В октябре и ноябре 2023 года криптовалюта Solana (SOL) продемонстрировала самую высокую доходность среди цифровых активов из первой десятки по капитализации. Согласно данным CoinGecko, за этот период цена токена увеличилась на 177%.

Во время судебного процесса над Сэмом Бэнкманом-Фридом экс-CEO торговой компании Alameda Research Кэролайн Эллисон назвала SOL «Сэм-коином» из-за сильного влияния основателя FTX и связанных с ним организаций. Однако это не помешало токену вырасти более чем на 300% через год после подачи биржей заявления о банкротстве.

Экосистема Solana активно привлекает ликвидность, а сам блокчейн за прошедший год получил ряд технических обновлений, повысивших пропускную способность и стабильность его работы. Основатель проекта Анатолий Яковенко и вовсе считает, что Ethereum может стать L2-решением для Solana.

Команда Incrypted разобралась, чем обусловлено стремительное развитие экосистемы Solana и рост котировок SOL, а также попыталась выяснить, насколько устойчив этот тренд.

«Возрождение» Solana в цифрах

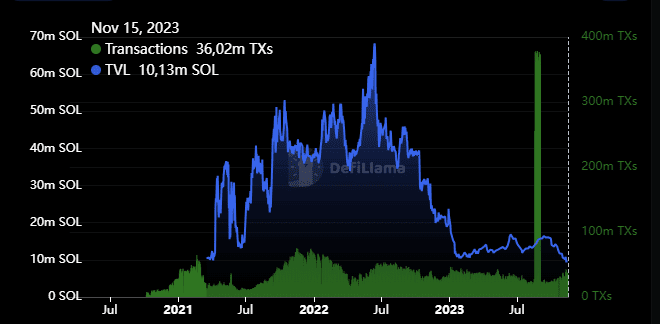

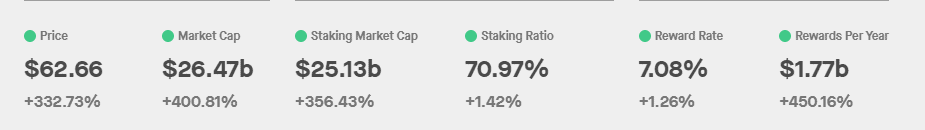

Чтобы лучше понять масштаб и темпы восстановления экосистемы Solana, рассмотрим ключевые метрики блокчейна к моменту написания статьи. В качестве отправной точки для сравнения возьмем крах FTX — 11 ноября 2022 года.

Отметим, что на момент подачи криптовалютной биржей заявления о банкротстве метрики Solana уже находились значительно ниже пиковых значений:

- котировки SOL: $17 против $62;

- суточный объем торгов: $2,2 млрд (130 млн SOL) против $6,7 млрд (108 млн SOL);

- число активных пользователей: 506 000 против 292 000;

- среднесуточное количество транзакций: 40 млн против 36 млн;

- количество заблокированного капитала (TVL): 26 млн SOL против 10 млн SOL.

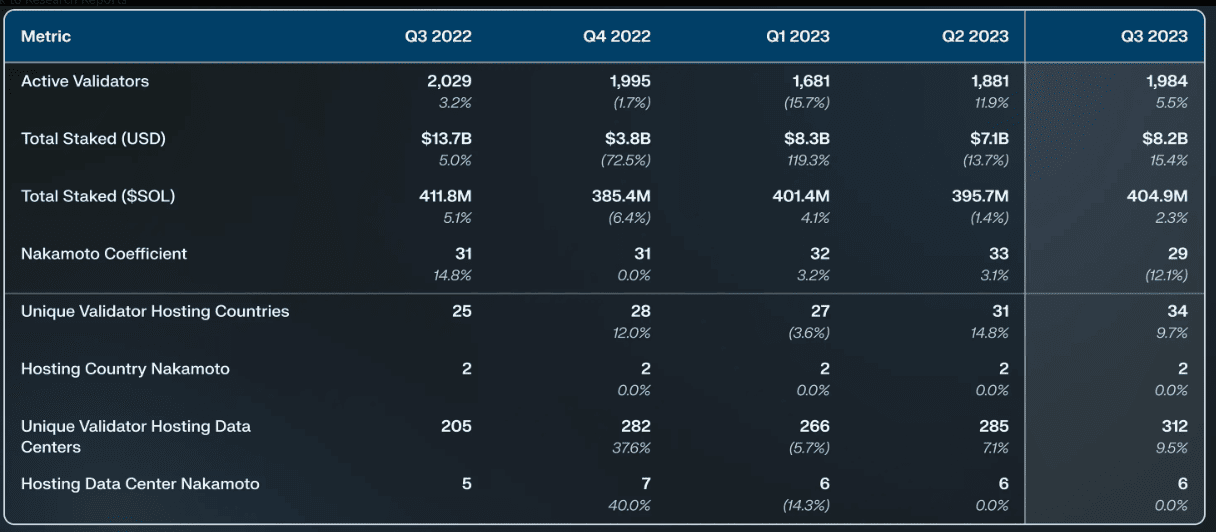

Также можно ознакомиться с квартальными данными от Messari.

