Несмотря на Постановление Кабинета Министров от 2 марта 2022 года № 178, Министерство обороны продолжает приобретать топливо с учетом НДС, что привело к ущербу для государства более чем на 1 миллиард гривен.

Ревизия Госаудитслужбы вызвала новый скандал с закупками Министерства обороны Украины. И на этот раз – горюче-смазочные материалы по НДС. Не выполняя Постановления КМУ от 2 марта 2022 г. № 178 , Минобороны продолжает покупать топливо по НДС. К тому же они умудрились найти «несуществующее» разъяснение ГНС, где якобы указано, что именно таким образом закупки проводить можно. Так кто же прав – Минобороны или Госаудитслужба? СтопКор разбирался в ситуации.

Очередная серия закупок Минобороны приобрела неприятную окраску, учитывая военное время и как следствие открытия уголовного производства. Стало известно, что Министерство обороны закупает топливо для армии по НДС, хотя правительством принято постановление №178 «Некоторые вопросы обложения налогом на добавленную стоимость по нулевой ставке в период военного состояния», которым регламентируется закупка горючего военными и устанавливается нулевая ставка на топливо для нужд ВСУ .

Противостояние Госаудитслужбы и Минобороны

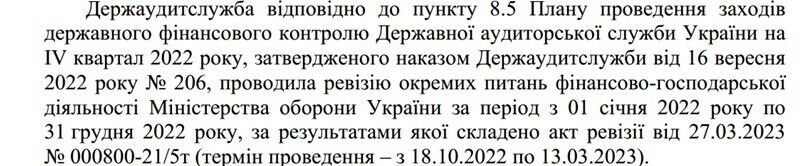

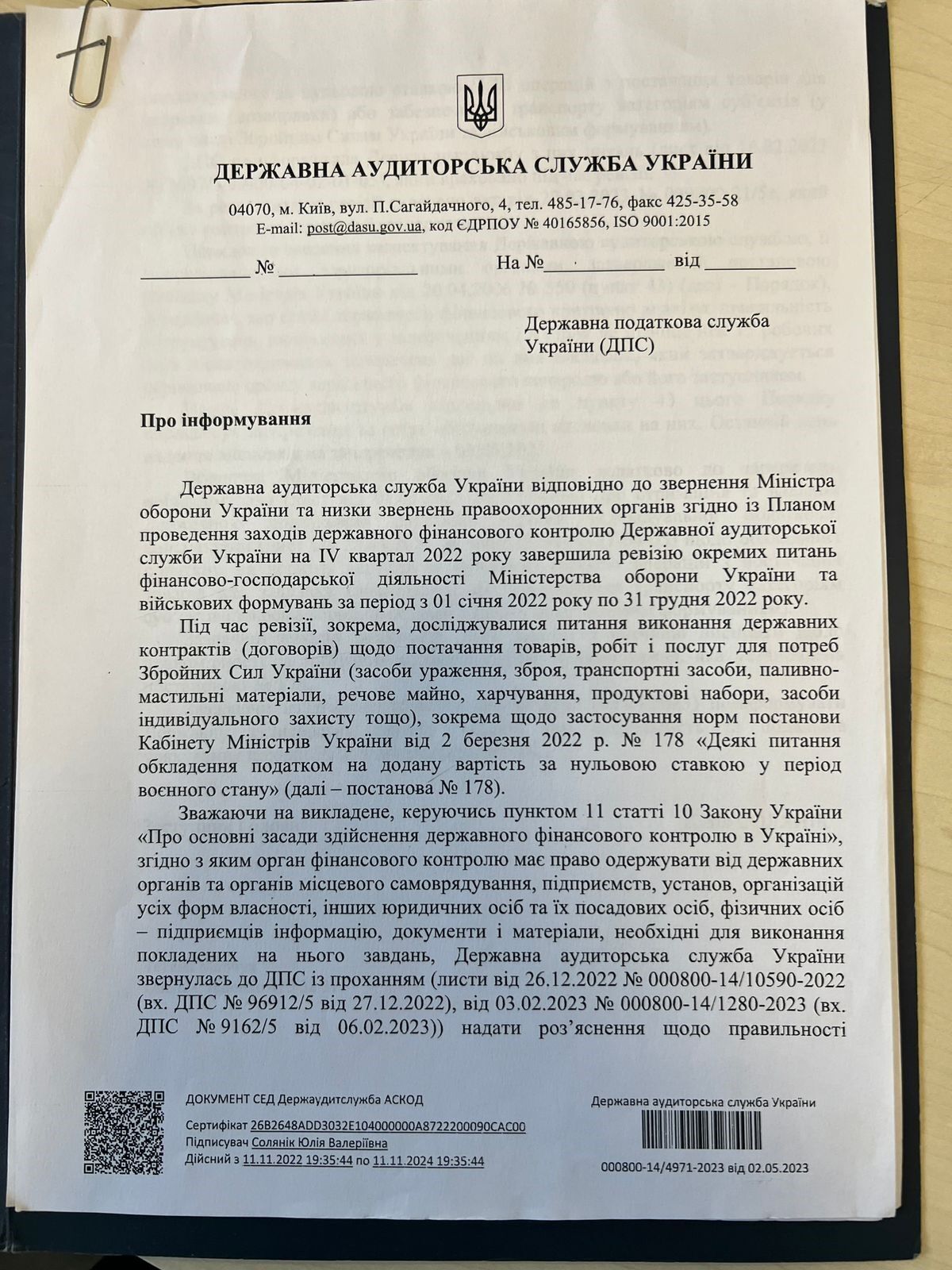

