200 млн 66,65% ООО «ИС „Лыбидь“» как владелец ТЦ Ocean Plaza ничего не стоит.

- При таких условиях единственным покупателем государственной доли может быть только Ротенберг или его доверенные лица!