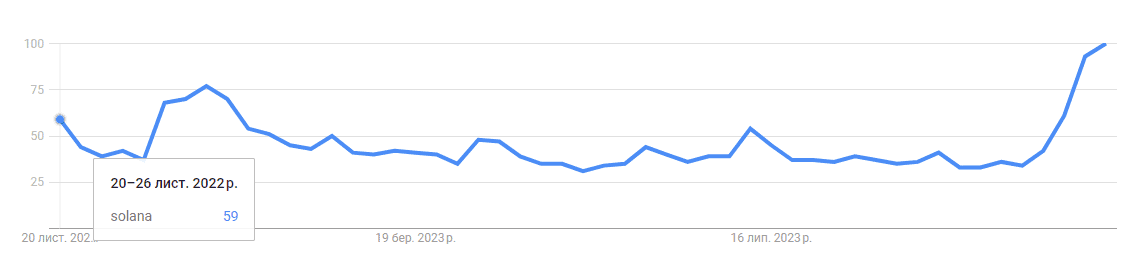

На фоне роста цены SOL увеличился и интерес к Solana со стороны пользователей Google. Индикатор количества запросов вырос до 100 по сравнению с 59 пунктами в ноябре 2022 года.

На фоне роста цены SOL увеличился и интерес к Solana со стороны пользователей Google. Индикатор количества запросов вырос до 100 по сравнению с 59 пунктами в ноябре 2022 года.

Даже в годовом масштабе далеко не все метрики демонстрируют убедительный рост, но если сравнить их с «лучшими временами» Solana, то становится понятно, насколько долгий и сложный путь предстоит пройти проекту, если он хочет «подняться» до прежних высот.

