Личность Сергея Вязмикина стала известна на всю страну благодаря расследованию Михаила Ткача «Батальон «Монако». Сюжет произвел настоящий фурор в Украине. По состоянию на момент написания этого материала, расследование только на YouTube посмотрели более 2 миллионов пользователей.

35-минутный сюжет рассказывает о публичных (и не очень) состоятельных украинцах, которые во время полномасштабного вторжения России в Украину переехали жить в тихое солнечное место, вместо того, чтобы поддерживать государство в эти непростые времена. Одним из неприметных участников видео стал Сергей Вязмикин, которого журналисты застали на пробежке вместе с опальным уже бывшим народным депутатом Украины Игорем Абрамовичем, избранным из запрещенной партии «ОПЗЖ». Для знающих специфику незаконной деятельности Абрамовича не секрет, что может объединять экс-нардепа и бывшего заместителя руководителя Департамента защиты экономики Национальной полиции Украины Сергея Вязмикина. Они вдвоем и еще несколько десятков человек не без ведома главы налогового комитета ВРУ Даниила Гетманцева – «смотрящие» за налоговой.

Профиль деятельности дуэта правоохранителя и нардепа достаточно широк. Грубо говоря, Вязмикин и Абрамович могут создать проблемы для бизнеса, так их и решить. В основном, эти проблемы создаются специально искусственно, а потом уже решаются за средства. Безусловно, значительная часть бизнеса, которым неизвестно откуда фискалы начисляют штрафы, идет в суд и там успешно оспаривают предписания, вынесенные ГНС. Однако это только первая часть плана по требованию средств из бизнеса, говорят источники из предпринимательской среды.

«У нас была проблема: фискалы в один момент приняли налоговое уведомление-решение на сумму в сотни миллионов гривен. Это был просто шок, ведь у всех наших предприятий не было такой прибыли и за 10 лет. Для того чтобы погасить такой долг, который неизвестно откуда выдуман, нам нужно было бы не то, что снять все средства со счетов, но и продать абсолютно весь бизнес. Сразу воспользовались правовыми методами – обратились в суд, в суде приостановили решение налоговой, а дальше его отменили, но на следующий день ГНС принимает новое уведомление-решение, согласно которому мы снова становимся должны идентичную сумму. Мы снова идем в суд, и этот процесс может продолжаться бесконечно. Однако здесь же ключевое в том, что работа бизнеса блокируется: мы не можем отгружать товар, ведь имеем «стоп» по всем налоговым накладным», — объясняет редакции представитель одной из крупных компаний на рынке.

«Конечно, приходится искать решение. В общем, этих решений есть два: как говорят люди, если вы сможете попасть к Гетманцеву и объяснить ему, что бизнес работает прозрачно, а все претензии от налоговой – вымогательство, это может повлиять на процесс. Если бизнес действительно где-то уклонился от уплаты налогов, где-то были «скрутки», которые сейчас есть, наверное, у большинства крупных компаний, путь другой: налаживание контакта с Вязмикиным или Абрамовичем. Эти люди точно смогут «решить вопрос» буквально одним звонком, но и здесь есть свои нюансы: стоимость таких «услуг» составляет по меньшей мере 100 тысяч долларов, а затем ежемесячно предприятие платит им определенную договоренную сумму, чтобы избежать новых проблем», — рассказывает источник

То, что Вязмикин и Абрамович являются теневыми кураторами налоговой системы нашего государства, кажется, вообще не секрет. Они недостижимы для правоохранителей не только из-за расстояния, но и из-за своего происхождения и людей, которые допустили их к схемам.

