В октябре 2023 года Cointelegraph сообщил об одобрении заявки BlackRock на запуск спотового биткоин-ETF. На фоне инцидента котировки первой криптовалюты пробили уровень в $29 000.

Позже выяснилось, что журналисты опубликовали непроверенную информацию, а инвестиционная компания по-прежнему ожидает решения регулятора. Однако подобная реакция рынка еще раз доказала — его участники очень многого ожидают от этих инструментов.

Редакция Incrypted разобралась, какое влияние на криптовалютный рынок могут оказать спотовые биткоин-ETF и корректно ли их сравнивать с ориентированными на золото биржевыми фондами.

Что такое ETF?

Торгуемый на бирже фонд (exchange-traded fund; ETF) — это индексный фонд, который, в зависимости от структуры, отслеживает определенный сектор, отдельный товар или даже конкретную стратегию.

В отличие от других инвестиционных фондов и трастов вроде Grayscale Bitcoin Trust (GBTC), акции ETF свободно обращаются на открытом рынке. С ними можно проводить те же операции, что и с ценными бумагами, — продавать или покупать паи в любой момент торговой сессии.

Это делает инструмент ликвидным и, как следствие, предоставляет инвесторам возможность мгновенного вывода средств. Продукт также позволяет оптимизировать расходы на управление, поскольку может отслеживать корзину активов, и имеет низкий финансовый порог входа.

Для традиционного рынка биржевые фонды являются привычным инструментом. Например, в США первый ETF появился в 1993 году — это Standard and Poor’s 500 Depository Receipt (SPDR). Он отслеживает индекс S&P 500 и до сих пор активно торгуется под тикером SPY.

Однако криптовалютные биржевые фонды появились сравнительно недавно и не совсем в том виде, в каком их ожидало увидеть сообщество. Знаковым стал запуск фьючерсного Bitcoin Strategy ETF (BITO) от компании ProShares, который Комиссия по ценным бумагам и биржам США (SEC) одобрила в октябре 2021 года.

Компромиссные решения

Комиссия долгое время противилась запуску биржевых фондов на цифровые активы. Среди аргументов регулятор в том числе апеллировал к отсутствию в США квалифицированных кастодиальных сервисов и культуры комплаенса, необходимой для предотвращения махинаций.

В конечном итоге SEC одобрила ETF на базе расчетных биткоин-фьючерсов Чикагской товарной биржи (CME), в число которых входит вышеупомянутый BITO. CME является регулируемым на федеральном уровне рынком — платформа находится под надзором Комиссии по срочной биржевой торговле США.

