Для каких стратегических целей Китай и Россия вкладывают многомиллиардные инвестиции в страны Африки и какие ресурсы представляют для них основной интерес?

Большие государства имеют множество инструментов для распространения своего влияния в мире: от культуры и еды, образовательного и научного обмена до кредитов и прямых иностранных инвестиций (ПИИ).

В диктатурах вроде России или Китая такие инициативы редко являются частными. Чаще всего это скоординированная политика, которая реализуется с долгосрочной целью: получить контроль над критически важными ресурсами или создать рычаги влияния на другие страны.

Один из ярких примеров — использование Россией энергоносителей и продовольствия в качестве оружия. Ситуация может быть менее очевидной в других секторах. Какие стратегические цели многомиллиардных инвестиций Китая и России в страны Африки?

Скачок азиатских тигров в Африку?

Есть два взгляда на прямые иностранные инвестиции: с точки зрения их поставщика и получателя. С точки зрения инвестора доля китайских и российских ПИИ, которые направлялись в Африку, была относительно небольшой.

В 2003-2021 годах Китай инвестировал в африканские страны почти 51 млрд долл, Россия — 1,7 млрд долл. Это лишь 1,6% от общего объема ПИИ Китая в 2021 году и менее 0,5% России в любой год. Однако эти относительно недорогие финансовые вливания имеют непропорционально большое политическое влияние.

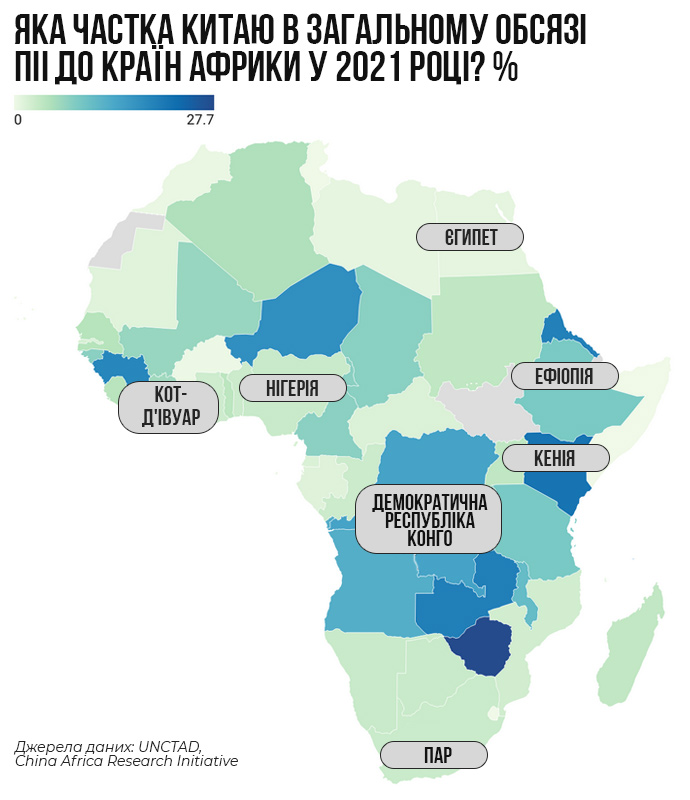

С перспективы получателя инвестиций (отдельных африканских стран) Китай является непропорционально значительным источником поступлений капитала. Например, в Эритрее, Кении, Замбии или Зимбабве на КНР приходится около 20% всех ПИИ.

Южная Африка и Демократическая Республика Конго являются основными получателями прямых иностранных инвестиций Китая (соответственно 12% и 10% от объема в страны Африки) благодаря их значительным запасам ценных полезных ископаемых (литий и уран).

Эти ресурсы имеют решающее значение для энергетического перехода и технологического развития. Усиление доминирования КНР над этими ресурсами способно изменить глобальную энергетическую динамику и укрепить его переговорные позиции в мире.

Стратегия Пекина демонстрирует стремление стать главным элементом экономической структуры Африки. По данным исследовательской компании China Africa Research Initiative, Китай преимущественно инвестирует в строительство и добывающую промышленность и в меньшей степени — в обрабатывающую промышленность и другие секторы.

Значительные инвестиции в горнодобывающую промышленность могут свидетельствовать о том, что Китай сосредотачивается на получении доступа к критическому сырью, включая литий и уран. Настойчивое инвестирование в эти отрасли указывает на стратегическое стремление КНР получать выгоду от богатой ресурсной базы Африки и, возможно, в долгосрочной перспективе обеспечить цепочки поставок для собственной промышленности.

Китайские инвестиции в литий — ключевой компонент для сектора «зеленой» энергетики — особенно агрессивны: горнодобывающие компании Поднебесной и производители аккумуляторов за последние два года инвестировали 4,5 млрд долл в литиевые шахты и возглавляют много африканских литиевых проектов в Намибии, Зимбабве и Мали.

