Завладение имуществом обанкротившихся украинских банков, вывод средств через подконтрольные зарубежные фирмы и причастность к силовому захвату завода пластмасс: как никому не известная молодая юрист Ольга Гутовская стала владелицей британской компании, орудующей сотнями миллионов долларов? Как работает, вероятно, мошенническая связка? И при чем здесь муж племянницы известного российского политика Дмитрия Медведева – владелец столичного ТРЦ Gulliver Виктор Полищук?

Редакция разоблачила новые детали «схемы» более чем на $600 млн, одним из лиц которой выступила новоиспеченная адвокат и бизнес-вумен Ольга Гутовская. Подробности – во второй серии журналистского расследования Игоря Хмурого.

Фигура малоизвестной юристки Ольги Гутовской, фирма которой WWRT Limited фактически за бесценок приобрела кредитные портфели крупнейших украинских банков, привлекла внимание редакции СтопКора в прошлом году благодаря ее роскошному образу жизни, агрессивному пиару в медиа и публичным обвинениям в мошенничестве.

Обнародованный нами материал повлек за собой немалый общественный резонанс и довольно неоднозначную реакцию со стороны самой Ольги. Из-за соцсетей она вышла с журналистами на связь и обвинила в искажении фактов. Поэтому мы предложили Ольге записать небольшое интервью, где она могла бы изложить свою позицию, а заодно и ответить на интересующие нас вопросы. Женщина сначала якобы охотно согласилась, но в течение почти месяца так и не могла найти время, чтобы посетить нашу студию.

В какой-то момент госпожа Ольга просто перестала брать трубку. Тогда мы сами поехали к ней в гости. Уже под домом героини игнор продолжился. В конце концов мы ее увидели и решили лично поинтересоваться, что из интервью. было и следа. Госпожа Ольга рассказала, что пообщалась с какими-то людьми и передумала давать интервью «, — отмечает Игорь Хмурый.

Следовательно, СтопКор решил самостоятельно исследовать подробности истории с «выкупом» кредитных долгов и разобраться в хитросплетениях вероятной «схемы» с участием Гутовской.

И чем дальше мы погружались в эту тему, тем логичнее выглядит предположение: ключевым звеном этого механизма может оказаться даже не британская компания WWRT Limited Ольги Гутовской, а та структура, которая передала ей права на долги банкиров. Речь идет о фирме «Стар Инвестмент Ван» и интересах, которые могут за ней стоять.

Начало истории датируется концом 2018 г., когда Фонд гарантирования вкладов физических лиц подготовил к аукциону пакет из 21 отечественного банка. В ноябре компания Exito Partners представила проект под названием «Элория», в котором достаточно детально расписала номинальную стоимость кредитов, имущества залога, его расположение и т.д. Кредитов по кейсу насчитали на почти 294 миллиона долларов, а общая стоимость обеспечения ссуд составила более 367 миллионов «зеленых».

Однако, несмотря на то, что в кейсе было только довольствий на 367 млн долларов, лот выставили на аукцион всего за полтора миллиарда гривен, что на тот момент составляло примерно 50 млн долларов.

В схожих вариантах употребляется голландская система торгов. Если желающих не находят — стоимость лота начинают уменьшать в разы и выставлять снова и снова, пока не продадут. Таким образом стоимость этого портфеля упала до 310 млн грн в декабре 2018 года. А это – всего примерно 11 млн долларов.

И вот здесь свою роль сыграла компания «Стар Инвестмент Ван», которая на тот момент называлась «Эй Пи Эс Украина».

Примечательно, что фирму зарегистрировали всего за четыре дня до начала приема предложений по первому лоту. 135 млн в уставный капитал внесла фирма из Чехии.

Первые торги «новорожденная» компания пропустила. На вторых у нее не было ни одного конкурента, поэтому играя на понижение забрала весь кейс за 62 млн грн. На тот момент это было примерно 2 миллиона долларов.

Выходит, что ФГВФЛ не просто допустил к торгам компанию, которой было меньше месяца и имело уставный капитал вдвое меньше цены лота. В конце концов, он отдал ей права на 294 млн долларов кредитов и 367 млн долларов застал меньше, чем за 0,5% их общей стоимости.

«Есть бизнес, скажем так… покупки долгов — это бизнес стервятников. Потому что эти люди покупают за один процент, два процента и даже ниже, полпроцента. Понимаете, чтобы купить за полпроцента, за процент долгов на сто миллионов, на миллиард. потом можно эти долги продавать дальше, залечивать, что-то делать, мучать кредиторов по этим долгам и т.д.», — комментирует управляющий партнер юридической фирмы «Spensers» Валентин Загария.

