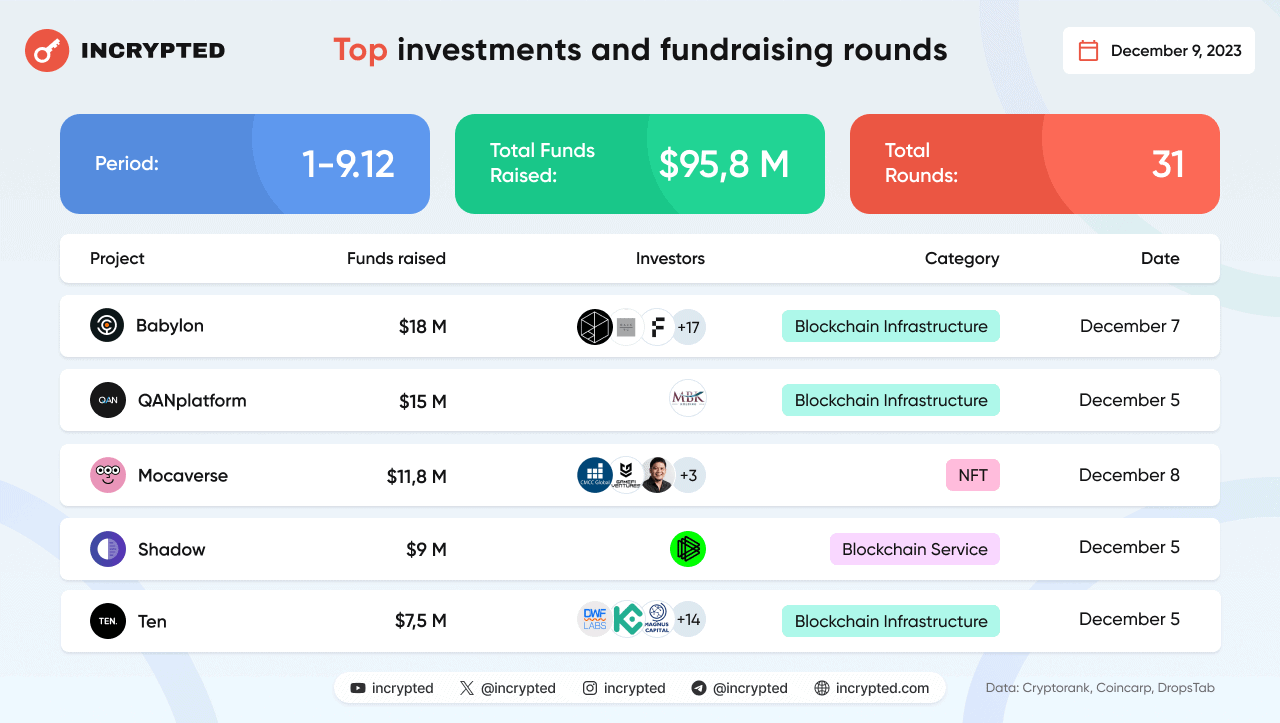

За 9 дней в декабре, 31 проект получил $95,8 млн. инвестиций.

В частности, за неделю финансирование получили:

- $18 млн — Babylon. Протокол биткоин-стейкинга привлек инвестиции в рамках раунда финансирования серии А. Группу инвесторов возглавила венчурная компания Polychain Capital, а среди других контрагентов значатся Hack VC, Framework Vent. Сбор средств начался в конце июля 2023 года и был закончен 7 декабря 2023 года.

- $15 млн — QANplatform. L1-блокчейн подписал инвестиционный контракт с холдинговой компанией MBK Holding. Новое финансирование поможет QANplatform дальше развивать свою технологию и «расширить охват в блокчейн-индустрии». Платформа имеет целью обеспечить безопасное и эффективное решение для компаний и разработчиков против потенциальных «угроз квантовых вычислений”.

- $11,8 млн — Mocaverse. Animoca Brands завершила второй раунд финансирования своего проекта. Деньги пойдут, в частности, на доработку системы лояльности на базе Realm Points. Другими контрагентам стали: Block1, OKX Ventures, Foresight Ventures, Polygon Ventures и Dapper Labs. Как и в предыдущий раз, инвесторы получили варранты на токены.

- $9 млн — Shadow. Криптовалютная платформа привлекла инвестиции в рамках посевного раунда финансирования. Средства пойдут на создание решений для сокращения затрат на разработку Ethereum-проектов. Раунд финансирования возглавила компания Paradigm. Кроме этого инвестиции поступили от таких контрагентов как Coinbase Ventures, Electric Capital, Ethereum Foundation, Uniswap, Flashbots.