В свою очередь Госаудитслужба провела ревизию отдельных вопросов финансово-хозяйственной деятельности Министерства обороны Украины с 01 января 2022 года по 31 декабря 2022 года и расценила такую закупку топлива как «ущерб предоставленный государству».

Госаудитслужбой определено, что данный ущерб составил более 1 млрд грн. Об этом свидетельствуют данные из документа, попавшего в руки редакции СтопКора. А сама сумма закупок соответственно превысила 6 млрд. грн.

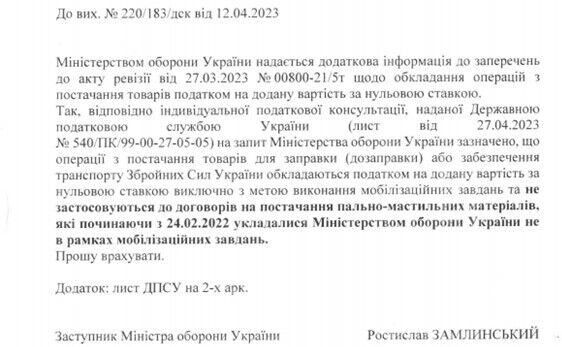

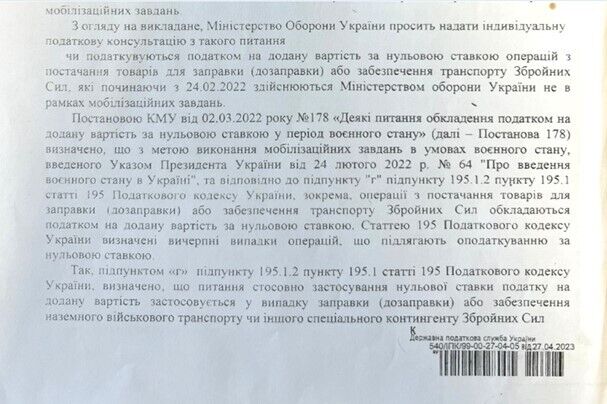

Министерство обороны Украины не растерялось и дало возражение на акт ревизии от 27.03.2023 №00800-21/5т по обложению операций по поставке товаров налогом на добавленную стоимость по нулевой ставке.

К этому же возражению прилагается копия письма за подписью заместителя Министра обороны Ростислава Замлинского, где объясняется, что закупается топливо не для мобилизационных задач.

К тому же, ссылаясь, якобы, на предоставленную индивидуальную консультацию Государственной налоговой службой Украины (письмо от 27.04.2023 №540/ПК/99-00-27-04-05), в ведомстве заявляют о правомерности данной закупки. Поскольку данное горючее закупалось не для выполнения мобилизационных задач, как указано в Постановлении 178.