Пекин движется к тому, чтобы к 2025 году получить львиную долю мировых мощностей по добыче лития и потенциально контролировать треть его добычи. В сочетании со значительной долей производства кобальта (China Moly, Zijin Mining и другие контролируют производство в Африке 30% меди и 50% кобальта) это ставит Китай в выигрышную позицию с возможностью влиять на глобальные цепочки поставок.

Хотя контроль Китая над добычей африканских полезных ископаемых в целом составляет менее 7% от общей стоимости добычи в Африке, его влияние в упомянутых секторах особенно сильно.

Потенциальные угрозы контроля Китая за добычей лития, меди и кобальта многомерны. Экономическое доминирование КНР в этих отраслях может привести к ситуации зависимости, когда африканские страны теряют рычаги влияния в переговорах о справедливых условиях, как это видно на примере попыток Конго пересмотреть договоренности с Пекином по развитию инфраструктуры в обмен на полезные ископаемые.

С политической точки зрения увеличение зависимости от китайских инвестиций может привести к сценарию, при котором интересы Китая будут существенно влиять на формирование политики в этих африканских странах. Более того, стандарты охраны окружающей среды и безопасности на добывающих предприятиях, принадлежащих китайцам, часто отодвигаются на второй план.

Отсутствие строгих правил и надзора может привести к ухудшению состояния окружающей среды и плохих условий труда, что нарушает этические вопросы и вызывает обеспокоенность относительно устойчивого развития.

По мере того как Китай усиливает контроль над добычей и переработкой критических полезных ископаемых, все громче звучат призывы к диверсификации цепей поставок. Международное сообщество, особенно страны Запада, стремится сформировать критически важную цепочку поставок полезных ископаемых, свободную от влияния Пекина. Однако преимущество Китая в развитии инфраструктуры и финансировании деятельности в Африке представляет серьезную проблему.

Подход России

Российские ПИИ в Африке стратегически выборочные и относительно небольшие, однако значимые с точки зрения геополитического влияния. Основными их направлениями, судя по ограниченным данным центробанка РФ, являются Конго, Зимбабве и Ангола.

Российско-африканский саммит 2023 года подчеркнул стремление Москвы расширить свое экономическое присутствие, ориентируясь на сельское хозяйство, горнодобывающую промышленность и энергетику с целью удвоить показатели торговли к 2030 году. Однако фактические ПИИ из России меньше 1% от общего их объема в Африке.

Россия и ее предприятия — «Росатом» в энергетическом секторе и «Русал» в горнодобывающей отрасли — участвуют в проектах, которые хоть и не масштабные по объему инвестиций, но имеют значительный политический и стратегический вес.

Эти проекты нередко касаются критически важных ресурсов. Прежде всего речь идет об уране, который является ключевым для ядерной энергетики и может позволить РФ получить значительный контроль над этими ресурсами. Например, «Росатом» активно увеличивает свои запасы урана, в том числе через приобретение проекта в Танзании за 1,15 млрд долл.

Российский контроль над ураном касается не только сырья, но и всего ядерного топливного цикла. Хотя Россия является относительно небольшим производителем «сырого» урана, ей принадлежит значительная доля мировой инфраструктуры его переработки и обогащения — около 40% и 46% соответственно. Эти возможности критически важны, поскольку позволяют перерабатывать «сырой» уран в топливо для ядерных реакторов.

Кроме того, Россия доминирует в экспорте атомных электростанций. В 2012-2021 годах она инициировала строительство 19 ядерных реакторов, причем 15 из них — за рубежом. Это намного больше любой другой страны за тот же период.

Российский контроль над технологиями ядерных реакторов создает зависимость для стран, которые используют эту технологию. Такая зависимость может распространиться и на африканские страны, если они решат использовать российские ядерные технологии, и будет иметь более широкие последствия, если Москва будет контролировать значительные ресурсы урана на континенте.

РФ также является главным поставщиком оружия в Африку, контролируя половину рынка. Такое доминирование вместе с привлечением асимметричных инструментов вроде частных военных компаний укрепляет ее влияние на континенте.

Хотя экономическое присутствие России в Африке не столь широкое, как китайское, ее роль в поставках стратегических товаров и военной техники в африканские страны — это многогранный вызов. Если бы Россия получила контроль над критически важными ресурсами вроде лития или урана, она могла бы создавать зависимости, влиять на рыночные цены и использовать их для политического влияния — то, что происходит в других регионах.

Потенциальные риски такой деятельности огромны. Контроль над критически важными ресурсами со стороны иностранного государства, особенно агрессивного, влияет на суверенитет стран и создает стратегический вызов глобального масштаба, поскольку эти ресурсы критически важны для «зеленого» энергетического перехода и технологического развития во всем мире.

Вместо вывода

Шахматная доска африканских ресурсов динамична, а каждый шаг России и Китая может изменить баланс мировых сил. Результат этой геополитической игры будет ощущаться за пределами африканского континента, очерчивая контуры международных отношений на долгие годы. Действия Российской Федерации и Китайской Народной Республики в Африке требуют внимания и стратегического ответа, который поддержит устойчивое и справедливое развитие.