- $7,5 млн — Ten (Obscuro). Протокол получил финансирование от более чем 10 фондов, в том числе DWF Labs, KuCoin Labs и Magnus Capital. Проект стремится создать решение, предназначенное для шифрования транзакций и повышения конфиденциальности в сети Ethereum.

- $6,9 млн — Sona. Стриминговый проект закрыл посевной раунд финансирования, который возглавила венчурная компания Polychain Capital. Средства пойдут на разработку новых функций платформы и расширение команды. Инвестиции также поступили от Haun Ventures и Rogue Capital.

- $5 млн — Sindri. Инфраструктурная платформа получила финансирование в посевном раунде, который возглавил CoinFund. Средства используют для расширения команды и сети разработчиков, специализирующихся на технологии zero-knowledge proof.

- $3,6 млн — Curvance. DeFi-платформа получила инвестиции в рамках посевного раунда финансирования от 17 инвесторов, среди которых Offchain Labs, Wormhole и сотрудники из Polygon, Scroll и Curve. Компания планирует использовать средства для расширения операций, поддержки проверок безопасности и привлечения специалистов на рынке DeFi.

- $3 млн — Gacha Monsters. Компания привлекла инвестиции в рамках посевного раунда финансирования под руководством Animoca Brands. Также инвесторами стали: Infinity Ventures Crypto, FBG Capital, Big Time Games. Фирма намерена развивать свою GameFi-платформу Poglin и для этого заключила стратегическое партнерство с Opensea, SUI и Open Loot, а также интегрировалась с Arbitrum.

- $2,5 млн — Endless Clouds. Компания, занимающаяся разработкой игр с элементами NFT и токенизации, привлекла инвестиции. Участие в раунде финансирования приняли 10 компаний, а также 17 частных инвесторов. Среди них: GameFi Ventures, Animoca Brands, Gabby Dizon, SkyVision Capital, Rocinante Research, 2 Punks Capital, Citizen Capital, Narcissus Ventures, OMG | Open Market Group, Momentum 6.

- $2,3 млн — Versatus. Стартап по масштабированию блокчейнов, ориентирующийся на Ethereum, закрыл посевной раунд финансирования, в результате которого его оценка выросла до $50 млн. Инвесторами стали NGC Ventures, Republic Crypto и Hyperithm. Компания начала сбор средств для раунда в июне и закрыла его в августе 2023 года.

- $2 млн — Web3Labs. Компания, помогающая блокчейн-стартапам развивать их экосистему, закрыла стратегический раунд финансирования. Инвесторами стали: Waterdrip Capital, Foresight Ventures, Cipholio Ventures, NextGen, Qtum, VCB Technology.

- $2 млн — Jellyverse. Децентрализованная платформа привлекла инвестиции в рамках посевного раунда финансирования. Средства получили компании, разрабатывающие начальные протоколы для проекта — Jelly Labs AG и Fintonomy LTD. Инвестиции пойдут на развитие платформы, которая позиционирует себя как проект сферы DeFi 3.0. Компания не раскрывала своих инвесторов.

- $1,41 млн — Gataca. Мадридская компания по кибербезопасности, специализирующаяся на технологиях децентрализованного управления идентификацией, объявила о получении инвестиций от Signature Ventures и SBX Capital.

- $1,2 млн — Candlestick. Блокчейн-стартап объявил о закрытии предыдущего раунда финансирования. Новый капитал планируют использовать для создания инструмента TraderScan, который будет помогать следить за самыми прибыльными адресами.

- $1,1 млн — SYMMIO. Платформа, предоставляющая решения для облегчения внебиржевой торговли деривативами, получила инвестиции от 0x_Messi, MS2 Capital, Gametheorizing (Selini Capital), Wangarian, GMoney, IvanBrightly, Pool2Paulie, Squirrel.

- $1 млн — Theta Labs. Маркетмейкер DWF Labs инвестировал в экосистему Theta Labs, которая занимается продвижением блокчейн-платформы гибридных облачных вычислений Theta Edgecloud.

- $915 000 — LandX. Протокол сельскохозяйственного финансирования привлек средства от частных инвесторов. Официальный запуск платформы запланирован на 15 декабря, тогда же и откроется публичное предложение токенов. Компания стремится перевести сельскохозяйственные активы и токенизированные сельскохозяйственные угодья в DeFi-экосистему, предоставляя фермерам начальный капитал в обмен на процент от их будущего урожая.

