В декабре Украина успешно провела второй пересмотр программы EFF и получила еще один транш в размере 900 миллионов долларов.

Это произошло на фоне стремительного хода событий по (не)утверждению пакета помощи Украине на сумму 61 млрд долл. в Конгрессе США и саммита лидеров стран ЕС, на котором должны были принять историческое решение о начале переговоров о вступлении Украины в ЕС и предоставлении четырехлетнего пакета поддержки (Ukraine Facility) в размере 50 млрд евро. Согласитесь, суммы поражают, и от горького привкуса от этих впечатлений не избавиться.

При подобных обстоятельствах привычного для нас «прогресса во внедрении реформ» очевидно недостаточно для того, чтобы осуществить необходимый для Украины экономический рывок. На что, собственно, и намекает нам МВФ в своих прогнозах.

Upside scenario (оптимистичный/положительный сценарий)

Программа по МВФ по-прежнему предусматривает два сценария развития событий в среднесрочной перспективе: базовый и негативный. Ключевые предположения для обоих сценариев — продолжительность и интенсивность боевых действий. Условия базового сценария предполагают, что интенсивность боевых действий постепенно будет снижаться до конца 2024 года. Даже базовый сценарий построен с учетом того, что война (без повышения интенсивности) может продолжаться на шесть месяцев дольше, а негативный сценарий хода событий предусматривает не только более длительный период войны — в течение следующих двух лет, но и рост ее интенсивности. Как следствие, в случае реализации негативного сценария сокращение реального ВВП в 2024 году можно ожидать на уровне 5%.

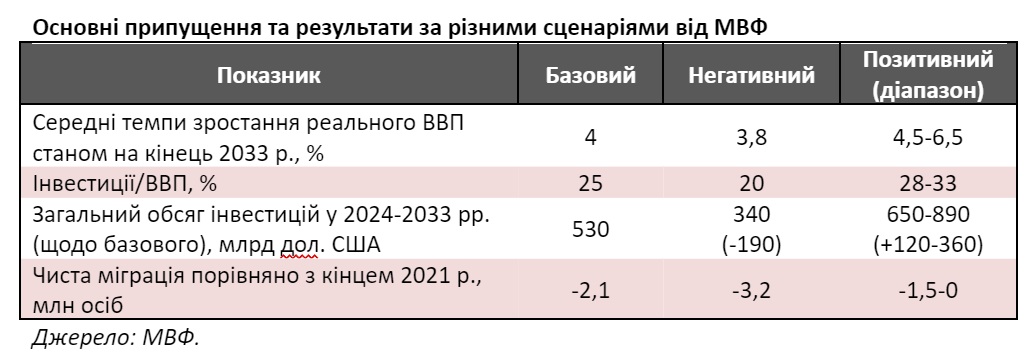

Вместе с тем специалисты МВФ подготовили «иллюстративный» положительный сценарий хода событий в средне- и долгосрочной перспективе, который, в частности, предусматривает более высокие инвестиции (особенно частного сектора), более интенсивное возвращение вынужденных мигрантов и увеличение производительности. В результате потенциальные темпы реального роста экономики в десятилетней перспективе могут повыситься в 1,5 раза, примерно с 4 до 6%. Это существенный рывок, который должен привести к увеличению среднего уровня благосостояния и улучшению качества жизни в Украине. Основные макроэкономические предположения всех трех сценариев приведены в таблице.

