Компания VBet: миллиардные обороты, налоговые скандалы и связи с Россией. Что скрывает игровая империя?

Украинцы тратят огромные суммы на ставки на спорт, но все ли знают, кто действительно зарабатывает на этом бизнесе? Один из лидеров в этой области – одна из крупнейших букмекерских компаний VBet, недавно оказавшаяся в эпицентре скандала. СМИ упрекали компании в связи с россиянами и причастности к вероятным финансовым махинациям. В самом ООО «ВБЕТ Украина» категорически опровергли эти тезисы и заявили, что в отношении общества вообще отсутствуют какие-либо уголовные дела.

Однако в Офисе Генпрокурора сообщили, что это не так: производство все-таки есть и продолжается досудебное расследование по уклонению компании от уплаты налогов в больших размерах. Кто же лукавит и в чем подозревают игорную империю?

Эта компания стала главным спонсором чемпионата Украины и национальной сборной по футболу, вытеснив конкурентов.

По данным СтопКора, заключенные Минмолодежьспорта Украины договоры с Favbet и VBet привели к монополизации рынка тотализаторов. Минмолодежьспорт утверждала, что эти договоры подписаны ради борьбы за чистоту спорта и выявление подозрительных ставок. Тем не менее, сами букмекерские конторы от этих соглашений, похоже, извлекли значительную выгоду в виде статуса официального партнера национальных сборных команд и мощной рекламы.

Замаскированные «российские следы» в деятельности компании и ее интересов можно увидеть через другую компанию Soft Construct Limited, стоящую за VBet. Именно она и оказалась связана с российской букмекерской конторой Фонбет через компанию Fastex. Эта компания, в частности, организовывала Russian Poker Tour, спонсорами которой были представители Фонбет. Однако после громкого резонанса в СМИ информация об этом партнерском взаимодействии была удалена с сайта Soft Construct, что свидетельствует о возможной попытке скрыть эти связи.

В то же время в самой VBet категорически заявили, что «Никогда не работали с РФ» и требовали удалить все материалы с подобными предположениями. Компания утверждает, что обнародованная информация якобы нарушает деловую репутацию общества, является «недобросовестной конкуренцией» и требует ее опровержения и удаления.

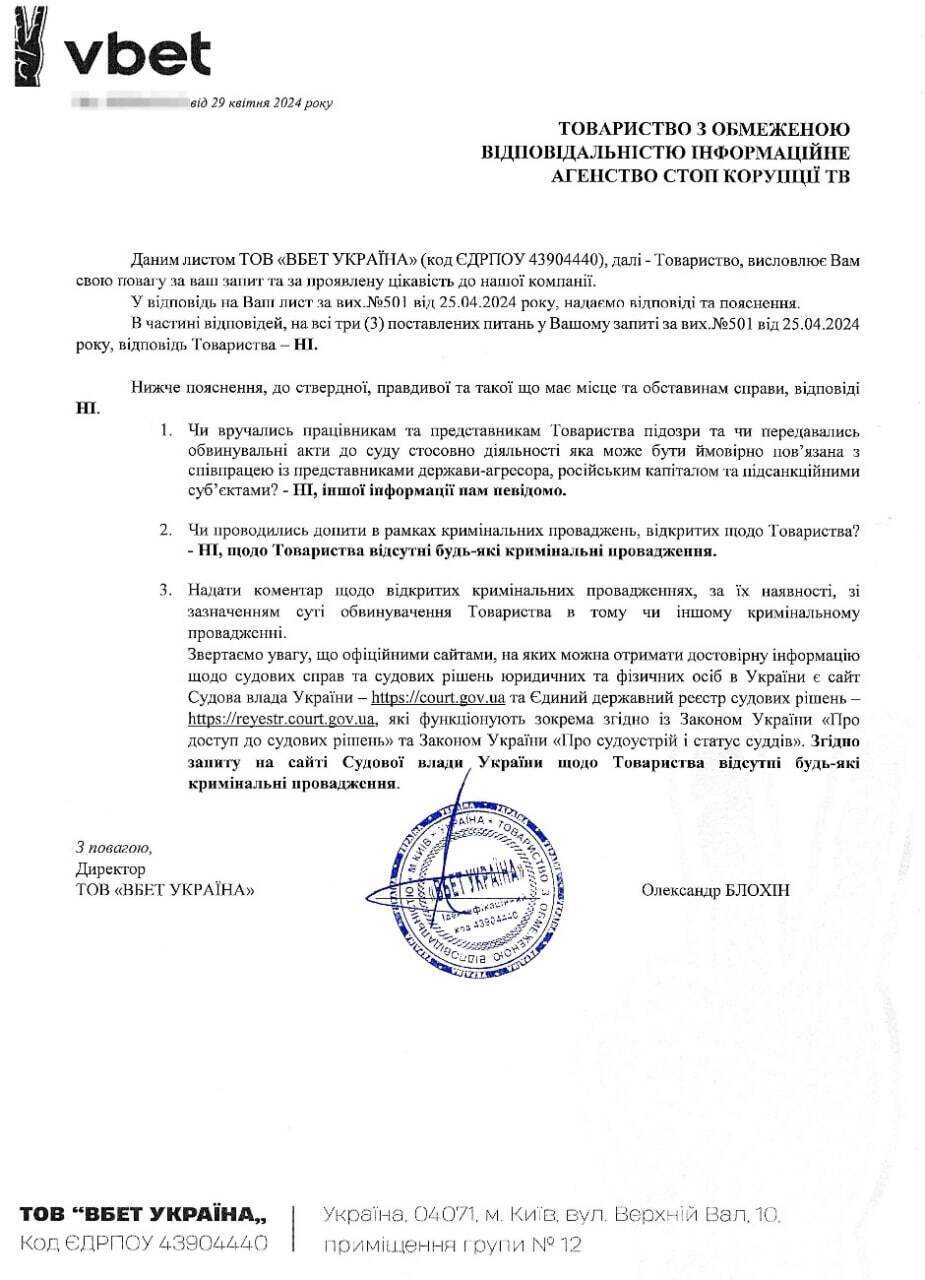

Кроме того, компания предоставила письменный ответ на запрос СтопКора, где указала, что в отношении ООО «ВБЕТ Украина» нет уголовного производства.

