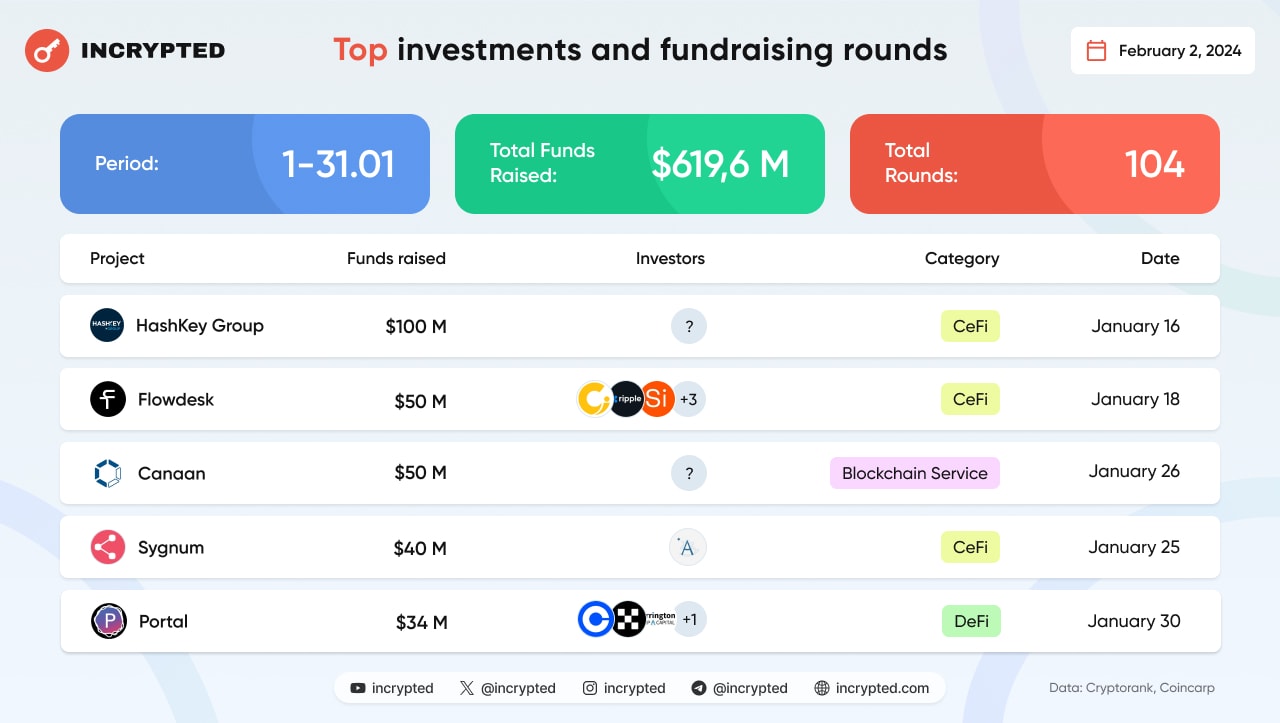

В январе 2024 года 104 проекта из сферы Web3 и блокчейна привлекли финансирование на общую сумму $619,6 млн. Редакция подробно разобрала инвестиции этого месяца.

Больше всего средств в январе привлек оператор криптовалютной биржи HashKey Group — $100 млн. Фирма не раскрыла подробности раунда финансирования серии А и не опубликовала список инвесторов. Представители HashKey Group отметили, что компанию оценили в $1,2 млрд. Новые средства пойдут на расширение криптовалютной экосистемы холдинга, диверсификацию бизнес-продуктов в Гонконге и инновационное развитие подконтрольных ему компаний.

Далее по объему полученного финансирования идут:

$50 млн — Flowdesk. Французский маркетмейкер отчитался о завершении раунда финансирования серии B, в результате которого его оценка выросла до $250 млн. Новый капитал стартапу предоставили Cathay Ledger Fund, Eurazeo, ISAI, Speedinvest, Ripple Labs и Bpifrance. Полученные средства компания намерена направить на наем персонала, расширение OTC-услуг и получение лицензий в Сингапуре и США.