Ключевой драйвер роста: сектор DeFi

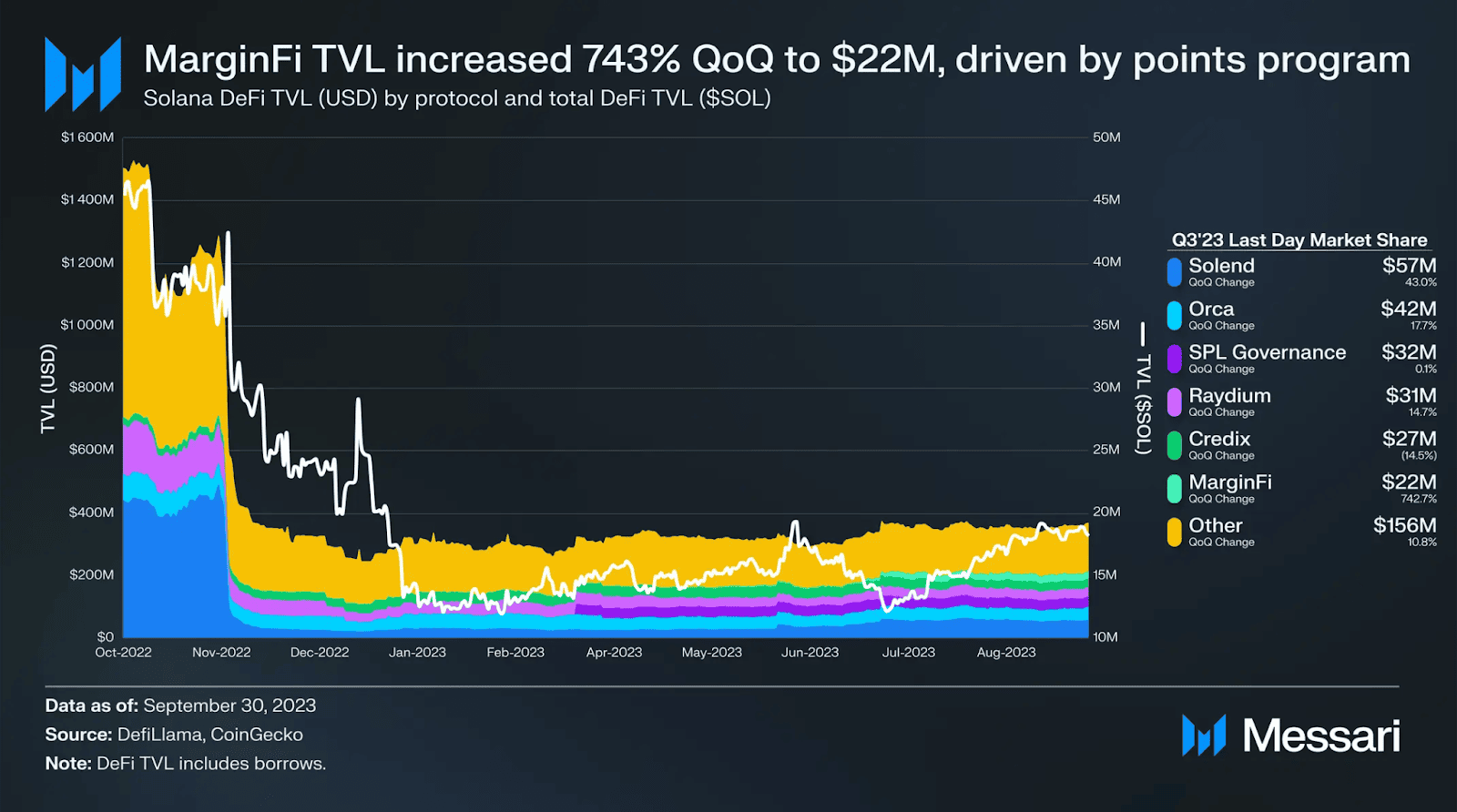

С лета 2023 года на Solana запускают новые DeFi-сервисы — платформы кредитования, LSD-протоколы и децентрализованные биржи (DEX). Разработчики нацелены создавать платформы нового поколения со «здоровой» токеномикой и качественным UI/UX.

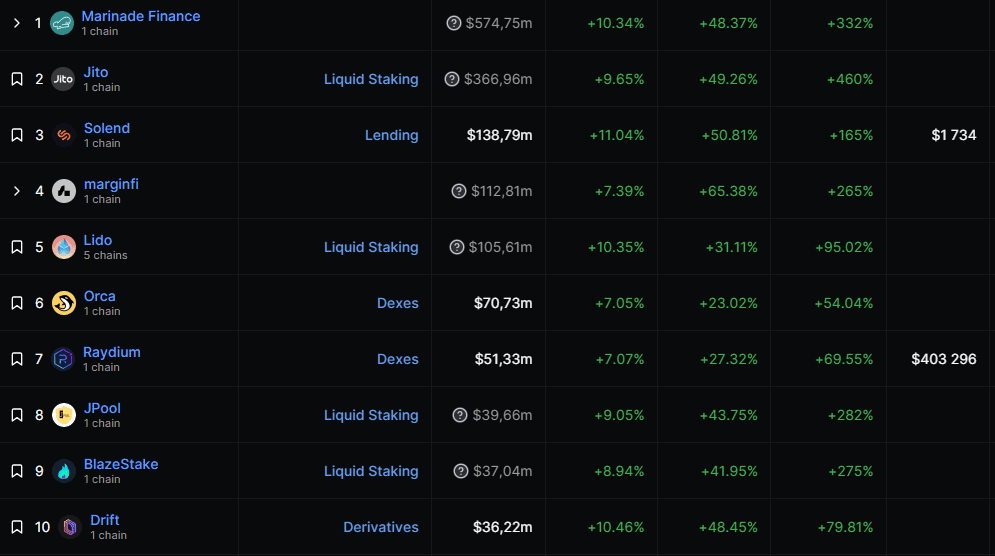

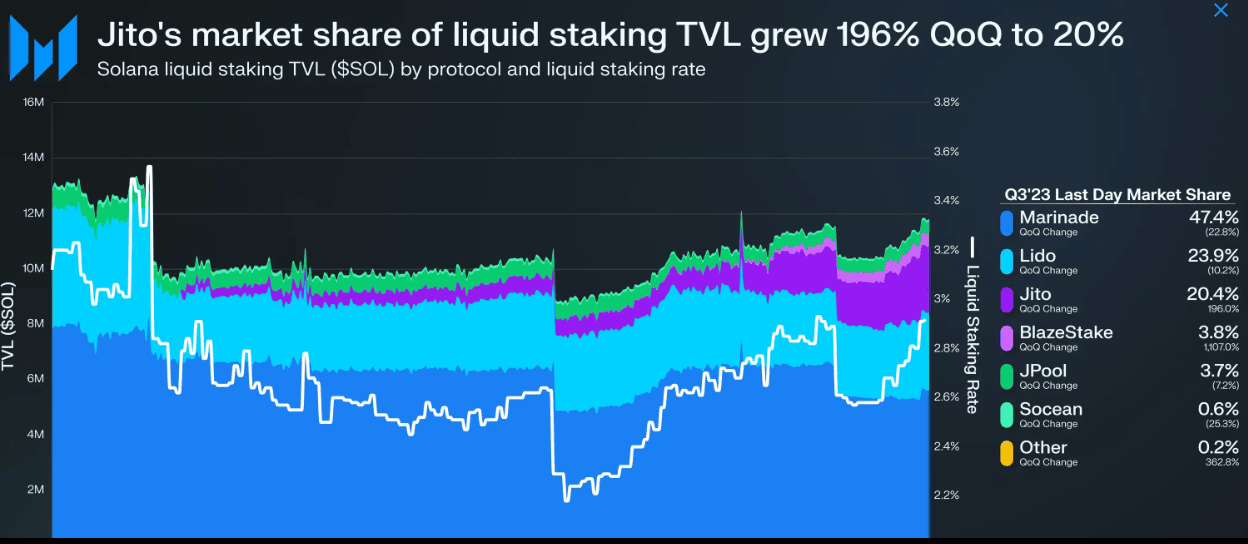

Ключевыми проектами новой волны DeFi на Solana стали Drift, Marinade, Cypher, Solend, Jito и marginfi. По данным DeFi Llama, именно на них приходится львиная доля прироста TVL блокчейна.