- $310 000 — TISA. Блокчейн-компания, предоставляющая услуги по хранению данных, получила средства от Industrial Thought. Платформа направлена на поддержку управляющих активами и дистрибьюторов и предоставляет «единый, прозрачный и эффективный способ управления данными».

Также отметим, что маркетмейкер DWF Labs приобрел токены Floki на сумму $1,25 млн.

Кроме того, компания Swan Bitcoin объявила, что будет инвестировать привлеченные в течение года $205 млн в венчурные компании, новый хедж-фонд и кредитный фонд.

Еще ряд проектов привлекли финансирование, однако не сообщили о сумме инвестиций.

Организация Algorand Foundation сделала инвестиции в платформу цифровых платежей в Афганистане HesabPay, которая функционирует на базе блокчейна Algorand. Решение было создано для «решения кризиса гуманитарной помощи». Более десятка организаций использовали платформу для отправки средств в Афганистан.

Децентрализованная блокчейн-платформа The Open Network (TON) привлекла инвестиции от венчурного подразделения криптобиржи KuCoin, фонда KuCoin Ventures. Организация намерена предоставить грант для поддержки роста и развитие экосистемы TON. Он будет направлен на разработку пяти приложений на базе TON с прицелом на платежи и сферу GameFi.

Сервис Inspect для автоматической группировки всей важной информации по проекту, которую можно просмотреть в функции Community на X аккаунтах, получил инвестиции от Merit Circle и Beam. Компания сообщила, что это финансирование поможет ей войти в игровую индустрию. Пока что Inspect работает только с NFT-проектами.

Фонд ABCDE инвестировал в протокол биткоин-стейкинга Babylon.

Компания Pyth Network, предоставляющая данные о ценах токенов в блокчейны, привлекла инвестиции от Castle Island Ventures, Multicoin Capital, Wintermute Ventures, Borderless Capital, CMT Digital, Bodhi Ventures, Distributed Global и Delphi Digital.

Протокол обмена данными Carv получил стратегическое финансирование от HashKey Capital. Благодаря новому капиталу компания ускорит развитие своей экосистемы.

Компания Bezant Technologies, которая «генерирует доходность, используя несколько запатентованных моделей машинного обучения для долгосрочной торговли цифровыми активами», привлекла капитал от Hyperithm и будет использовать финансирование для ускорения разработки своей платформы и запуска первого продукта — фонда Bezant Absolute Returns.

MAP Protocol объявил о получении стратегических инвестиций от Waterdrip Capital и DWF Labs. С помощью протокола пользователи могут взаимодействовать с сетью биткоина.

OKX Ventures объявила об инвестициях в Web3-платформу StarryNift, которая сочетает в себе геймификацию и метавселенную.

Проект Rhinestone, создающий платформу, которая позволит создать безопасную экосистему для абстракции аккаунтов, завершил предыдущий раунд финансирования, с участием 1kx, Safe, Lattice, Heartcore и частных инвесторов.

