Новая квартира – теперь роскошь? На фоне вооруженной агрессии рф в Украине набирает обороты восстановление жилья, но стоимость стройматериалов не стоит на месте и выросла по крайней мере вдвое по сравнению с довоенным периодом. Среди причин эксперты называют монополизацию цементного рынка крупными игроками. Еще бы, ведь потребность в цементе достигает не менее 2 млрд долларов.

Кто именно решил нажиться на восстановлении Украины в результате российских обстрелов? И действительно ли украинский строительный рынок де-факто контролирует цементный «картель»? Подробнее об этом – в новом расследовании журналистки СтопКора Аллы Легезы.

В Киевской области бушует восстановление : ремонтные и строительные работы продолжаются в изуродованных войной Буче, Гостомеле, Ирпене и других населенных пунктах области. Впрочем, охватить все уничтоженные или разрушенные объекты региона сразу невозможно, отмечает губернатор Киевщины Руслан Кравченко. Ведь средства на восстановление уходят из бюджета, а он достаточно ограничен. Как рассказал СтопКору глава Киевской ОВА, в области на сегодняшний день реконструировали более 13 тысяч объектов, то есть чуть меньше половины.

«Да, хотелось бы одновременно все отстроить всю Киевскую область и заявить что мы отстроили. Это 28 тысяч объектов. Но исходим из того, что мы имеем: правительство выделяет, мы восстанавливаем«, – отметил Кравченко.

Суммы нужны немалые: например, на восстановление только одной пятиэтажки в Макарове предусмотрено более 50 млн гривен. А таких домов – почти 30 тысяч. В целом, по подсчетам, чтобы восстановить жилищную и социальную инфраструктуру Киевщины понадобится более 100 млрд грн. А по всей Украине, по данным Киевской школы экономики, эта сумма составляет более 151 млрд долларов или 5,5 триллиона гривен.

«Сумма не укладывается ни на экране калькулятора, ни в голову. И эта цифра еще не финальная, потому что, во-первых – обстрелы происходят ежедневно, а во вторых – стоимость стройматериалов растет как на дрожжах, а с начала войны – особенно стремительно», – комментирует журналистка.

Почему цена строительства и ремонта растет как на дрожжах, и новое жилье становится для рядовых украинцев недоступной роскошью?

