В 2022 году крупнейшим финансовым донором Украины были не США, ЕС или МВФ.

Как ни странно, им была сама Украина, а точнее — Национальный банк, который в 2022 году занял правительству 400 млрд грн.

НБУ остается крупнейшим внутренним кредитором государства и сейчас. Суммарно правительство должно центральному банку почти 700 млрд грн и ежегодно тратит десятки и даже сотни миллиардов на обслуживание этого долга.

Долги бюджета перед Нацбанком выглядят как перекладывание денег из одного «кармана» государства в другой. Дело в том, что доходы, которые НБУ получает от Минфина в качестве уплаты процентов, становятся частью прибыли центрального банка, которая затем переводится обратно в бюджет.

Однако в реальности так бывает не всегда. Например, в 2024 году более 80% средств, которые государство будет перекладывать между своими «карманами», потеряются по дороге.

Кто на самом деле зарабатывает на долгах правительства перед Нацбанком и почему бюджет теряет на этом дважды?

Сколько правительство должно НБУ?

Для покрытия дефицита государственного бюджета с помощью внутренних ресурсов правительство выпускает в обращение облигации внутреннего государственного займа (ОВГЗ). В Украине этот инструмент считается наиболее надежным, из-за чего он стал важным элементом финансового рынка.

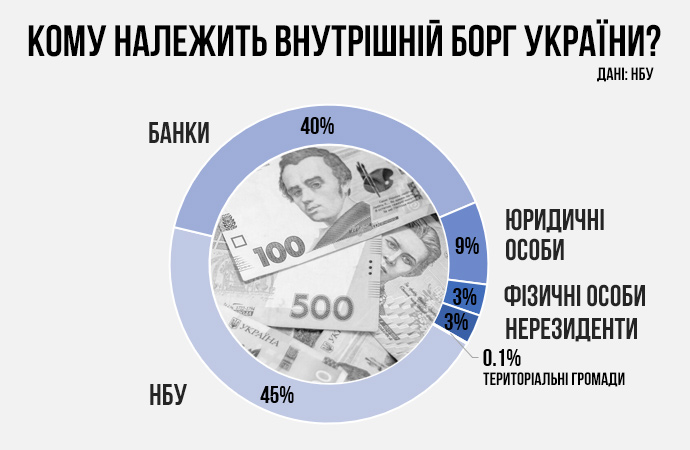

Однако даже банки не инвестируют в ОВГЗ так много, как регулятор. В распоряжении последнего находятся облигации на общую 690,7 млрд грн — 45% от всего внутреннего долга страны.

Чтобы понять, почему правительство должно так много денег НБУ, достаточно вспомнить 2022 год. В первые месяцы большой войны налоговые поступления резко сократились, а расходы выросли. Средств в бюджете не хватало, а международные партнеры еще не были готовы выделять необходимое Украине финансирование. Именно в этот момент на помощь пришел Нацбанк, которому правительство продало облигаций на 400 млрд грн.

Покупая активы, в частности ОВГЗ, Национальный банк создает деньги и вводит их в обращение. Этот процесс называют эмиссией, а в народе — «печатание» денег.

Выпущенные в 2022 году ОВГЗ — это самая большая часть долга бюджета перед Нацбанком. Чтобы их выпустить, пришлось даже изменить закон о Нацбанке, который запрещает «печатать» деньги для нужд бюджета, а также принять специальное правительственное постановление.

Суммы и условия ценных бумаг, выпущенных в 2022 году, следующие: 280 млрд грн — плавающая ставка (на уровне средней учетной ставки НБУ за 12 месяцев, предшествующих платежу), погашение в 2033-2036, 2038-2040 и 2052 годах; 120 млрд грн — ставка 11% годовых, погашение в 2037 году.