$50 млн — Canaan. Производитель устройств для майнинга биткоина привлек инвестиции. Известно, что новый капитал фирма получила путем выпуска и продажи 50 000 конвертируемых привилегированных акций серии А. Компания использует финансирование для расширения своих производственных мощностей, исследования и разработки и других общекорпоративных целей.

$40 млн — Sygnum. Швейцарский криптовалютный банк получил средства в ходе очередного раунда финансирования. Ключевым инвестором выступила группа Azimut Holdings. Новый капитал направят на расширение деятельности в странах Азии и Европы.

$34 млн — Portal. Стартап закрыл посевной раунд финансирования. Инвесторами стали Coinbase Ventures, Arrington Capital, OKX Ventures и Gate.io. Проект стремится создать инфраструктуру на базе биткоина, которая позволит любому пользователю обменивать первую криптовалюту между рядом блокчейнов за «считанные секунды». Новый капитал планируют использовать для запуска продуктов, развития экосистемы и создания приложения на базе ИИ, которое «будет помогать принимать инвестиционные решения».

Нераскрытые детали

Ряд проектов отчитались в течение января о привлечении финансирования, однако не раскрыли сумму инвестиций.

Среди них: WISe.ART, DeMR, Nubit, Memecoin, Gelato, Polyhedra Network, Oort, Orbiter Finance, BeWater, Rome Protocol, Beoble, InTax, CCData, Cadence Protocol, EDX Markets, BDACS, BitGo, Meson Network, B² Network, TProtocol, GG, Puffer Finance, Doubler, Zeepr.

