Малоизвестная компания «Стар Инвестмент Ван» приобрела права на кредиты и залоги 21 банка на сумму свыше $600 млн всего за 0,5% от их стоимости

Игра на понижение или торги с «дисконтом» в 99,5%: несколько лет назад новая компания «Стар Инвестмент Ван» за бесценок выкупила у ФГВФЛ кредитные портфели более двадцати обанкротившихся банков. Впоследствии в игру вступила еще одна фирма – WWRT Limited Ольги Гутовской, обвиняемой в требовании огромных средств с владельцев этих финучреждений. Кто «кошмарит» украинских банкиров? Какую роль в этой схеме играет один из богатейших бизнесменов страны Виктор Полищук ? И при чем здесь российский след?

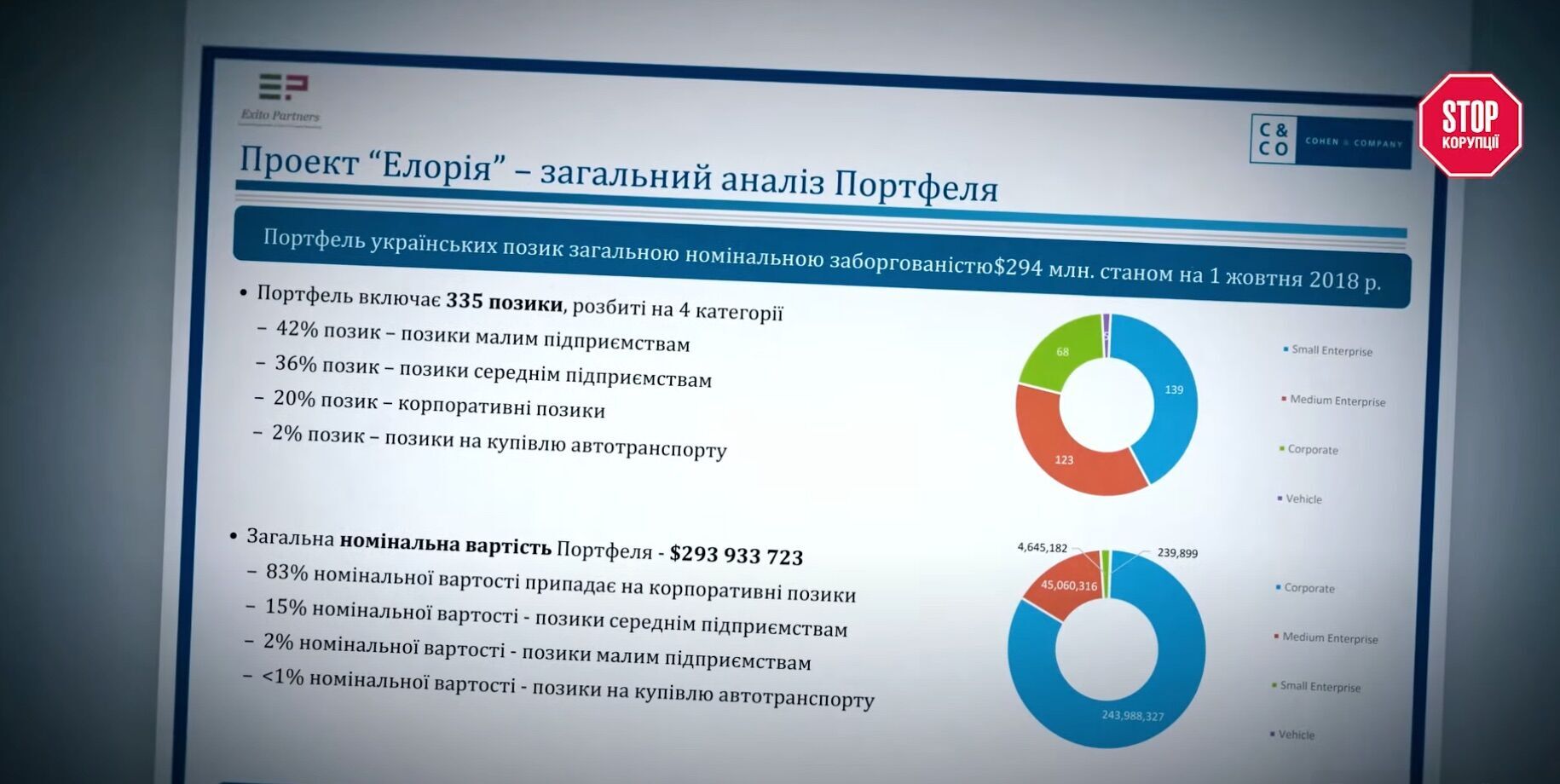

В ноябре 2018 года компания Exito Partners представила проект «Элория» — речь идет о пакете по кредитным активам обанкротившихся украинских банков, который подготовил к торгам Фонд гарантирования вкладов физических лиц. Всего финучреждений-банкротов было 21, кредитов по кейсу — почти на $294 млн, а общая стоимость залогов по займам — еще $367 млн. Одним из самых жирных кошек, как на финансовом сленге называют кейсы, этого портфеля был печально известный банк «Михайловский».

По данным СМИ, этот банк в свое время входил в сферу интересов Виктора Полищука. Последний известен как бизнесмен в сфере недвижимости и розничной торговли. В 2021 году, по версии Forbes, занимал 36-е место в топ-100 самых богатых украинцев. Владельца торговых сетей электроны