Биткоин-фьючерсы на CME

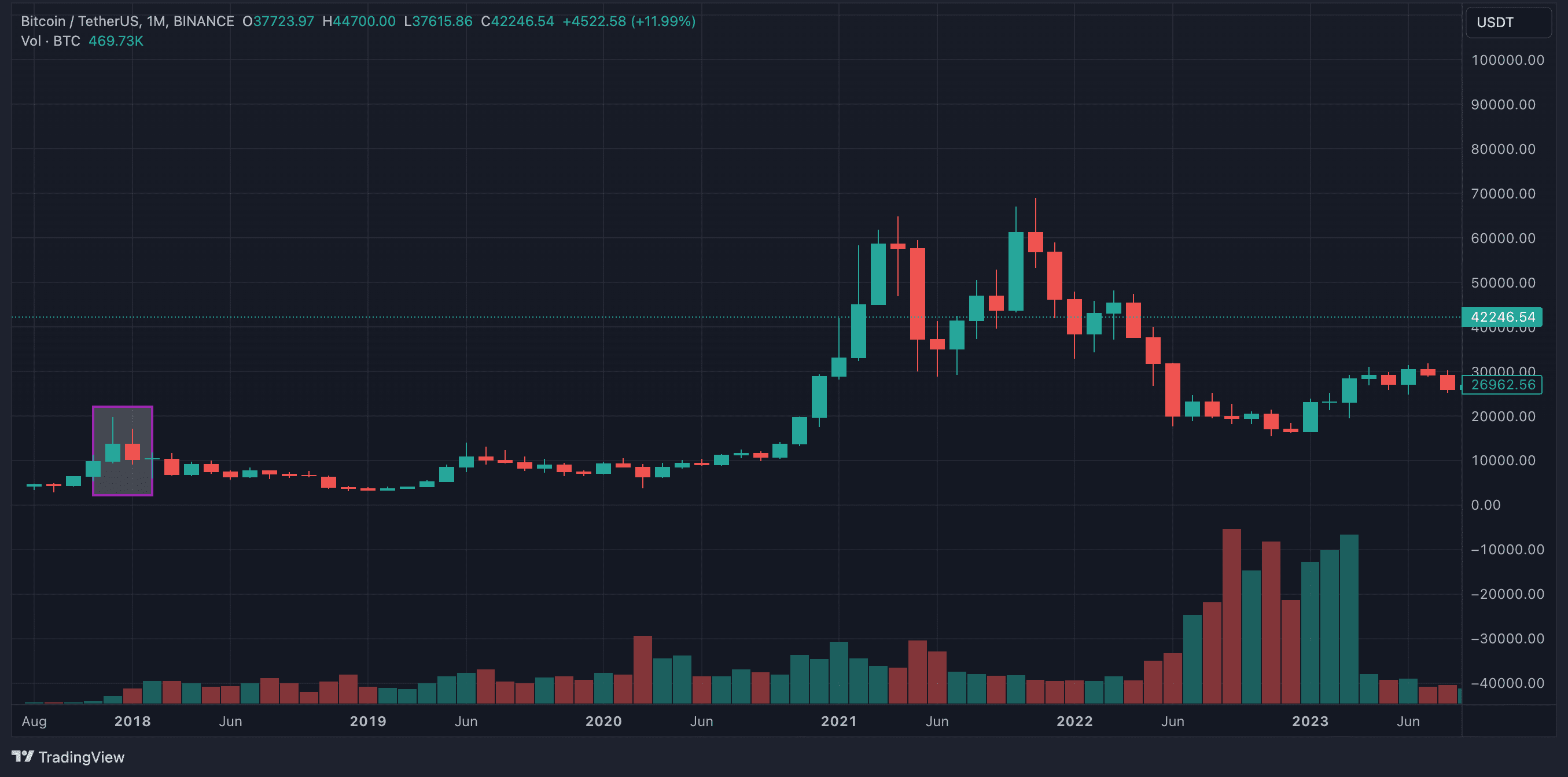

CME запустила биткоин-фьючерсы в декабре 2017 года. В том же месяце цена цифрового золота обновила исторический максимум. В январе 2017 года произошла коррекция и начался длительный флэт — котировки достигли установленного ранее пика только в ноябре 2020 года.

Поскольку биткоин-фьючерсы появились практически шесть лет назад, уже существуют исследования, которые ставят перед собой целью оценить эффект от запуска инструментов. Мнения в этом контексте разнятся.

Одни считают, что появление фьючерсного рынка повысило ликвидность биткоина и его привлекательность по сравнению с другими криптовалютами с точки зрения соотношения риска и доходности.

Другие, напротив, сделали выводы о дестабилизирующем влиянии инструментов — приток ликвидности оказался слишком мал, чтобы оказать значимый положительный эффект, однако выросла волатильность рынка, снизилась его доходность, повысились риски.

Запуск BITO

Акции BITO начали торговаться на Нью-Йоркской фондовой бирже 19 октября 2021 года. Инструмент показал один из самых успешных в разрезе торговой активности дебютов.

В первую же сессию его оборот составил 24,42 млн акций. Объем почти дотянул до $1 млрд, а на преодоление этого рубежа BITO потребовалось всего два дня.

Менее чем через месяц после запуска BITO котировки биткоина достигли исторического максимума на уровне $69 000, а затем ушли в глубокую коррекцию.

После BITO появились и другие схожие инструменты. Скорее всего, в моменте они не оказали существенного влияние на цену первой криптовалюты. Как и в случае с фьючерсами на CME их запуск произошел на закате ралли, когда в рынок закладывалась грядущая коррекция. К тому же в сообществе уже говорили об определенных проблемах экосистемы Terra.

