Основанная выходцем из Киева Максом Левчином финансовая компания PayPal полноценно заработала в Украине 17 марта 2022 года. Таким образом компания решила поддержать украинцев, которые с одной стороны бежали от полномасштабной войны, с другой — собирали пожертвования для покупки всего необходимого на фронт.

Основанная выходцем из Киева Максом Левчином финансовая компания PayPal полноценно заработала в Украине 17 марта 2022 года. Таким образом компания решила поддержать украинцев, которые с одной стороны бежали от полномасштабной войны, с другой — собирали пожертвования для покупки всего необходимого на фронт.

До того сервис в Украине был доступен в режиме send only. Такой режим позволяет создать учетную запись, пополнять ее банковской картой и рассчитываться в интернет-магазинах. Впрочем, получать или переводить деньги — нет. Мгновенные переводы между пользователями — самая большая ценность сервиса, который работает на более чем 200 рынках мира и имеет более 426 млн клиентов.

День запуска полноценной работы PayPal в Украине многие называют историческим. Ведь для этого понадобились десятки лет, изменения в отечественное законодательство и дипломатические усилия.

Однако украинские пользователи PayPal, что до полноценного запуска, что после продолжают сталкиваться с распространенной проблемой — блокировкой аккаунта и заморозкой денег. Причем никаких уведомлений или предупреждений PayPal не присылает.

Больше всего от этого страдают волонтеры, военные, которые открывают сборы на личные счета, производители дронов. И это не технический сбой, а целенаправленная политика компании, которая довольно туманно описана в правилах пользования сервисом.

Так, в июле 2024 года польский антимонопольный регулятор (UOKiK) выдвинул PayPal Europe штраф на $27,3 млн за то, что компания в договорах с пользователями четко не указала условия, по которым они могут быть оштрафованы.

«Положения PayPal являются общими, неоднозначными и непонятными. Читая эти положения, потребитель не может предсказать, какие из его действий могут считаться запрещенными, или какие санкции могут быть применены к нему. Таким образом, PayPal имеет неограниченную возможность по своему усмотрению решать, совершил ли пользователь запрещенное действие и какое наказание ему за это грозит, каким может быть, например, блокировка денег на счету», — говорится в позиции UOKiK.

Недавно в украинском сегменте PayPal прокатилась очередная волна блокировки учетных записей. Среди них оказался и отечественный производитель дронов «Дикие шершни».

«Мы не единственные украинские фандрейзеры, которые были заблокированы в последнее время. Это возмутительно. Призываем компанию пересмотреть свою политику и решения, чтобы убедиться, что она поддерживает Украину, а не выступает на стороне террористических захватчиков», — говорится в сообщении „Диких шершней“.

PayPal прекратил свою деятельность в России еще в марте 2022 года параллельно с запуском в Украине. Хотя новые аккаунты из РФ создать не получится, компания продолжает обслуживать уже существующие счета.

Впрочем, с 7 октября 2024-го PayPal начал взимать ежегодную комиссию с россиян, если счет не использовался или не пополнялся в течение года. Комиссия составляет 3,5 тыс. руб. (~$35). Если пользователь не соглашается на такие условия, он должен вывести средства и закрыть аккаунт, если же на счету меньше необходимой суммы, PayPal списывает весь остаток.

Такими действиями компания вроде и показывает, что находится по правильную сторону баррикад, но проблемы украинских пользователей от этого не исчезают. Ситуация с «Дикими шершнями» — очередной тому пример.

БизнесЦензор разбирался, почему PayPal блокирует счета украинцам.

Только для личного использования

PayPal предлагает несколько типов счетов: личные, корпоративные, для благотворительности. Но украинцам доступны только личные аккаунты. Работу в Украине компания называет гуманитарной помощью, поэтому с самого момента запуска в нашей стране об аккаунтах для бизнеса речь не шла.

Как отмечается на официальном сайте PayPal, пользователи из Украины могут отправлять и получать платежи от друзей и родственников. Для того, чтобы получать оплату за товары или услуги, а также для сбора средств, в соответствии с общими правилами сервиса, нужно пользоваться корпоративным аккаунтом. То есть сборы, которые открывают украинцы на личные счета, PayPal может расценивать как нарушение и блокировать учетные записи.

Более того, даже от друзей и родственников получить деньги не так просто.

Знакомый военнослужащий, который попросил не называть его имя, рассказал БизнесЦензору, что друг недавно ему переслал из Германии 2 тыс. евро для покупки машины, необходимой для выполнения боевых задач. Но PayPal без всякого уведомления деньги заблокировал. Пришлось оформлять возврат средств и терять на комиссии. Нужную сумму в конце концов перебрасывали через карты украинских банков.