Остальные ОВГЗ, которые находятся в портфеле НБУ, регулятор покупал в предыдущие годы. Суммы и условия этих ценных бумаг следующие:

- 2014 года — 12 млрд грн, ставка — 12,5% годовых, погашение состоится в 2024 году;

- 2015 года — 35,25 млрд грн, ставка — 11,18-12,5% годовых, погашение в 2025-2029 годах;

- 2016 года — 17,8 млрд грн, ставка — 9,81-9,95% годовых, погашение в 2030-2031 годах;

- 2017 года — 223,46 млрд грн, ставка для ОВГЗ на 78,29 млрд грн — 8,17-11,3% годовых, для остальных — уровень инфляции плюс 2,2%, погашение в 2025-2047 годах.

Выпущенные в 2017 году ОВГЗ являются результатом репрофайлинга или реструктуризации. Тогда правительство обменяло облигации общей стоимостью 220 млрд грн на новые, но с разными датами погашения, чтобы равномерно распределить во времени выплаты по ним и не создавать существенной долговой нагрузки на бюджет.

Сколько стоит долг правительства перед Нацбанком?

ОВГЗ в портфеле НБУ — это долг, а значит, его нужно возвращать. Учитывая его размер, это могло бы стать настоящей проблемой для правительства в будущем. Однако, к счастью, погашение этих облигаций почти равномерно распылено во времени до 2052 года.

«Конечно, портфель НБУ большой и составляет почти 46% всех ОВГЗ в обращении. Наибольший объем погашений приходится на 2037 год, когда состоится погашение 120 миллиардов гривен военных облигаций. Но в целом погашение облигаций в портфеле распределено во времени на длительный период и не будет создавать для бюджета никаких проблем», — отмечает старший финансовый аналитик группы ICU Тарас Котович.

Эти долги нужно не только возвращать, но и обслуживать, то есть платить проценты. Размер платежей по большей части долга правительства перед НБУ на 425,18 млрд грн — плавающий и зависит от уровня инфляции и учетной ставки. Иными словами, Минфину довольно сложно прогнозировать будущий объем выплат.

По расчетам Нацбанка, в 2023 году правительство должно заплатить ему в виде процентов по ОВГЗ 120,75 млрд грн. Из этой суммы 81,15 млрд грн — купонные платежи по выпущенным в 2022 году ОВГЗ, остальные 39,6 млрд грн — купоны по облигациям предыдущих лет.

В 2024-2025 годах выплаты правительства в пользу НБУ будут меньше, поскольку меньше будут учетная ставка и инфляция, к которым привязаны такие платежи.

Из одного кармана в другой?

На первый взгляд, долги правительства перед Нацбанком — это перекладывание денег из одного «кармана» государства в другой. Согласно закону, почти всю полученную в течение года прибыль НБУ должен перевести в бюджет.

В 2023 году НБУ перечислил в бюджет почти 72 млрд грн прибыли по итогам 2022 года, что сполна компенсировало купонные выплаты Минфина в пользу регулятора за тот год. Однако в следующем году эта ситуация не повторится.

Согласно закону о госбюджете на 2024 год, казна за 2023 год получит от НБУ всего 17,7 млрд грн прибыли. Это притом, что в этом году Минфин выплатил НБУ более 120,75 млрд грн процентов по ОВГЗ. То есть по дороге между «карманами» государства потеряются более 100 млрд грн (85% от выплат правительства в пользу НБУ).

Где потерялись 100 миллиардов гривен?

Чтобы ответить на этот вопрос, нужно проследить за деньгами, которые правительство получило от центрального банка по ОВГЗ в 2022 году. Как говорилось выше, каждый раз, когда НБУ покупает облигации Минфина, он создает новые деньги.

Эмиссия денег НБУ в 2022 году привела к росту избыточной ликвидности банковской системы. Иными словами, у банков накопились «лишние» полтриллиона гривен (на пике, в июле 2023 года, сумма достигла 579 млрд грн). Избавиться от этих излишков почти невозможно, какие бы меры банки не предпринимали.

Например, если банки потратят всю избыточную ликвидность на приобретение ОВГЗ, то объемы этой ликвидности не изменятся. Правительство снова потратит ее на финансирование расходов и она вернется в банковскую систему.

Также банки не могут выдать на «лишние» средства кредиты. Во-первых, во время войны на такой ресурс слишком мало платежеспособного спроса. Во-вторых, учитывая риск невозврата этих средств, многие банки могли бы обанкротиться. В-третьих, банковское кредитование так же не изменит общий объем ликвидности в системе — средства просто перетекут с одних счетов на другие.