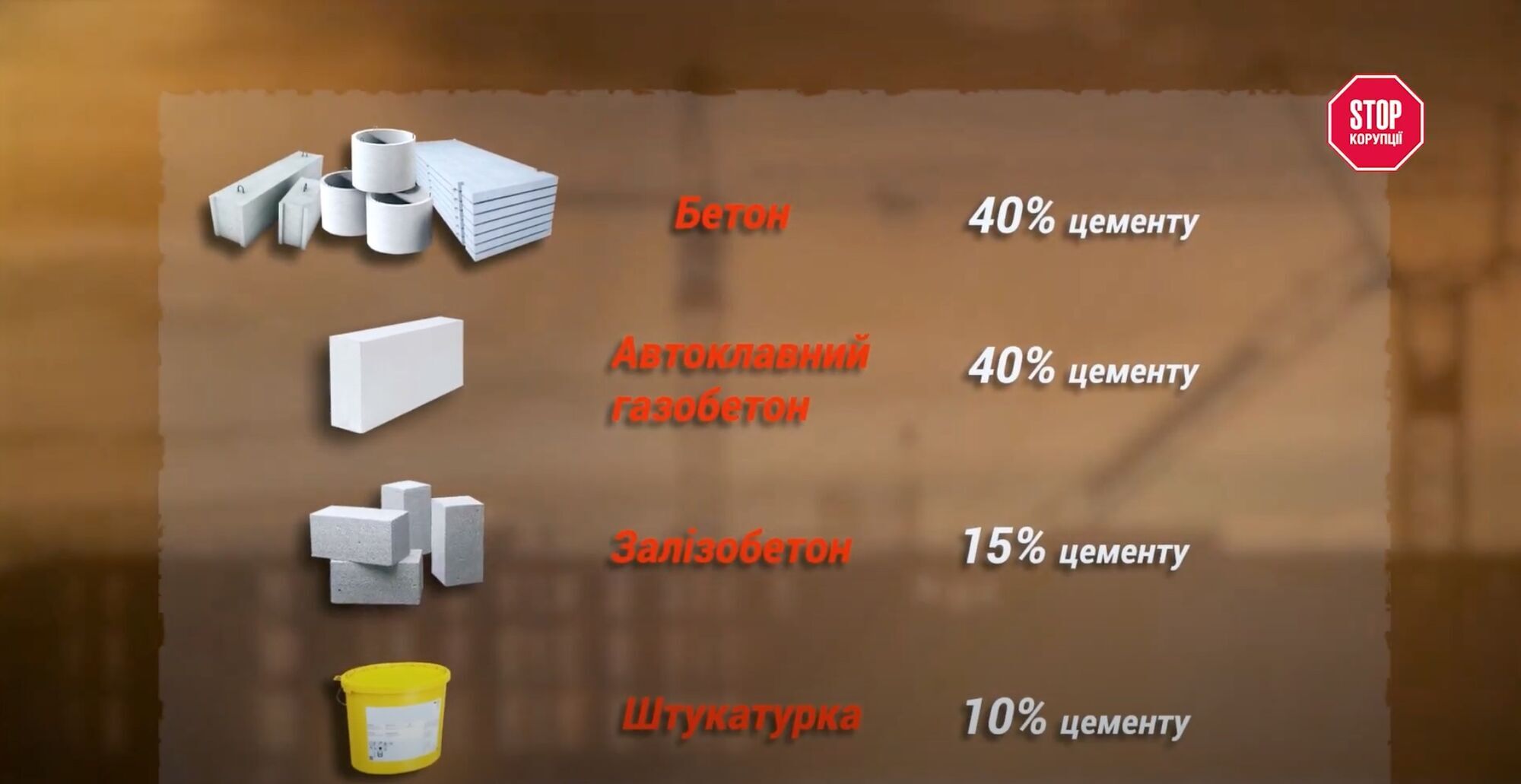

Дело в том, что значительная часть строительно-ремонтной продукции содержит именно цемент. В частности, по данным производителей стройматериалов, в бетоне его 40%, в автоклавном газобетоне также примерно 40%, почти 15% в железобетоне и даже в штукатурке ориентировочно 10 %. Чтобы исследовать, как изменялась стоимость этого материала, СтопКор взял за основу данные «Государственного дорожного научно-исследовательского института имени Шульгина».

Так, в августе этого года средняя цена на цемент марки М-500 составила 5238 грн за тонну. В октябре 22-го он стоил в пределах 3978 грн за тонну. То есть за год средняя стоимость этого материала, по нашим подсчетам, выросла почти на 32%. Динамикой цен на цемент с 2019 по 23 год с нами поделился также Олег Сиротин – исполнительный директор Ассоциации производителей автоклавного бетона, которые являются одними из крупнейших потребителей вяжущих материалов. В частности, до войны эта отрасль покупала около 360 тысяч тонн цемента в год.

«С 2019 года по состоянию на сейчас стоимость цемента подорожала примерно на 85%. То есть в 2020 году по сравнению с 2019 годом стоимость цемента выросла примерно на 4%. В 2021 году стоимость выросла на 5%. цемента для нашей отрасли выросла на 37% И в 2023 году по состоянию на данный момент стоимость цемента выросла на 24%«, – констатирует Сиротин.

Следовательно, пропорционально возрастала и стоимость большинства материалов, содержащих цемент.

По данным гендиректора промышленно-строительной группы «Кузнечная» Сергея Пилипенко, в 2021 году средняя стоимость кубометра бетона составляла около 1600 грн. Пока же – 2000-2500 грн. То есть, за два года цена выросла на 50%.

