Производители оружия для ВСУ нуждаются в оборотных средствах, но банки не спешат их кредитовать или делают это на общих для бизнеса условиях. Без решения этой проблемы поставки на фронт не увеличатся.

Оборонные компании нуждаются в дополнительном финансировании для своевременной отгрузки оружия на фронт, преодоления форс-мажорных ситуаций и быстрой разработки новой техники, которая крайне необходима Вооруженным Силам Украины.

Однако льготного кредитования для производителей военной техники в Украине не существует. В отличие от аграриев и энергетиков, оборонная сфера кредитуется на общих условиях с высокими процентными ставками или ищет средства в других местах.

Невозможность взять дешевый кредит в банке тормозит развитие оборонных компаний в разгар технической гонки с Российской Федерацией.

Дискуссия о создании программ льготного кредитования для производителей вооружений ведется с 2023 года. Тогда премьер-министр Денис Шмыгаль говорил о возможности включить оборонные компании в государственную программу «5-7-9%», а глава Нацбанка Андрей Пышный даже включил их в стратегию по развитию кредитования.

Хотя банки демонстрируют высокие показатели ликвидности и относительно большие прибыли, массового кредитования оборонной промышленности все еще нет. Последний раз внедрение соответствующих льготных программ власти анонсировали в марте 2024 года, но, по данным источников ЭП, решение застряло в правительстве.

Зачем оборонным компаниям кредиты

Для производства оружия компания должна сначала получить аванс на закупку компонентов. Обычно государственные заказчики — Минобороны, Госспецсвязи, Нацгвардия и другие — дают предоплату в размере 50-80% от суммы контракта.

Учитывая размер дыры в госбюджете, выбивать высокие авансы от государства удается не всем. Также из-за недостатка средств могут возникать форс-мажоры с финансированием. ЭП известно о случае, когда одно из ведомств из-за нехватки денег существенно уменьшило размер аванса уже после подписания крупного контракта.

Поскольку авансов не всегда хватает на закупку компонентов, оборонным компаниям приходится искать финансовое плечо.

Потребность в привлечении дополнительных денег сохраняется и после выполнения контракта. Дело в том, что с производителями вооружений в Украине заключаются в основном короткие контракты, как правило — в рамках бюджетного года. То есть компания до декабря отгружает продукцию, а потом несколько месяцев следующего года ждет перераспределения бюджета и заключения новых годовых соглашений.

Во время контрактного затишья предприятия отправляют рабочих в простой. Чтобы поддерживать производство, компании вынуждены искать деньги на выплату зарплат или перебиваться небольшими заказами от воинских частей.

Есть расходы, которые не прописаны в государственных контрактах и которые финансируются из кармана производителя: создание прототипов, испытания и выпуск предсерийных партий.

Например, разработка бронеавтомобиля компании Inguar стоила 700 тыс долл, а НПО «Практика» тратит на конструирование нового бронетранспортера миллионы долларов. По данным опрошенных ЭП компаний, стоимость разработки «машинного зрения» для FPV-дронов стоит сотни тысяч долларов.

Восстановление цехов после ракетных или шахедных ударов, релокация предприятий, закупка генераторов и топлива тоже ложатся на плечи производителей. В «Украинской бронетехнике» рассказали ЭП, что в бесперебойное обеспечение электричеством литейного предприятия нужно инвестировать 500 тыс долл.

Для финансирования этих расходов производители, по логике, должны обращаться к банкам. Однако для оборонных компаний не существует льготных условий кредитования, поэтому они сталкиваются с кучей проблем. Например, одному из производителей банк предложил заем под невыгодные 17% годовых, а другому отказал из-за военных рисков.

Поэтому потребность в оборотных средствах военные предприятия в основном покрывают из своих прибылей, которые могли бы инвестировать в развитие производств и новые разработки.

«Льготные кредиты упростили бы жизнь. Мы бы оптимизировали структуру поставок, снизили бы себестоимость, быстрее бы масштабировали производство», — говорит Алексей Бабенко, основатель компании VYRIY, производящей высокотехнологичные дроны.

«В периоды между государственными контрактами берем прямые заказы от воинских частей, но они покупают только готовый товар. Одно из подразделений готово купить у нас дронов на 20 миллионов гривен, но свободных операционных средств для их производства сейчас нет. Если бы была возможность взять кредит, мы бы заняли деньги под этот проект», — добавляет директор ISR Defence Владислав Алексеенко.

Почему банки не кредитуют оборону

Говорить, что банки совсем не кредитуют оборонно-промышленный комплекс (ОПК), нельзя. Например, банк «Пивденный» в 2023 году прокредитовал оборонные компании на 415 млн грн, а за первую половину 2024 года выдал им займов еще на 315 млн грн. Кредитный портфель предприятий ОПК в Ощадбанке в 2023 году составил 6 млрд грн, а в этом году может вырасти до 12 млрд грн.

