По мере продолжения полномасштабной войны в Украине, происходит значительная потеря десятков миллиардов гривен из-за незаконной торговли контрафактными сигаретами, которые могли бы быть использованы для обеспечения Вооруженных Сил. Почему правительству не удается остановить этот поток контрафактного табака и какие факторы способствуют его дальнейшему росту?

Сколько теряет украинский бюджет от нелегальных сигарет?

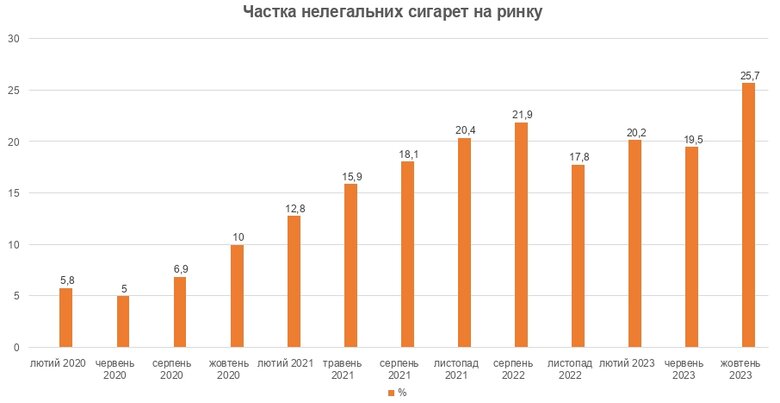

По данным исследования рынка, проведенного Kantar Ukraine в октябре текущего года, доля нелегальной табачной продукции на рынке достигла 25,7%. Еще в июне этот показатель составлял 19,5%. Такой процент «тени» является абсолютным антирекордом за всю историю исследования нелегальной торговли в Украине, начиная с 2011 года.

То есть во время полномасштабной войны каждая четвертая пачка сигарет продается без уплаты предусмотренных законодательством налогов, которые Украина полностью направляет на поддержку Вооруженных Сил и закупку оружия.

По оценке Kantar Ukraine, из-за этого государственный бюджет может недополучить в текущем году 23,5 миллиарда гривен налоговых поступлений.

Это больше половины всех выделенных правительством средств на «Армию дронов» в 2023 году (40 млрд грн) и значительно превышает расходы на Главное управление разведки Минобороны (18,7 млрд грн), которое вынуждено привлекать средства волонтеров для закупки катеров и другой необходимой техники.

То есть эти средства позволили бы увеличить финансирование закупки беспилотников для ВСУ в полтора раза и обеспечить разведчиков Минобороны.

По данным Kantar, лидерами по уровню распространения нелегальной продукции являются 8 областей Украины, где реализуется 70% такой продукции: Днепропетровская — 17%, Одесская — 12%, Львовская — 9%; Харьковская — 9%; Хмельницкая — 7%; Кировоградская — 6%; Черновицкая — 5%, Ровенская — 5%. При этом основными каналами распространения нелегальной продукции остаются киоски (39%), магазины (30%), уличные торговцы (18%) и открытые рынки (11%).

По данным Государственной налоговой службы, в то же время объемы табачных изделий, легально реализованных субъектами хозяйствования розничной торговли, в сентябре-октябре почти во всех этих областях значительно упали (за исключением Кировоградской).

При этом активно развиваются каналы продажи в Telegram, которые специализируются на мелкооптовой торговле: предлагают еще более низкие цены при заказе от 500 пачек, стимулируя таким образом перепродажу нелегальных сигарет традиционными розничными каналами. В продаже также появились сигареты насыпью без упаковки (просто в картонной коробке), мелкооптовые партии табака (в том числе со вкусовыми добавками), фильтров и гильз для мелкопромышленного производства нелегальных сигарет.

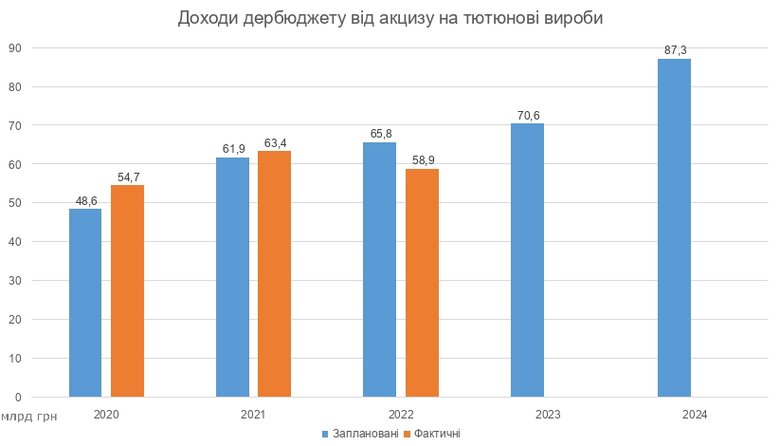

Поэтому, несмотря на ежегодное повышение ставок акцизного налога на табачные изделия на 20%, в 2022 году поступления от него в госбюджет впервые за последние годы уменьшились — до 58,9 млрд грн с 63,4 млрд грн в 2021 году.