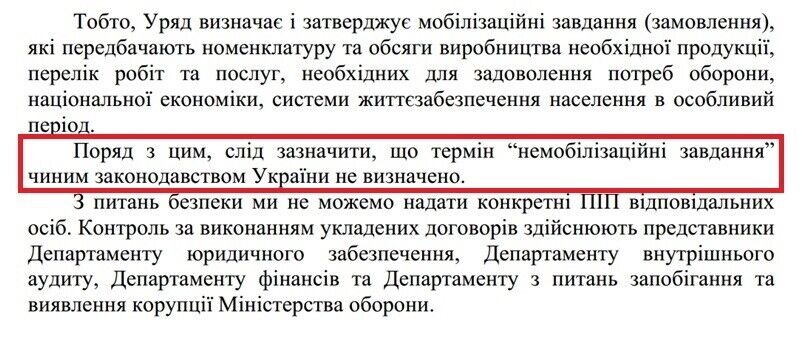

Для выяснения обстоятельств дела редакция СтопКора также обратилась в Министерство обороны Украины за разъяснениями по поводу ситуации, сложившейся вокруг закупок горючего по НДС, а также, для точного определения, что означает термин «немобилизационные задачи». Ведь именно эти меры позволили закупать горючее по НДС. В ответ Министерство обороны отказалось, что законодательством данный срок не определяется.

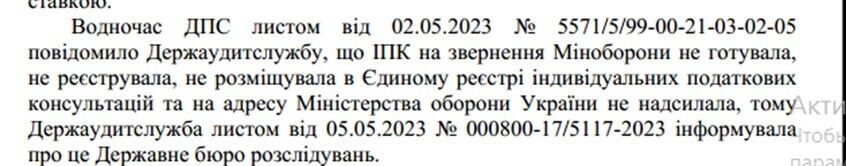

И здесь следует еще более интересная информация – Государственная налоговая служба официально уведомила Госаудитслужбу (письмо от 02.05.2023 № 5571/5/99-00-21-03-02-05), что никакого индивидуального разъяснения на обращение Минобороны не готовила, не регистрировала, не размещала в Едином реестре индивидуальных налоговых консультаций, а тем более в адрес Министерства обороны Украины не направляла.

А это значит, что документ, которым сейчас так гордо апеллирует Министерство обороны Украины, фактически поддельный.

По данным причинам, Госаудитслужба проинформировала об этом Государственное бюро расследований (письмо от 05.05.2023 № 000800-17/5117-2023). И на сегодняшний день по данному факту было открыто уголовное производство.

«Оборудования» по НДС и старые-новые мошенники

Топливо для Минобороны уже засветилось со скрутками по НДС в мошенническом скандале и. В 2022 году частный поставщик с помощью механизма «сверток» изъял из обращения средства, предназначенные для выплаты налога государству, о чем отметила Государственная аудиторская служба. По информации из открытых источников, поставщиками топлива, незаконно получавшими возмещение НДС от Министерства обороны Украины в 2022 году, являются компании экспредседателя Государственного агентства экологических инвестиций Украины, экс-замглавы комитета Украины по государственному материальному резерву Владислава Якубовского.

Во время президентства Виктора Януковича Владислав Якубовский занимал должность руководителя Государственного агентства экологических инвестиций Украины и заместителя председателя Государственного комитета Украины по государственному материальному резерву. Известным он стал по делу в хищении средств, полученных Украиной в рамках Киотского протокола.

После крушения Януковича Якубовский появился в группе «Трейд Коммодити» Грановского-Адамовского. И пока в государстве продолжалась активная фаза АТО, «Трейд Коммодити» закупала топливо у компании «Роснефть», представляя это как производство дизельного топлива, тогда как на самом деле это была смесь керосина и базовой смазки. Такое мошенничество приводило к поломкам в двигателях украинских танков и другой военной техники. К тому же происходило хищение страны на миллиарды гривен.

Кстати, бизнес-партнер Якубовского – бывший спортсмен международного класса Заза Зозиров, который был активным участником преступной группировки ОПГ «Савлоха». Зозиров стал партнером Якубовского по компании «Констракшн Поинт», основанной в 2009 году. На тот момент Якубовский уже сотрудничал с Юрием Иванющенко. Уставный капитал компании – 500 000 гривен. В ней у Якубовского есть 50%, еще по 25% принадлежит Зазе Зозирову и гражданину Грузии Зази Гумберидзе. Пик спортивной карьеры борца Зазы Зозирова пришелся на конец 90-х, когда у президента Федерации спортивной борьбы был криминальный авторитет Борис Савлохов, а другой звездой этого же вида спорта в тот же период – Эльбрус Тедеев, депутат-регионал.

