Евгений Казьмин выманивает миллиарды из ComInBank.

По всей видимости, «Коммерческий индустриальный банк» (ComInBank), явно связанный с контроверзным бизнесменом Евгением Казьмином, в ближайшее время может повторить участь «Айбокс банка» (iBox банк), который фактически был ликвидирован решением Нацбанка в марте текущего года. Причина та же — активное обслуживание транзакций мискодированных сделок подпольных интернет-казино и упорное игнорирование финансового мониторинга, как отмечает Иван Чип в своем обзоре для проектов CRiME и [громкие дела].

Как сообщала ранее «Экономическая правда», в сентябре Национальный банк оштрафовал «Коминбанк» на крайне крупную сумму – 135,15 млн грн. Столь драконовские санкции были наложены за нарушение законодательства в сфере предотвращения и противодействия легализации (отмыванию) доходов, полученных преступным путем, финансированию терроризма. Также взыскание наложено за нарушение требований валютного законодательства в сентябре 2023 года.

Согласно официальному сообщению Нацбанка, среди нарушений, в частности, необеспечение функционирования надлежащей системы управления рисками, неприменение в своей деятельности риск-ориентированного подхода и непринятие надлежащих мер с целью минимизации рисков. Кроме того, регулятор обвинил ComInBank в предоставлении недостоверной информации на запросы по выполнению банком требований законодательства в сфере финмониторинга и информации о валютных операциях с ошибками, а также ненадлежащей верификации плательщика.

Среди других претензий – нарушения в разработке и внедрении внутренних документов по вопросам финмониторинга и задержка во внедрении комплексной интегрированной системы автоматизации процессов финансового мониторинга.

Возможно, сумма штрафа была бы меньшей, если бы бенефициары «Коминбанка» вняли окрику Нацбанка за несколько месяцев до этого. В мае этого года НБУ оштрафовал ComInBank на 10,45 млн грн за нарушение правил финмониторинга и предписал нарушения исправить. Но, похоже, владельцам банка выгоднее платить крупные штрафы, чем работать в правовом поле.

Тут стоит упомянуть, что «Коминбанк» всплыл в масштабном расследовании Бюро экономической безопасности и СБУ в конце прошлого года.

«Происходит документирование противоправной деятельности должностных лиц субъектов хозяйствования, которые с целью уклонения от уплаты налогов создали ряд веб-сайтов двойников, на которых осуществляется незаконная хозяйственная деятельность в виде онлайн-бизнеса, без уплаты налога на прибыль, НДФЛ и военного сбора. По имеющейся информации, ориентировочный ежемесячный объем их теневых операций может достигать 12 млрд грн. Это в свою очередь может составлять 2 млрд грн не уплаченных налогов», — говорилось в официальном заявлении БЭБ.

Следствие установило, что с целью прикрытия противоправной деятельности, действуя по предварительному сговору с должностными лицами банковских учреждений Украины и финансовых компаний как резидентов так и нерезидентов, упомянутая группа лиц в своей деятельности использовала реквизиты 80 субъектов хозяйствования с признаками фиктивности.

С целью обеспечения проведения незаконных финансовых операций, их мискондинга и избежания первичного финансового мониторинга, фактические владельцы указанных компаний вступили в преступный сговор с должностными лицами банков.

Мискодинг — манипуляция с данным кодированием, когда вместо четырехзначного кода платежа 7995, относящегося к азартным играм, указывался любой другой. Таким образом, ставки на спорт или платежи в онлайн-казино в банках проходили как плата за видеоигры, покупка цветов и так далее. Или же, с другой стороны, банк, получив деньги от игорного бизнеса на выплату выигрыша игроку, отправляет его под кодом также совершенно другой отрасли, или даже проводя его как обычный перевод с карты на карту.

По данным ряда СМИ, у «Коминбанка» транзакции по коду 7994 – покупка видеоигр – за последние полтора-два года составляли 90% от общего объема. А это, по мнению журналистов, более 120 млрд грн.

Упомянутый выше iBox банк, вместе с «Коминбанком» обслуживавший схемы теневых воротил игорного бизнеса, по данным следствия, ежегодно зарабатывал на азартном схематозе более 2,5 млрд грн. Если сведения моих коллег на счет объемов мискодинга в «Коминбанке» верны, тут порядок сумм «гешефта» аналогичный.

Логично, что бенефициар «Коминбанка» готов заплатить и 135 миллионов штрафа, и 235. Да хоть миллиард – он всё равно останется в огромном плюсе. Так что вылечить этот гнойник в банке может лишь отзыв лицензии финансового учреждения и последующее уголовное преследование его владельца.

А с владельцем «Коммерческого индустриального банка» всё очень интересно.

