В отчете от Glassnode отмечается, что в начале этой недели наиболее активными продавцами стали инвесторы, удерживающие биткоин менее 155 дней.

За последние два дня в общей сложности краткосрочные инвесторы отправили на биржи для дальнейшей продажи BTC на сумму около $4 млрд.

Аналитики считают, что спекулянты не стали рисковать, а дождались, когда BTC подскочил выше $44 000. При этом сломить сопротивление на уровне $45 000 биткоин так и не смог.

После этого спекулянты перешли к продажам криптовалюты, что и спровоцировало ее падение почти до $40 000. Поступление на биржи было разделено на два этапа.

Первоначально на торговые площадки были отправлены биткоины на $1,93 млрд. Затем краткосрочные инвесторы перевели на биржи цифровую валюту еще на сумму $2,08 млрд.

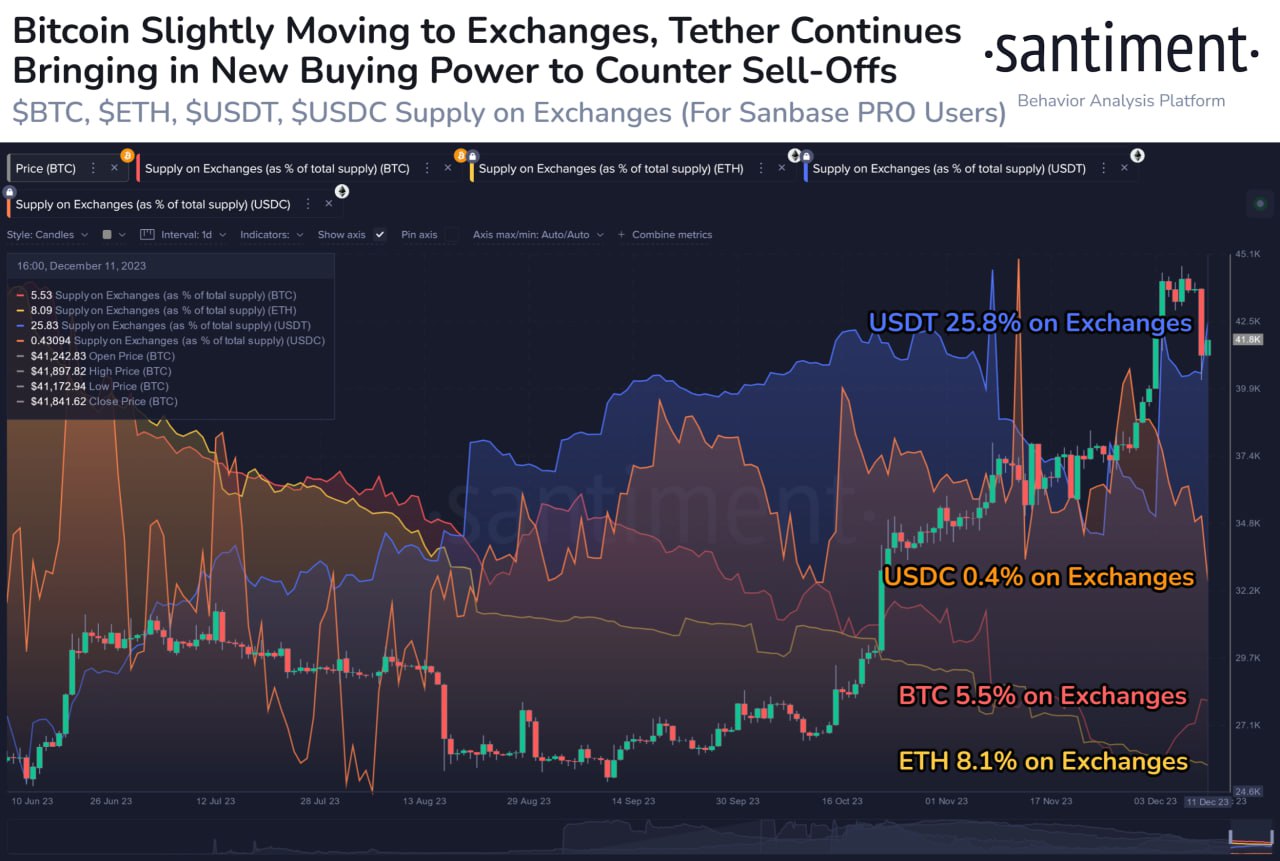

На рост количества биткоинов на биржах накануне указала компания Santiment. Она выяснила, что предложение цифровой валюты на торговых площадках росло на протяжении последних нескольких дней.

Такое поведение инвесторов намекало на их подготовку к сбросу, который и состоялся в минувший понедельник, подчеркнули аналитики.