На этом фоне удорожал и ремонт домов. Как рассказал представитель одной из столичных ремонтных компаний, стоимость их работ, только на этапе подготовки стен к покраске или поклейке обоев, в зависимости от толщины слоя, выросла с начала полномасштабной войны с 300 грн за квадрат до 500.

Увеличение цены на цементно-вяжущие прямо влияет на стоимость строительных услуг, поскольку оказываем услуги комплексно, это и работа, и материал под ключ. Как известно, цемент является основным вяжущим в строительных смесях, когда есть стяжки, цементно-песчаные штукатурки и так далее. До войны штукатурные смеси стоили 130 грн, а после начала, летом 2022-го они стоили 350 грн. То есть цена выросла даже не вдвое, а почти втрое«, – объясняет Виталий Карпенко, руководитель проектов компании «Теплодом».

Ценовые колебания на ремонтно-строительные материалы сильно отражаются и на рынке недвижимости.

Правда, в этой отрасли прямо прорционально стоимость квадратного метра растет не сразу, ведь когда нет запросов на новые квартиры, застройщики некоторое время искусственно сдерживают цены, комментирует коммерческая директор компании «Интергал-Буд» Анна Лаевская.

«Если говорить конкретно о бетоне и цементе, стоимость выросла по сравнению с довоенным периодом вдвое. Колебание цен на эти материалы непосредственно влияет на стоимость возведения жилых домов. мы имеем скорее уменьшение маржи и прибыльности застройщиков и строительных проектов, поскольку перевести на цену метра рост стоимости материалов не представляется возможным на текущий момент«, – отметила она.

Так или иначе, цена за квадратный метр с начала полномасштабного вторжения уже изменилась, и ситуация может существенно ухудшиться, как только спрос на жилье возобновится. Актуальными данными о первичном рынке жилья в столице поделился Денис Судилковский — маркетинг-директор известной компании по поиску недвижимости «Лун».

«Средняя цена среди всех классов, выставленных на продажу, составляет 47 300 грн за квадратный метр. До полномасштабного вторжения эта цена была 35 400 грн за квадрат. Как только люди будут возвращаться еще активнее в столицу, мы сможем наблюдать возобновление спроса, и соответственно , это должно сказаться на росте цен«, – добавил он.

Но из-за чего или из-за кого так стремительно взлетели цены на стройматериалы?

Факторов, влияющих на ценообразование, много: это и удорожание стоимости топлива и электроэнергии, и нарушение логистики, и увеличение зарплат, и общая инфляция.

«Но в процессе подготовки материала мы обратили внимание на еще один весомый фактор, – это олигополизация цементного рынка, которая, по словам производителей стройматериалов, произошла из-за отсутствия импортного цемента в Украине«, – подчеркивает Алла Легеза.

Как объясняет Олег Сиротин, стоимость цемента в 2020 и 2021 году медленно росла, потому что когда была введена антидемпинговая пошлина на молдавский и белорусский цемент, на рынке Украины оставался еще один импортный цемент – из Турции. И его цена была ниже отечественного продукта. Но в 2021 году была антидемпинговая пошлина введена уже на турецкий цемент, и в последующие два года можно было наблюдать стремительный рост цен на внутренний цемент от украинских производителей.

Как утверждают производители стройматериалов, ограничение импортной конкуренции явилось одной из причин стремительного повышения стоимости цемента.

Этот вопрос исследовали и в общественной организации «Лига антитраста», которая в сентябре 2021 года подала заявление в АМКУ с требованием прекратить необоснованный рост стоимости цемента на 35-50% за три года. Следовательно, в тот же период произошло соответственно и удорожание строительно-ремонтных материалов и квадратных метров, что подтверждает и динамика цен на «первичку» в Киеве.

Кто контролирует рынок цемента в Украине?