Одним из факторов развития DeFi в сети Solana стали низкие комиссии, контрастирующие со сравнительно высокой стоимостью газа в Ethereum и L2-сетях вроде Arbitrum, переживших наплыв децентрализованных приложений в первой половине 2023 года.

Если добавить к этому повышение стабильности, общую узнаваемость бренда и сравнительно низкую активность хакеров, то блокчейн выглядит привлекательным для пользователей. Однако, возможно, что приток ликвидности и увеличение количества транзакций вызваны другими факторами — развитием LSD и потенциальными аирдропами.

Ликвидный стейкинг

Блокчейн Solana использует алгоритм консенсуса Proof-of-Stake (PoS), поэтому, чтобы стать валидатором, необходимо заблокировать определенное количество SOL. Фактически это значит заморозить активы без возможности их использования в децентрализованных приложениях.

В сети Ethereum эта проблема решена с появлением сервисов ликвидного стейкинга, получившими популярность после обновления Shapella.

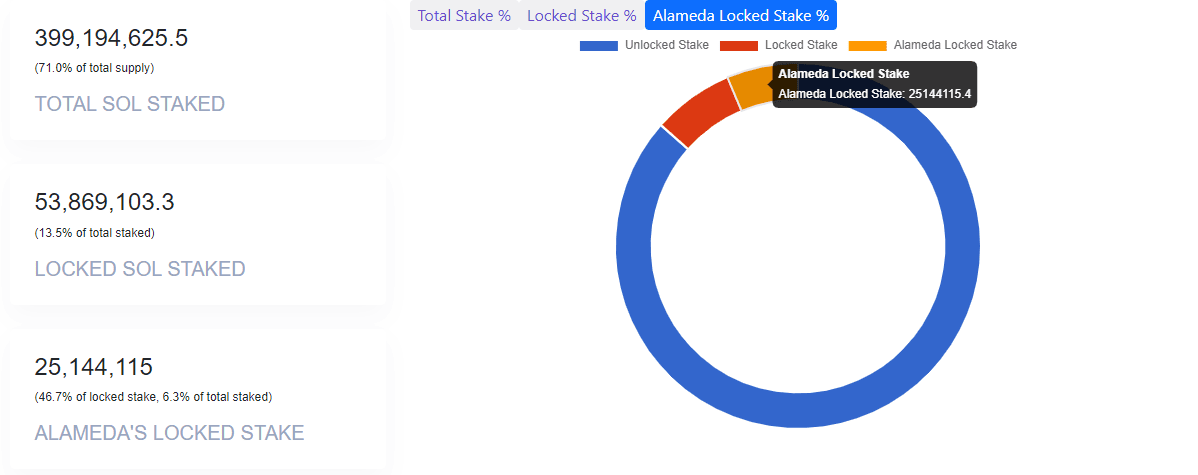

Однако в экосистеме Solana, где на момент написания в стейкинге находится 395 млн SOL при циркулирующем предложении 422 млн SOL (93%), подобные сервисы получили развитие только в 2023 году.

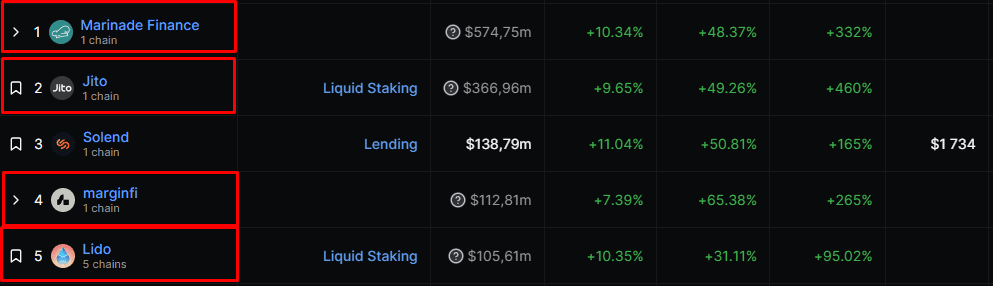

Из пяти приложений с наибольшим приростом TVL четыре связаны с ликвидным стейкингом. Наиболее популярными стали Marinade Finance, Jito и marginfi.

Развитие LSD-сервисов оказывает системное влияние на экосистему Solana, поскольку:

- токены для стейкинга нужно приобрести, за счет чего увеличиваются объемы сделок и ликвидность на DEX;

- общее количество SOL в депозитных смарт-контрактах растет, сокращая свободное предложение;

- ликвидные токены разблокируют капитал, который затем используется в DeFi, например, для кредитования или предоставления ликвидности.

Одновременно появляются предпосылки для роста цены SOL и стимулируется активность в децентрализованных приложениях из-за чего вся экосистема получает импульс к развитию.