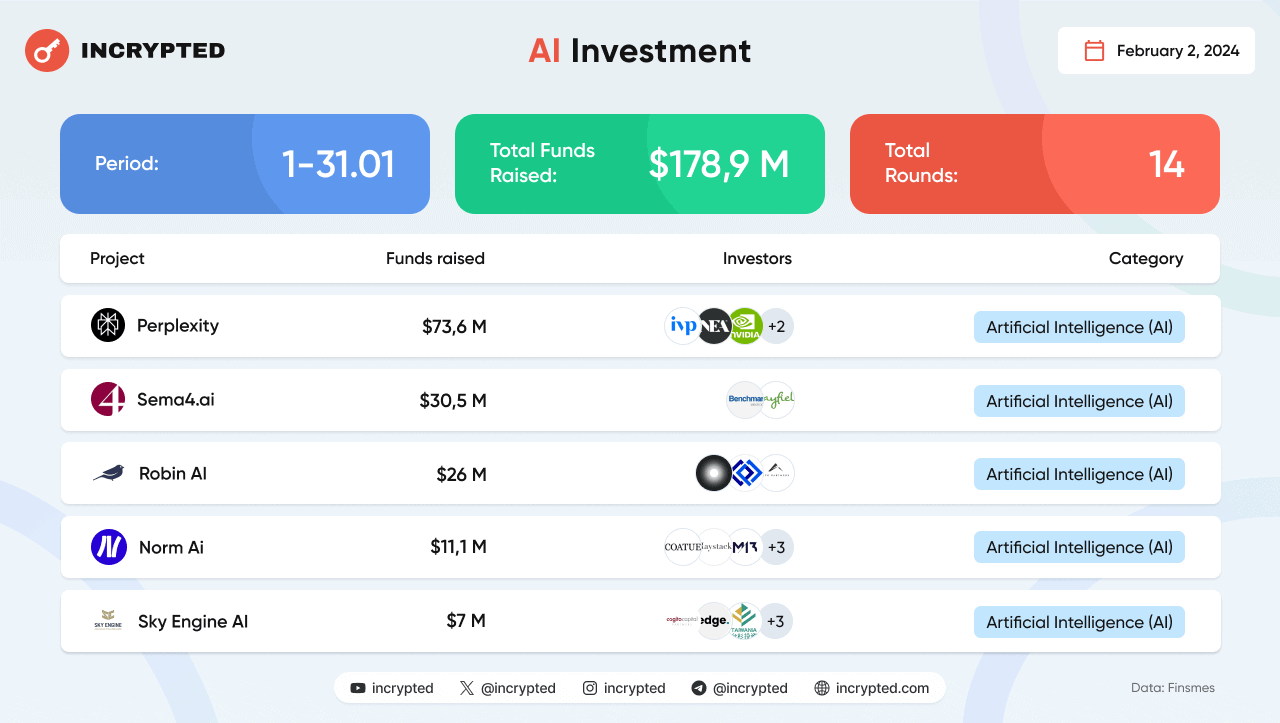

Инвестиции в искусственный интеллект

В январе стало известно о привлечении более $178 млн проектами, которые направят средства на разработку решений на базе искусственного интеллекта, по данным Finsmes.

$73,6 млн — Perplexity. Стартап, создающий ИИ-помощника, получил средства в рамках раунда финансирования серии B, который возглавил IVP с участием NEA, NVIDIA, Databricks и Bessemer Venture Partners, а также частных инвесторов Джеффа Безоса, Ната Фридмана и Тоби Людке. Компания намерена использовать полученные средства для расширения своего бизнеса.

$30,5 млн — Sema4.ai. Стартап, который внедряет искусственный интеллект с открытым исходным кодом в работу предприятий, получил финансирование от Benchmark и Mayfield Fund. Sema4.ai создает так называемых интеллектуальных агентов, которые «меняют способы сотрудничества работников с искусственным интеллектом».

$26 млн — Robin AI. Британская компания привлекла инвестиции в рамках финансирования серии B, которое возглавил Temasek. Инвесторами стали QuantumLight, Plural и AFG Partners. Стартап намерен использовать средства для расширения своей команды в США, открытия офиса в Сингапуре для выхода на рынки Азиатско-Тихоокеанского региона, а также для расширения команды специалистов по искусственному интеллекту.

Robin AI использует генеративный искусственный интеллект для того, чтобы помочь юридическим командам автоматизировать и ускорить процесс составления и согласования контрактов.

$11,1 млн — Norm Ai. Нью-Йоркская компания, работающая над соблюдением регуляторных требований к ИИ-агентам, получила финансирование в рамках посевного раунда, который возглавил Coatue при участии Haystack Ventures, M13 Ventures, Basis Set Ventures, Expa Ventures и Atypical Ventures. Компания намерена использовать полученные средства для расширения деятельности и охвата рынка.

$11 млн — Ask-AI. Фирма, которая предоставляет решения для поиска ответов и инсайтов с помощью искусственного интеллекта для предприятий, привлекла инвестиции. Раунд финансирования серии А возглавил фонд Leaders Fund с участием Vertex Ventures, State of Mind Ventures, GTMFund и других.

$7 млн — Sky Engine AI. Платформа, предоставляющая ИИ для его использования в автомобилестроении, робототехнике, медицинской диагностике и других секторах, получила инвестиции. Раунд финансирования возглавил Cogito Capital Partners при участии Charles W. Morgan, Edge VC, Taiwania Capital, Movens Capital и High-Tech Gründerfonds.