В следующем году они должны вырасти до 87,3 миллиарда гривен. Это почти столько же, сколько получит госбюджет от перенаправления «военного НДФЛ» на производство дронов и снарядов. Но запланированные поступления госбюджета от акциза на сигареты могут оказаться под вопросом из-за роста нелегального рынка.

Однако председатель Комитета Верховной Рады по вопросам финансов, налоговой и таможенной политики Даниил Гетманцев уверяет, что поступления от акциза растут, несмотря на увеличение доли нелегальной продукции на рынке. По его данным, легальное производство сигарет вернулось к уровню 2021 года, а поступления акцизного налога с табачных изделий в январе-ноябре 2023 года увеличились на 41,8%, или на 21,9 млрд грн, по сравнению с аналогичным периодом прошлого года.

«По результатам 2023 года мы ожидаем поступления акцизного налога с табачных изделий в сумме 80,3 млрд грн, что обеспечит выполнение показателя доходов (70,62 млрд грн) на 113,7% (плюс 9,7 млрд грн). По предварительным расчетам и с учетом динамики производства и ввоза табачных изделий рисков не выполнения показателей 2024 года в условиях текущей ситуации нет», — убежден Гетманцев.

Почему растет «черный рынок» сигарет?

Доля прямых налогов в розничной цене пачки сигарет достигает 70-80%. Это акцизный налог (который с 2017 года ежегодно растет на 20-30%), 5% акциза с розничной реализации и 20% НДС.

Кроме того, легальные производители платят налог на прибыль предприятий, военный сбор и налоги на труд, а также другие налоги и сборы. Участники нелегального рынка избегают уплаты всех или большей части этих платежей. Это делает нелегальный табачный бизнес чрезвычайно выгодным.

Данные отчета Временной следственной комиссии Верховной Рады по вопросам расследования возможных нарушений законодательства, которые могли привести к уменьшению поступлений в государственный и местные бюджеты (ВСК по экономической безопасности) указывают, что некоторые местные производители табачных изделий платят иногда в десятки раз меньше налогов, чем международные компании.

Так, компании с иностранными инвестициями платят в среднем 3-4 млн гривен налогов на 1 тонну полученного сырья. В то же время данные Налоговой службы свидетельствуют, что пять местных производителей, которые завозили табачное сырье в Украину в 2023 году, платили от 0 до 67 тысяч гривен налогов с тонны.

Самыми распространенными на украинском рынке являются два вида нелегальной продукции — сигареты с признаками подделки и продукция, которая предназначена для продажи в зоне беспошлинной торговли (с надписью Duty Free) или для экспорта и нелегально продается в Украине.

По последним данным Kantar Ukraine, за полгода на украинском рынке увеличилась как доля поддельной табачной продукции (с 6,9% до 11,3%), так и доля так называемых «фейковых Duty Free» сигарет (до 12,9% с 10,9% в июне 2023 года).

Данные исследования свидетельствуют, что 26% контрафактных сигарет произведены компаниями «Украинское табачное производство» и «Юнайтед Тобако», и имеют признаки поддельных акцизных марок.

Остальные 74% контрафактных сигарет — это подделки брендов международных табачных компаний, которые не имеют акцизных марок вообще.

При этом о прекращении работы фабрики «Юнайтед Тобако» председатель Комитета Верховной Рады по вопросам финансов, налоговой и таможенной политики, нардеп от «Слуги народа» Даниил Гетманцев заявлял год назад, назвав это «знаковой победой над «русским миром» в битве в Желтых Водах».

Сейчас Гетманцев утверждает, что несмотря на появление в продаже продукции с указанием производителя «Юнайдет Тобако», фабрика в Желтых Водах не работает.

«По состоянию на сегодня указанное предприятие производственную деятельность не осуществляет. Оборудование под контролем и не используется», — заверил депутат.

В то же время 72% нелегальной табачной продукции с пометкой Duty Free или предназначенной для экспорта, имеет надпись о том, что ее производителем является Винниковская табачная фабрика.

В марте Государственное бюро расследований (ГБР) проводило на этой фабрике обыски. На складе производителя нашли 1,6 млн пачек сигарет без акцизных марок, однако о дальнейших результатах этих обысков не сообщалось.

Чем грозят нелегальные сигареты?

Председатель ВСК по экономической безопасности Ярослав Железняк признает, что несмотря на обращение к правоохранителям, уменьшить объемы нелегального производства и продажи сигарет не удается.

«Мы много раз передавали и точки продаж, и конкретные данные по фабрикам, которые производят нелегальную продукцию… Если коротко — ничего не произошло. Правоохранители это все покрывают, и ведет история к конкретным людям у власти. Каждая нелегальная фабрика работает под «крышей» этих людей», — констатирует депутат.

По его словам, также существуют случаи, когда правоохранители отменяют арест крупных партий нелегальных сигарет якобы для их передачи для нужд военнослужащих, однако в итоге они снова попадают в продажу на «черный рынок».