Однако нельзя закрывать глаза на тот факт, что институциональные участники торгов получили возможность занять короткие позиции против биткоина в моменте достижения им ценового максимума.

В долгосрочной же перспективе фьючерсные-ETF повысили ликвидность криптовалютного рынка и привлекли к нему внимание большего числа традиционных игроков. Одобрение инструментов со стороны SEC также сняло «навес» нарратива касательно возможности введения регулятором запрета на операции с цифровыми активами.

Вместе с тем специалисты Банка международных расчетов считают, что при определенной концентрации деривативов под управлением биржевых фондов последние могут оказывать негативное влияние на рынок. В частности, повысив его волатильность.

Некоторые также отмечают, что по мере институционализации рынка фьючерсы на CME приобретают все большую значимость. Особенно это заметно во время восстановления криптовалютных котировок. При этом вполне вероятно, что значимый вклад в динамику вносят именно биткоин-ETF вроде BITO.

Неэффективная корреляция

Фьючерсные биткоин-ETF заинтересовали институциональных участников рынка, поскольку предоставили им доступ к криптовалюте через понятный и регулируемый механизм. Но подобные инструменты обладают рядом особенностей, которые существенно снижают их эффективность.

Одной из задач любого биржевого фонда является точное отслеживание определенного индекса. Однако, поскольку на котировки фьючерсов влияет ряд факторов вроде даты экспирации, основанные на этих деривативах ETF часто неэффективно коррелируют с базовыми активами.

Для фьючерсного ETF управляющая компания открывает длинные позиции по краткосрочным деривативам. В случае с BITO — это биткоин-фьючерсы CME. По мере приближения даты экспирации контрактов она закрывает позиции, попутно открывая новые в инструментах с более дальним сроком обращения (выполняет операцию роллирования).

Кроме того, управляющая компания удерживает ликвидные денежные средства или их эквиваленты вроде казначейских бондов. При росте котировок базового актива она использует прибыль от деривативов для расширения ликвидного пула. В обратной ситуации — пул нивелирует убытки по контрактам.

Подобная стратегия со временем может негативно влиять на показатели ETF, поскольку неизбежные контанго и бэквордация вкупе с расходами на роллирование приводят котставанию его котировок от спотовых цен.

В мае аналитики K33 отметили, что с начала 2023 года акции BITO отставали от спотового биткоина на 2,6%-13,8%.

Чем спотовый ETF отличается от фьючерсного?

Как ясно из названия, спотовые ETF инвестируют не в деривативы, а непосредственно в активы. Поэтому, обладая всеми преимуществами фьючерсных биржевых фондов, они лишены ряда их недостатков вроде необходимости выполнять операции роллирования.

Операторы спотовых биткоин-ETF, если подобные инструменты все же одобрят в США, будут держать криптовалюту на счетах зарегистрированных кастодианов. Судя по заявкам для SEC, большинство управляющих компаний выбрали в качестве такового Coinbase Custody. Исключением являются структуры, имеющие под контролем аналогичные сервисы.

Однако сам факт исключения деривативов повышает эффективность инструмента. Поскольку управляющая компания непосредственно владеет целевым активом, фонд более точно отслеживает его котировки.

Более того, спотовый ETF предлагает более привлекательные комиссии: провайдеру не нужно проводить роллирование, а контанго и бэквордация отсутствуют, что снижает операционные затраты. Особенно это будет заметно при долгосрочных инвестициях.

Некоторые аналитики также считают подобные фонды менее волатильными в сравнении с фьючерсными структурами и трастами вроде GBTC.

Можно ли сравнивать спотовые биткоин-ETF с золотыми фондами?

В сообществе преобладают позитивные мнения касательно воздействия, которое спотовые биржевые фонды могут оказать на криптовалютный рынок. Один из взглядов на дальнейшее развитие событий неразрывно связан с нарративом, в рамках которого эти инструменты сравнивают с ETF на золото.