Ключевой вопрос в том, что вообще заставляет инвесторов покупать токены и использовать их в ликвидном стейкинге? Среди причин аналитики выделяют привлечение новых разработчиков, обретение независимости от Alameda Research и FTX и решение ключевых технических проблем. Но есть еще один фактор.

Дропхантинг и баллы лояльности

Общим для всех топ-приложений Solana является не только ниша LSD, но и программы лояльности для пользователей.

Большая часть новых сервисов все еще не запустили токены, поэтому рассматриваются проекты, которые потенциально могут распределить аирдропы. Это привлекает многочисленных дропхантеров.

Чтобы реализовать здоровую токеномику в таких условиях, разработчики запускают программы лояльности. Раздаваемые в их рамках баллы впоследствии могут быть конвертированы в токены. Подобные инициативы реализовали:

- MarginFi — 3 июля 2023 года;

- Cypher — 18 июля (завершена);

- Solend — 3 августа 2023 года;

- Jito — 14 сентября 2023 года (завершена — токен анонсирован).

Рост числа транзакций и объема капитала в некоторых DeFi-сервисах может быть обусловлен активностью пользователей, пытающихся получить больше баллов в надежде на аирдроп.

Эту тенденцию усиливает рост цены SOL и общая атмосфера эйфории на фоне восстановления рынка, которые поощряют высокорисковые сделки.

Таким образом, мы получаем кумулятивный эффект нескольких факторов: страх упущенных возможностей, ожидания аирдропов, новый для Solana тренд на LSD и общий рост цены криптовалюты. Все они, по сути, мультипликаторы доходности, которые совокупно создают «магнит» для капитала.

Техническое развитие Solana и его влияние на экосистему

Несмотря на пессимистические прогнозы и общее падение активности в сети после банкротства FTX, разработчики Solana не сидели сложа руки. За последний год блокчейн получил несколько важных технических обновлений и нововведений.

Переход валидаторов на версию клиента 1.16 в конце сентября 2023 года позволил оптимизировать использование памяти, расширить поддержку доказательств с нулевым разглашением (ZKP) и интегрировать конфиденциальные переводы с новым стандартом токена. Апдейт также повысил стабильность сети и снизил требования к оборудованию валидаторов. Ожидается, что версия 1.17 добавит еще больше возможностей для интеграции ZKP.

Другим крупным улучшением стало представленное в апреле 2023 года State Compression. Решение удешевляет хранение данных за пределами основной сети, используя ончейн-хеши для доказательства их подлинности. Благодаря ему появились так называемые «сжатые NFT» (cNFT) с гораздо меньшими расходами на создание и обслуживание. Стоимость минта крупных коллекций сократилась в десятки раз.

По данным Messari, в третьем квартале 2023 года выпущено 40 млн cNFT с использованием протоколов DriP (87% токенов) и Dialect. И на данный момент это наиболее активная ниша NFT-сегмента Solana.

Кроме того, Jump Trading разрабатывает собственный клиент для Solana — Firedancer, который теоретически позволит увеличить пропускную способность блокчейна до 1 млн транзакций в секунду. Идет работа и над первым легким узлом — Tinydancer, упрощающим проверку транзакций для пользователей, не имеющих доступа к мощному оборудованию

На фоне этого также растет интерес к виртуальной машине Solana (SVM), которую начинают рассматривать как конкурента доминирующей на рынке EVM. Один из самых известных примеров — план по развитию MakerDAO, предусматривающий использование SVM для создания собственной сети. А проект Eclipse работает над тем, чтобы превратить эту среду в полноценный слой исполнения для модульных сетей.

Наиболее ощутимым на повседневном уровне стало отсутствие отключений сети — на момент написания Solana бесперебойно работает почти 300 дней и готова обновить свой рекорд в этом направлении.

Обновления сети, скорее всего, окажут положительный эффект в долгосрочной перспективе. Апдейты привлекут новых разработчиков, а также обеспечат надежную и доступную инфраструктуру пользователям во время бычьего рынка, когда Ethereum станет слишком дорогим и медленным.

(Де) централизация?

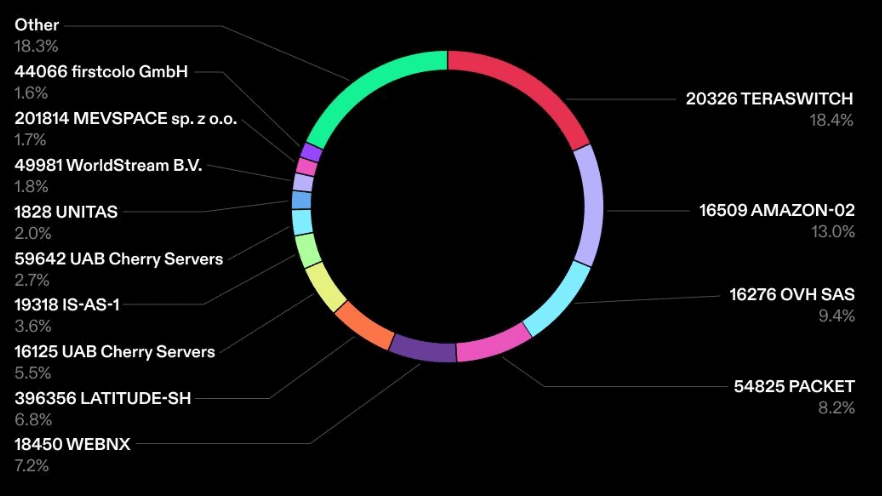

Ключевой проблемой Solana как блокчейна является ее централизация. Обвинения сообщества, связанные с этим аспектом работы сети, обосновываются:

- широким использованием дата-центров для запуска нод;

- высокими требованиями к «железу» валидаторов;

- отсутствием диверсификации клиентов;

- неравномерном распределении SOL, большую часть которых получили ранние инвесторы и команда проекта.

На Х легко найти треды как в пользу этих тезисов, так и нацеленные на развенчание «мифа» о централизации Solana. И некоторые проблемы команде удалось полностью или частично решить — Jump Crypto представили альтернативный клиент, а требования к оборудованию стали несколько ниже, хоть и остаются достаточно высокими для запуска ноды в домашних условиях.

Вместе с этим, валидаторы Solana по-прежнему отдают предпочтение облачной инфраструктуре. Проблема такого подхода проявилась в ноябре 2022 года, когда провайдер Hetzner в один момент отключил более 1000 узлов, что было сопоставимо с 20% атакой на сеть.

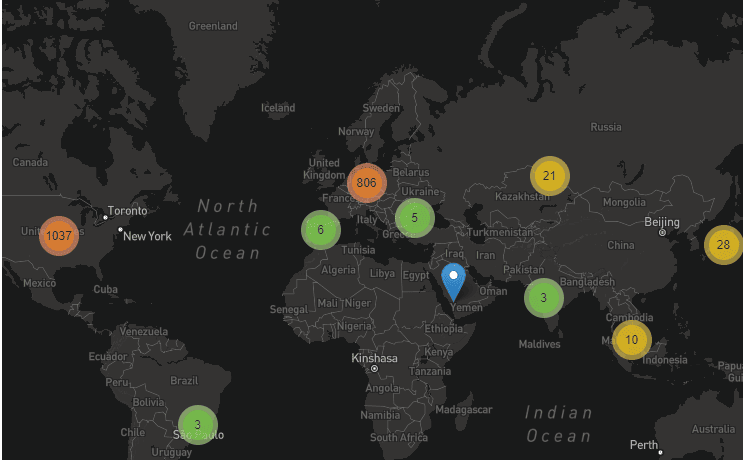

На момент написания для развертывания нод задействовано более 300 дата-центров по всему миру, поэтому вероятность повторения подобного сценария снизилась. Однако 18% валидаторов все еще используют мощности провайдера Terraswitch, 9% — OVH SAS, а 13% — сервисы от Amazon. Изменение пользовательского соглашения любой из этих компаний может нанести ощутимый удар по инфраструктуре Solana.

Нерешенной остается и проблема географической централизации валидаторов — больше 50% стейк-узлов сконцентрировано в США. Впрочем, с аналогичными сложностями столкнулся и Ethereum.

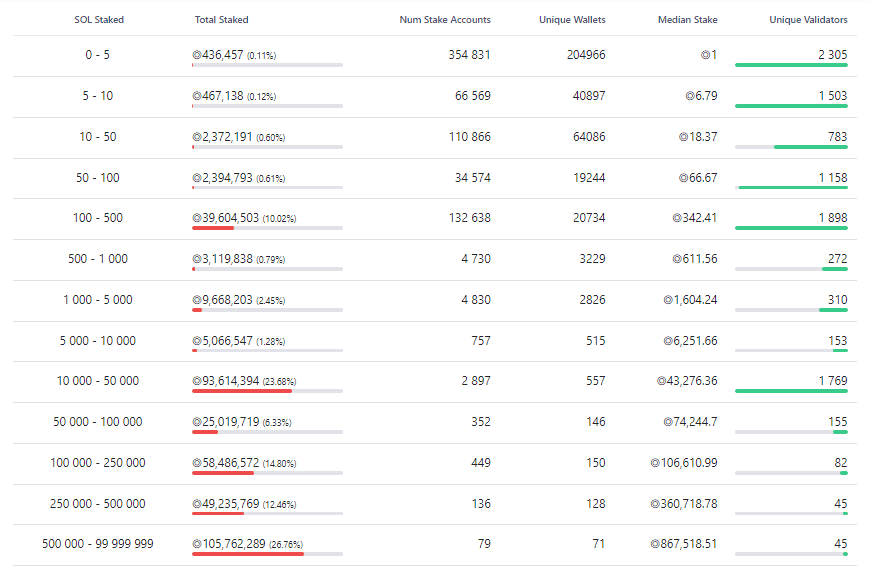

К этому стоит добавить централизацию стейкинга. По данным Solana Compass, почти четверть всей заблокированной ликвидности приходится на 45 крупнейших валидаторов со средним депозитом от 500 000 SOL до 99 999 999 SOL.