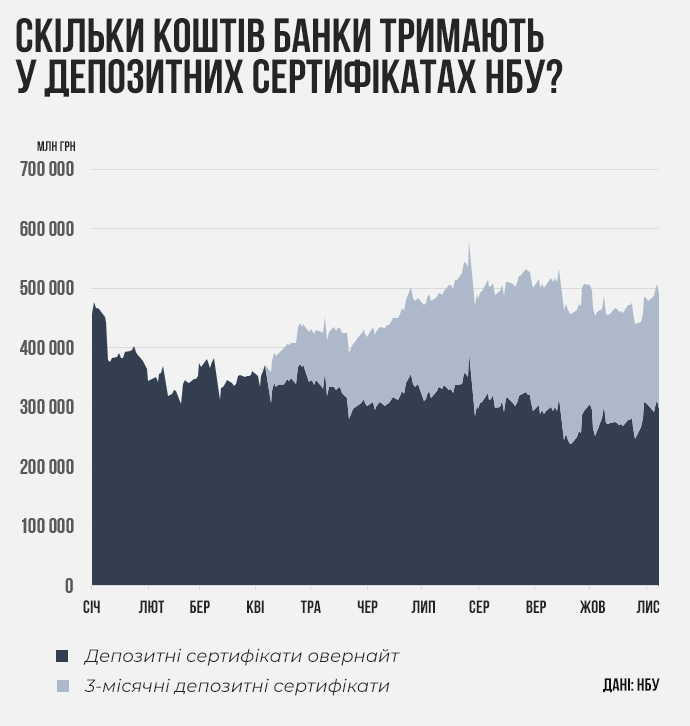

Едва ли не единственный способ изъять избыточную ликвидность из обращения — разместить ее в Нацбанке. Это происходит с помощью депозитных сертификатов (ДС), которые банки покупают у НБУ. Однако изъятие средств из обращения имеет свою цену. Она измеряется в процентах, которые получают банки за то, что передают свои средства регулятору.

Доходность ДС зависит от учетной ставки. Ставка по ДС овернайт (в них хранится большинство избыточной ликвидности, срок обращения — один день) равна учетной ставке НБУ (16%), а по трехмесячным ДС (в них разрешено вкладываться банкам в зависимости от объема срочных депозитов, которые у них открывают клиенты) составляет учетную ставку плюс 4 процентных пункта (сейчас 20%).

9 ноября банки держали в депозитных сертификатах НБУ более 492 млрд грн, из которых 195 млрд грн — трехмесячные «депсерфы» со ставкой 20% годовых.

По данным Нацбанка, к 5 ноября на выплату процентов по депозитным сертификатам потрачено 73,5 млрд грн. В регуляторе отказались оценить, какой может быть сумма выплат в пользу банков по итогам всего 2023 года, отметив, что «этот вопрос слишком чувствительный».

«Прогнозные объемы ДС и выплаты по ним не являются публичной информацией, учитывая ее сенситивность, которая обусловлена зависимостью от многих факторов, в том числе находящихся за пределами непосредственного влияния НБУ (например, получение правительством финансовой помощи от международных партнеров, ее конвертация в гривну и направление в банковскую систему)», — ответили в НБУ.

Бюджет теряет дважды

Если обобщить движение денег, которые НБУ создал во время эмиссии, то можно сделать вывод, что значительная их доля «потеряется» в прибылях коммерческих банков. Из 120,75 млрд грн, которые Минфин заплатит Нацбанку за ОВГЗ, в банках в этом году могут осесть около 88 млрд грн выплат по депозитным сертификатам.

Выплаты НБУ по депозитным сертификатам стали одной из ключевых предпосылок рекордной доходности банковской системы. Накануне в Нацбанке отчитывались, что только за девять месяцев 2023 года банки получили 110 млрд грн прибыли. Понятно, что по итогам всего года ее размер вырастет еще больше благодаря стабильным выплатам по ГС.