Чем можно объяснить такую удивительную успеваемость и уровень доверия?

Стоит отметить, что одним из самых больших лотов в этом портфеле был банк «Михайловский». Его связывают с одним из самых богатых украинцев – владельцем ТРЦ Gulliver, нескольких крупных сетей магазинов бытовой техники и еще ряда ценных активов – Виктором Полищуком. Также, по данным СМИ, жена Полищука через свою тетю является родственницей путинского приспешника и экс-президента рф Дмитрия Медведева.

Кроме того, фамилия Полищука фигурировала в нескольких громких силовых конфликтах и рейдерских захватах. Несколько лет назад общественная организация «Стоп нелегал» проводила митинг под «Гулливером» именно по поводу «российского следа» господина Полищука. Там на них напала его охрана, но впоследствии скандальное дело спустили на тормозах.

А позже, эту же охрану активисты той же организации заметили во время силового захвата завода пластмасс в Броварах.

«Я удивился, когда приехал на завод пластмасс и увидел тех самых охранников, которые нас нас и избивали. Я спросил одного человека, а это оказалась чуть ли не правая рука Полищука, что он здесь делает? Он начал очень агрессивно вести себя, разбил мой мобильный телефон, а также нанес мне многочисленные физические повреждения.Мне пришлось тогда вызвать скорую помощь, чтобы меня осмотрели», — рассказал глава ОО «Стоп нелегал» Денис Шинкаренко.

И вероятно, «отжим» завода был организован именно из-за схемы со старым кредитом по бумагам «Стар Инвестмент Ван».

«Схема захвата завода достаточно проста. «Стар Инвестмент Ван» получает решение суда по ипотеке имущества и мгновенно делает перерегистрацию права собственности, пока оппоненты не пришли в себя. А дальше в ход идет брутальная сила, которая до этого засветилась в «Гулливере», — комментирует расследователь Игорь Хмурый.

Так что вырисовывается следующая картина. Банк «Михайловский», связанный с Полищуком, входит в портфель, который выкупила компания, зарегистрированная в его бизнес-центре и помогающая «отжимать» имущество его служба безопасности. А самое интересное, что сейчас «британская» компания Ольги Гутовской требует грандиозные средства у владельцев нескольких крупных банков из этого пакета, но обанкротившихся «Михайловский» и «бросивших» его вкладчиков почему-то не затрагивает.