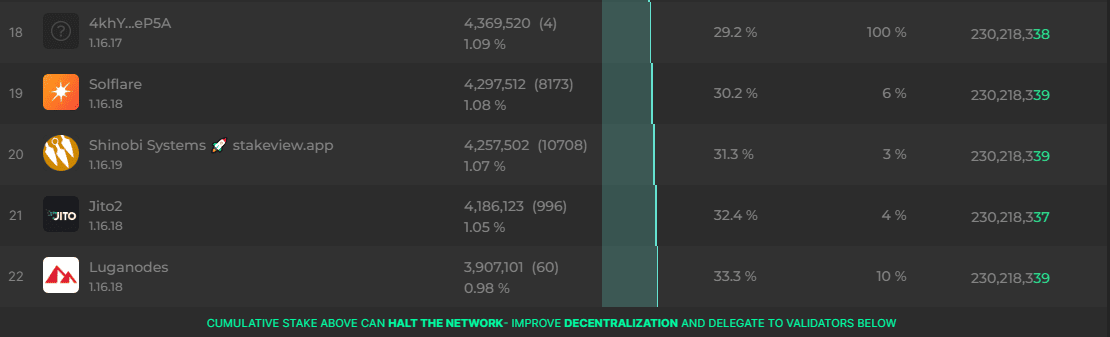

Кроме того, 22 крупнейших валидатора совокупно контролируют более 33% стейка, что потенциально опасно для механизма консенсуса PoS.

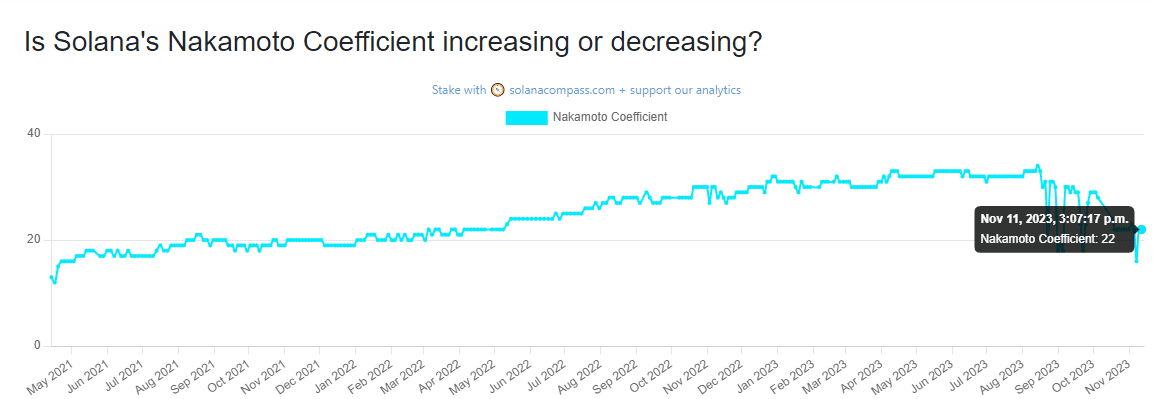

Используемый для оценки децентрализации Solana коэффициент Накамото, достигнув своего пика в августе 2023 года, также начал снижаться и сейчас составляет 22 пункта.

По итогу, если с технической стороны разработчикам удалось снизить централизацию блокчейна, то организационно стейкинг Solana, по сути, контролируется группой крупных держателей SOL, а большая часть узлов расположена в США и потенциально уязвима к политическим решениям властей.

Дамоклов меч Alameda Research

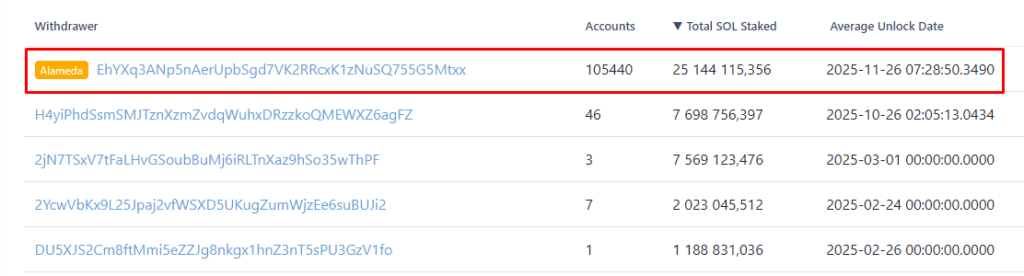

Никуда не делась и зависимость Solana от действий своего крупнейшего инвестора — Alameda Research, а если точнее — ликвидаторов обанкротившейся компании. Она владеет 25 млн SOL, что составляет 6% от всех застейканных токенов. Для сравнения — общее количество SOL вне стейкинга на момент написания составляет 27 млн.

Пока проект в относительной безопасности, поскольку Alameda приобрела активы на условиях постепенной разблокировки и принадлежащая компании криптовалюта заморожена в смарт-контрактах Solana. Средний срок анлока этих активов датируется ноябрем 2025 года.