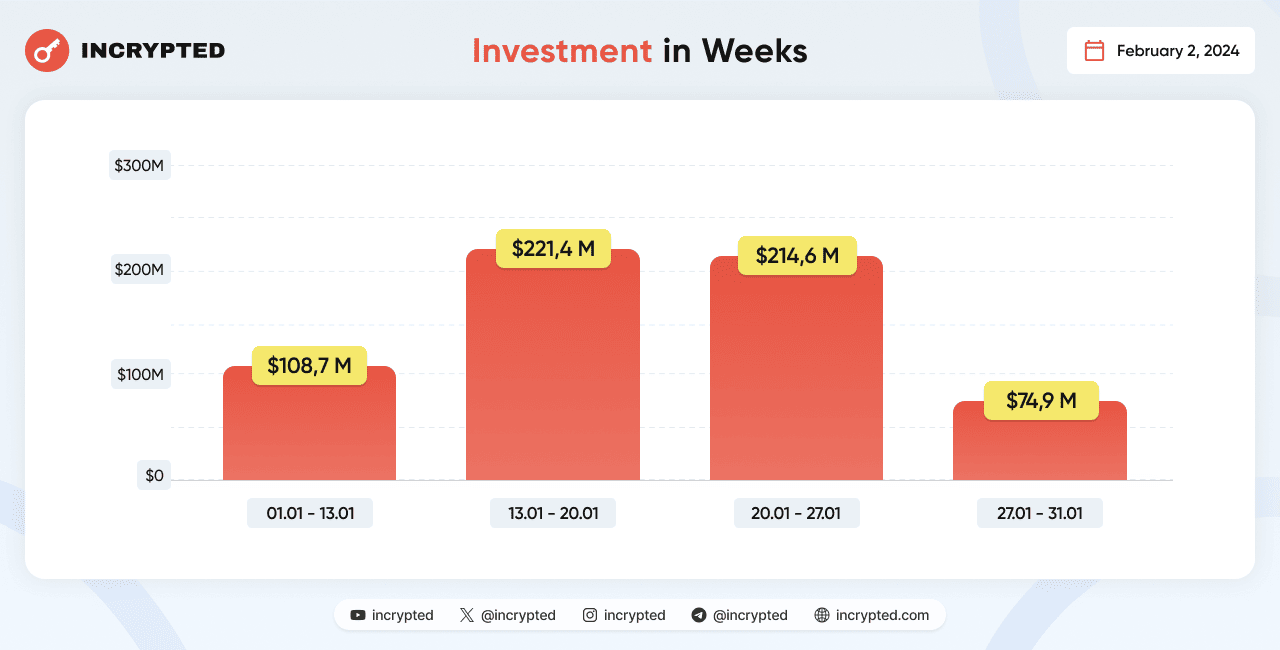

Динамика:

Наибольшую сумму инвестиций в размере $221,4 млн проекты привлекли в период с 13 по 20 января.

В период с 1 по 13 января проекты привлекли инвестиции на общую сумму $108,7 млн. Лидерами по сумме полученного финансирования стали проекты Tune.FM и Finoa. Внимание фондов было сосредоточено на секторах DeFi и разработки блокчейн-сервисов.

С 20 по 27 января проекты получили $214,6 млн финансирования. Тогда лидерами по сумме полученного финансирования стали проекты Canaan и Sygnum, а внимание фондов было сосредоточено на секторе разработки блокчейн-сервисов.

Кроме того, в конце месяца, с 27 по 31 января, 21 проект получил $74,9 млн финансирования, а именно:

В этот период $34 млн инвестиций привлек проект Portal, о нем мы упоминали выше.

$7 млн — Forgotten Playland. Социальная игровая Web3-платформа привлекла финансирование. В инвестиционном раунде приняли участие Merit Circle, Spartan Group, C2 Ventures и Paper Ventures. Платформа планирует выпустить свой первый продукт в I квартале 2024 года.

$6,5 млн — Mesh. Компания PayPal инвестировала в криптовалютный стартап Mesh, предоставляющий платежные услуги в секторе криптовалют. Отметим, проект получил $5 млн инвестиций в стейблкоинах PYUSD, еще $1,5 млн — наличными. Mesh считают криптовалютной версией сервиса Plaid, который позволяет подключать банковский счет к приложениям и сайтам.

$6 млн — Gevulot. Стартап закрыл посевной раунд под руководством венчурной компании Variant. Команда проекта планирует запустить L1-сеть на базе доказательств с нулевой долей разглашения. В раунде финансирования также приняли участие следующие контрагенты: RockawayX, Volt Capital, Staining Accommodations. Кроме того, средства предоставили бизнес-ангелы, а именно: CEO Polygon Labs Марк Буарони и основатель Manta Network Шумо Чу.