Другие системные банки, к которым обращалась ЭП, либо не имеют в кредитных портфелях оборонных предприятий, либо отказались называть объемы такого кредитования. Нацбанк не ведет агрегированной статистики по сферам банковского кредитования.

В то же время озвученные банками цифры — лишь капля в море потребностей ОПК во время войны. Кажется, что оборонные предприятия и банки не находят общего языка, хотя последние получают рекордные прибыли и имеют свободные сотни миллиардов гривен.

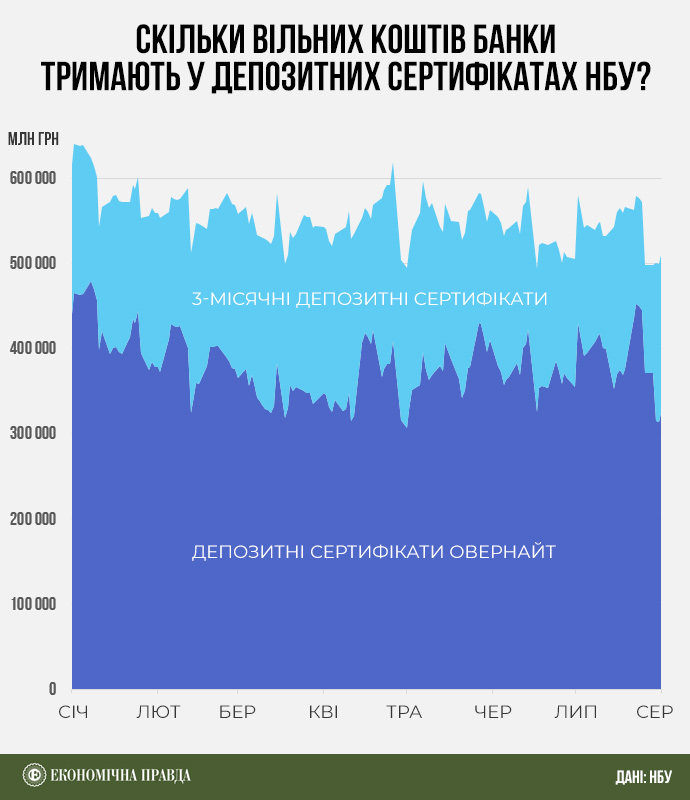

Банки стали едва ли не самым прибыльным бизнесом в Украине благодаря свободной ликвидности, которую они не направляют ни на финансирование государственных расходов через покупку облигаций, ни на кредитование экономики. Зато банки вкладывают эти средства в депозитные сертификаты НБУ под 13-16% годовых.

Неудивительно, что монетарная политика Нацбанка вызывает немало критики, в частности среди бывших руководителей центробанка. Сам НБУ на эту критику традиционно отвечает необходимостью поддерживать финансовую стабильность. Направить все свои свободные средства на кредитование ОПК банки не могут по нескольким причинам.

Во-первых, источник этих денег — остатки на текущих счетах бизнеса и населения. Иными словами, банк должен иметь к ним постоянный доступ на случай, если клиенты захотят снять средства со своих счетов. Даже если все банки направят деньги с депозитных сертификатов на кредиты, то избыточная ликвидность банковской системы не исчезнет, а перераспределится между банками.

Во-вторых, к банкам выдвигаются жесткие требования по структуре их активов, ведь они управляют средствами вкладчиков. По нормативам НБУ, для сохранения устойчивости банк должен диверсифицировать инвестиции: не вкладывать все средства в кредитование одного сектора или приобретение одного типа ценных бумаг.

Ответственность перед вкладчиками и надзор со стороны регулятора делают банки крайне осторожными в предоставлении займов. Именно поэтому при выдаче кредитов они требуют у заемщиков залог и дополнительные гарантии возврата денег.

При этом банки не считают ОПК более рисковым сектором для кредитования и выставляют к оборонным компаниям те же требования, что и к другим бизнесам.

«Для нас клиент, работающий в оборонно-промышленном секторе, не отличается от клиента, который занимается, например, розничной торговлей. Критерии те же: приемлемая кредитоспособность и детальный анализ деятельности», — объясняет заместитель председателя правления Sense Bank Елена Зубченко.

В том, что объемы кредитования оборонной промышленности недостаточны, банки отчасти винят самих оружейников, называя их «молодыми и инфантильными» компаниями, у которых нет опыта взаимодействия с банками.

«Часто это компании, которые только недавно запустили производство, произвели какое-то количество оружия и получили первые контракты от Минобороны. Иногда у них даже нет финансовой отчетности, которую они могли бы показать банку, чтобы подтвердить свою платежеспособность», — говорит ЭП топ-менеджер одного из государственных банков.