И это еще не все… дальше только криминальные связи становятся еще более интересными. В 2020 году в рамках дела об импичменте Дональда Трампа американская разведка опубликовала переписку Льва Парнаса (он является партнером Руди Джулиани, а тот, в свою очередь, был адвокатом Трампа). И вот, как выяснили журналисты в переписке с Арсеном Аваковым, Парнас вспоминает «Украинскую локомотивную компанию» и Владислава Якубовского: он хочет, чтобы Аваков помог Якубовскому начать перевозку на «Львовской железной дороге».

Как пробелы в законодательстве могут влиять на трейдовый рынок

Правительственное постановление №178 стало в определенной степени камнем преткновения для отечественного топливного рынка. Поставки горючего на фронт могут «тормозить», а в документе мы замечаем некоторые пробелы.

В условиях войны, когда основная часть государственных средств направляется на оборону страны и обеспечение армии всем необходимым вместо упрощения процедур государственных закупок, часть из них, к сожалению, наоборот — усложняются. В частности, это касается и вопроса обеспечения горючим украинских военных.

О том, почему процесс доставки горюче-смазочных материалов для армии является усложненным и дорогостоящим, в эксклюзивном комментарии журналистам рассказал представитель одной из компаний, длительно плодотворно работающий на отечественном энергетическом рынке.

Как отмечает эксперт, летом 2022 года из-за большой нехватки нефтепродуктов в стране Министерство обороны, как крупный потребитель топлива, было заинтересовано в первоочередном получении горючего. Поэтому все контракты заключали за 100% предварительной оплаты, ведь без этого военное ведомство фактически должно было конкурировать за дефицитное топливо с рядовыми потребителями. Соответственно, контракты заключались на условиях, когда действовала льготная ставка НДС – 7%, просуществовавшая до конца июня 2023 года. В то время налог на добавленную стоимость также не подлежал возврату. Потому подобные условия удовлетворяли все стороны. Однако налоговые «каникулы» закончились, ставка НДС после 1 июля этого года выросла до 20% и ситуация кардинально изменилась.

Кроме того, специалист по топливному рынку отметил, что осенью прошлого года Аппарат Департамента государственных закупок МО узнал о постановлении КМУ №178 от 02.03.2022 года «О некоторых вопросах обложения налогом на добавленную стоимость по нулевой ставке в период военного положения», которое имеет ряд серьезных пробелов:

— во-первых, Минобороны отсутствует в перечне организаций, которые могут делать закупки по нулевой ставке НДС;

— во-вторых, в преамбуле постановления КМУ №178 указаны только закупки, проводимые в рамках выполнения мобилизационного заказа;

– в-третьих, формулировка целевого назначения в этом документе, по мнению экспертов, прописана некорректно.

В итоге Министерство обороны пришло к выводу, что существует юридическая позиция, согласно которой военное ведомство не относится к данному постановлению.

«Из-за демпинга цен по всему спектру нефтепродуктов, монопольное положение на рынке до последнего времени занимало ПАО «Укрнафта», которое все контракты с Минобороны также заключало сначала с 7% ставкой НДС, а затем с 20%. В этой ситуации, когда есть один монопольный поставщик, и с уже существующими рисками, Государственная аудиторская служба и Генеральная прокуратура или местные прокуратуры по месту регистрации компаний, подают иски как к «Укрнафте», так и к компаниям-контрагентам на рынке, которые поставляли продукцию в течение первого года полномасштабной войны 2022 года и в начале 2023 г. При чем суммы исков к «Укрнафте» колоссальные, ведь эта компания фактически была монополистом в поставках для МОУ», — комментирует наш собеседник.

Следует отметить, что весь НДС уже был уплачен в бюджет Украины в прошлом году. Он был зарегистрирован поставщиками по адресу Министерства обороны Украины. И у Государственной налоговой службы, в основном, нет никаких вопросов к поставщикам. Фактически эти средства сейчас пытаются просто переложить из одного «бюджетного кармана» в другой, попутно создавая ряд правовых коллизий и оснований для коррупционных проявлений и блокируя все поставки для Минобороны со стороны частных поставщиков, отмечает специалист. Дополнительные средства в государственной казне от этого, конечно же, не появятся, ведь никакой добавленной стоимости нацбезопасности и обороны такие действия государства не несут.