$4 млн — Squid. Швейцарский поставщик «защищенного межсетевого маршрутизатора», привлек финансирование. Раунд возглавил Polychain Capital при участии Nomad Capital, North Island Ventures, Maelstrom, Chorus One, The Department of XYZ, Breed, Binary Builders и Typhon Ventures, Distributed Global, Fabric Ventures, Node. Компания намерена использовать средства для ускорения разработки своих продуктов, а также интегрироваться с децентрализованными приложениями.

$2,7 млн — BBOX. Децентрализованная биржа деривативов получила инвестиции в рамках раунда предварительного финансирования под руководством Hashed и Arrington Capital. Также инвесторами стали Consensys, CMS Holdings, Flow Traders, Manifold Trading, Mask Network и Nomura’s Laser Digital. Команда проекта работает над запуском автоматизированного маркет-мейкера.

$2,5 млн — Infrared. Децентрализованный протокол закрыл инвестиционный раунд под руководством Synergis. Полученные средства будут направлены на развитие сети валидаторов и запуск собственного токена. Также в раунде приняли участие такие контрагенты: GC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, Signum Capital Ouroboros Capital, Decima, Oak Grove Ventures, DoraHacks, Tenzor Capital и частные инвесторы, представляющие Injective, Curve, Espresso и многие другие криптопроекты.

$2,5 млн — Ithaca Protocol. Стартап объявил о закрытии предыдущего посевного раунда финансирования. Команда стремится создать «наиболее ликвидный и эффективный с точки зрения капитала протокол опционов».

$2,5 млн — Reboot World. Компания, создающая метавселенную искусственного интеллекта, получила финансирование. На платформе пользователи могут «сопоставлять физические активы с цифровыми в форме NFT», выпускать их на рынок и интегрировать их в игры.

$2 млн — NAVI Protocol. Децентрализованный протокол ликвидности привлек инвестиции. Раунд финансирования возглавили венчурные фонды OKX Ventures, Hashed Fund и организация dao5. Кроме того, инвесторами проекта стали Mechanism Capital, Gate.io, Arche Fund, Mysten Labs, ViaBTC Capital и ряд других фондов.

$1,5 млн — Hivello. Поставщик платежных решений на основе блокчейна получил финансирование от Blockchange, Cypher Capital, MH Ventures, Primal Capital, Contango Digital Assets, Candaq и других. Компания намерена расширить свои технологические возможности, ускорить разработку продуктов и укрепить свои позиции на рынке в сфере услуг DePIN.

$1,5 млн — Yooldo. Игровая Web3-платформа завершила раунд финансирования в результате которого ее оценка выросла до $3 млн. Инвесторами стали: Bedrock Ventures, Double jump.tokyo, Edimus, Hyperithm, Klaytn Foundation, Manta Network, Neopin, Planetarium, Presto Labs, Vista Labs. Команда также отметила, что спонсорами были Aptos Foundation, BNB Chain, Immutable X, Oasys.

$1,2 млн — Bmaker. Команда проекта Bmaker, нацеленного на создание L2-протокола для смартконтрактов биткоина, привлекла финансирование от C3u Capital, Tangle Capital и Waterdrop Capital. Разработчики запустили платформу, а также представили коллекцию NFT на маркетплейсе Element. Полученные средства будут направлены на дальнейшее развитие инфраструктуры Bmaker.

$1 млн — Yet Another Company. Инфраструктурный Ethereum-стартап объявил о завершении раунда финансирования, который возглавила LambdaClass при участии Gagra Ventures, C² Ventures и инвесторов-ангелов. Компания стремится решить проблемы фрагментации ликвидности и совместимости рынков в экосистеме Ethereum.

Не раскрыли сумму инвестиций:

Компания TProtocol объявила об успешном завершении раунда финансирования с участием Summer Capital, Matrixport Venture и Spark Digital Capital. TProtocol призван предоставить эмитентам RWA возможность осуществлять транзакции в блокчейне и листить активы на платформе TProtocol.