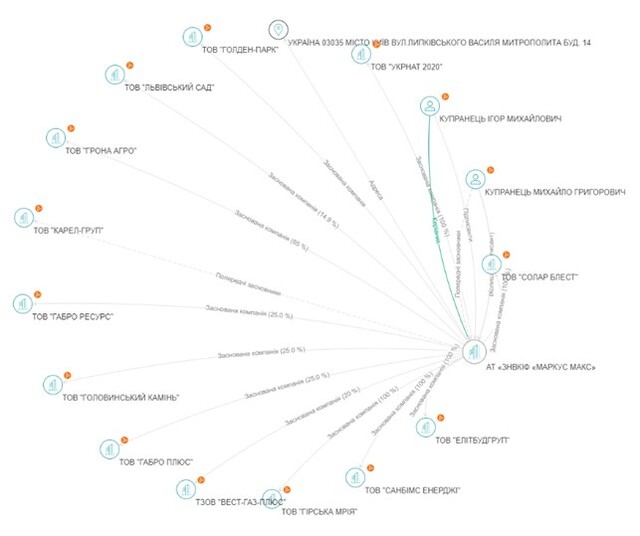

Однако они зарабатывают не только на схематозе и вымогательстве. Вязмикин, карьера которого в правоохранительных органах завершилась в 2019 году, внезапно стал солидным бизнесменом. Пока официально он возглавляет только одну компанию – акционерное общество «Закрытый недиверсифицированный венчурный корпоративный инвестиционный фонд «Фарт капитал». Уставный капитал корпорации составляет 800 миллионов гривен, а ее основатели – родственники бывшего шефа Вязмикина Игоря Купранца и сестра супруги экс-полицейского. Эта компания в свою очередь выступает основателем в нескольких других. К холдингу, контролируемому приближенными к Вязмикину людьми, есть множество вопросов. Об этом мы рассказывали в нашем предыдущем материале.

Однако, как оказалось, АО «ЗНИКИФ «Фарт капитал» — лишь вершина айсберга в запутанном клубе бизнесов Сергея Вязмикина. Добавим только одно: вероятно, деятельность «Фарт капитала» фиктивна, этот вывод можно сделать из следующего:

- Финансовая отчетность компании очень «странная». Согласно отчетности «Фарт капитал», в 2022 году акционерное общество получило доход в размере 11 млн грн, при этом убытки корпорации составляли 86 миллионов. В 2023 году при неизвестном доходе прибыль компании составила почти 84 млн грн.

- Юридический адрес компании не соответствует ее реальному местонахождению. Журналисты побывали по адресу, указанному в реестрах, и не нашли никакого подтверждения деятельности там огромного фонда «Фарт капитал».

Офис компании Вязмикина, по официальным данным, находится рядом со станцией метро Нивки в столице в относительно новом жилом доме. При общении с местными жителями они нас заверили, что никогда не слышали о деятельности инвестиционного фонда.

Мы согласны с тем, что это не преступление, однако вопрос, как компания без офиса и без сотрудников (согласно отчетности) могла получить более 2 млн долларов США прибыли, при том, что в прошлом году они получили убыток более чем в 2 млн долларов США. В этом и проявляются возможности Вязмикина: на компании по орбите приближенных к нему людей налоговая не обращает внимания, потому что знает, что нельзя. Но это только начало.

Из-за ряда компаний, связанных с окружением бывшего полицейского, можно найти еще одно акционерное общество «Закрытый недиверсифицированный венчурный корпоративный инвестиционный фонд «Маркус макс», к которому следует присмотреться. Кроме названия, фактически идентичного с «Фарт капитал», в них совпадают адрес регистрации (ул. Митрополита Василия Липкивского, 14 в Киеве) (ранее по этому адресу было зарегистрировано общество, возглавляемое Вязмикиным), а также руководитель – бывший руководитель Департамента защиты экономики НПУ Игорь Купранец. Основным же акционером фонда является отец Игоря Купранца Михаил, являющийся конечным бенефициарным владельцем «Маркус макс».

Адрес расположения компании является адресом массовой регистрации других предприятий, входящих в орбиту Вязмикина-Купранца.