До полномасштабного вторжения в Украине действовало 5 цементных групп, в которые входят заводы в разных регионах Украины. Это компании Cemark, IFCem, Buzzi, Кривой Рог цемент и Балцем. Последняя, к сожалению, из-за войны и временной оккупации Харьковщины сегодня не действует, однако другая четверка работает на полную мощность и вместе в 2022 году произвела почти 5,5 млн. тонн цемента. Ожидаемая цифра производства к концу этого года, по нашим данным, составляет около 7 млн. тонн. Для сравнения: в пик своей активности, в 2021 году, отечественные производители совместно производили более 11 млн тонн.

Но восстановление набирает обороты, отметила в комментарии Стопкору глава парламентского комитета по вопросам градостроительства и председатель партии «Слуга Народа» Елена Шуляк, поэтому ожидается, что запросы на цемент и строительные материалы будут только расти.

«Укрвнешэкспертиза вместе при поддержке USAD международных партнеров сделали очень интересное исследование. Они посчитали, что для того чтобы восстановить разрушенное, Украине понадобится как минимум 64 млрд долларов именно на производство строительных материалов», – подчеркнула нардепка.

В указанном исследовании есть еще один интересный вывод: только одного цемента нужно для восстановления более 35 млн тонн, что в денежном эквиваленте специалисты оценили почти в 2 млрд долларов.

«По нашим данным, максимальная годовая способность украинских цементных заводов сегодня составляет 13,6 млн тонн цемента. Поэтому, по словам застройщиков, этого не хватит для восстановления и понятно, что спрос на цемент в Украине будет просто безумный», – констатирует журналистка.

А где спрос превышает предложение, там и цена может взлететь в «космос».

«В условиях вернее повышения объемов строительства и последующего восстановления начала новых строительных проектов существующих поставок и объемов производства будет недостаточно, и это будет приводить к достаточно существенному росту стоимости этих материалов и комплектующих«, – комментирует Анна Лаевская.

Тот факт, что мощностей на производстве цемента для покрытия спроса на этапе восстановления недостаточно, отмечается и в вышеупомянутом исследовании. Можно предположить, что Украина нуждается сегодня в больших инвестициях для возведения новых заводов. Но на практике ситуация пока обратная. Репортеры СтопКора под прикрытием исследовали, что и на имеющихся цементных мощностях уже продолжаются массовые сокращения. Речь идет, в частности, о заводе » Дикергофф», куда по легенде наши «агенты» планировали трудоустроиться.

Какие у «Дикергоффи» объемы производства и что происходит с компанией?

Редакция СтопКора пыталась выяснить это непосредственно в компании, направив запрос, но ответ мало того, что предоставили без цифр, обобщенный и не на все вопросы, да еще требуют его не разглашать. Что вызвало удивление у журналистов.

Теоретически сокращение на мощностях может объяснять продажу украинских заводов » Дикергофф» материнской итальянской компанией Buzzi, которая по данным НАПК, с марта 2023 года была внесена в список «Международных спонсоров войны».

Сообщения о соглашении с ирландской компанией CRH за 100 млн евро в Buzzi опубликовали на официальном сайте в июне этого года. Кстати, у CRH тоже были мощности в рф, но в марте 2022 года компания заявила о выходе с российского рынка.

Цифры сделки тоже достаточно интересны. Продажа двух работающих заводов » Дикергофф» всего за 100 млн евро выглядит как скидки в «черную пятницу», потому что, по нашим данным, построить один цементный завод в Украине сегодня стоит от 250 до 300 млн.

Пока это соглашение между мировыми цементниками-гигантами находится на рассмотрении в Антимонопольном комитете Украины.

Как говорится в ответах на запросы Стопкора, сначала в АМКУ не приняли заявления о предоставлении разрешения компаниям на покупку/продажу акций «Дикергоффа», а после поступления документов повторно – начали в октябре дело о концентрации, поскольку есть угроза монополизации или существенного ограничения конкуренции. Сегодня в цементной отрасли разыгрывается очень интересная комбинация, рассказывает народный депутат Украины Сергей Нагорняк.