https://www.ukr.net/news/details/kyiv/94594713.html «Технополис» и «Эльдорадо», ТРЦ «Gulliver», строительных компаний в медиа также называют близким родственником россиянина Дмитрия Медведева, бывший представителем «клана Януковича» и даже неофициальным «куратором» Киевщины времен каденции беглого президента.

Впрочем, самое интересное – как именно происходили аукционы. Ведь, несмотря на то, что общая стоимость кейса превышала $600 млн, лот выставили на аукцион всего за эквивалент $50 млн. А дальше, по «голландской системе» торгов, его стоимость постепенно сбавляли — сначала до $11 млн, а в конце концов — вообще до 62 млн грн, то есть примерно $2 млн. Таким образом, «скидка» составила более 99,5%!

Такие случаи – неединичны, и часто за ними стоит завуалированный «отжим» активов, отмечают эксперты. Ведь приобретение за бесценок прав на кредитные портфели в дальнейшем позволяет новым владельцам кейса фактически «выбивать» долги с банкиров, в том числе с применением коллекторских фирм и других сомнительных методов.

«Есть бизнес, скажем так… покупки долгов — это бизнес стервятников. Потому что эти люди покупают за один процент, два процента и даже ниже, полпроцента. Понимаете, чтобы купить за полпроцента, за процент долгов на сто миллионов, на миллиард. потом можно эти долги продавать дальше, залечивать, что-то делать, мучать кредиторов по этим долгам и т.д.», — отмечает управляющий партнер юридической фирмы «Spensers» Валентин Загария.