«Математически выплаты НБУ в пользу банков (по депозитным сертификатам) съедают его доходы, которые он получает от ОВГЗ. Получается, что Минфин платит дважды за политику высоких ставок: и из-за высоких ставок по ОВГЗ (и те, которые принадлежат НБУ, и те, которые принадлежат другим участникам рынка), и недополучает дивиденды от Нацбанка», — объясняет руководитель аналитического отдела Concorde Capital Александр Паращий.

Неудивительно, что в Минфине не в восторге от этой ситуации. За последние два года там предприняли как минимум две попытки пересмотреть свой долг перед НБУ.

Летом 2022 года депутаты едва не одобрили норму, которая обязывает НБУ автоматически переводить процентные доходы от эмиссионных ОВГЗ в бюджет в течение десяти дней после их получения. А при подготовке бюджета-2024 ко второму чтению Минфин заложил в документ статью, которая позволяет правительству провести еще один репрофайлинг ОВГЗ, находящихся в собственности Нацбанка.

Обе попытки оказались неудачными, поэтому коммерческие банки и в дальнейшем будут обогащаться на долгах бюджета перед центробанком. Правда, в НБУ не видят в этом ничего плохого.

«Заработанные средства остаются в системе из-за установленного в период военного положения запрета для частных банков на распределение прибыли. Поэтому эта прибыль остается у банков для повышения их устойчивости и поддержки дальнейшего активного кредитования. Только устойчивые банки способны обслуживать экономику и возвращать вклады населению, поддерживать восстановление страны», — ответили в НБУ.

В регуляторе добавляют, что текущая монетарная политика, благодаря которой обогащаются банки, позволила избежать дальнейшей денежной эмиссии в 2023 году, а также сохранила устойчивость гривны. В конце концов, если бы НБУ не поглощал лишнюю ликвидность банковской системы, то она могла бы перекочевать на валютный рынок, «сжечь» золотовалютные резервы и привести к существенной девальвации гривны.

Какой выход?

Действительно ли на долгах, которые бюджет вынужден был брать у Нацбанка, обогащаются только крупные бизнесмены, владеющие украинскими банками? Да, но частично.

Крупнейшим владельцем банков в Украине является государство. Именно в государственных банках сосредоточена большая часть избыточной ликвидности банковской системы, ведь социальные выплаты, зарплаты бюджетников и денежное обеспечение военным выплачивается преимущественно на счета, открытые в Приватбанке и Ощадбанке.

Хотя госбанки и зарабатывают больше всего на избыточной ликвидности банковской системы, однако большую часть таких доходов в следующем году они переведут обратно в бюджет в форме дивидендов.

Негосударственные банки, которые также аккумулируют избыточную ликвидность, не могут вывести свои прибыли. Они направят эти средства на покрытие убытков, нанесенных банковской системе войной. Однако и здесь государство нашло способ вернуть свое. Для этого в парламенте решили ввести для банков налог на сверхприбыли.

«Операционный дизайн режима инфляционного таргетирования дает банкам дополнительный непредсказуемый доход при повышении ключевой ставки. Поэтому во многих странах вводится в разной форме windfall tax (налог на непредсказуемые доходы). Это касается не только банков, но и других компаний (например, ресурсных), которые получили непредсказуемый доход по определенным причинам», — поясняет главный менеджер по макроэкономическому анализу «Райффайзен банка» Сергей Колодий.

Недавно парламент принял в первом чтении законопроект, который предлагает повысить ставку налога на прибыль для банков с 18% до 36%. В случае его окончательного одобрения новый налог заработает со следующего года и будет касаться прибыли, которую банки получат в 2024 году.

«Эта идея немного запоздалая, ведь в следующем году доходы банков будут не такими значительными: процентные доходы будут уменьшаться значительно быстрее расходов. Но она точно не бессмысленна, некоторые западные страны такой налог уже применяют», — добавляет Паращий.

Поэтому в 2023 году государство фактически просубсидирует банковскую систему. Правда, такая субсидия не просто поддержит устойчивость украинских банков в условиях войны, но и позволит им неплохо заработать.