«Если происходит поглощение ирландской CRH итальянской компании Buzzi, по состоянию на сегодняшний день 32% рынка уже имеют ирландцы. Они планируют провести сделку покупки еще 14% рынка у итальянской компании, и уже будут иметь 46%», – отмечает парламентарий.

По СтопКору данным, рынок цемента между компаниями-гигантами в Украине сейчас распределен следующим образом: у «Ивано-Фраковскцемента» доля на рынке до полномасштабной войны составляла 34%, на втором месте «Cemark» (CRH) с 28%, у «Дикергоффа» – 15% и около 12% в «Кривой Рог Цемента».

Итак, если сделка купли-продажи между CRH и Buzzi все же согласуют, «Cemark» станет лидером на рынке и будет диктовать свои цены и собственные правила игры.

А их, ввиду практики ведения бизнеса упомянутых компаний гигантов в других странах, не всегда можно назвать честными. К примеру, как писали в 2003 году в издании «Зеркало недели», международная группа CRH входила в число компаний, в отношении которых Еврокомиссия проводила расследование за создание общего рынка.

А в 2009 году немецкий суд оштрафовал 6 крупных производителей цемента на 330 млн евро за картельный сговор. Компании, среди которых была и уже известная нам Дикергофф, скупали продукцию и конкурентные предприятия, приостанавливали их работу и держали высокую цену на собственный цемент. Почти похожую ситуацию с участием CRH зафиксировали власти в Венгрии в 2020 году, о чем сообщали на сайте местного органа по конкуренции.

И таких примеров мировой монополизации рынка и закрытия производств с значительным ростом цены цемента – немало.

К тому же, по данным, полученным СтопКором из собственных источников, заводы «Дикергофф» в Украине тоже уже находятся под угрозой закрытия, ведь работают по устаревшей технологии – влажному процессу, а это противоречит экологическим целям CRH. Так что произойдет в случае согласования упомянутой сделки купли-продажи – вопрос открытый. Его, к слову, в CRH проигнорировали, не дав ответа на редакционный запрос.

Насколько может вырасти стоимость цемента в случае поглощения этого рынка и его монополизации, спрогнозировать сложно. Но то, что цена будет расти, очевидно, утверждают производители стройматериалов и застройщики.

«Если строительные материалы подорожают на 30-40%, возможно еще какие-то дополнительно 5-6% застройщики перенесут на прайсы продаж, но опять же, если будет обеспечен спрос на это жилье, если рыночная ситуация это позволит», – предполагает Анна Лаевская.

Повторится ли мировая практика монополизации цементного рынка компаниями-гигантами в Украине и что решит АМКУ?

Вероятно, решение принимать будет непросто, ввиду открытой поддержки компании CRH руководством страны.

По нашей информации, во время встречи Владимира Зеленского с премьер-министром Ирландии Лео Варадкаром в Киеве шла речь о возобновлении Украины и участии в этом процессе ирландского бизнеса, в частности компании CRH.

СтопКор направил запрос по этому поводу в Офис Президента, но за месяц ответа мы так и не получили. Никак не прокомментировали и в Кабмине публичную поддержку компании CRH во время встречи Дениса Шмыгаля с главой правительства Ирландии. Однако есть и положительные сигналы этих встреч. Речь также шла о привлечении новых инвестиций по строительству цементных заводов в Украине, а это, по словам народных депутатов, – один из путей решения проблемы монополизации цементного рынка.

А пока высокопоставленные должностные лица будут вести переговоры по привлечению инвестиций, СтопКор продолжает следить за ходом событий. В частности, Антимонопольный комитет официально включил наших представителей в освещение информации о концентрации в виде приобретения компанией CRH украинских мощностей «Дикергофф«.