При этом даже такой оптимистичный ход событий недостаточен, чтобы догнать по уровню развития соседние страны Восточной Европы. Рассмотрим это на примере Польши. Не секрет, что в течение последних 30 лет экономическое отставание Украины от Польши постепенно увеличивалось. По данным МВФ, по состоянию на конец 2020 года ВВП по паритету покупательной способности на одного человека в Украине и Польше составлял 13,1 тыс. долл. и 34,1 тыс. долл. соответственно. И до войны, согласно вполне обоснованным предположениям роста потенциального ВВП для Польши и Украины в 2,5 и 4% в год соответственно при неизменном количестве населения, на преодоление такого разрыва Украине понадобилось бы около 60 лет. Темп роста реального ВВП, который бы позволил Украине преодолеть этот разрыв за 20 лет, еще до начала полномасштабного вторжения составлял 7,5% в год. Сохранение разрыва в уровне доходов по сравнению с другими странами региона на горизонте ближайших десяти лет также подтверждается расчетами специалистов МВФ (см. рис.).

.png)

Такая ситуация приводит к тому, что даже краткосрочные темпы роста на уровне двузначных величин в течение нескольких лет (предусмотренные в рамках оптимистичного сценария) после завершения войны не дают возможности обеспечить рост, который позволит Украине догнать по среднему уровню жизни наших западных соседей. Такое положение можно расценить как тупик и обречение на статус самой бедной страны Европы, а можно считать его низким стартом для стремительного развития. И это может указывать на то, что Украина будет делать больше и быстрее, чем от нее можно ожидать. Например, одной из немногих развивающихся стран, которой удалось присоединиться к «клубу развитых экономик» в течение последних 30 лет, является Республика Корея. Вместе с тем, если бы в середине 1950-х кто-то в разрушенной войной, бедной и аграрной стране озвучил предположение о том, что через 40 лет МВФ будет считать ее развитой экономикой, то его назвали бы, мягко говоря, человеком с богатой фантазией.

Дополнительные риски по оценкам МВФ

Перечень рисков от специалистов МВФ, которые могут в наибольшей степени повлиять на ход базового сценария, частично совпадает с рисками, указанными в последнем инфляционном отчете Национального банка: более длительный срок/интенсификация войны, снижение объемов/частичная потеря поступлений международной (финансовой) помощи, уменьшение транзитных возможностей (как из-за повреждения портовой инфраструктуры, так и из-за проблем с западными соседями).

Вместе с тем также выделяются дополнительные как внешние, так и внутренние риски, на которые обращают недостаточно внимания либо совсем не озвучивают в Украине.

Внешние риски: стремительное глобальное замедление/рецессия мировой экономики и волатильность цен на сырьевые товары. Вероятность материализации риска глобальной рецессии оценивается как средняя (10–30%), а его влияние — как существенное. Материализация этого риска может привести к проблемам с внешним финансированием и потребует фискальной консолидации и поиска новых источников финансирования (в том числе монетарного и на менее благоприятных условиях). Вероятность риска волатильности сырьевых цен оценивается как высокая (30–50%), как и его потенциальное влияние. Рост цен на энергоносители приведет к дополнительному давлению на платежный баланс и росту потребности во внешнем финансировании. Снижение цен на аграрную продукцию вызовет дополнительное негативное влияние на важную отрасль украинского экспорта. Для противодействия этому риску Украине, в частности, возможно, придется ограничить доступ к энергетическим ресурсам для некоторых категорий потребителей и направить дополнительные ресурсы для обеспечения нужд наименее обеспеченных слоев населения.

Дополнительными внутренними рисками были названы рост социального напряжения в обществе и потеря необходимого темпа реформ. Вероятность того, что оба риска материализуются, оценивается как средняя (10–30%), но сила их ожидаемого влияния на базовый сценарий оценивается как высокая. Согласно оценкам специалистов МВФ, снижение уровня жизни и усиление неравенства могут подорвать национальное единство и привести к принятию популистских решений, которые расширят фискальные и внешние дисбалансы, а потеря необходимого темпа реформ может привести к «усталости» международных партнеров и уменьшению внешней финансовой поддержки.

Для противодействия обоим рискам Украине следует поддерживать взвешенную монетарную и фискальную политику, продолжать антикоррупционную и судебную реформы, мобилизовать внутренние источники финансирования и определить приоритеты по расходам.