По его словам, распространенная причина отказа в предоставлении кредитов оружейникам — завышенные ожидания. Так, заемщик, который производил тысячу дронов, хотел получить кредит на 0,5 млн долл для выпуска миллиона дронов в год, но не объяснил, как он это будет делать. Среди других причин отказа — невысокая деловая репутация компании или ее владельца, отсутствие контрактов с Минобороны или даже подтверждений, что оружие, которое они производят, допущено к эксплуатации.

Как нарастить кредитование отрасли

Проблемы с получением кредитов есть не только у оборонных стартапов. С ними сталкиваются и зрелые производители. Прежде всего, на пути становится вопрос залога.

«Даже у крупных оборонных компаний нет залогового имущества, чтобы брать кредиты для финансирования миллиардных контрактов. Как правило, имущество оценивают с дисконтом 50%. Произведенную продукцию банки в залог не берут, потому что не знают, что с ней делать», — рассказывает директор НПО «Практика» Юлия Высоцкая.

Частичное решение для небольших частных производителей нашли в правительстве.

«Частные компании с выручкой до 50 миллионов евро в год могут получить банковское финансирование с помощью механизма государственных портфельных гарантий. Частные компании ОПК могут привлечь до 100 миллионов гривен с покрытием до 80% объема кредитной сделки государственной портфельной гарантией», — говорит заместитель председателя правления Ощадбанка Юрий Кацион.

Он добавляет, что на оставшиеся 20% кредита заемщик может предоставить банку поручительство собственника, производственную линию или другое имущество. К сожалению, многие оружейники не знают о таких возможностях, поэтому не обращаются за кредитами, говорит банкир.

Проблему залога мог бы частично решить факторинг — возможность производителя продавать банку обязательства государства по договору. Тогда заемщик уже сейчас получает средства для производства товаров, а банк — право на средства, которые государство заплатит производителю в будущем. Однако сейчас такие операции невозможны.

«Во-первых, в действующих нормативно-правовых актах отсутствуют положения и разъяснения, регламентирующие порядок рассмотрения и приема органами казначейства бюджетных обязательств распорядителей средств, которые должны выплачиваться в пользу лица, отличного от лица контрагента по контракту.

Во-вторых, органы казначейства не имеют инструкций или разъяснений по поводу возможности изменения реквизитов оплаты по зарегистрированным бюджетным обязательствам и осуществления оплаты на другого субъекта (третьему лицу)», — объясняет первый заместитель председателя правления банка «Пивденный» Максим Цымбал.

Еще одно препятствие в кредитовании оборонных предприятий — срочность контрактов, которая влияет на срочность кредитов. Банки боятся давать производителю средства на срок более года, потому что не уверены, что в следующем бюджетном периоде компания будет иметь заказ от государства.

«Необходимо ввести практику долгосрочных контрактов на оборонную продукцию, чтобы производители могли привлекать средства не только на производство текущей продукции, но и инвестировать в развитие на долгосрочной основе. Есть практика стран НАТО, где соглашения заключаются на три-пять лет, а иногда и на более длительные периоды», — добавляет Цымбал.

Будет способствовать кредитованию и разрешение на экспорт вооружений, добавляют банкиры. Сейчас покупатель оружия в Украине один — государство. Следовательно, объемы производства и обороты оружейников зависят от платежеспособности и потребностей правительства. В таких условиях кредитование становится рисковым, ведь заемщик не сможет продать свой товар в случае резкого проседания спроса, например, если закончится война.

Разрешение на экспорт вооружений увеличит количество покупателей. Более того, оно может положительно повлиять на платежеспособность самих производителей, ведь они уже сейчас способны производить гораздо больше оружия, чем его может купить государство.

Наконец банковское кредитование остается слишком дорогим. Крупные банки готовы кредитовать производителей оружия под 15-17%. Выходом из этой ситуации могла бы стать государственная программа компенсации процентных ставок наподобие «5-7-9%».

Минстратегпром готовит решение

В мае Верховная Рада приняла законопроект, благодаря которому Минстратегпром сможет компенсировать банкам процентные ставки по кредитам, которые они предоставят оружейникам. Таким образом открылся путь к введению для ОПК программы, похожей на «5-7-9%». Производители оружия получат кредиты под низкий процент, а государство компенсирует банкам разницу между рыночной и льготной ставками.

Впрочем, решение парламента — лишь первый шаг, правительство еще должно разработать правила и механизмы. В Минстратегпроме ЭП рассказали, что работа над программой продолжается и ведомство сообщит, как только она будет готова к запуску.

В марте издание Forbes писало, что новое постановление должно было заработать еще весной. Решения нет до сих пор. Похоже, разработка механизма требует тщательного согласования с ведомствами и она оказалась сложнее, чем ожидалось.