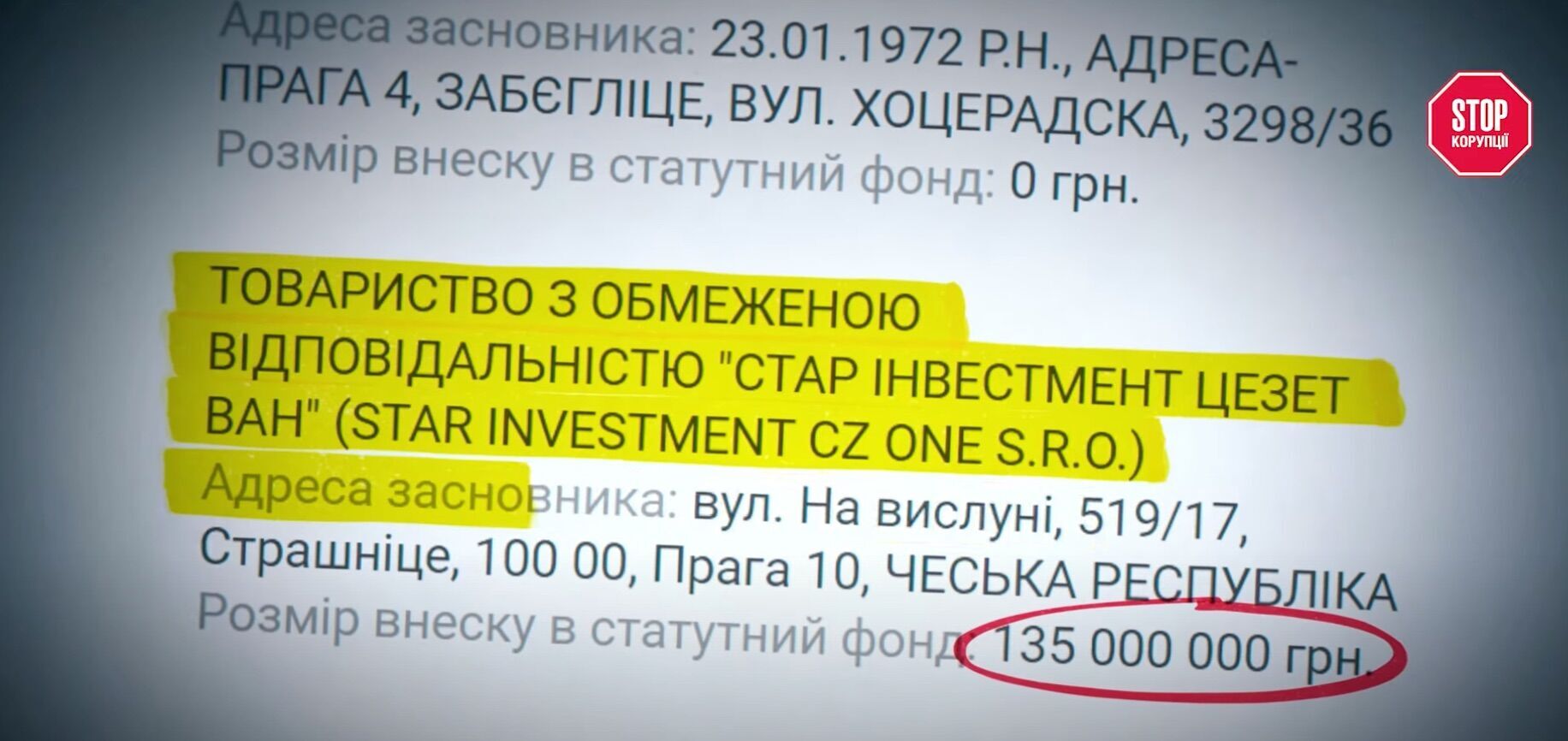

Но самое интересное, кто именно за копейки выкупил лоты 21 украинского банка. Покупателем стала фирма «Стар Инвестмент Ван», зарегистрированная всего за четыре дня до начала приема предложений по первому аукциону. Именно она без конкуренции, играя на понижение, забрала себе весь кейс. Примечательно, что адрес регистрации компании совпадает с адресом ТРЦ Gulliver все того же Виктора Полищука.

Напомним, фигура малоизвестной юристки Ольги Гутовской, на фирму которой WWRT Limited переписали кредитные портфели, которые до этого приобрели за бесценок, привлекла внимание редакции СтопКора в прошлом году благодаря ее роскошному образу жизни, агрессивному пиару в медиа и публичным обвинениям в мошенничестве. . Потянув за эту ниточку, наши расследователи вышли на «Стар Инвестмент Ван» и разоблачили новые детали, вероятно, мошеннической схемы присвоения имущества на сотни миллионов долларов.