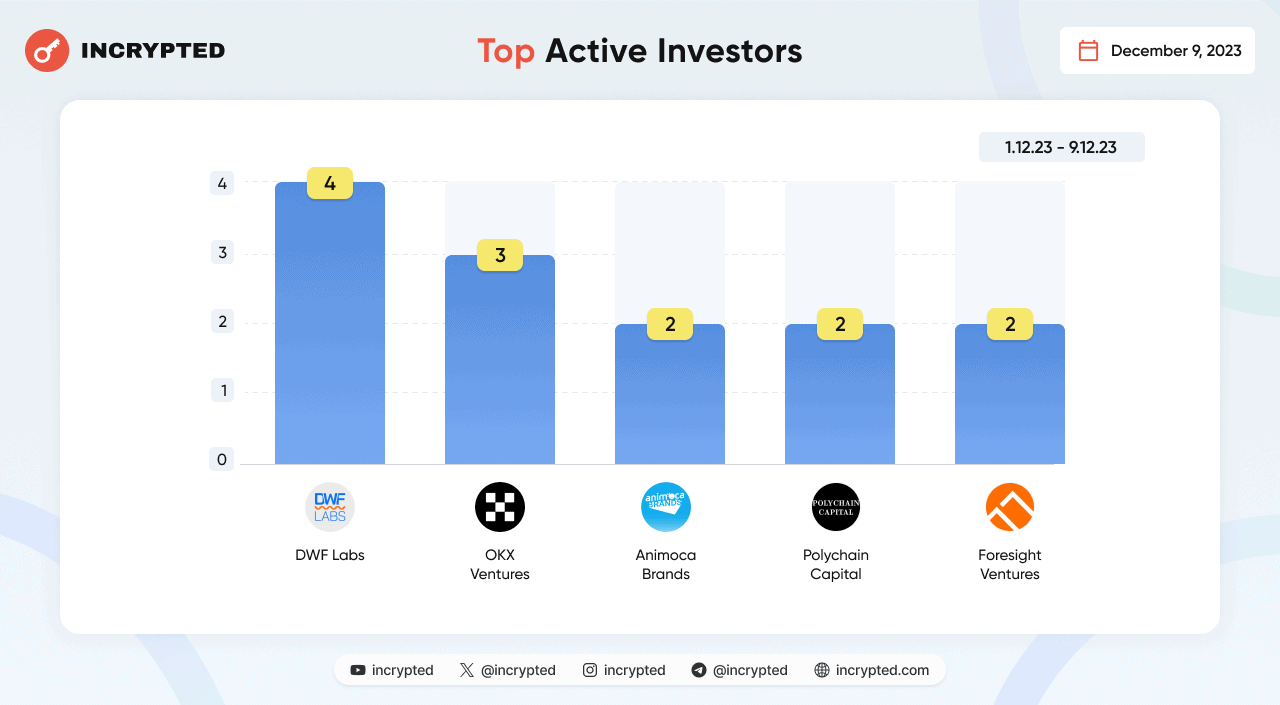

Топ-5 фондов по количеству инвестиций в период с 20 по 25 ноября, согласно данным CryptoRank:

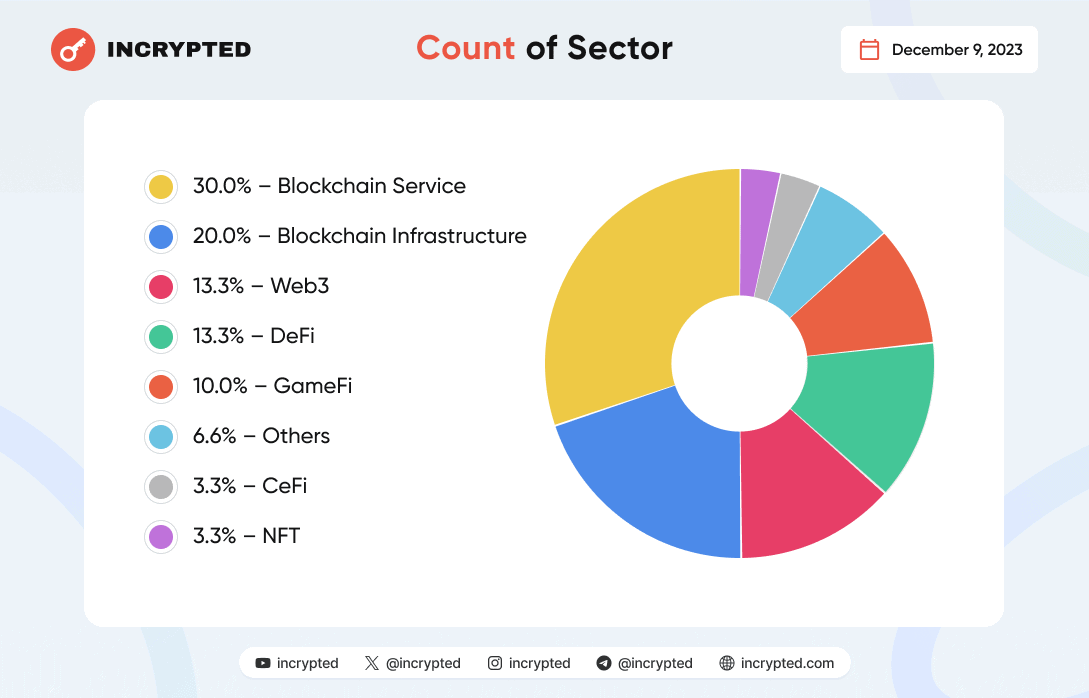

За неделю финансирование привлекли проекты таких сегментов: Web3, блокчейн-сервисы, блокчейн-инфраструктура, GameFi, DeFi, CeFi, NFT и другие.

Напомним, в ноябре проекты в сфере Web3 и блокчейна привлекли более $954 млн.