Вторая половина мая для валютного рынка будет более спокойной и прогнозируемой, а резких колебаний курса ожидать не стоит. Впрочем, эксперты говорят о том, что управляемая девальвация гривны продолжится.

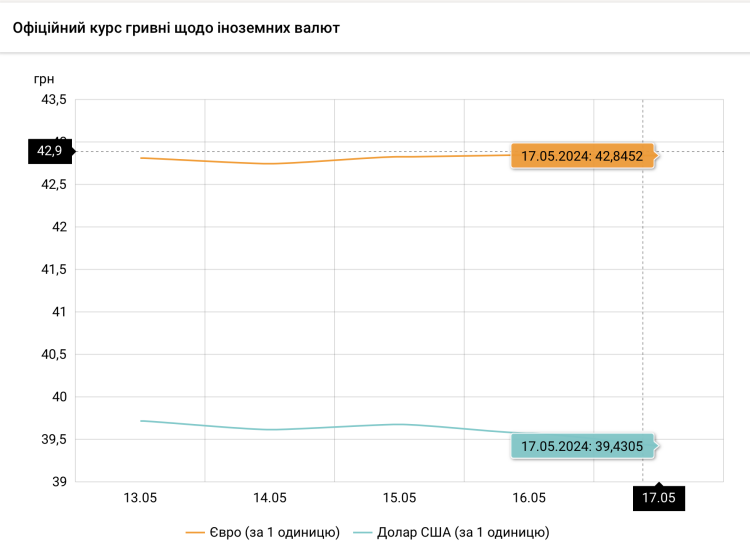

За прошлую неделю официальный курс доллара НБУ упал на 29 копеек. Если 13 мая доллар стоил 39,72 грн/долл., то уже 17 мая – 39,43 грн/долл. Хотя наличный доллар и пересек отметку 40 грн, в течение мая наблюдаются незначительные колебания на валютном рынке.

Как менялся курс доллара в течение недели с 13 по 17 мая

На прошлой неделе гривна на межбанковских торгах несколько укрепилась. Если в пятницу 10 мая курс доллара был 39,56 грн, то по состоянию на пятницу 17 мая официальный курс снизился на 14 копеек и составил 39,42 грн.

Наличный доллар на прошлой неделе уже стоил дороже 40 грн. Продажа американской валюты колебалась от 39,9 до 40 грн за доллар.

Анна Золотько, директор департамента казначейских операций Unex Bank, отметила, что торги на ВРУ в начале прошлой недели отметились умеренным ростом котировок. Такой курсовой тренд был ожидаемым: к 20 мая бизнес должен оплатить квартальные налоги, поэтому предложение валюты на рынке ближе к концу недели усилилось.

«Реакция наличного рынка на курсовые тенденции межбанка оказалась очень слабой. В начале прошлой недели стоимость американского доллара здесь также умеренно выросла и в отдельные моменты курс даже переходил отметку 40,0 грн/доллар, но укрепление гривны на ВРУ пока не привело к сопоставимому удешевлению наличной валюты. В пятницу утром курс продажи доллара находился в диапазоне 39,8-39,9 грн/долл.», – говорит Золотько.

Александр Хмелевский, кандидат экономических наук, независимый эксперт, говорит, что в целом в течение мая наблюдаются небольшие колебания валютного курса. Курс доллара находился в коридоре 39,23-39,71 грн. за доллар и 42,20-42,92 грн. за евро.

Объемы торгов на межбанке остаются посредственными, несколько выше 200 млн. долларов в день. Рынок находится в спокойном состоянии

Золотько добавляет, что участники рынка в основном оценивают текущий тренд по укреплению безналичной валюты как временный. Именно этим и объясняется очень слабая реакция наличного курса на тенденции ВРУ.

Каким будет курс доллара с 20 по 24 мая

Хмелевский прогнозирует, что на этой неделе ожидается некоторое снижение курса гривны. Тем не менее курс доллара будет оставаться в коридоре 39,30–39,90 грн, а курс евро 42,20–43,00 грн. По мнению эксперта, существенных изменений валютного курса на этой неделе ждать не стоит.

Эксперты убеждены, что на коротком временном горизонте перспективы дальнейшего укрепления гривни ограничены. До 20 мая из-за уплаты налогов бизнесом на рынке еще может сохраняться тренд на снижение курса, однако на этой неделе следует ожидать коррекции и роста котировок на ВРУ. Учитывая тот факт, что наличный курс на этой неделе оставался на относительно высоких уровнях, скорее всего, подорожание доллара на ВРУ не приведет к сопоставимому росту курса в наличном сегменте. Об этом говорит Анна Золотько.

На мой взгляд, в течение этой недели стоимость доллара будет находиться в диапазоне 39,7–40,2 грн/доллар.

Тарас Лесовой, начальник департамента казначейства банка «Глобус», объясняет, что вторая половина мая для валютного рынка будет более спокойной и прогнозируемой. Важной для рынка будет дальнейшая управляемая девальвация гривны. По итогам года, согласно прогнозам, она должна составить еще 3% начального курса января, если курс доллара будет совпадать с заложенным в бюджет курсом, а это 40,7 грн.

«Предполагаем, что в мае гривна к доллару может потерять от 0,2 грн до 0,5 грн — а курс будет в промежутке 39,7-40 грн. То есть темпы девальвации будут меньше предыдущего месяца», — говорит Лесовой.

Что будет влиять на курс валют в ближайшее время

Курс валют остается стабильным по ряду причин. Одна из них – принятие решения о предоставлении Украине международной помощи от США и транша от ЕС. Объемы макрофинансовой помощи, которую Украина сможет получить до конца года, совпадает с запланированными 37 млрд долларов для покрытия части расходов бюджета

Тарас Лесовой добавляет, что с 4 мая Национальный банк Украины продолжил реализацию стратегии на дальнейшую либерализацию рынка, упразднив ряд ограничений для бизнеса, предусмотрев под эти нужды 5,5 млрд долларов, которых должно вполне хватить для сохранения равновесия между спросом и предложением. Следовательно, дисбаланса, который потенциально мог бы повлиять на курсовые показатели, не будет.

«Международные резервы регулятора по состоянию на начало мая составили более 43 млрд долларов, которых вполне достаточно для более смелых действий регулятора. Экспортные поступления, на основе которых формируются международные валютные резервы, должны быть на приличном уровне, ведь объем экспорта почти достиг довоенного уровня», – отметил Лесовой.