Компания VanEck не будет взимать комиссию за управление средствами в своем спотовом биткоин-ETF до 31 марта 2025 года. Общий чистый приток капитала в фонд с момента начала торгов составил $251,39 млн.

Согласно официальному заявлению компании, специальное предложение могут отменить раньше, если объем активов под управлением (AUM) ETF превысит $1,5 млрд. В таком случае комиссия составит 0,2%.

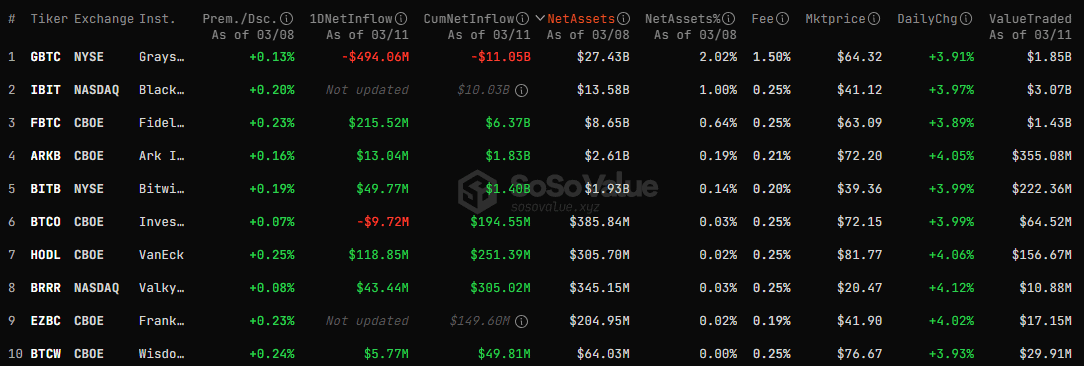

По данным SoSo Value, фонд VanEck Bitcoin Trust (HODL) контролирует биткоины на $305,7 млн. Чистый приток в этот ETF 11 марта 2024 года составил $118,85 млн.

Это больше, чем, например, у ARK 21Shares Bitcoin ETF (ARKB), который в рейтинге находится значительно выше:

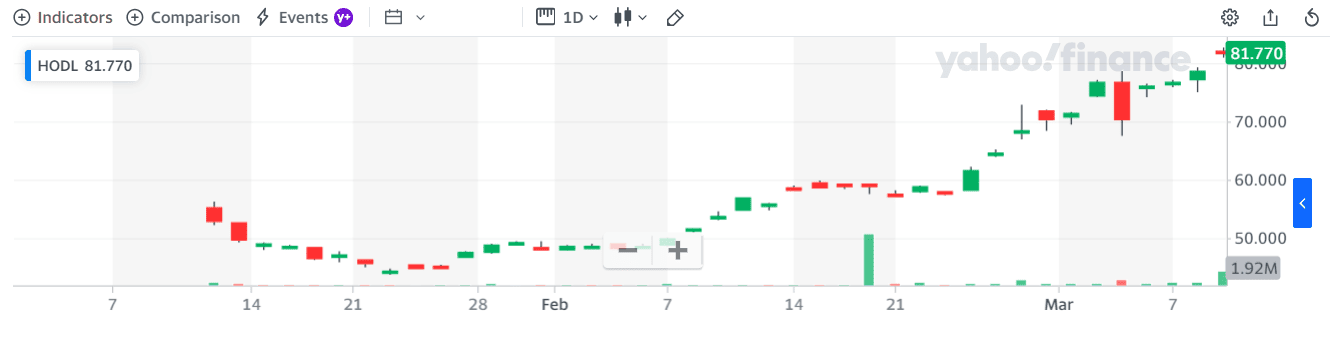

На фоне новости стоимость акций фонда подскочила на более чем 4%. На премаркете эта позиция торгуется по $81,81, согласно Yahoo Finance:

Напомним, 11 марта 2024 года биткоин обновил исторический максимум и обошел по капитализации серебро. Это напрямую влияет на активность и показатели спотовых ETF на базе первой криптовалюты.