Ситуация с этим предприятием зеркальна в «Фарт капитал» — неизвестный доход, отсутствие работников, убытки в 2022 году и прибыль в 2023 году. Такое впечатление, что эти цифры просто берутся из головы.

АО «ЗНИКИФ «Маркус макс» – является основателем десятков других компаний, среди которых можно выделить несколько. Однако одна из компаний оказалась с особенно интересной историей. Речь идет об обществе с ограниченной ответственностью «Элитстройгрупп».

«Элитстройгрупп» в 2017 году был застройщиком бизнес-центра «Iceberg» по адресу: г. Киев, ул. Митрополита Василия Липковского, 14. Именно в этом здании зарегистрировано значительное количество компаний, связанных с Вязмикиным.

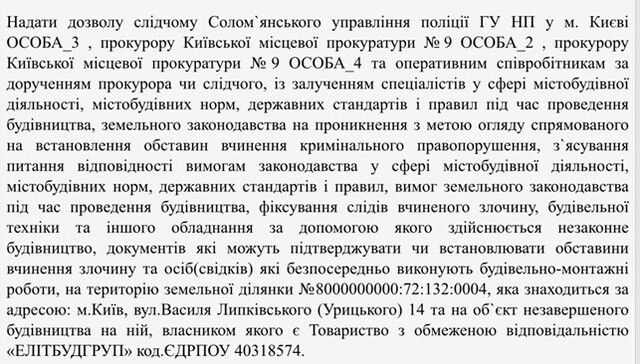

Строительство бизнес-центра на улице Василия Липковского сопровождалось не только скандалами, но и уголовными производствами. Как нам удалось установить, против должностных лиц компании по орбите Купраца-Вязмикина было начато уголовное производство по ст. 356 УК Украины (самоуправство). Материалы о правонарушениях внесены в ЕРДР под №12017100090009199.

Как установило следствие, «Элитстройгрупп» приобрела старое нежилое помещение и получила разрешение на его реконструкцию. Однако вместо предусмотренных законодательством и разрешением действий предприятие разрушило приобретенные помещения и на их месте начало строить новый бизнес-центр. Уголовное производство, начатое по данному факту, пошло «в никуда».

Как ни странно, однако уголовное производство осталось без движения: никто не понес никакого наказания, а бизнес-центр удалось узаконить. Теперь он принадлежит компаниям Вязмикина и Купранца. Но и даже это не самое интересное в деятельности «Элитстройгрупп». Компания, как вы уже догадались, имеет тождественную финансовую отчетность с другими предприятиями бывших полицейских: 2022 год – убытки, 2023 год – доходы. Как объяснить такое «совпадение» в прошлом году – мы не знаем, но, похоже, работает еще одна схема Вязмикина, также связанная с Государственной налоговой службой.

Как нам удалось установить, за последние 2 года «Элитстройгрупп», которая через «десятые руки» принадлежит отцу Игоря Купранца Михаилу, 16 раз обращалась к фискалам с письмами о возмещении налога на добавленную стоимость (НДС). Каждое из этих писем было согласовано, как следствие, компании Купранца-Вязмикина из бюджета возвращали миллионы гривен. Только за что – пока не совсем понятно, ведь если верить той же финансовой отчетности компании, активной предпринимательской деятельности они не вели.

Наш материал – это свидетельство о массиве мошеннических и влиянии на налоговые органы, оказываемые бывшим полицейским Сергеем Вязмикиным. Несмотря на то, что, по нашим данным, в течение полномасштабной войны в Украину он не возвращался, на родине у него дела обстоят прекрасно. С одной стороны, у него есть «законный» бизнес, который неизвестно откуда приносит ему (вероятно, декларативно) десятки миллионов гривен прибыли, а с другой стороны, схематоз обеспечивает миллионы долларов «в конверте». Только вот почему бывшие коллеги Вязмикина – правоохранители в упор не видят схем, организуемых экс-заместителем руководителя Департамента защиты экономики НПУ и его приспешниками.