«При определенных обстоятельствах для защиты PayPal, а также безопасности и целостности сети покупателей и продавцов, которые пользуются услугами PayPal, компания может принимать меры на уровне учетной записи или на уровне транзакции. Наши решения об удержании, ограничениях и резервах могут основываться на конфиденциальных критериях, которые важны для нашего управления рисками и защиты PayPal, наших клиентов и / или поставщиков услуг. При оценке риска, связанного с вашей учетной записью PayPal, мы можем использовать запатентованное моделирование рисков и мошенничества. Кроме того, мы можем быть ограничены нормативными актами или государственными органами в раскрытии определенной информации о таких решениях. Мы не обязаны раскрывать подробности нашего управления рисками или процедурами безопасности», — говорится в пользовательском соглашении PayPal.

Новые старые проблемы

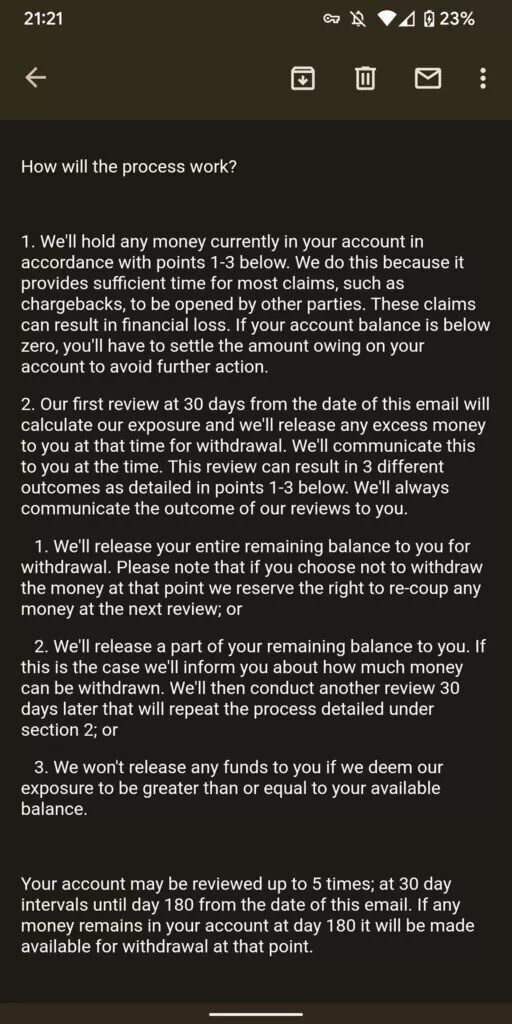

О блокировке аккаунтов и денег на счету украинцы начали жаловаться буквально сразу, как PayPal расширил свой функционал в Украине в 2022 году. Система тогда выборочно замораживала средства на счетах украинцев на срок от 30 до 180 дней. То есть до полугода пользователи не могли ни просмотреть состояние счета, ни вывести или перевести деньги кому-то другому.

Обращение в службу поддержки кроме стандартной отписки ничего не давало.

«Из соображений безопасности мы не разглашаем детали нарушения, поскольку это позволит обойти наши меры безопасности. Мы проводим тщательное расследование, прежде чем принимать такое решение, поэтому это окончательное решение, которое не будет отменено», — отвечал PayPal на многочисленные обращения.

С того момента прошло более двух лет, но ситуация не изменилась. Любая учетная запись или операция могут быть заблокированы без объяснения причины и без каких-либо уведомлений со стороны PayPal. Вот как произошло с «Дикими шершнями» или нашим знакомым военнослужащим, или сотнями других пользователей сервиса.

Здесь надо понимать, что PayPal является глобальным финансовым учреждением, которое среди прочего обязано соблюдать все действующие законы и нормативные акты по борьбе с отмыванием денег (AML — Anti-money laundering) и финансированием терроризма.

Владельцем PayPal с 2002 года является eBay со штаб-квартирой в Сан-Хосе в Калифорнии. Поэтому в первую очередь PayPal будет выполнять требования американского законодательства и других нормативных актов особенно в части AML.

Соединенные Штаты, которые системно занимаются проблемой отмывания денег и финансирования терроризма с 70-х годов прошлого века, по сути, являются международным AML-эталоном, глобальным законодателем в этой области.

Украинцы привыкли к финансовой свободе, которая не вписывается в американские представления регуляции и контроля. Мгновенные денежные переводы с карты на карту или по номеру телефона (P2P-переводы) — вполне обыденные вещи для Украины, но не для Европы или тем более США, где каждая операция тщательно исследуется соответствующими структурами и внутренними службами финансового мониторинга.