Согласно Galaxy Digital, в первый же год торговли приток средств в спотовые биткоин-ETF может превысить $14 млрд, что обеспечит рост котировок базового актива на 74%.

Оценка аналитиков строится на предположении, что в биткоин инвестируют 10% всех институциональных инвесторов при средней аллокации в 1%. В качестве одного из аргументов они также приводят эффект, который ETF оказали на рынок золота.

Другие эксперты дополнительно указывают на «системный дефицит», вызванный циклом халвингов биткоина, и наличие устойчивой группы долгосрочных держателей актива, которые не намерены его продавать.

Действительно, с запуска ориентированных на золото биржевых фондов цена драгоценного металла выросла примерно в четыре раза. При этом на момент написания стоимость активов под управлением золотых ETF, акции которых торгуются на рынке США, оценивается в более чем $115 млрд.

До появления целевых фондов вкладывать средства в золото было достаточно проблематично. Необходимо было приобретать физические слитки или монеты, транспортировать их, а затем заботиться об их сохранности. Все это стоило денег, рынок был фрагментированным и низколиквидным.

Поэтому институционалам приходилось нести сопутствующие издержки, а розничные инвесторы практически не участвовали в крупных операциях. Ориентированные на золото фонды решили указанные проблемы.

Для институциональных инвесторов то же самое должны были сделать фьючерсы на биткоин, а затем и деривативные ETF. Однако, как уже было сказано выше, эти инструменты не отличаются высокой эффективностью, поэтому спотовые фонды являются гораздо более привлекательной точкой входа.

У розничного же пользователя с криптовалютами подобные трудности отсутствуют в принципе. Они далеко не первый год имеют прямой доступ к цифровым активам через биржи и другие торговые платформы.

Кроме того, токены легко хранить и транспортировать, поскольку все содержимое кошелька занимает ровно столько же места, что и клочок бумаги с записанной на нем сид-фразой.

Учитывая вышесказанное, сравнивать спотовые биткоин-ETF с ориентированными на золото структурами не совсем корректно. Поэтому эффект от одобрения инструмента следует оценивать более консервативно.

Какое воздействие на рынок окажут спотовые биткоин-ETF?

Оценить краткосрочное влияние спотовых ETF на котировки криптовалют достаточно сложно.

С одной стороны, для определенных участников рынка их одобрение может стать сигналом к фиксации прибыли, как это, возможно, было с деривативами Чикагской товарной биржи и фьючерсными фондами. Однако указанные инструменты появились на излете ралли, тогда как со спотовыми биткоин-ETF ситуация другая — индустрия только выходит из медвежьей фазы.

С другой стороны, будучи более эффективными по сравнению с фьючерсными фондами и самими деривативами, эти структуры могут привлечь внимание большего числа институционалов и, как следствие, необходимую для роста ликвидность.

Некоторые участники сообщества также считают, что провайдерам ETF выгодна краткосрочная просадка котировок — это позволит привлечь активы по более низкому курсу.

Существует и полярное мнение — с точки зрения структур вроде BlackRock целесообразнее постепенно наращивать позиции, стараясь избегать импульсного воздействия на цену. Оба сценария вероятны, поэтому стоит помнить о потенциальном повышении волатильности.

Немаловажно также, что вслед за ориентированными на биткоин фондами рынок, вероятно, увидит структуры, накапливающие Ethereum и другие активы на базе Proof-of-Stake.

Отраслевые компании вроде бирж, кастодиальных сервисов и других провайдеров услуг также извлекут выгоду от одобрения спотовых фондов, поскольку выстроенную вокруг этих продуктов инфраструктуру необходимо обслуживать. Теоретически они получат огромный приток финансирования, что положительно скажется на развитии всей индустрии.

Таким образом, даже если спотовые биткоин-ETF не повторят успех ориентированных на золото продуктов, положительный эффект от их принятия почувствуют все участники рынка, в том числе и рядовые пользователи.

В перспективе последние получат более качественные и надежные сервисы, большую ликвидность на рынках, а также целый ряд новых продуктов, катализатором появления которых выступят именно институционалы.