Основная статья Уголовного кодекса, посвященная борьбе с незаконным производством нелегальной табачной продукции (ст. 204 УКУ «Незаконное изготовление, хранение, сбыт или транспортировка с целью сбыта подакцизных товаров»), относится к подследственности Бюро экономической безопасности, которое до сих пор так и не начало полноценную работу. Перезагрузка БЭБ является одним из важных обязательств Украины перед международными партнерами.

«В целом, пока не перезагрузим БЭБ, который должен нормально этим заниматься, ничего не будет», — уверен Железняк.

С ним соглашается экономист, координатор экспертных групп Экономической экспертной платформы Олег Гетман. Однако, по его мнению, работа ВСК смогла мобилизовать правоохранительные органы.

«Вызывали руководителей Налоговой, Таможни и Нацполиции. Они вынуждены были отчитываться какими-то хорошими новостями на ее заседаниях. Соответственно, приказы спускались в регионы и полицейские действительно закрывали точки, которые продавали контрафакт. Как только срок работы ВСК начал заканчиваться, показатели начали резко ухудшаться», — говорит Гетман.

Он отмечает, что с начала 2023 года легальное производство сигарет в Украине начало восстанавливаться, однако после снижения внимания правоохранителей в четвертом квартале эта тенденция изменилась на противоположную.

«Но в любом случае, это «ручное управление», поэтому сверхважно наконец перезагрузить Бюро экономической безопасности с участием международных партнеров, и то же самое сделать с Налоговой службой. Тогда и без временных комиссий и без ручного управления правоохранительные органы будут работать нормально, а до тех пор будем иметь негативные результаты», — добавляет эксперт.

Глава налогового Комитета Рады Даниил Гетманцев считает, что уже принятые изменения в законодательство позволят снизить долю «черного рынка» уже в ближайшее время.

«Исследование Kantar, проведенное в октябре, демонстрирует высокий уровень работы так называемой схемы Duty Free, которая еще работала в силу того, что закон №3326, которым мы запретили такую деятельность, еще не вступил в силу», — говорит Гетманцев.

По его словам, эту схему использовали некоторые компании, которые имеют официальные лицензии. Прекращение же работы остальных участников «черного рынка» напрямую зависит от эффективной работы правоохранителей.

«Существуют вообще нелегальные производства, подпольные цеха, которые наполняют рынок дешевой продукцией, должны быть отработаны правоохранительными органами», — добавил Гетманцев.По его мнению, часть схем поможет закрыть принятие разработанных вместе с бизнесом изменений в закон №481, который среди прочего регулирует производство и оборот табачных изделий.

Повышение акцизов вместо борьбы с «тенью»

В 2024 году акциз на табачные изделия должен планово вырасти еще на 20%. По мнению Олега Гетмана, это позволит увеличить поступления в госбюджет, однако и теневой рынок будет расти.

«Безусловно поднятие акциза увеличит теневую долю. Возможно, наши законодатели считают, что это допустимые потери», — считает эксперт.

В Европейской бизнес ассоциации призывают Офис президента выполнить обещание, данное бизнесу летом по активной борьбе с «тенью», объединив усилия всех ответственных правоохранительных и контролирующих структур — Налоговой службы, Прокуратуры, Нацполиции, СБУ, а также обеспечить полноценное реформирование Бюро экономической безопасности.

В Американской торговой палате (АСС) также констатируют, что в 2023 году легальный бизнес не увидел эффективной борьбы с нелегальным табачным рынком. В то же время органы власти пытаются усложнить правила работы для легальных игроков.

«В течение этого года табачная индустрия наблюдала, как одна за другой появлялись разного рода законодательные инициативы, такие как: обеспечение прослеживаемости подакцизной продукции, запрет выкладки легальной продукции, государственное регулирование производства и оборота подакцизной продукции, очередное повышение акцизов для легальной продукции и другие законодательные новеллы, которые только усложняли деятельность легального бизнеса и отнюдь не ликвидировали теневой сектор», — отмечают в АСС.

В Американской торговой палате призвали представителей власти немедленно усилить работу по выявлению и пресечению деятельности нелегальных производителей табачных изделий. Ведь теневой рынок не только искажает конкуренцию и наносит вред добросовестному бизнесу, но и уменьшает доходы госбюджета.

«В условиях полномасштабной войны, недостаточного наполнения государственного бюджета и замедления экономической и военной помощи со стороны международных партнеров, рост теневого сектора экономики, по мнению представителей бизнеса, недопустим», — отмечают в АСС.

В то же время стоит заметить, что принятая еще в 2017 году Стратегия в сфере противодействия незаконному производству и обороту табачных изделий на период до 2021 года прекратила действовать, не достигнув поставленных целей. Нового плана действий государства в этой сфере с тех пор до сих пор не приняли.

Следовательно, из-за отсутствия системной политики и роста «теневого рынка» табака, государству не удается достичь ни одной из поставленных целей — ни увеличения поступлений госбюджета, ни уменьшения уровня распространенности курения. Кроме этого, «черный рынок» подпитывает развитие преступности и коррупции в правоохранительных органах, а также приводит к ухудшению условий работы легальных производителей, что дополнительно бьет по экономике и поступлению налогов.