Также, как отметил эксперт по топливному рынку, Генеральная прокуратура требует признать все договоры, заключенные с начала военного положения и до сих пор недействительными в части НДС. Причем независимо от того, действовали ли на момент заключения механизмы возврата НДС и льготная ставка 7%,

«Также Генпрокуратура требует вернуть эти средства Министерству обороны. Таким образом, сейчас складывается ситуация, когда в конкуренции с ПАО «Укрнафта», когда оно только заходило на рынок, все остальные поставщики отказались от позиции о 100% предварительной оплате от Минобороны. То есть, за весь 2023 год не было ни одной тонны горючего, которую поставили бы на Минобороны по предварительной оплате», — добавляет специалист.

Иными словами, процесс получения горюче-смазочных материалов военными на передовой существенно усложнился и возникает угроза нового дефицита. Как отмечают эксперты, выход из этой ситуации — урегулировать проблему путем четкого внесения изменений в постановление КМУ № 178. А именно — констатировать факт, что Минобороны в перечне постановления отсутствует, и добавить Министерство в перечень.

Таким образом, если дополнить перечень, добавив к нему МОУ, у документа будет однозначное толкование как для военного ведомства, что все новые тендеры на топливо нужно объявлять без НДС, так и для фискальных органов, которые будут возвращать средства по этому налогу поставщикам. Это упростит процедуру закупок и для отечественных продавцов нефтепродуктов, и для заказчика (Минобороны), и для конечных потребителей — украинских защитников на фронте.

Правовые коллизии и как правительство не дорабатывает

Итак, в стране сложилась ситуация, как в народной поговорке – у каждого своя правда. Министерство обороны покупает топливо по НДС, ведь это не на мобилизационные задачи (вопросы, какие еще задачи они могут выполнять во время военного положения?), а воинские части, Нацгвардия, пограничники без НДС.

Если не вдаваться в юридические тонкости, а объяснить на человеческом языке: норма прописана действительно криво. Ведь с марта 2022 года Минобороны, учитывая привязку данного постановления, приняло решение приобрести топливо без НДС только в пределах мобилизационных планов, как указано в постановлении, а во всех остальных случаях – по НДС.

Однако Госаудитслужба расценивает закупку топлива Минобороны по НДС как «ущерб государства».

А пока продолжаются баталии с разъяснениями и двусторонними обвинениями, Министерство обороны продолжает поддерживать свою позицию и планирует снова закупить топливо с учетом налога на добавленную стоимость.

Разъяснения по первоисточникам, или как СтопКор правду искал

Изучая непростую ситуацию, СтопКор обратился за разъяснениями ко всем ведомствам, которые тем или иным способом, причастны к ситуации с налогообложением горючего.

Прежде всего, письмо-запрос направлено в Миноборону. На что редакция получила следующий ответ (отписку): «При закупке горюче-смазочных материалов, соответствующие операции облагаются налогом в порядке и размерах, определенных действующим законодательством Украины.» – указано в документе.

Также был направлен запрос в Госаудитслужбу Украины по вопросам правомерности закупки горюче-смазочных материалов с налогообложением. Госаудитслужба письмом сообщила редакцию СтопКора об осуществлении семи финансовых проверок договоров заключенных Министерством обороны и подтвердила открытие по ним уголовного производства.

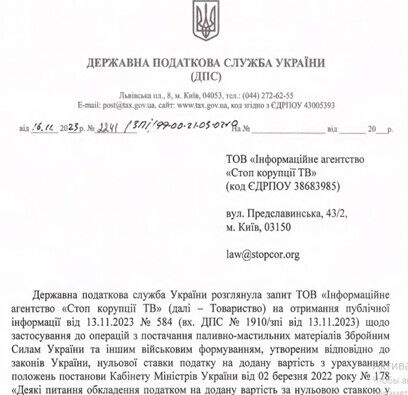

Еще одна инстанция, в которую обращался СтопКор, для подтверждения или опровержения заявлений Министерства обороны – Государственная налоговая служба Украины. В ответ поступило письмо за подписью директора методологии Марианны Куц, где сообщено, что никаких индивидуальных консультаций Министерству обороны не предоставлялось.