С конца 2016 года «Коминбанк» контролирует британский подданный Стефан Пол Пинтер (по состоянию на 8 марта этого, 2023 года у него было 94,86% акций банка, ещё 5,14% принадлежат главе правления финучреждения Татьяне Путинцевой). Согласно официальной легенде, британский инвестор приобрел ComInBank за $5 млн у крупного крымского торговца металлоломом Евгения Казьмина в 2016 году.

Как писало издание Neweurope, Стефан Пол Пинтер является партнером-учредителем, генеральным директором и главным инвестиционным директором GML International Limited, компании, основанной в 1983 году для предоставления корпоративных и государственных консультаций, сбора и реструктуризации долгов, конвертации долгов и крупных инвестиций в развивающиеся рынки. Позже фирма расширила свою деятельность, включив в нее создание и структурирование новых источников финансирования для банков, компаний и правительств развивающихся стран на международных рынках синдицированных кредитов, облигаций и торгового финансирования.

В 1996 году GML запустила свой первый инвестиционный фонд, за которым последовала серия фондов для кредитования развивающихся рынков, особых ситуаций и торгового финансирования. Имеет представительства в Киеве, Москве, Генуе, Тбилиси, Стамбуле, Алматы, Бухаресте и Белграде. В 2007 году консалтинговое и управленческое направления были выделены в отдельную структуру GML Capital LLP. GML International Limited выступает управляющим членом GML Capital LLP. Конечным бенефициаром обеих компаний в британском реестре указан Стефан Пол Пинтер.

Собственно, GML International Limited и входящая в её структуру GML Capital LLP являются источниками дохода Стефана Пинтера. И если вникнуть в финотчетность этих компаний (найти можно здесь и тут), то возникнет подозрение, что эти «предприятия» вряд ли могли сгенерировать для своего бенефициара капитал для покупки «Коминбанка» в 2016 году. Ведь их годовая чистая прибыль измерялась совсем не в миллионах, а сотнях тысяч фунтов стерлингов. То есть, осмелимся осторожно предположить, что в этой истории Стефан Пол Пинтер выступает «фунтом».

Кто же тогда купил «Коминбанк» у Евгения Казьмина? У автора этих строк есть робкая догадка, что этот загадочный покупатель сам Евгений Казьмин.

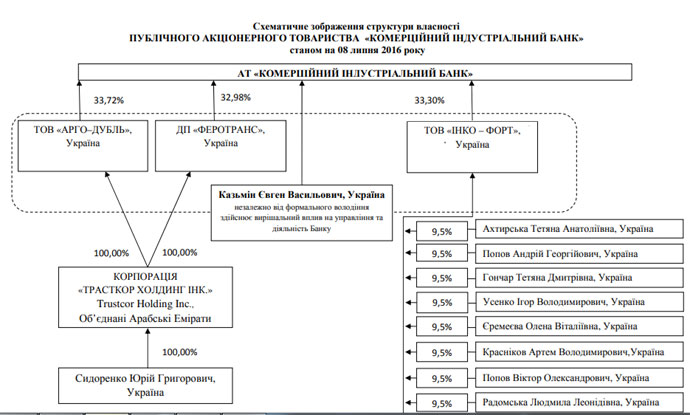

Напомним, что ComInBank долгое время принадлежал главе концерна ЕДАПС Юрию Сидоренко. В 2015 году крымский бизнесмен Евгений Казьмин договорился с Сидоренко о покупке банка за 4,2 млн долларов. С этого момента ComInBank погряз в скандалах и уголовных делах.

Бывший глава службы безопасности ComInBank Анатолий Мазур рассказал подробности покупки финучреждения Казьминым.

По его словам, легальных средств у бизнесмена не было, поэтому ему пришлось обманывать Нацбанк при покупке. Юрист, нанятый Казьминым для оформления покупки банка, в пакете документов для НБУ подал сфальсифицированную декларацию, согласно которой источником средств для покупки банка является продажа монет мертвому лицу, купленных у мертвого лица, а сделку оформлял покойный нотариус. НБУ в эту историю не поверил и не разрешил Казьмину оформить банк на себя. В итоге номинальными акционерами ComInBank стали юридические лица, учрежденные сотрудниками компаний крымского бизнесмена.

В марте 2016 года Казьмин стал главой набсовета банка, а Нацбанк вскоре признал его конечным бенефициаром финучреждения.

28 апреля 2016 года Казьмин был задержан сотрудниками СБУ по подозрению в финансировании сепаратизма в Крыму. Простыми словами, СБУ выяснила, что бизнесмен после аннексии продолжил вести бизнес на оккупированном полуострове, уплачивая налоги в бюджет РФ. Казьмин отправился в СИЗО.