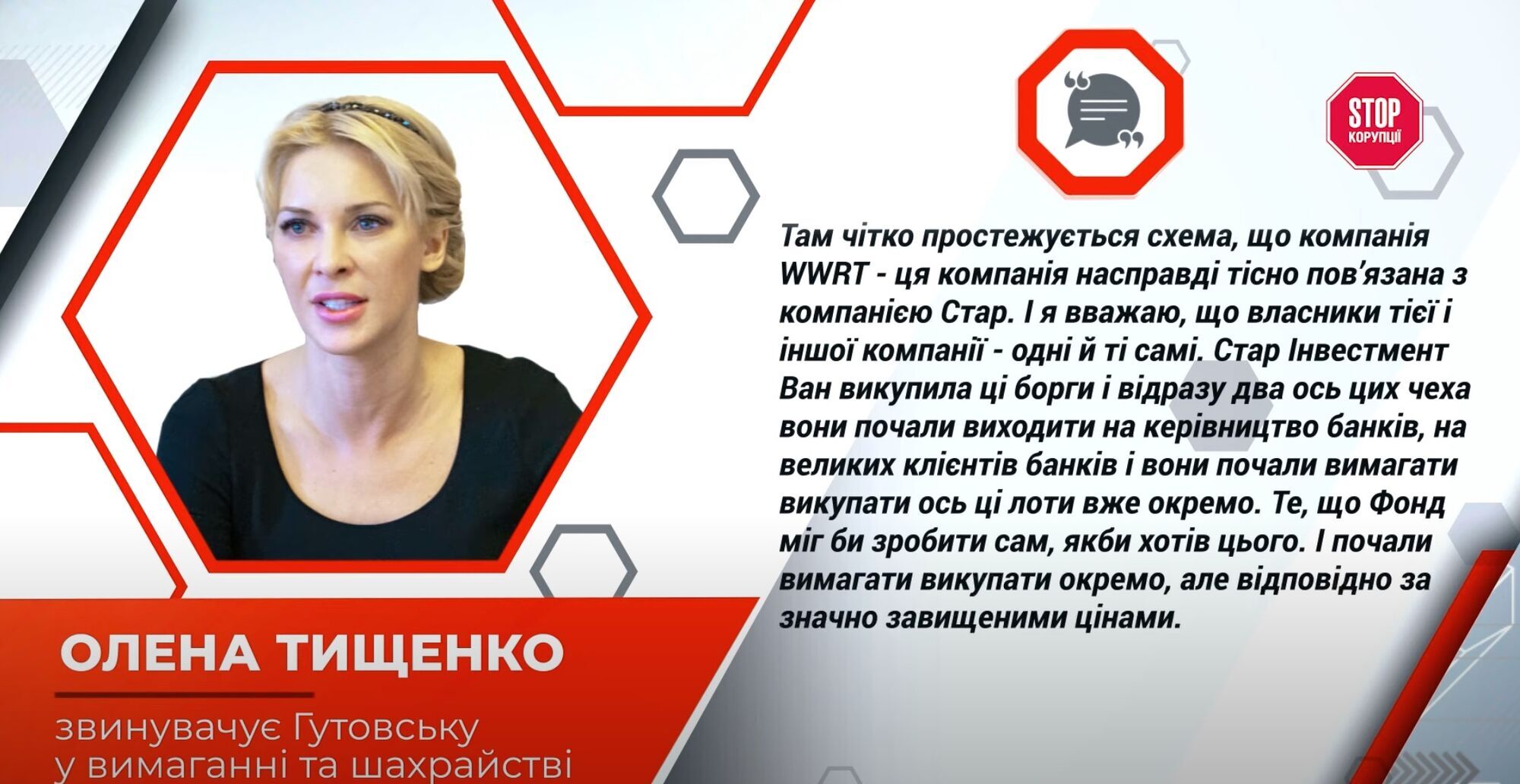

Напомним, некоторый свет на детали этой «схемы» смог пролить интервью Елены Тищенко, эксдружины Сергея Тищенко, в свое время возглавлявшего обанкротившийся банк «Фортуна». Елена рассказала о возможном механизме вымогательства денег группой интересующих через ряд иностранных компаний, к которым причастна и Гутовская. И, по ее мнению, за «Стар Ивнестмент Ван» и компанией Гутовской стоят одни и те же люди.

«Там четко прослеживается схема, что компания WWRT на самом деле тесно связана с компанией «Стар». И я считаю, что владельцы той и другой компании – одни и те же. «Стар Инвестмент Ван» выкупила эти долги, и они сразу начали выходить. на руководство, на крупных клиентов банков, и потребовали выкупать вот эти лоты уже отдельно – по значительно завышенным ценам», – утверждает госпожа Тищенко.

На этом фоне возникает закономерный вопрос: почему возвратом средств вкладчикам не занимается Фонд гарантирования, пока портфели банков еще не имеют отношения к государству?

Тем более что разыскать выведенные за границу миллиарды — реально, утверждают эксперты. Однако почему-то Фонд не спешит этого делать. Один из печально известных примеров – история с «Дельта Банком».

«Мы в присутствии двух украинских адвокатов, трех английских солистерв, трех разведчиков финансовых из Великобритании, презентовали на двух больших ватманах — две схемы. Первая схема — как был выведен миллиард долларов. И вторая схема — где его искать. Мы презентовали все компании, которые на тот момент существовали в мире и которые были контролируемы Николаем Лагуном, его прокси, номиналами, связанными лицами.Мы нашли недвижимость во многих странах, многих юрисдикциях – это Кипр, Австрия, Великобритания, Сейшелы, Панама, Вьетнам и т.д. «Более ста компаний. На вопрос Фонда как быстро вы сможете арестовать активы собственника банка, наш солистер сказал, что мы сделаем это за шесть недель», — вспоминает управляющий партнер юридической фирмы «Spensers» Валентин Загария.

Выходит, что в конце концов вкладчики из собственных карманов компенсируют «схемы» по банкротству банков, а ловкие дельцы и лица с рейдерским шлейфом на них наживаются? СтопКор продолжит тщательно исследовать историю с «Стар Инвестмент Ван» и WWRT Limited, а также вероятную связь покровителей Ольги Гутовской и Виктора Полищука. Продолжение следует.

Напомним, малоизвестная адвокат за бесценок получила кредитные портфели крупнейших украинских финучреждений и ведет лакшеры-жизнь, при отсутствии какой-либо юридической деятельности. Ты иногда Елена Тищенко обвинила адвоката Ольгу Гутовскую, чья фирма WWRT Limited добивается ареста имущества ряда отечественных банков, в требовании огромных сумм и мошенничестве. По данным фактам вроде бы возбуждено несколько уголовных производств.