Протокол Doubler привлек инвестиции от DWF Labs, Mask Network, Corporation, Continue Capital и еще 8 инвесторов.

Игровая платформа GG привлекла средства от криптовалютного венчурного фонда Delphi Digital, чтобы создать онлайн игру, объединяющую криптовалюты, игры и дополненную реальность. Также инвесторами стали: gmoney, Cozomo de Medici, Coop Records и другие.

Компания Binance Labs, венчурное подразделение одноименной биржи, инвестировала неназванную сумму в проект Puffer Finance. Это протокол ликвидного стейкинга Ethereum на базе EigenLayer. Оценка стартапа не разглашается. Полученные средства разработчики Puffer Finance направят на развитие внутренней инфраструктуры и доступных продуктов, говорится в релизе.

Протокол децентрализованных бессрочных фьючерсов Zeepr получил финансирование от Cincubator.

Компания Oddiyana Ventures сделала стратегические инвестиции в L1-блокчейн Nibiru.

Протокол BitSmiley получил инвестиции в рамках раунда финансирования, который совместно возглавили OKX Ventures и ABCDE с участием еще 11 инвесторов. Новый капитал используют для расширения команды, развития экосистемы и построения стратегических партнерств.

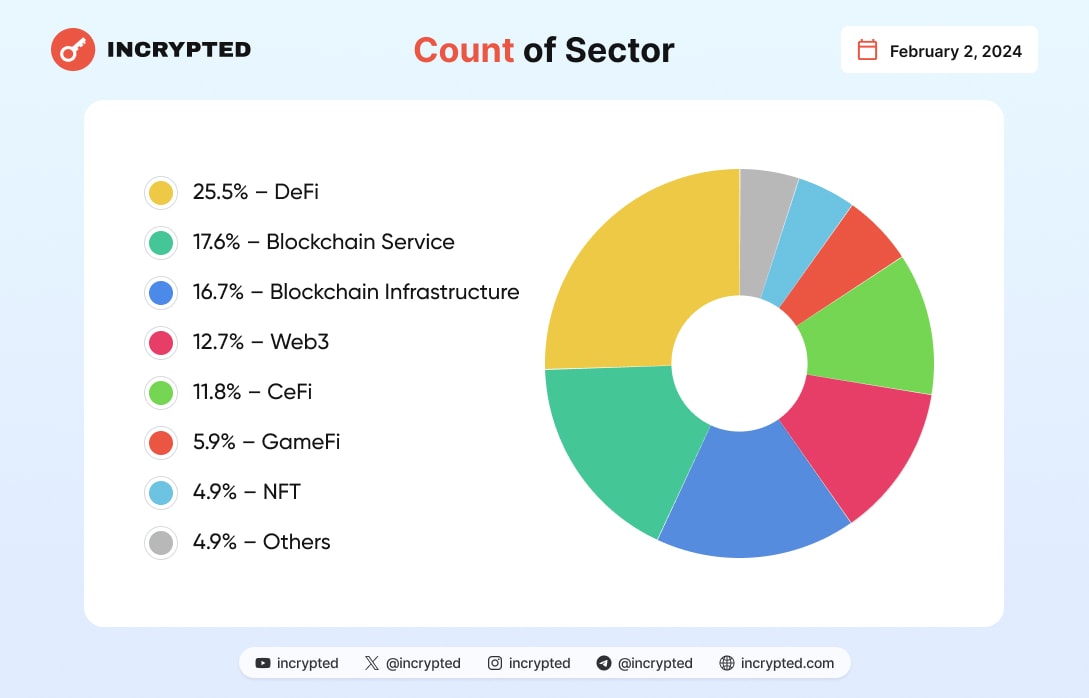

Инвесторы и сегменты

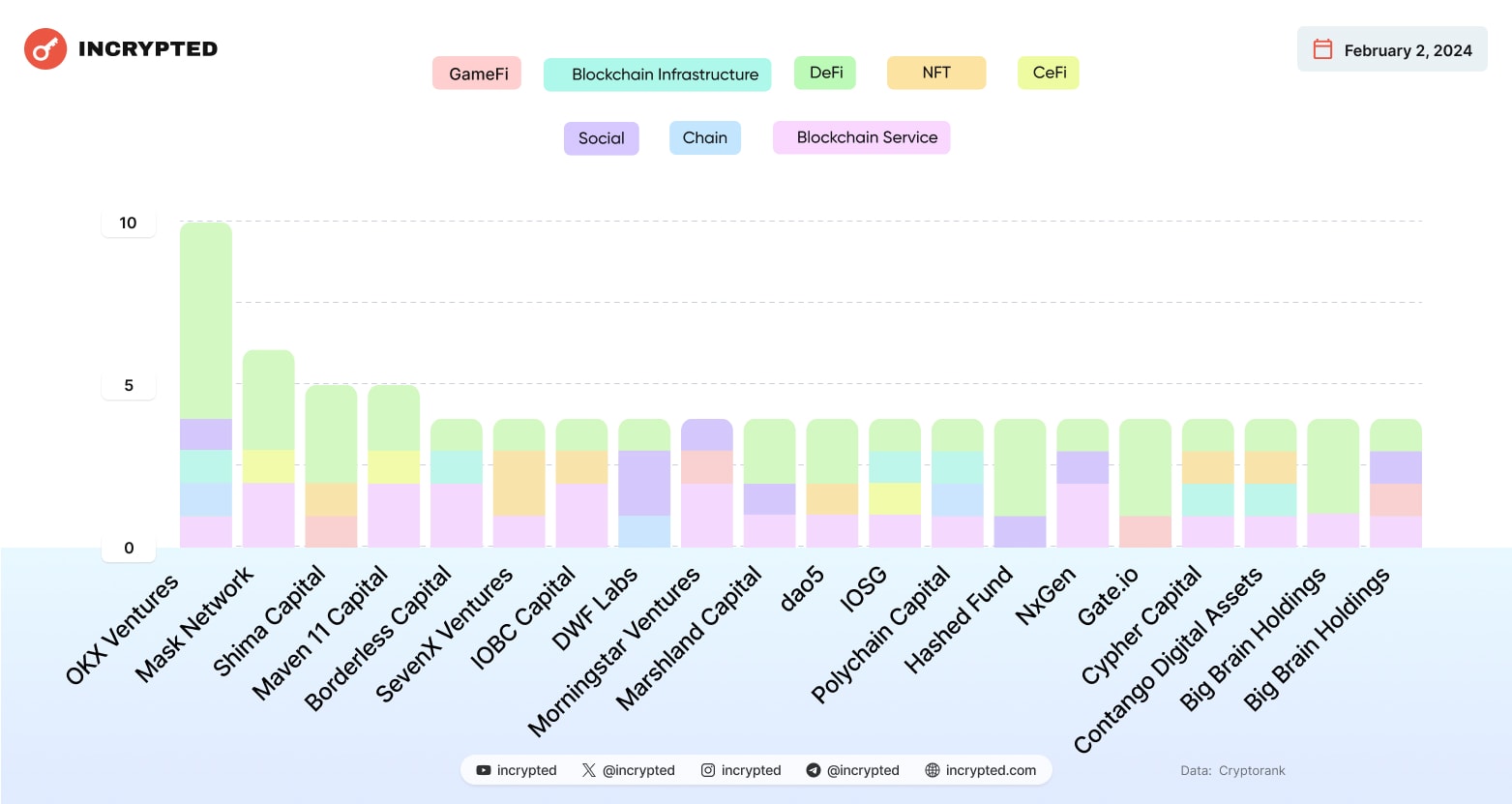

Согласно CryptoRank, самым активным инвестором в январе стал OKX Ventures. Фонд вложил средства в 10 стартапов, причем 6 из них из DeFi-сектора.

В фокусе инвесторов в январе находились секторы DeFi и разработки блокчейн-сервисов.