Елена, бывшая жена банкира Тищенко, считает, что Ольга Гутовская, юрист, является человеком, осуществляющим деятельность в рамках большой схемы вымогательства денег.

Масштабная атака на крупные украинские банки, а на ее острие – малоизвестная адвокат? Британская фирма WWRT Limited, зарегистрированная на юриста Ольгу Гутовскую, за бесценок получила от компании «Стар Инвестмент Ван» кредитные портфели отечественных финансовых учреждений и, очевидно, намерена воспользоваться этим в собственных интересах. Так, Елена Тищенко (экс-жена владельца банка «Фортуна») обвиняет Гутовскую и Ко в мошенничестве и вымогательстве колоссальных денежных сумм.

Елена Тищенко предполагает: за обеими структурами («Стар Инвестмент Ван» и WWRT Limited) на самом деле могут стоять одни и те же заинтересованные лица. А исполнительницей масштабной и, вероятно, преступной схемы стала почти неизвестная в юридических кругах украинская адвокат Ольга Гутовская, которой искусственно «раздули» медиарейтинги.

Кто на самом деле атакует отечественные банки и их владельцев и какова роль юриста Гутовской в этой истории? Детали ситуации осветил в новом расследовании журналист СтопКора Игорь Хмурый.

Первым звеном схемы стал аукцион по продаже активов разорившихся банков, который проводил Фонд гарантирования вкладов. Именно ФГО через ProZorro выставил на торги кредитные портфели отечественных финансовых учреждений. Как разъяснил в комментарии журналистам адвокат Игорь Ясько, стандартная практика предполагает выкуп активов банков-банкротов по цене от 20 до 30% от их реальной стоимости.

В случае с банком «Фортуна» покупателем выступила компания «Стар Инвестмент Ван». Однако общая стоимость лота составила… всего 0,03% от общей стоимости всех кредитов и залогов.

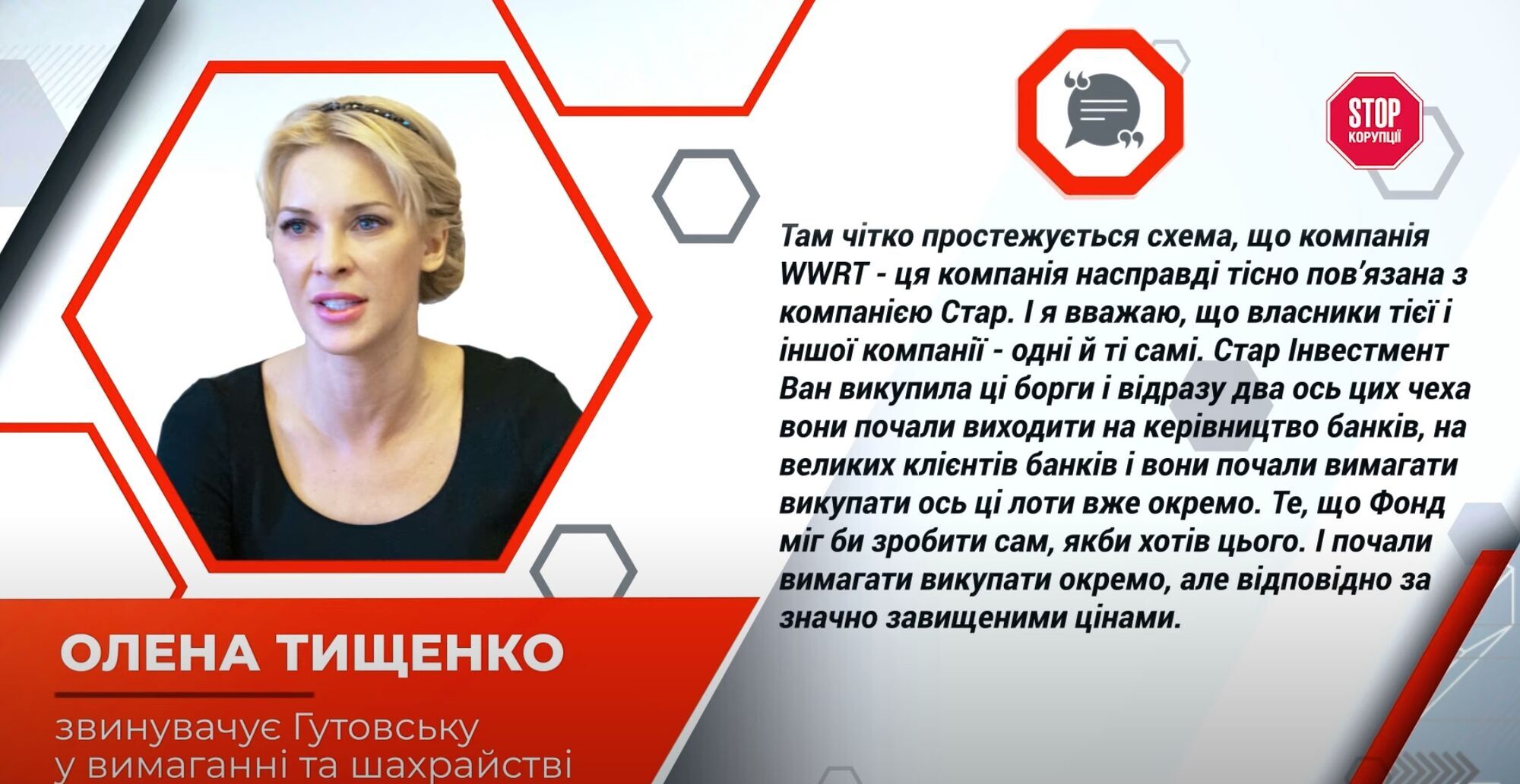

По словам Елены Тищенко, как только «Стар Инвестмент Ван» выкупила долги, представители компании сразу начали выходить на менеджмент и крупных клиентов банков и требовать выкупать каждый лот отдельно – по значительно завышенным ценам. Впоследствии «Стар Инвестмент Ван» переуступила кредиты другой фирме – WWRT Limited Ольги Гутовской, а вот все залоги оставила себе.

«И вот когда они уже отступали, четко отделился этот мошеннический умысел. Потому что они отступили права только по кредитам. А залог «Стар Инвестмент Ван» оставил себе. По законам Украины такое невозможно. И по законам ни одной страны это невозможно. Потому что залог обеспечивает выполнение основного обязательства. Она идет исключительно в привязке к кредиту. И тем, что они себе оставили залог, а фирме WWRT сбросили кредиты, они уже показали, что это фактически одни и те же люди», – отмечает Тищенко.

Она предполагает, что молодая юрист Гутовская стала своеобразным «лицом» компании, осуществляющей шантаж, в том числе и через искусственно завышенную «медийную узнаваемость».

В этой запутанной истории предстоит разобраться правоохранителям: как сообщила Елена Тищенко, по указанным фактам уже инициированы четыре уголовных производства. СтопКор продолжит внимательно следить за их ходом.

Напомним, что английская фирма WWRT Limited, принадлежащая «эксперту по правовым вопросам» Ольге Гутовской, странным образом за незначительный процент получила права на кредитные обязательства ряда отечественных банков. И это при том, что у юриста нет в послужном списке большого перечня выигранных дел, а свидетельство адвоката получила… всего полгода назад.