Именно поэтому Национальный банк Украины в последнее время усиливает позиции финмона, требуя даже от небанковских финансовых учреждений проводить жесткую AML-политику. Проще говоря, НБУ берет под полный контроль денежные переводы украинцев, о чем мы подробно писали в этой статье.

AML-проверка касается не только банковского сектора или электронных кошельков. Проводить ее должны даже криптовалютные биржи. Одним из основных канонов Anti-money laundering является принцип Know Your Customer (KYC). То есть любой финансовый сервис, включая криптовалютные, должен знать о своем клиенте все — от имени, почтового индекса и паспортных данных до официального месячного дохода. Любые отклонения профиля — это гарантированный билет к блокировке, а затем дополнительной проверке.

Службы финансового мониторинга, что за рубежом, что в Украине объединяет, пожалуй, одна деталь — они держат в секрете алгоритмы и методы своей работы. Более того, постоянно их меняют, чтобы к ним невозможно было приспособиться.

Собственно, об этом и пишет PayPal в пользовательском соглашении или отписках на жалобы пользователей: «Мы не обязаны раскрывать подробности нашего управления рисками или процедурами безопасности».

Регион повышенной опасности

Из-за того, что в Украине уже более десяти лет идет война, два из которых — полномасштабная, наша страна считается регионом повышенной опасности. Самым большим камнем преткновения в работе международных финансовых и не только сервисов являются временно оккупированные территории, особенно те, что были оккупированы до 24 февраля 2022 года.

Те же ВПЛ с Донбасса после начала полномасштабной войны имеют проблемы с добавлением банковских карт в Apple Wallet или Google-кошелек. Им приходится проходить дополнительные процедуры проверки, формируя соответствующие заявления и предоставляя кипы документов.

Проще говоря, центральные офисы тех или иных компаний (особенно финансовых) не знают, что делать с пользователями из того же Крыма, который де-факто аннексирован Россией с 2014 года, но де-юре является частью международно признанных границ Украины. Дать, например, крымчанам неограниченный доступ к финансовым сервисам может расцениваться, как финансирование терроризма, ведь в отношении территории полуострова были в свое время применены международные санкции.

Американские и международные регуляторы в таких вопросах довольно жесткие, поэтому ни одна компания не будет подвергаться опасности штрафов или любых других мер воздействия. Учитывая, что доля украинского рынка в мировом масштабе мала для неоправданного риска.

Яркий пример — американская краудфандинговая компания Buy Me a Coffee, которая у нас стала альтернативой Patreon после скандала с блокировкой аккаунта фонда «Повернись живим» с донатами на $250 тыс. и блокировкой аккаунта блогера и волонтера Сергея Стерненко в начале 2023 года, отказалась в августе 2024-го предоставлять полноценный сервис для пользователей из Украины.

Buy Me a Coffee просто заблокировал возможность вывода денег на карты украинских банков.

«Поскольку примерно 20% территории Украины подпадает под действие санкций, стало чрезвычайно трудно точно проверять и контролировать местоположения, что создает значительные риски ошибок», — объяснили тогда в техподдержке сервиса, искренне извинившись за возможные неудобства.

То есть сервису проще полностью отказаться от обслуживания пользователей из Украины, чем подвергаться возможным финансовым санкциям со стороны американского, европейского или международных регуляторов.

Как уже было отмечено выше, PayPal свою работу в Украине позиционирует гуманитарной помощью. Как отмечается на официальном сайте компании, изменения в услугах и сборах (украинцам отменили комиссии) применяются пока до 31 декабря 2024 года. Далее — на усмотрение компании.

Учитывая неопределенность военно-политической ситуации в Украине БизнесЦензор не рекомендует украинцам держать значительные суммы на кошельках PayPal или других международных финансовых сервисов, в том числе криптовалютных. Ведь они могут быть заблокированы в любой момент без каких-либо уведомлений или объяснений. «Дикие шершни» успели вывести основную массу денег за день до блокировки аккаунта. Чистое везение.

Резюме

Антиукраинская истерия в США будет расти минимум до президентских выборов 5 ноября. Следовательно, в зависимости от того, кто разместится в Овальном кабинете, будет формироваться дальнейшая политика в отношении пользователей тех или иных, в частности, финансовых сервисов из Украины.

Рассчитывать на поблажки не приходится. Запрет на поставку летального оружия Соединенные Штаты преодолели только в 2018-м. Быстрее, чем преграды на работу PayPal в Украине. Ведь война — войной, а денежные потоки должны находиться под контролем корпораций, частью которых является PayPal.