Здесь необходимо сказать несколько слов о том, кто такой Казьмин и чем зарабатывал на «хлеб с маслом». Еще в начале 2000-х он занялся в Севастополе сбором и утилизацией металлолома, позже к этому добавилось строительство. Затем бизнес расширился на материк, появилась группа компаний «КВВ Групп». Сам Казьмин стал депутатом Севастопольского горсовета от Партии регионов, в 2012 году даже оказался в списке партии Януковича на выборах в Верховную Раду, но в парламент не попал.

Когда Россия оккупировала Крым, Казьмин уехал на материк и заявил, что не ведет бизнес на полуострове и не имеет отношения к собственности, стратегическому и оперативному управлению строительными площадками на полуострове.

Довольно быстро выяснилось, что это неправда, а семья Казьминых перерегистрировала активы в РФ и продолжает работать в Крыму. Издание «Крым.Реалии» выяснило, что оставшийся в Крыму бизнес большой семьи Казьминых обширен. ООО «Карбон», ранее принадлежавшее Евгению Казьмину, много лет активно строило недвижимость в Севастополе и других регионах полуострова.

В ноябре 2014 года предприятие перерегистрировали по российскому законодательству. Тогда из учредителей и руководителей исчезло имя Евгения Казьмина. На данный момент фирмой владеет его брат Владислав Казьмин.

В государственном Реестре предприятий и организаций России есть и другие предприятия, принадлежащие членам семьи Казьмина. Они до сих пор получают крупные подряды из госбюджета РФ. При чем, журналисты выяснили, что эти фирмы через цепочку офшоров помогали Казьмину строить жилье в Украине.

Кроме того, бывший глава службы безопасности холдинга Казьмина Анатолий Мазур утверждает, что даже после аннексии Крыма бизнесмен незаконно вывозил оттуда лом в Турцию.

СБУ же обвинила Евгения Казьмина в том, что под его непосредственным руководством в Крыму строилось жилье, часть из которого предназначена для бесплатного предоставления сотрудникам ФСБ и Министерства внутренних дел страны-агрессора. Речь идет о так называемом «Городке Мира», который принадлежащая Казьмину компания «Карбон-строй» возводила в окрестностях Симферополя.

Во время обысков у Казьмина нашли российский паспорт. А также следствие получило доказательства получения бизнесменом российского гражданства. Кроме прочего, при обыске следствием были обнаружены наручные часы с изображением герба России и надписью «Москва- Кремль», очевидно подаренные подсудимому за особые заслуги перед «новым» отечеством.

Однако, несмотря на документальные доказательства, которые фигурировали в деле, через пять месяцев прокурор, ведущий уголовное производство, ходатайствовал об освобождении Казьмина от уголовной ответственности. Основанием для этого якобы стал тот факт, что подозреваемый добровольно сообщил следствию о своей финансовой деятельности, ставшей впоследствии предметом разбирательства, еще до того, как ему инкриминировали соответствующую статью.

Когда владелец «КВВ групп» оказался на свободе, то выяснил, что лишился части бизнеса. Ее рейдерским путем отобрали бывшие бизнес-партнеры. Сам Казьмин ранее действовал аналогично, когда рейдерил киевский завод «АТЕК».

Несмотря на частичную потерю бизнеса, банк Казьмин сохранил. Еще летом 2016 года, находясь в СИЗО, он якобы продал банк «иностранному инвестору». По факту это было переоформление финучреждения на подставное лицо – британского инвестбанкира Стефана Пола Пинтера – чтобы сберечь актив.

Несмотря на то, что юридический адрес банка — Бульварно-Кудрявськая, 6 в Киеве, реальное местоположение офиса — Предславинськая, 28. Именно по этому адресу находится офис «КВВ Групп» Казьмина.

Источник в банке утверждал, что на Предславинской Казьмин лично принимает участие в совещаниях правления и по сути осуществляет управление финучреждением.

Службой безопасности банка руководил Андрей Ряжский, по совместительству глава СБ «КВВ Групп». Ряжский до сентября 2016 года был главой СБ фирмы «Карбон» Казьмина, которая до сих пор находится в собственности семьи бизнесмена и платит налоги в бюджет РФ.

В структуре банка до сих пор работают многие сотрудники «КВВ Групп». А юрист Евгений Порада, который в 2015 году сфальсифицировал документы для покупки Казьминым банка, сейчас заместитель главы набсовета ComInBank.

На фотографиях Казьмин стоит рядом с главой правления банка Татьяной Путинцевой. Это фото сделано после 2019 года, когда Путинцева возглавила банк.

Как видим, есть веские основания считать, что «Коминбанком» до сих пор владеет Евгений Казьмин, гражданин страны-агрессора.