И хотя сложно предугадать, как будет выглядеть рынок, когда ликвидаторы Alameda Research получат большую часть токенов, почти наверняка можно утверждать, что их продадут. Реализация такого объема активов потребует тщательно разработанных графиков продаж, но так или иначе 14% от циркулирующего предложения повлияют на котировки SOL.

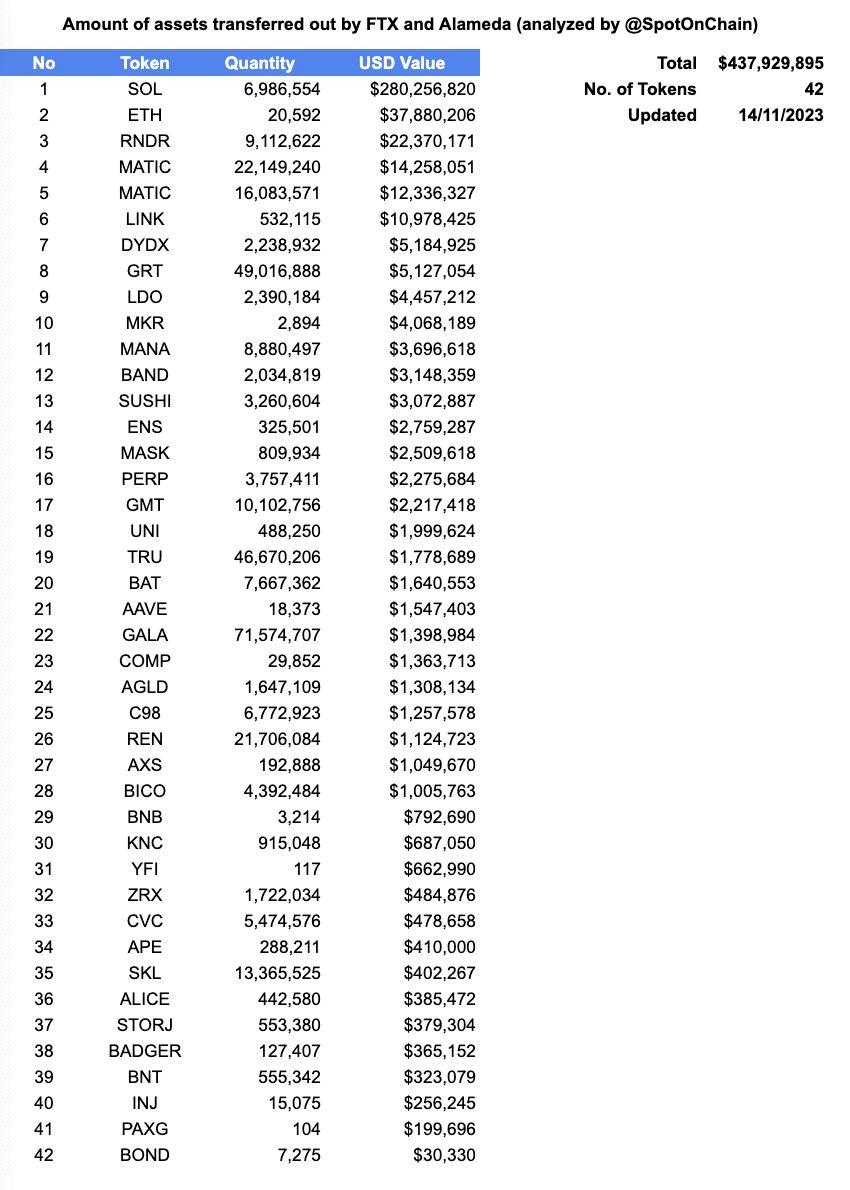

Впрочем, актив успешно преодолевает давление от продажи токенов, находящихся на балансе FTX. Биржа практически завершила цикл реализации, отправив на другие платформы почти 7 млн SOL. На момент написания у FTX осталось еще 3400 токенов, но это вряд ли сможет сильно повлиять на цену.

Второе препятствие на пути к «светлому будущему» Solana — кризис ликвидности, который могут спровоцировать раздачи аирдропов в «слабые руки» или снижение стимулов со стороны экосистемных DeFi-приложений.

Эта тенденция может быть усилена падением цены SOL, спровоцированным той же Alameda Research или другими неблагоприятными рыночными обстоятельствами. Далеко не всем хватит веры в Solana, чтобы отправить в стейкинг дешевеющий актив. Особенно, если другие экосистемы смогут предложить более привлекательные условия.

Таким образом, стремительный рост Solana и ралли SOL основаны на трех основных факторах:

- появление и стремительное развитие сервисов ликвидного стейкинга;

- программы лояльности и возможные аирдропы токенов от новых DeFi-протоколов;

- рост популярности SVM и техническое развитие блокчейна.

Однако сложно предугадать, как долго продлится импульс LSD-платформ и как поведут себя пользователи после получения ожидаемых раздач. Не исключено, что после этого рост TVL Solana замедлится и сеть вновь выйдет на плато, на котором находилась с момента краха FTX.