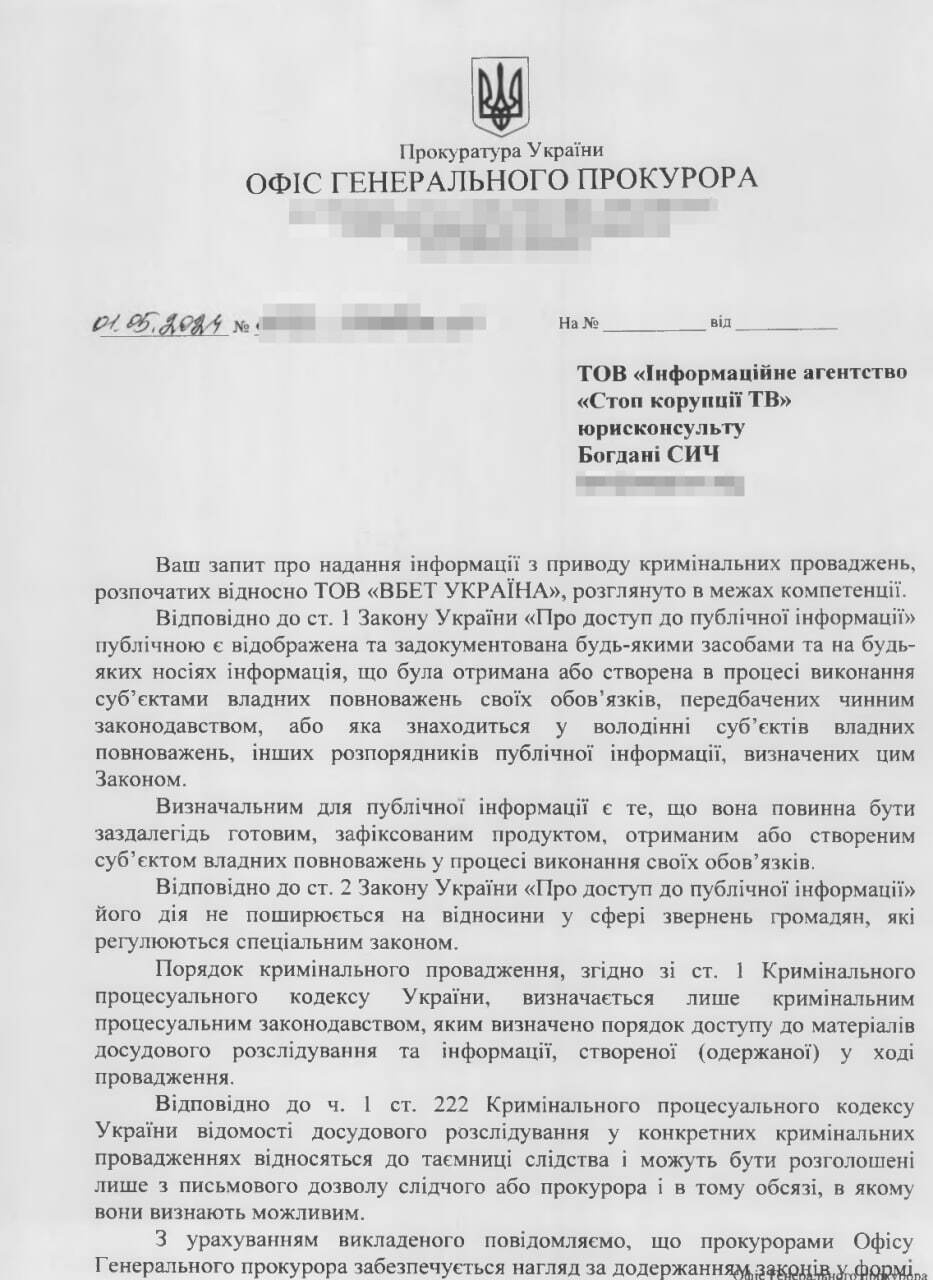

А вот в Офисе Генпрокурора Украины нам сообщили совсем другое — дело есть, его расследует БЭБ и оно касается вероятного уклонения от уплаты налогов в больших размерах:

«В ходе досудебного расследования, среди прочих, исследуются факты возможного уклонения от уплаты налогов в особо крупных размерах и незаконной деятельности по организации азартных игр должностными лицами ООО «ВБЕТ УКРАИНА», — говорится в письме.

Что скрывает VBet и почему ответ компании противоречит официальной информации от правоохранителей? Ведь игровые компании в день проводят сотни тысяч транзакций и обороты в десятки миллиардов гривен в месяц. А неуплаченные налоги во время войны — это создание пробелов в бюджете, не соответствующее государственным интересам, в конечном счете играет на руку врагу. Так что продолжим разбираться в этой теме.

Напомним, Офис Генпрокурора на днях разоблачил очередное нелегальное онлайн-казино с российскими корнями. Перед судом предстанут десять членов преступной группировки, переведшие почти три миллиарда гривен доходов в российскую федерацию. Им предъявлены обвинения в создании, руководстве преступным сообществом или преступной организацией, участие в нем (ч. 1, 2 ст. 255 УК Украины), а также в незаконной деятельности по организации или проведению азартных игр, лотерей (ч. 4 ст. 28 ч .1 ст.