Скромная госслужащая, миллионерша в шикарной шубе или «законсервированная» агентша рф?

По ходатайству прокуратуры суд арестовал активы Светланы Грошовой, которая под «крышей» ФГВФЛ руководила ликвидацией обанкротившихся отечественных финучреждений. Ведь в декларации чиновницы среди прочего элитного имущества обнаружили недвижимость в оккупированном Крыму и корпоративные права российской компании. Но сейчас Грошова добивается снятия ареста с доходных активов.

Как ликвидатор украинских банков «Финансы и кредит» и «Платинум» Светлана Грошова приобрела элитное состояние и сделала инвестиции в экономику враждебного государства? И откуда вообще такое количество чиновников-миллионеров в рядах Фонда гарантирования вкладов физлиц?

По данным электронной декларации, обнародованной НАПК, ликвидатор банков «Финансы и кредит», «Платинум» и других обанкротившихся финансовых учреждений Украины Светлана Грошова в 2022 году заработала более 1,3 млн грн. Кроме того, женщина задекларировала драгоценности на 800 тыс. грн: среди ее «достижений» – шуба из меха соболя, ювелирные изделия и дорогие часы.

Но все это – «каплина в море» по сравнению с недвижимостью и доходными активами сотрудницы ФГВФЛ.

В том же 2022 году, то есть уже в разгар полномасштабной войны с рф, чиновница задекларировала три автомобиля, три квартиры и паркоместа в столице, квартиру и дом в Днепре, усадьбу и ряд другой недвижимости на Днепропетровщине, а также квартиру и другую недвижимость у моря в аннексированном Крым. Более того, Денежная имеет в собственности активы в россии, которые приобрела с 2019 по 2022 год, в том числе квартиры и другие нежилые помещения.

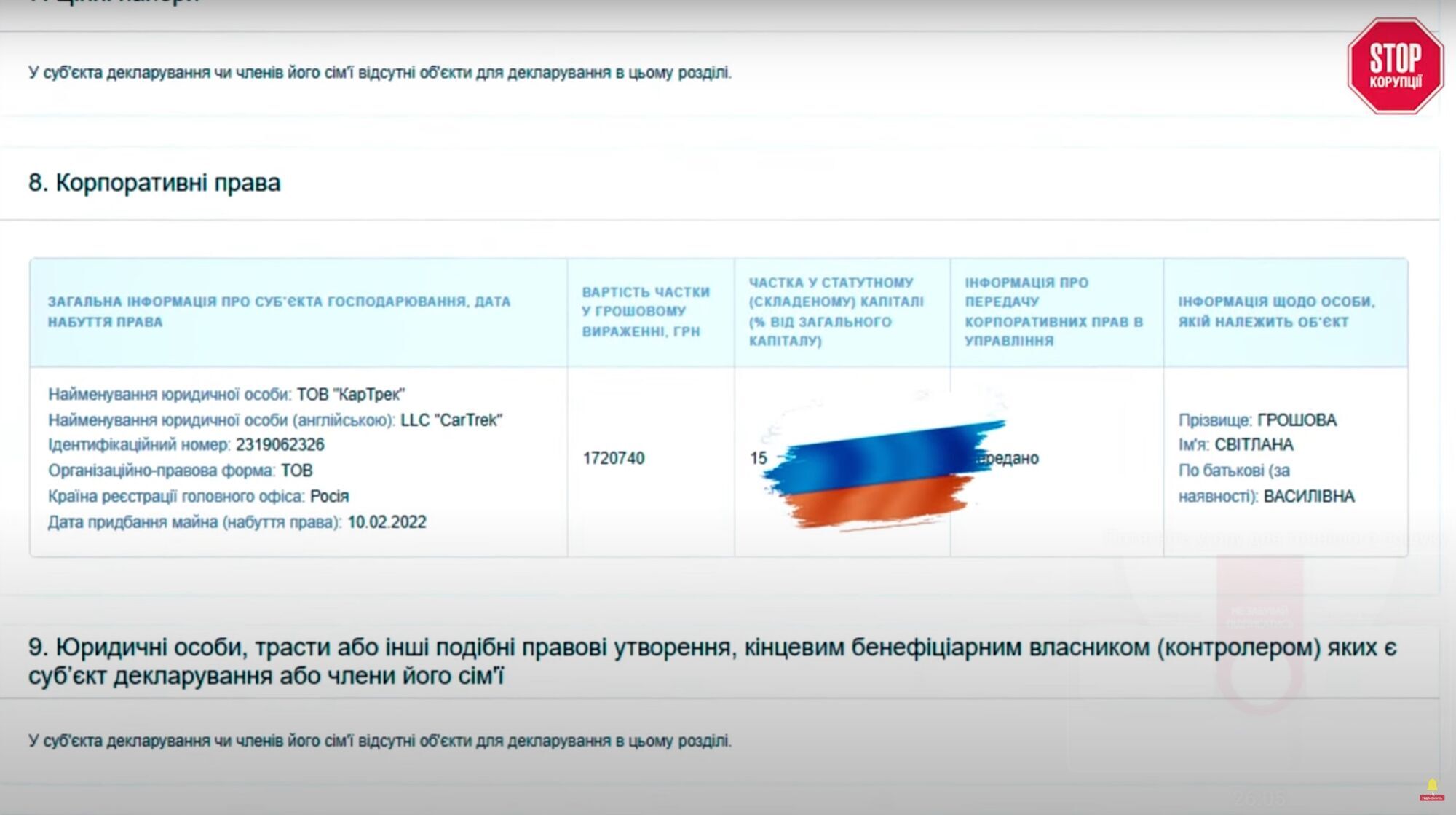

А буквально за две недели до начала широкомасштабного вторжения, в феврале 2022 года Денежная инвестировала средства непосредственно в экономику рф, став совладелицей предприятия «Картек». В данной компании имеют судьбу также граждане россии и фирма VALARTIS CONSULTING, являющаяся владельцем ООО «РИМБОРСО-РУССИЯ», основной вид деятельности которого – операции по управлению проблемными активами.

По данным СМИ, чтобы избежать санкций и вероятной национализации российских активов, Денежная перерегистрировала долю в этой фирме на сына Станислава, проживающего в Москве и имеющего гражданство рф. И хотя на активы ликвидатора в конце концов наложили арест, пока она воюет в судах за их разблокирование.

Неужели в рядах Фонда гарантирования вкладов физлиц столько лет свободно работало и еще и неплохо зарабатывало лицо, напрямую связанное со страной-агрессором?

«Это свидетельствует о том, что российская разведка работает по 5-балльной шкале оценки на 5 с плюсом. Я уверен, что она сына поставила учредителем на ту фирму, потому что из ФСБ ей показали пальчиком: эй, что ты делаешь? На такие должности идут не случайные люди. В народе их называют «консервами», они – не активные агенты, но выполняют функцию предоставления информации», – считает ветеран АТО Константин Ильченко.

Напомним, в Фонде гарантирования вкладов отказались предоставить ответ на запрос СтопКора о состоянии руководства. Поэтому журналисты проанализировали открытые данные и обнаружили: глава ФГВФЛ Светлана Рекрут задекларировала более 6 млн зарплаты в год. Это почти в 20 раз больше, чем у Владимира Зеленского, и вдвое выше, чем у европейских президентов.